China holds over 15% of the global beer market share, making it the largest beer-consuming country in the world. However, as Chinese consumers cut back on spending and show evolving consumer preferences, such as more demand for premium and craft beers, it presents both opportunities and challenges for beer brands. By 2025, the beer market in China is expected to generate RMB 641.7 billion.

Download our China F&B White Paper

China’s beer market remains the largest producer and consumer in the world

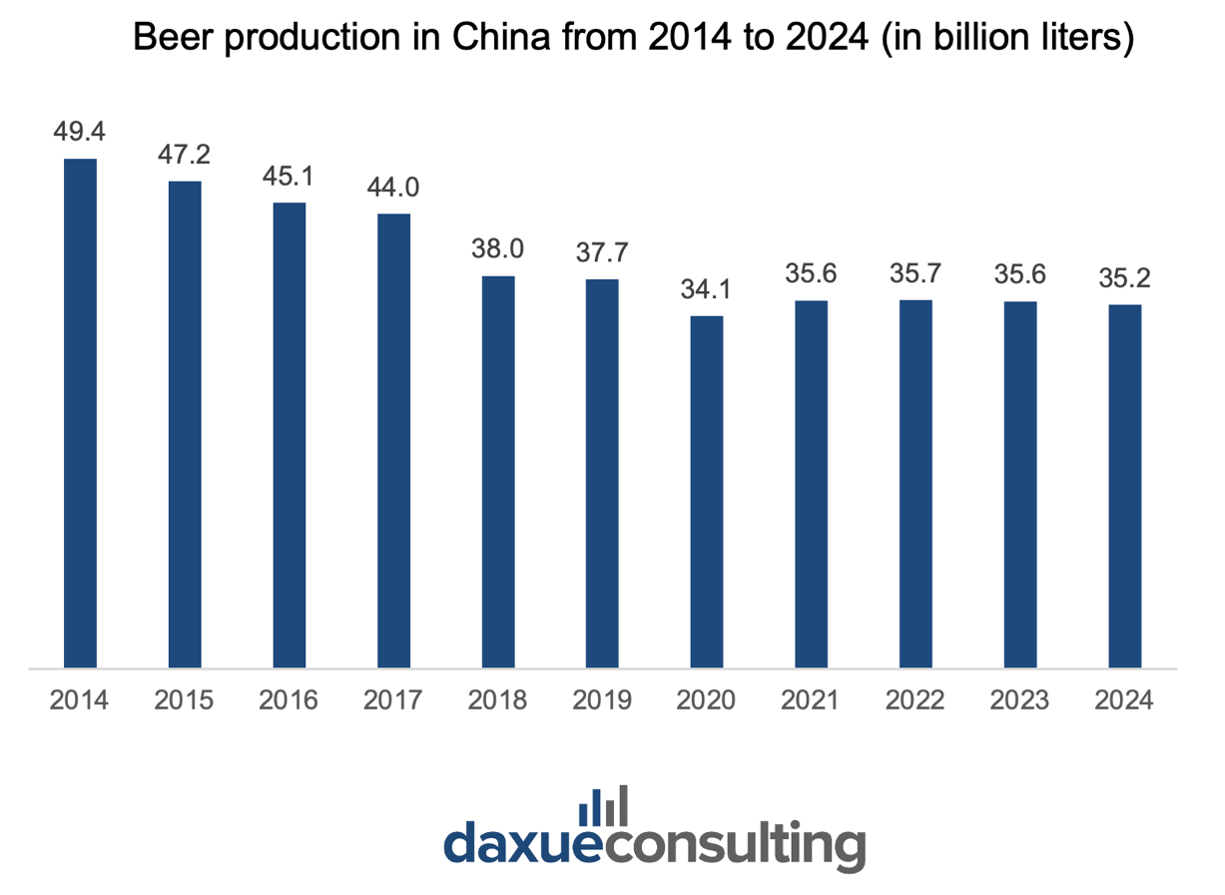

Beer production peaked in 2013 and experienced a 3.4% annual decline until 2017. This downward trend reversed as the market shifted toward premiumization, bringing steady recovery. Despite setbacks due to COVID-19 lockdowns in 2020, the rise of e-commerce and live-streaming platforms also helped mitigate the damage, allowing production to rebound to 35.6 billion liters in 2021, with a 4.4% growth rate.

On the demand side, beer consumption also declined between 2014 and 2018 by an average of 6.7%. However, as consumers developed a stronger preference for high-quality beers, consumption rebounded from 37.96 to 38.57 million kiloliters between 2019 and 2021.

Even after the COVID-19 restrictions were lifted, Chinese consumers continue to show interest in purchasing beer online. 53% of consumers preferred online purchases in 2022, with interest rising to 83% in 2023. Moreover, between 2018 and 2022, online alcohol sales in China grew at a 16% CAGR, capturing 39% of global e-commerce alcohol sales.

The rise of premium and ultra-premium beers

As middle-income families grow and consumers value high-quality, consumers are seeking premium beer, such as Qingdao, Budweiser, and Carlsberg. In response, beer brands have been using premiumization to boost their profit margins and expand their market share. As the beer industry gets more competitive, there’s need for brands to stand out through unique experiences relevant to young consumers.

“Premiumization can remain effective, but it needs to evolve to an experience-oriented one. Beyond the product itself, brands need to elevate experiences, such as pairing beer with curated dining experiences or interactive packaging that enhances the consumer’s connection with the product.”

– Manman, Corporate Innovation Lead at AYO Innovation Consulting

At the ultra-premium end, beer in China is a symbol of a premium lifestyle, much like fine wine and high-end liquor. Leading breweries are using heritage marketing and exclusive packaging to position their most high-end products and appeal to affluent consumers. For instance, Budweiser’s Snake Year Edition is an ultra-premium release priced at RMB 1,988 (about USD 280) per 798 ml bottle, limited to just 3,000 bottles globally, targeting collectors and high-end consumers. Similarly, Tsingtao Centennial Hongyun, priced at RMB 669 (about USD 91), comes in a limited edition gift box, signed brewmaster certification, premium ingredients, and the inclusion of two crystal glasses.

The titans of China’s beer market

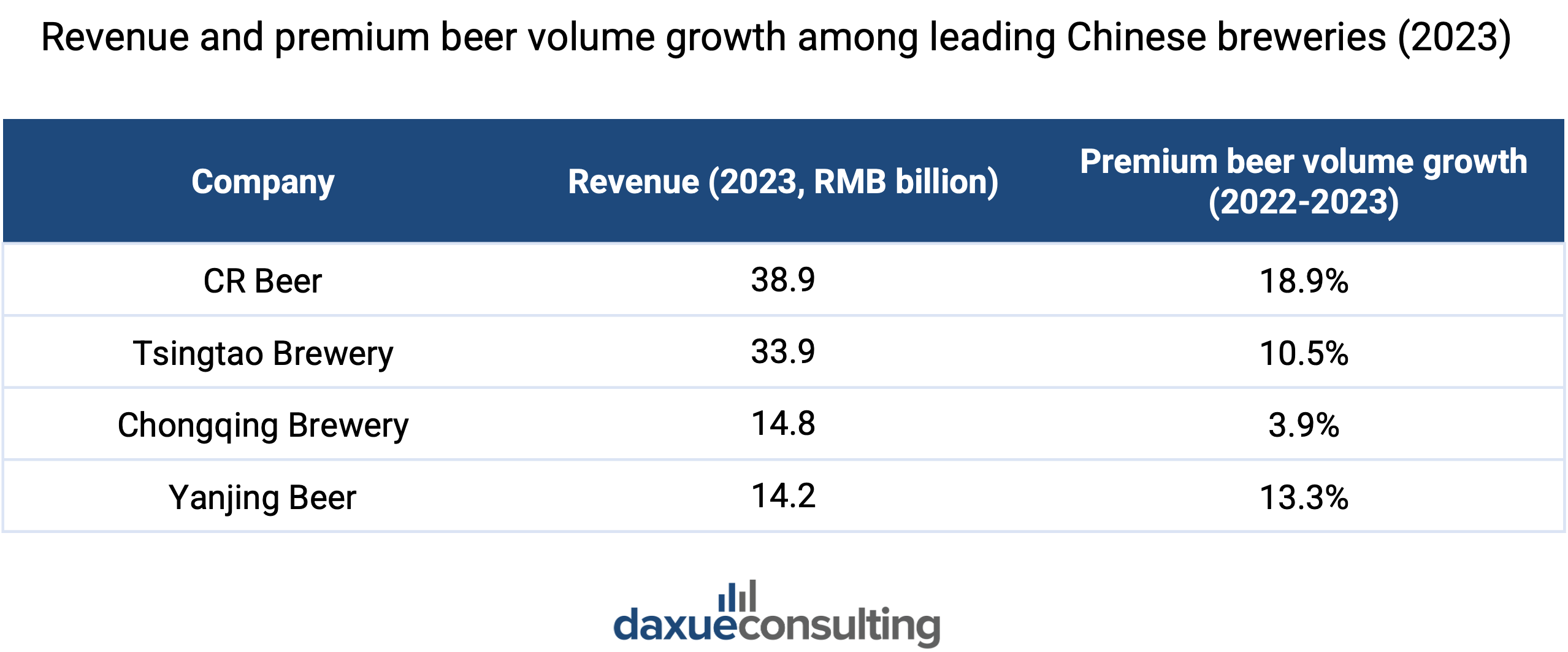

From 2017 to 2021, the top five beer companies in China increased their market share from 75.6% to 92.9%, with China Resources Beer (CR Beer), Tsingtao Brewery, Budweiser, Yanjing, and Carlsberg emerged as dominant forces, forming a highly concentrated industry. Instead of competing on volume, profitability can also depend on higher revenue per ton. This has driven brands to focus more on premium beer instead of maximizing production of their mass beer.

CR Beer, known for its Snow Beer brand, acquired Heineken (China), a move that elevated its overall product pricing and expanded its portfolio with premium offerings, such as Craftsmanship (匠心营造). As part of the premiumization strategy, CR Beer is also venturing into the baijiu market through its “beer + baijiu” dual empowerment model. CR Beer aims to create synergy that would allow beer to inherit baijiu’s cultural heritage and baijiu to benefit from beer’s modern market strategies, thereby driving mutual growth and industry transformation.

Tsingtao Brewery is renowned for its product quality and century-old brand heritage. The company has reinforced its premium positioning through the launch of products like “Hong Yun Dang Tou” (鸿运当头). In particular, the introduction of “A Century of Legends” (一世传奇), an ultra-premium product, underscores Tsingtao’s leadership in China’s beer consumption upgrade.

As part of the Danish Carlsberg Group, Chongqing Brewery benefits from strong international resources and technical expertise, solidifying its leading position in the local market while enhancing its competitiveness in the premium segment.

Who drinks beer? Understanding China’s beer consumers

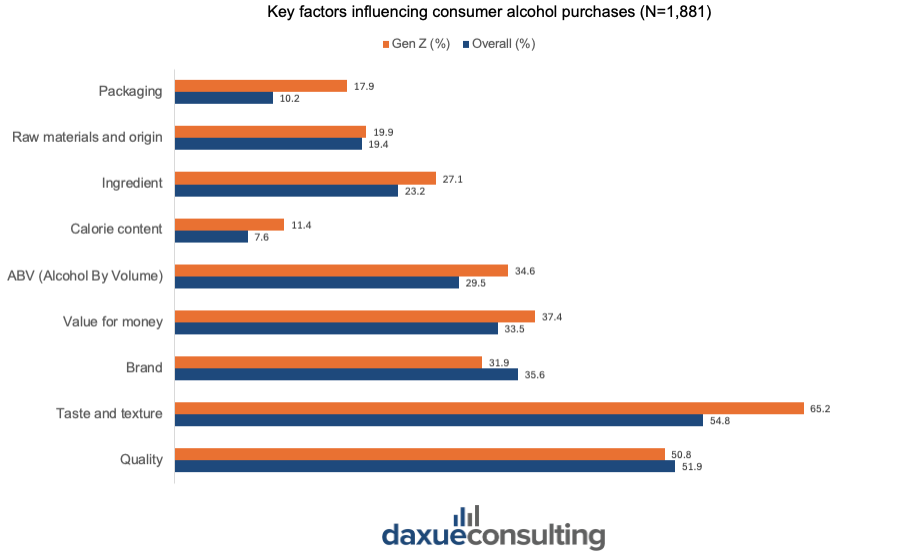

As of 2024, 59% of beer consumers in China are aged 25-44, with men comprising nearly 60%. Based on a survey of 1,881 respondents conducted by 36Kr Research Institute, domestic baijiu (58%) and beer (53%) are the most popular, significantly ahead of wine, fruit and herbal liqueurs, and Western spirits.

Beyond taste and texture, alcohol quality and brand recognition are the two other key factors consumers prioritize when purchasing alcoholic beverages, reflecting a growing demand for high-quality alcoholic drinks.

Additionally, as Gen Z emerges as a core consumer group, their preferences increasingly shape alcohol consumption trends. Compared to the overall consumer base, Gen Z’s interests are nearly 1.76 and 1.5 times more significant for packaging and calorie content, respectively, indicating that Gen Z consumers not only seek high-quality, low-calorie alcoholic beverages but also value packaging that is stylish, fun, or bold. In other words, alcohol products that strike a balance between aesthetics and alcohol quality are more likely to attract Gen Z consumers’ attention and loyalty.

Indeed, diversified and lightweight packaging, such as sleek aluminum cans, mini cans, and resealable aluminum bottles, has become a major trend in China’s beer market in recent years. The rise of canned beer has enhanced visual appeal, aligning with modern lifestyles while reflecting consumer demand for convenience and sustainability.

Beyond the buzz: Healthier drinking trends

With growing health awareness, low-alcohol and non-alcoholic beers are gaining traction. The non-alcoholic beer segment (≤0.5% ABV) grew from RMB 312 million to RMB 1.32 billion from 2017 to 2023, at a CAGR of 105.7%.

Leading global beer companies are also embracing this shift. For example, when measured against the typical 5% ABV, lower alcohol alternatives represent a larger part of AB InBev’s portfolio. Meanwhile, the company is committed to grow in the zero-alcohol segment with extensions of brands, such as Corona Cero and Budweiser Zero.

Distinguished from industrial beer by its strict ingredient selection, longer fermentation, and richer flavor, craft beer is increasingly appreciated by Chinese consumers for its potential health benefits due to its high content of phenolic compounds, which have been linked to positive effects on cardiovascular health, neurodegenerative diseases, and even the immune system. From 2013 to 2023, the number of enterprises engaged in craft beer related businesses grew from only 15 to 2,010, reflecting the rapid market expansion.

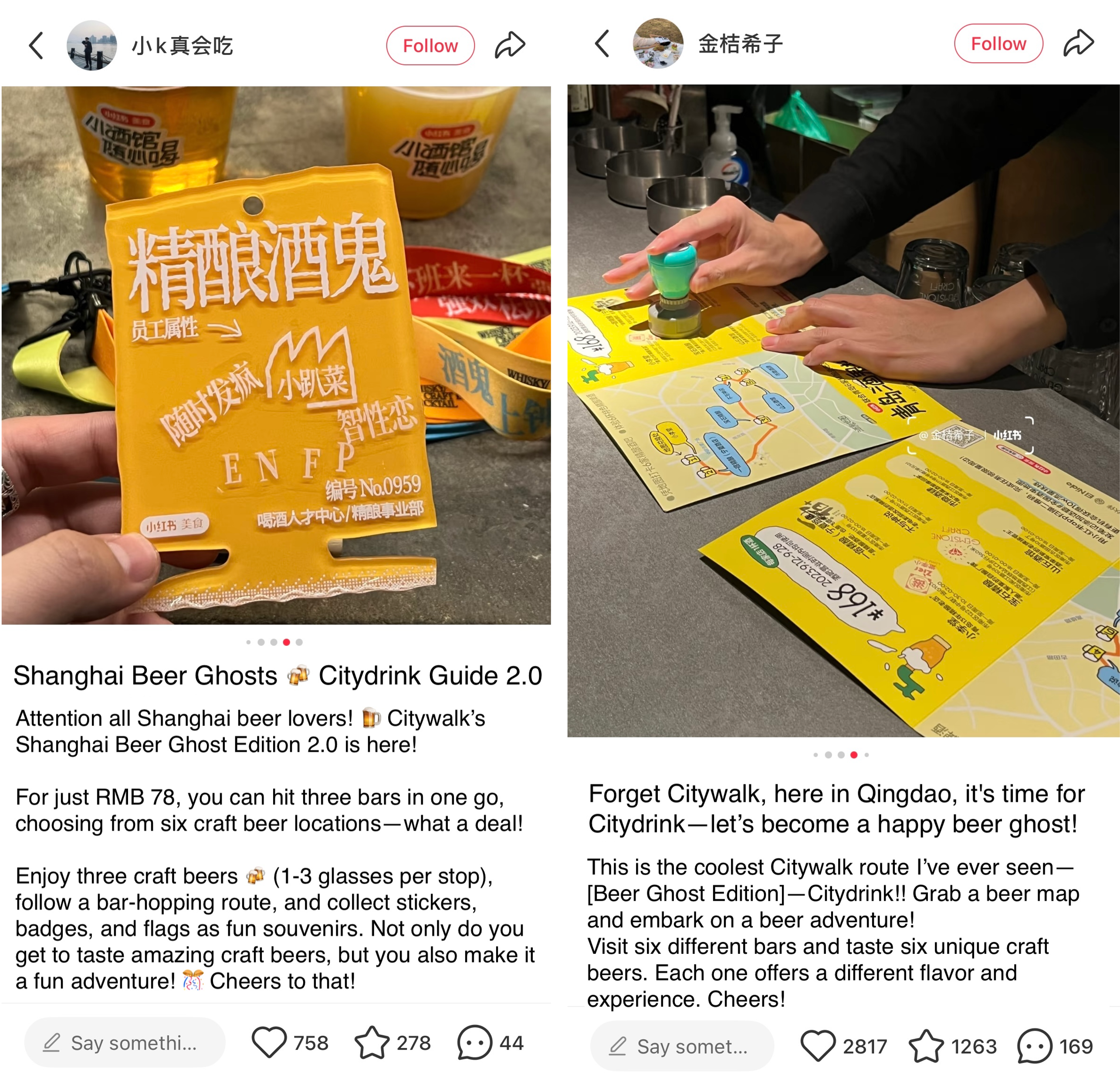

On Xiaohongshu, craft beer enthusiasts have extended Citywalk into Citydrink, exploring and checking in along the “Beer Ghost Map” (酒鬼地图) drinking routes.

Summer is coming: Beer’s biggest season

Beer is a social and sports-viewing staple, with peak sales occurring from April to September. In summer 2024, beer sales in China spiked by 50% following the UEFA Euro Cup kickoff. Due to time zone differences, matches air during midnight to early morning hours, fueling a surge in nighttime beer consumption, reflected in a 40% year-on-year increase in late-night alcohol delivery orders. Unlike in Western markets, where stadiums and bars see the biggest sales boost, China’s on-demand platforms like Ele.me and Meituan enable fast beer delivery, making at-home sports viewing a major sales driver.

Ice promotion has become a game-changer in beer summer marketing. The “Ice + X” trend has gained traction across multiple beverage categories, making ice cups a highly versatile and widely adopted concept. In summer 2024, orders for ice cups increased by 208%, and orders for “ice cup + beer” increased by 299% compared to summer 2023, reported by Ele.me. With pre-filled ice cups sold alongside bottled or canned beer, consumers can enjoy an instantly chilled drink anywhere.

Recognizing the growing trend of “Ice + X” consumption, beer brands partnered with Ele.me and convenience store chains to integrate ice cup promotions. For instance, Tsingtao Brewery saw a 70% increase in sales, and Carlsberg boosted brand recognition by 80% and retail sales by 88%.

The beer market in China is going premium

- China continues to be the leading producer and consumer of beer in the world. After reaching its peak, beer production has been gradually decreasing. Consumption also fell until it rebounded in 2019.

- Chinese consumers are showing greater demand for premiumization. This has led brands to compete against higher revenue per ton rather than on the volume of their mass-market beer.

- The beer market is dominated by five beer companies – CR Beer, Tsingtao Brewery, Budweiser, Yanjing, and Carlsberg – who hold over 92.9% of market share.

- Gen Z is shaping beer consumption trends, placing higher value on aesthetics, calorie content, and innovative packaging.

- Health-conscious beer options are on the rise, with non-alcoholic and low-alcohol beers growing at a CAGR of 105.7% from 2017 to 2023. Craft beer is also booming, with the number of craft beer enterprises in China rising from 15 in 2013 to 2,010 in 2023.

- Beer remains a social staple, particularly during major sports events. Meanwhile, innovative marketing strategies, like the “ice cup + beer” promotions, are boosting beer sales in the summer.