Following the global diet trend, the meal replacement market in China is on the rise. The result of Daxue consulting’s survey on perceptions of healthy diet in China shows that the majority of the Chinese consumers have become familiar with the concept of meal replacement. Additionally, Euromonitor International forecasts that the market size may reach 120 billion RMB in 2022. The growth of the market can be understood by the wider healthy eating trend in China, in conjunction with the consumers’ increasing demand of convenient meal options.

According to CBNData’s report, the number of consumers and the consumption of the Chinese meal replacement market both doubled in 2019. Moreover, its media exposure, based on the Sina media index, has been steadily increasing. The industry was brought to the spotlight by state-run media like China Daily with positive report in the end of 2020. In the report, a regular meal replacement consumer commented that “the meal replacement industry has huge potential for growth, and the market needs not only products, but also education about healthy eating.” In conjunction with the increasing awareness of food nutrition and the trend of healthy diet, the meal replacement market in China will continue to expand, and the brands have to know the users’ needs and concerns to capture the market.

Chinese meal replacement consumers: Urban, women, and dieters

In China, the concept of meal replacement is still relatively new and many consumers are still skeptical of the possibility of replacing solid meals with food like smoothies and yoghurt. Regular consumers of meal replacement are still the minority and many consumers purchase them out of curiosity or only as their diet occasionally. CBNData’s report points out that only 22 percent of consumers who had purchased meal replacement products online spent more than 1,000 yuan on meal replacements in 2019, but more than 60 percent of them consume meal replacements at least once a week, and 20 percent do so once a day.

According to the report, women are the main consumers of meal replacements in China, accounting for more than triple of the consumption amount by male consumers in 2019. This is due to larger weight loss demand among female consumers, and most of meal replacement products position themselves as weight control diet option.

The products are popular among the Millennials and Gen Z, due to their larger demands of weight control diet option and convenient diet options. Those born after 1995 contributed to the most consumption amount as the age group, possibly because their wider acceptance of non-traditional diet options and their more frequent use of social media, where meal replacement brands emphasize their marketing.

People in the first and second-tier cities are still the main consumers of meal replacement products, due to their larger demands on convenient food option and the better penetration of the diet trends in those cities, assisted by the offline presence of products in gyms or stores. At the same time, the brands should bring their attention to the slower but also steady growth of the market in the lower-tiered cities. Brands can put more effort into the “xiachen” market to accelerate the overall growth of the meal replacement market and gain market share.

Chinese meal replacement brands

CBNData’s report indicates that the number of brands in the market doubled from 2018 to 2020. The biggest brands in the online channels are Herbalife specializing in meal replacement smoothies, Sharkfit specializing in pre-cooked chicken breast, and MissZero specializing in instant meals. The three brands are representative of the actors in the Chinese meal replacement market. While Herbalife provides wider categories of diet supplements, the latter two specialize in the meal replacement, and specifically, Sharkfit for fitness enthusiasts, while MissZero for those on diet.

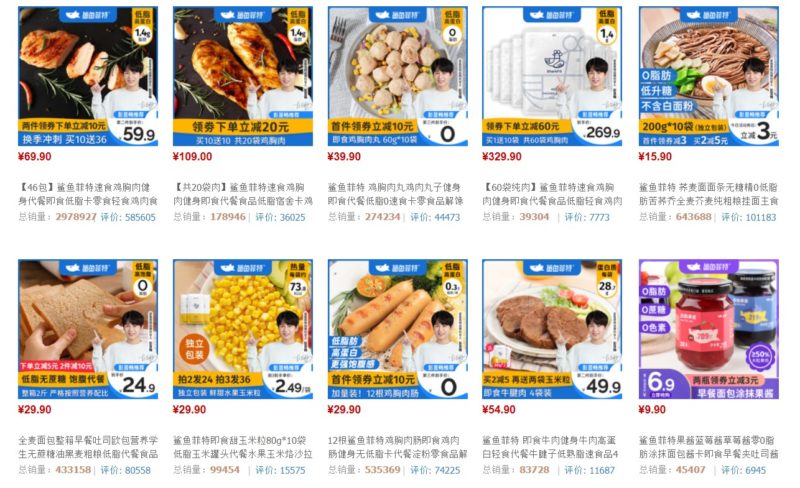

Source: Tmall (MissZero (left), Sharkfit (right)), meal replacement promotional materials highlight that they are low fat and high protein

Examining popular brands in the market which specialize in meal replacement products, we can find that although they are known for their specialized categories, they are expanding their products offering to other types of meal replacement categories in order to capture more market share. In general, most of brands offer most of common categories of meal replacement products, including smoothies, yoghurt, energy bars, and pre-cooked meals.

Source: Tmall (Sharkfit), meal replacement product categories, many products are not smoothies or bars but instant meals marketed as ‘meal replacement’ in China

Meal replacement trends on social media: Xiaohongshu

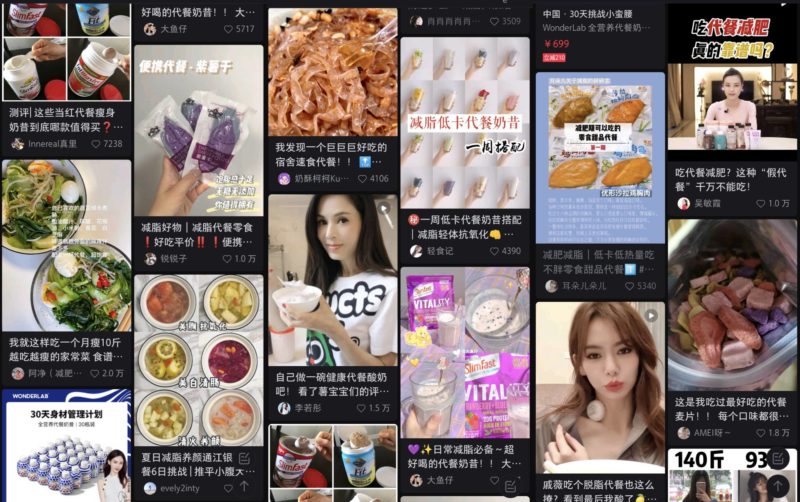

On Xiaohongshu, meal replacement is a trending topic, with more than 280 thousands posts about meal replacement. A wide range of meal replacement products are shared; the most popular categories of meal replacement on Xiaohongshu are smoothies, powders and snacks. The majority of content is posted by female users and put emphasis on the products’ effects on weight control and other types of health benefits like vitamin supplement and digestion improvement.

Source: Xiaohongshu, trending posts for meal replacement

Ingredient list is high priority

Rather than showing the personal experience on weight control by the products, most of users choose to highlight the ingredient list of the products to offer a more direct and intuitive way of demonstrating the benefits of the products.

At the same time, the taste of the product is another most emphasized part in all the posts. Even when bearing the goal of weight control in mind, the majority of the consumers are not willing to compromise on the taste of the products. Although there are a wide range of meal replacement products that can help the consumers achieve their weight control purpose, those offering a wide variety of appetizing flavors are the ones that stand out on social media.

Social media also is a place for criticism of meal replacements

On Xiaohongshu, some of the trending posts criticize the proclaimed health benefits of meal replacement and its efficacy on weight control. Hence, brands needs to pay more attention to their marketing to differentiate themselves from snacks and use more scientific evidence to convenience prospective consumers.

Source: Xiaohongshu, posts questioning the efficacy of meal replacement

Perceptions on meal replacement’s health benefits among Chinese

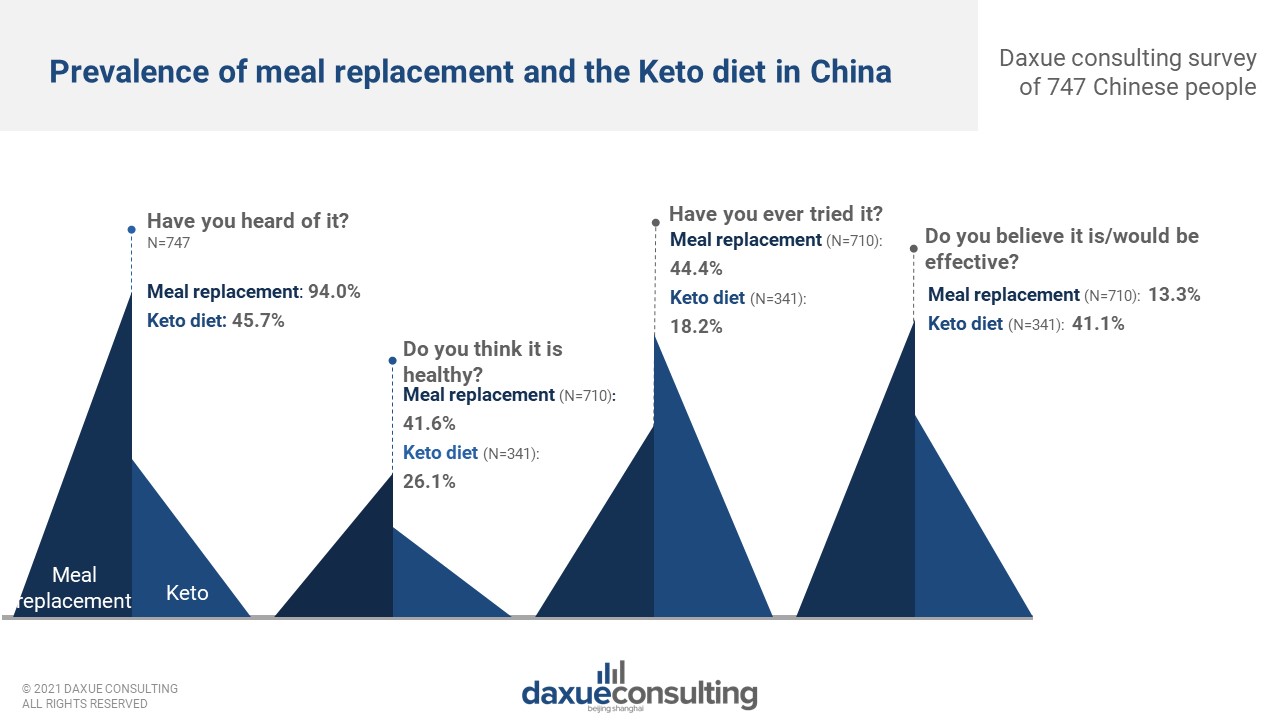

According to Daxue consulting’s survey on perceptions of healthy diets in China, the majority of the respondents are relatively aware of meal replacement as a diet option in China. 94% respondents have heard of it and 26.4% of them claim to be familiar with it. Compared to keto diet, another globally popular diet trend, meal replacement is significantly more well-known in China. Our analysts suggest that the popularity of meal-replacement products is due to its recent aggressive market expansion and promotion in the Chinese market.

See our full health perception in China survey results here

However, the report also points out that despite the consumers’ familiarity with the trend and its popularity on social media like Xiaohongshu, only 38.9% of them have ever tried meal replacement themselves. Moreover, 57.3% of the respondents who have heard of meal replacement consider it unhealthy and 86.1% of them think it has a weak or no effect on losing weight. Our analysts draw attention to its presence on social media and point out that the nature of most of posts is product recommendations and sharing experiences. The seldom presence of of scientific data or proof for benefits of meal replacement may have led to the lack of confidence in this new health product in China.

Source: Daxue consulting survey on health perceptions in China, Meal replacement Vs Keto diet

Elevated by the general trend of healthy diet in China, brands in the market still have some works to do to convince more consumers of the health benefits of meal replacement. Other emphasizing the products’ effects on weight losing and their nature of convenient diet option, brands should make put more marketing efforts in showing their products’ health benefits and their capability of replacing a solid meal without compromising nutrition intakes. Only by doing so, they can attract those skeptical of meal replacement’s health benefits, and further expand the market.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about healthy food consumption in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast