Massive Open Online Course (MOOC) is an online learning ecosystem featuring unlimited participation, openly accessible curriculum, and interactive features. MOOCs have gained vast popularity in China since 2013, allowing millions of Chinese learners regardless of location, schedule, and financial constraints to access quality education. The overall e-learning market grew exponentially and reached maturity in 2018. During the COVID-19 pandemic, MOOCs received a surge in demand as schools closed down due to lockdowns and health concerns. The number of online education users reached 423 million in March 2020. After the measures relaxed, MOOCs user base still remained large, reflecting the potential of e-learning platforms in enhancing the Chinese education.

Despite the growth, the MOOC market in China is facing various challenges including the low completion rates, rough user experience, the lack of effective face-to-face elements, homogenized competition among providers, and the recent education crackdown which left the future of MOOC market uncertain.

The development of the MOOC market in China

The concept of MOOC took off in 2011, when professors from Stanford University started the online learning companies Udacity and Coursera. Following that in 2012, MIT and Harvard University launched edX. The three platforms would later become the leading MOOC providers, offering more than half of all MOOCs worldwide in 2015. Coursera and edX had a large number of Chinese enrollments in their early years even though courses were only available in English, revealing a huge demand for online learning in China.

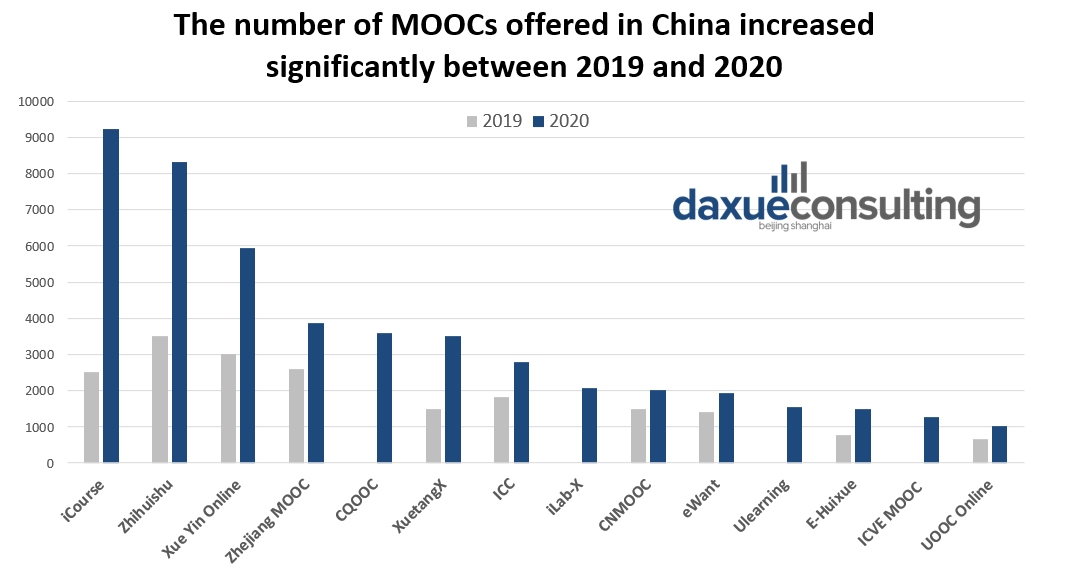

The development of MOOC in China first began when Tsinghua University launched China’s first MOOC platform called XuetangX in 2013, using edX’s open source. The platform offers over 3,500 courses, including 10 online degree programs. Between 2013-2016, Chinese firms and universities joined in the initiative and launched other MOOC platforms such as iCourse, Zhihuishu, CNMOOC, and many others. In 2020, there were over 34,000 MOOCs from more than 15 providers in China.

With the growing demand of e-learning as well as the applications of digital technology, China also saw the emergence of highly funded EdTech firms such as Yuanfudao, Zuoyebang, VIPKid, and GoGoKid. Read more about these innovative ed-tech startups in China.

The Chinese government has been supportive of MOOC since early in its development

In 2015, China Ministry of Education (MOE) announced a set of policies aimed to promote the development of online learning platforms. In 2018, MOE announced an initiative that recognizes best Chinese MOOCs every year, setting the bar that China should have at least 3,000 nationally recognized MOOCs in 5 years. Online courses that pass the quality criteria and evaluation would receive a national recognition.

China’s education crackdown expected to last for a few years

After the crackdowns on tech giants, the government had moved onto regulating the $100-$120 billion USD private tutoring sector. MOE has handed out fines on a number of education companies for misleading pricing and false advertising. Rising EdTech startups Zuoyebang and Yuanfudao were fined a total of 2.5 million yuan ($386,000 USD) for deceptive marketing.

Two weeks after that, the ministry established a special department to oversee tutoring institutions. The department will monitor and supervise on areas including teaching content, duration, tutor qualifications, fees, and advertisements.

MOE announced new rules which include banning private tutoring firms from making profits off the core education, preventing them from raising capital and hiring foreigners to teach school subjects. These rules apply to both offline and online forms of tutoring. In addition, MOE will stop approving new tutoring companies and require the existing ones to undergo regulatory reviews.

The 14th Five-Year-Plan emphasizes high-quality development through addressing social problems

The National People’s Congress approved the Five-Year Plan on March 2021, outlining development policies and reforms for China during 2021-2025. This time the plan focuses more on living quality and sustainability, rather than economic growth like the past years. The government’s position on regulating the education industry can stem from two major social problems:

1) China’s demographic crisis: The falling birthrate and aging population

According to the official notice, the crackdowns on education were aimed to further ease the financial burden for families and reduce workload for students on compulsory education. This is believed to be an attempt to slow down the demographic crisis after the three-child policy failing to increase childbirth rate in upper-tier cities. As China is moving towards aging society like Japan, economic problems such as worker shortage may arise.

One of the main reasons many Chinese do not want children is the high cost of raising a child. According to a survey conducted by China Youth Daily, 61.7% would not have a second child because of financial reasons. Although China has relatively cheaper tuitions, private tutoring can be expensive and is often seen as necessary for children to keep up in the competitive school environment. Chinese parents spend an average of 120,000 yuan per year on tutoring according to National education association, while per capita disposable income in Shanghai was 72,232 yuan in 2020.

2) China’s need to reform education

China has an exam-based education system which places more values on academic performance, leading to fierce competition among students. It is common for Chinese parents to send their children to tutoring schools for extra training on core subjects to perform better on entrance exams like Zhongkao 中考 and Gaokao 高考. These exams can often decide the academic future of domestic students, whether they can attend a good school or study in a competitive field. The tutoring culture also induces inequality such that students whose parents can’t afford tutoring would fall behind. President Xi described K-12 education market as a “social problem” during the CPPC conference in March 2021

According to MOE, there were over 400,000 tutoring institutions in China at the end of 2018. An average of 75% of K12 students reported to attend tutoring centers after school or during breaks, with greater percentages for Beijing and Shanghai.

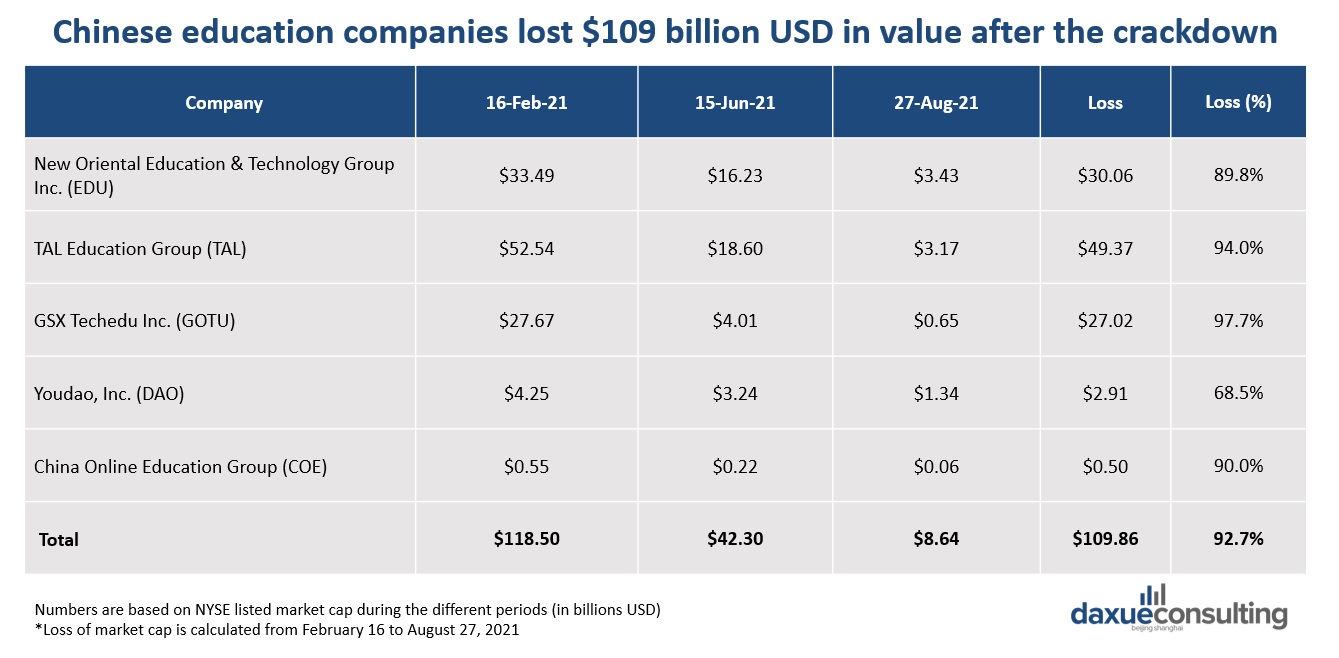

The effects of tightened regulations have been devastating for many education companies.

Education crackdowns has led to drastic drops in market cap for almost all education firms. The 5 largest education companies in China have lost over $109 billion USD in market value since February 2021, with the average of 88.8% loss in value. The crackdown has also disrupted IPO of Chinese EdTech unicorns Zuoyebang and Yuanfudao.

Chinese education platform VIPKid mentioned it would suspense online courses taught by foreign-based tutors to comply with the new regulations. As of 2020, VIPKid employed more than 70,000 foreign teachers from North America.

Many tutoring companies like Yuanfudao and 51Talk have been laying off staffs and shutting down offline tutoring centers. ByteDance’s English tutoring platform GoGoKid will shut down completely. While two other teaching platforms for kids and young students under umbrella (Guagua Long and Qingbei) will shift focus to other subjects like arts.

What will happen to the MOOC market in China?

It is unclear how the new rules will be enforced. How things will turn out also depends on the future policies and changes later on. Nonetheless, the Chinese government clearly sees the private tutoring sector as a problem, intending to turn the sector into non-profit. The crackdown has shown a direction towards reshaping the education sector and reforming the Chinese education as a whole.

We can expect smaller impacts on MOOC market

Unlike tutoring firms which focus on K12 test preparations, MOOC has a much broader scope on subject offerings, and it is geared more towards university students and professionals. Most MOOCs are free to access, with a mix of free and paid certification. MOOCs that cover compulsory subjects may no longer be monetized if MOE strictly enforce the rules.

The bans on foreign courses, materials, and foreign-based tutors may put an end to one-on-one language tutoring courses. Some language MOOCs may be affected because of this. Language MOOC providers may need to make adjustments, for example, switching to Chinese teacher led classes and shifting focus to international users.

MOOC to continue focus on higher education as an important part of the education reform

Domestic innovation is the center of the 14th Five-Year-Plan. Since education is the primary source of innovation as it can directly upgrade human capital, the government would need to make education better and more accessible. MOOC as a platform can provide equal access to high-quality education particularly in rural areas where China is trying to transform.

Wu Yan, the head of China’s Higher Education Department mentioned during the press conference in 2018 that “MOOCs are critical to reform China’s traditional cramming teaching model, particularly in higher education”. He also added that MOOC’s large-scale sharing nature would allow China to meet massive and complex needs in different regions.

Final thoughts on MOOC market and the education crackdown

The crackdowns on after-school tutoring businesses will only disrupt the supply. As long as schools in China continue to place more importance on exam scores, there will still be demand for tutoring. Reforming education can take years of implementing policies. In a short term, the supply for tutoring schools might move online and underground as the reform continue to unfold.

There will be further reform on the national examination and enrollment system. Depending on the upcoming policies, MOOCs providers may have the opportunity to capture demand for new emerging areas in the place of core subjects tutoring. In the meanwhile, MOOC might see more demand for online courses that offer skills development, out-of-school knowledge, and elective courses.