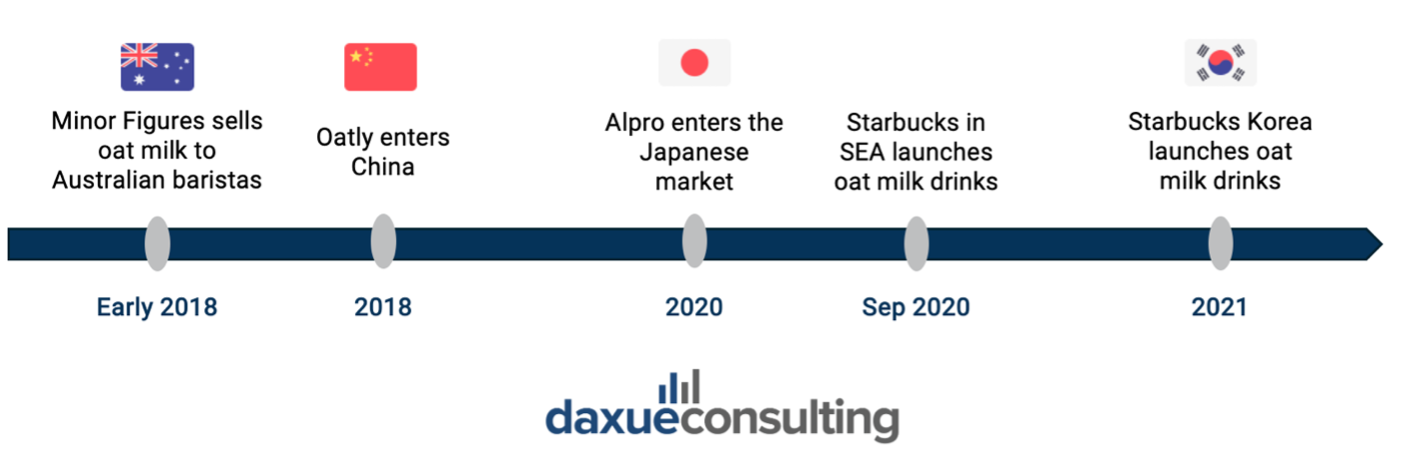

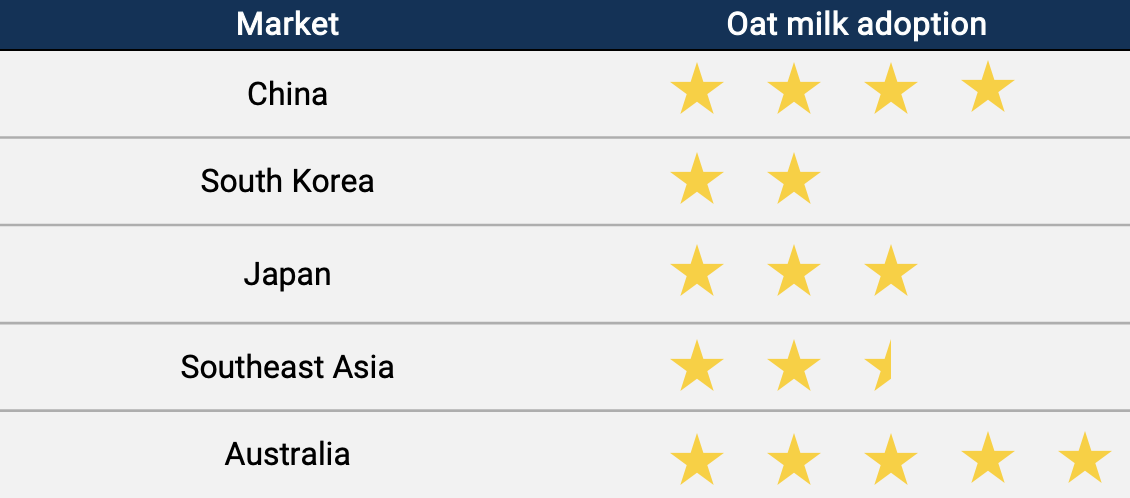

The global oat milk market reached approximately USD 2.52 billion in value in 2022 and is forecasted to grow to USD 6.09 billion by 2032. While oat milk initially gained popularity in the West, it has now expanded into the APAC region. Global brands such as Oatly and Alpro have entered various APAC markets through partnerships with coffee shops or through targeting end-consumers. However, market maturity varies widely, reflecting diverse consumer preferences and adoption rates of oat milk in the APAC.

Overview of oat milk in the APAC

A highly competitive market

The oat milk market in the APAC is highly fragmented, lacking clear dominance by a single player. The top five companies are Oatly Group AB, Freedom Foods Group Ltd, Nestlé SA, PureHarvest, and Sanitarium Health and Wellbeing Company. Together, they have a market share of 23.5%.

Off-trade is the main consumption channel

In APAC, the largest and fastest-growing market by distribution channel for oat milk is the off-trade segment. It encompasses sales through retail channels such as supermarkets, grocery stores, and convenience stores.

Oat milk in China

Oatly’s 2018 entry and coffee shop partnerships

Oat milk gained popularity in China around 2018 when Oatly entered the market by partnering with high-end coffee shops in Shanghai. This strategy significantly increased Chinese consumers’ exposure to oat milk. Now, increasing numbers of coffee shops, including the leading coffee chain Luckin Coffee, incorporate oat milk into their beverages.

Market share and growth in China

With a market size of USD 236.3 million in 2022, the Chinese oat milk market is projected to grow at a 9.8% CAGR (2023-2032), reaching USD 598.9 million by 2032. It is growing faster than the overall milk-substitute market, which has a 3.96% CAGR (2024-2028).

From cafés to retail: how oat milk won over China

According to our 2023 survey (n = 1,000), convenience is everything, with around 40% of respondents primarily consuming coffee in bottle format or in coffee shops. In contrast, relatively few prepare coffee at home. This is why, instead of targeting Chinese end-consumers, Oatly first focused on partnering with coffee and tea chains like Starbucks and HEYTEA (喜茶). It was not until consumers became more familiar with oat milk that the beverage was sold in retail outlets and online.

Now, oat milk in China is widely used in other beverages beyond coffee. In 2022, Oatly launched the Oatly Tea-Master, a beverage designed specifically for milk tea and developed specifically for the Chinese market. The product quickly gained popularity, with over 50,000 tea shops across China incorporating it into their drinks by the end of 2022.

Drivers of oat milk consumption in China

In China, oat milk consumption is driven by several factors. First, oat milk is a popular alternative to dairy milk for individuals who are lactose intolerant, which is the case for over 70% of East-Asian descent, and for more than 90% of adults in some regions of China.

Secondly, Chinese consumers are increasingly seeking products that are sustainably sourced and environmentally friendly. According to our 2022 survey (n = 1,000), 97% of respondents believe that environmental sustainability has at least some importance when buying food and beverages. This makes oat milk a better option to dairy milk, as it is less resource-intensive.

Lastly, a rising emphasis on health and wellness among Chinese consumers has led to increased interest in plant-based alternatives like oat milk, due to their lower saturated fat and higher fiber content compared to dairy milk.

Oat milk still has room for growth in China

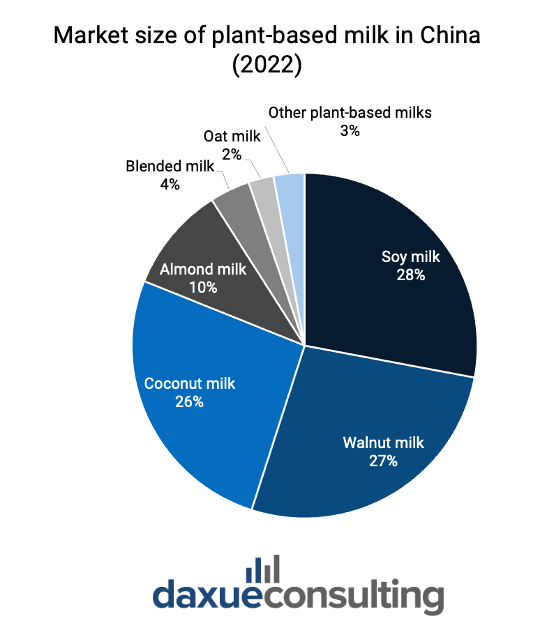

Compared to other plant-based milk in China, oat milk still occupies a small market share of 2%, which is worth RMB 960 million (USD 135.16 million). It is still far behind soy milk (28%), walnut milk (27%) and coconut milk (26%).

Oat milk in South Korea

Starbucks’ summer 2021 oat milk launch

Oat milk experienced a surge in popularity in South Korea around 2021. In the summer of 2021, Starbucks Korea introduced oat milk as a menu option. Within the first month following its launch, over 200,000 oat milk drinks were sold. Around the same time, local coffee chain A Twosome Place started offering oat milk drinks. Oat milk’s popularity extended to independent cafés, as reported by the South Korean distributor of Oatly. As a result, sales of Oatly surged by 160% year-over-year in November 2021.

By the end of 2021, Maeil, the country’s second-largest milk producer, introduced its oat milk product, Amazing Oat, in stores following its online popularity. Within the first three months of its launch on the Kakao Makers online marketplace, over 310,000 packs of Amazing Oat were sold.

Oat milk was still in the early stages at the end of 2022

As of October 2022, oat milk sales in South Korea were insignificant compared to other milk alternatives. Soy milk dominated the market with around USD 514.92 million in sales, followed by almond milk with approximately USD 73.56 million.

However, the number of coffee shops offering oat milk options has not finished increasing in South Korea. Currently, oat milk is the fastest-growing plant-based milk in South Korean cafés, catering to the preferences of health-conscious customers. In 2023, the chain Ediya Coffee announced that all its milk-based coffees can now be made with oat milk. The same year, Mega Coffee also introduced oat milk beverages into its menu. This trend is projected to persist, given Koreans’ strong affinity for coffee and their increasing focus on healthy alternatives.

Oat milk in Japan

European giant Alpro enters the market in 2020

Oat milk started becoming popular in Japan around 2020, with Danone’s brand Alpro entering the market. Although oat milk was already available in Japan before 2020, the arrival of a major player offering an affordable product propelled oat milk into the spotlight. A year later, in 2021, Oatly entered the Japanese oat milk market. The market entrance was followed by local brands like Marusan and Coca-Cola Japan.

Outpacing the overall milk substitute market

The oat milk market in Japan is expected to grow fast, with a projected compound annual growth rate (CAGR) of 13.1% from 2024 to 2032. This is even faster than the Japanese milk substitute market, which has a CAGR of 11.02% (2024-2028).

Educating consumers: how oat milk won over Japan

To popularize oat milk in Japan, Alpro focused on B2C sales. Initially, Alpro focused on educating customers about the health advantages of oat milk through TV and digital campaigns. Alpro also conducted product samplings with health-conscious consumers by partnering with a well-known yoga studio in Japan. Alpro’s dedication to serving end-consumers is further demonstrated by its early efforts to develop packaging that aligns with Japanese consumers’ habits. This led Alpro to introduce a 250ml oat milk packaging size to match the small-sized soy and almond milk products already popular in Japan.

Japan’s health considerations are driving oat milk consumption

In Japan, the consumption of oat milk and other plant-based substitutes is primarily motivated by health considerations rather than ethical or environmental concerns. Alpro Japan’s Instagram content underscores this by highlighting the nutritional benefits of oat milk, including its calcium, vitamin D, and fiber content, aligning closely with the interests of Japanese consumers.

However, while oat milk is getting more popular in the Japanese milk substitutes market, the preferred alternatives are still soy milk and almond milk, which have been consumed in Japan for longer.

Oat milk in Southeast Asia

Oatly’s entry and awareness challenges

Oat milk became more widespread in SEA as early as 2020. This was due to Oatly’s partnership with major coffee chains to promote oat milk consumption in the region. In September 2020, Starbucks released Oatly beverages in a few countries including Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam.

However, a survey conducted by Oatly in Singapore in 2021 (n = 1,000) revealed that one-third of respondents were unfamiliar with plant-based milk. Meanwhile, three-quarters were unaware of its benefits, showing that oat milk was still in its infancy.

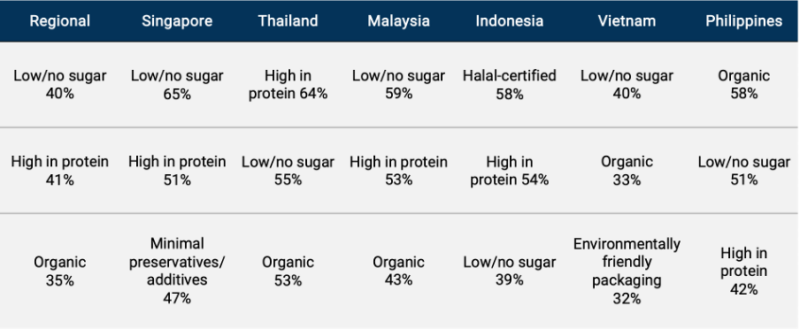

Nutritional value drives plant-based milk consumption in SEA

According to Milieu Insight’s 2023 survey of 1,000 respondents across Southeast Asian countries, a consistent trend emerges regarding motivations for choosing plant-based milk. Nutritional value, particularly sugar and protein content, ranks among the top three criteria across all surveyed countries. Since oat milk has twice lower protein content and more than twice as much sugar compared to the preferred alternative soy milk, it could potentially hinder the growth of oat milk in SEA.

In contrast, factors like environmentally friendly packaging, organic labeling, and the absence of preservatives play a relatively minor role in consumer decision-making.

Barriers to oat milk adoption in Southeast Asia

Several challenges hinder the wider adoption of oat milk in Southeast Asia. Accessibility remains a key issue. Currently, plant-based milk alternatives are more readily available in food establishments like cafés rather than retail outlets. Affordability is another concern, as plant-based substitutes are generally more expensive than conventional dairy products.

A look at Oatside: a brand made in Singapore dominating SEA

Despite oat milk’s market share lagging behind soy and almond milk in SEA, the emergence of Oatside, a successful Singaporean oat milk brand, highlights the opportunities in the SEA oat milk market.

Oatside was created in 2022, and within just two years, it secured USD 65 million in Series A funding. It also managed to expand its market presence to 18 countries worldwide, focusing on APAC. Following its successful launch, Oatside expanded to oat ice cream, with a range of different flavors.

Oatside’s success stems from various factors. One key element is the brand’s commitment to conducting in-house research and development. This allows them to have complete control over the taste, texture, and quality of the oat milk. This dedication resulted in a product that is creamy and malty, reminiscent of Milo, a popular beverage in SEA. Additionally, the brand’s success can also be credited to its playful marketing approach, incorporating cartoons and culturally relevant humor.

Oat milk in Australia

Early 2018: Oat milk for baristas

In early 2018, UK brand Minor Figures was the first company to start selling oat milk to Australian baristas. Like other milk alternatives in Australia, oat milk is predominantly consumed in coffee shops. A 2021 survey encompassing over 900 Australian cafés found that plant-based milk makes up 25% of milk coffee sales and the number is increasing. Notably, oat milk is the fastest-growing plant milk in the market. On the other hand, as of 2023, plant-based milk makes up only 7.5% of retail milk sales in Australia.

Rapid growth forecasted for Australia’s oat milk market

The Australian oat milk market was valued at USD 106.9 million in 2023. It is expected to reach USD 625.4 million by 2032, with a growth rate (CAGR) of 21.04% from 2024 to 2032.

Soy milk currently holds the largest market share in Australia, accounting for almost half of the non-dairy milk market. Coconut milk, on the other hand, is experiencing the fastest growth rate.

Oat milk in the APAC: main takeaways

- The landscape of oat milk in the APAC is characterized by intense competition. There is no clear dominance by a single player observed.

- Oat milk gained traction in China in 2018 when Oatly entered the market, forming partnerships with high-end coffee shops. Oat milk is now widely used in coffee and tea chains.

- Oat milk surged in popularity in South Korea in 2021. Despite initial growth, oat milk sales in South Korea remain modest compared to soy and almond milk.