The online education market in China underwent a 5-year period of exponential growth from 2013 to 2017 and reached maturity in 2018. China’s online education industry entered a “gold rush” boom around 2013, with surging venture capital and increasingly segmented products such as question banks, O2O tutoring, and children’s English. Companies such as 51Talk and Liulishuo have been listed one after another. By the end of 2018, the crazy gold rush era in the e-learning industry had ended, and was largely centered on English classes.

However, against the backdrop of the COVID-19 pandemic outbreak, the e-learning market in China experienced a surge in market demand. With the school summer break commencing in July 2020, various online education institutions entered the battleground of recruiting students for extracurricular tutorials. The competition is intense since the online education market in China is filled with a large number of players, and the market share gained by each player is fairly small. The bottleneck of achieving profitability has not been loosened, according to Caixin. China’s e-learning market looks for more in-depth development and more complex technology to promote the next round of development.

The e-learning market’s competitive landscape has taken its initial shape with K12 online education sector growing rapidly

After 20 years of devious development, China’s e-learning industry realized large-scale monetization with the support of “live-streaming” in 2017. In 2018, with the initial formation of the competitive landscape and the intervention of the government, the online education industry began the initial stage of maturity. Market competition in 1st tier cities is saturating, while 2nd tier cities became the new battleground.

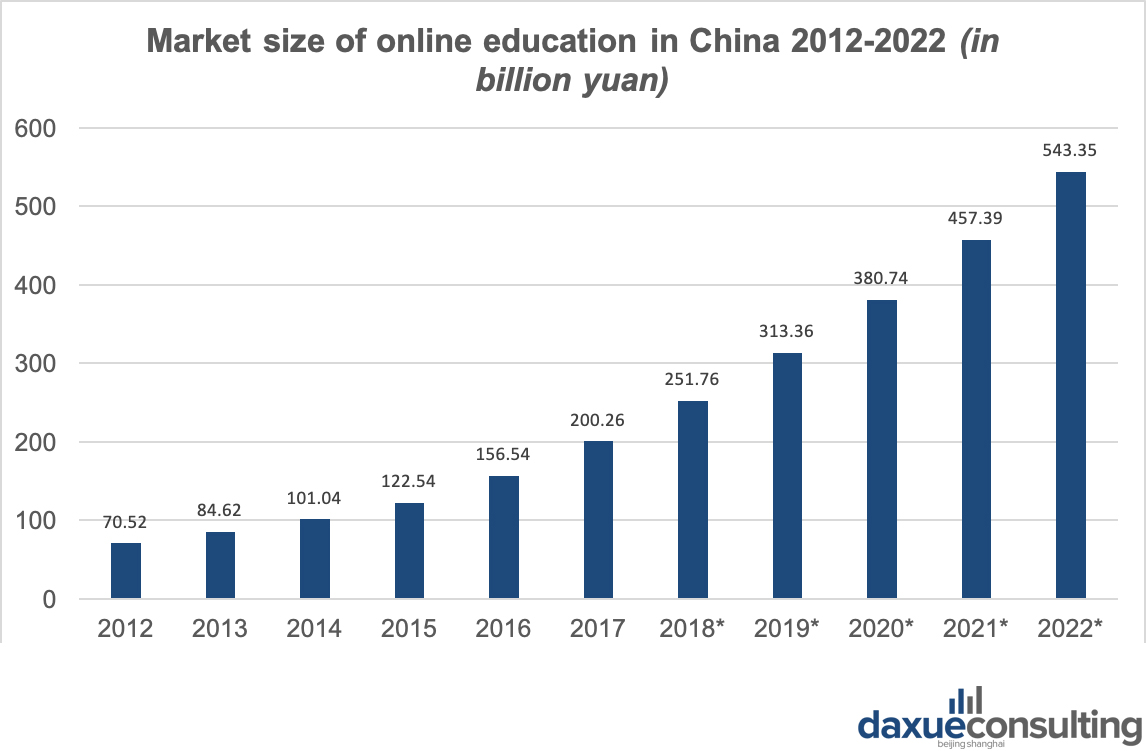

Data Source: Statista, Market size of online education in China is growing as more players enter the market

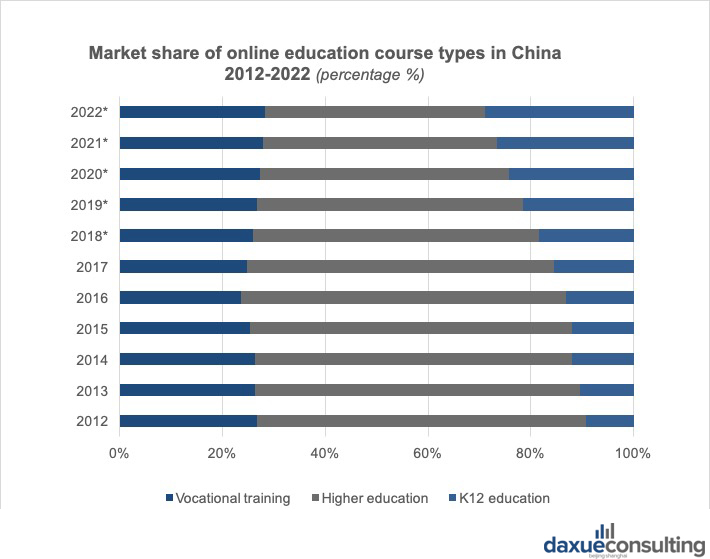

As of 2018, the online education market in China reached 251.76 billion yuan, and the number of paying users reached 135 million. The major players in the online education market in China are Yuanfudao, Zuoyebang, Xue’ersi, and Baicizhan. Higher education and vocational training account for 75% of the total market share.

The K12 education sector in China has grown rapidly, and its share has almost doubled in the past 6 years. K12 online education apps also occupy a far larger share in terms of the number of MAU in all fields of education. As of November 2018, the top three e-learning apps with leading MAU are all K12 online assignment-based apps. This is probably related to the “excessive assignments tactic” in many elementary and middle schools in China, wherein students are encouraged to hone their skills with an abundant amount of homework.

Data Source: iResearch, K12 e-learning is growing in market share

It is also worth noting that in 2018, online education has also been officially included in the scope of supervision of the education industry. The Chinese government has issued national standards and evaluation schemes for online courses, in which engagement is listed as an important dimension.

Under quarantine, the online education market in China revitalized, but the core issues remain unresolved

Due to the COVID-19 pandemic, schools of all types were postponed following the Chinese Ministry of Education’s notices. From February 10th to 28th 2020, the Chinese Ministry of Education issued a series of notices to provide guidance and measures to prevent and control the pandemic in the field of education.

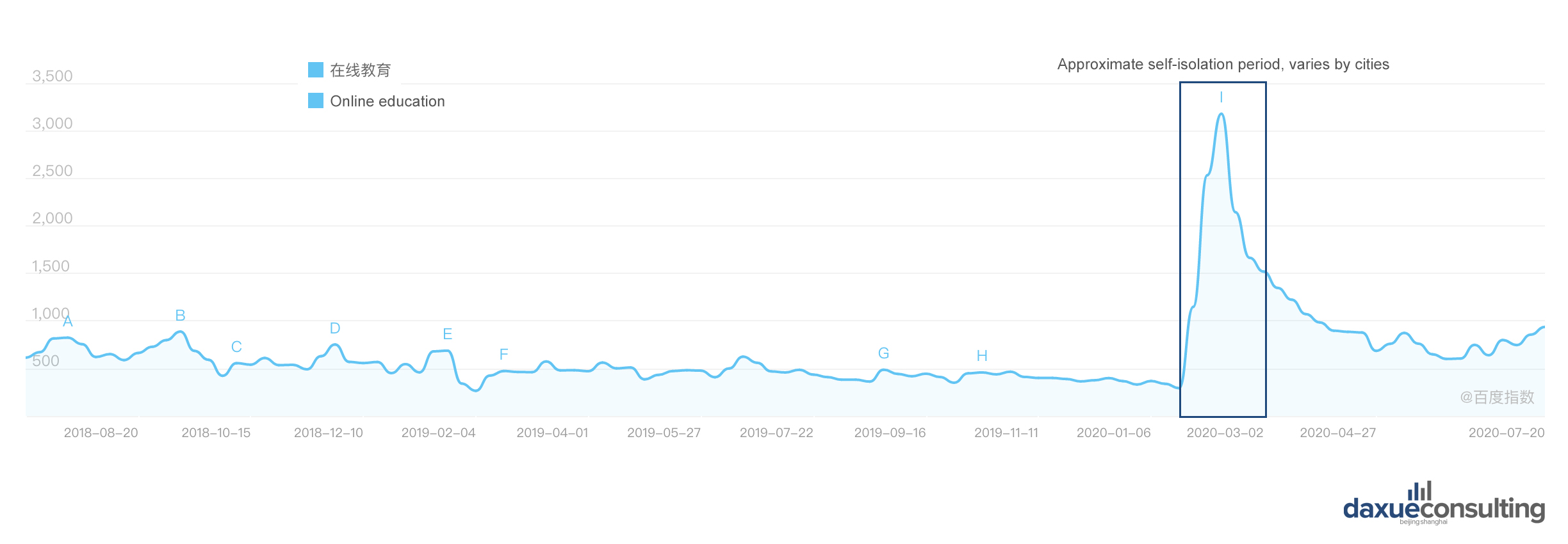

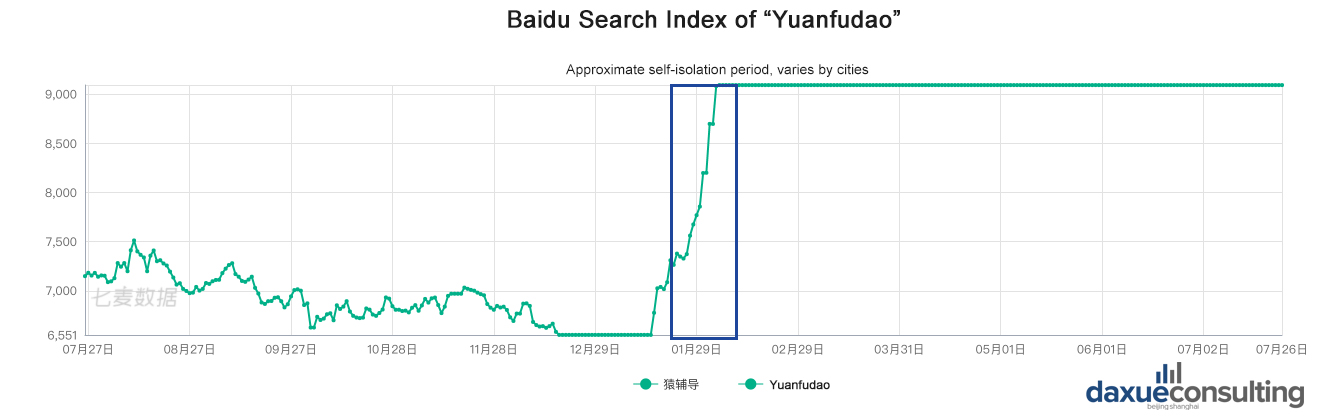

Data Source: Baidu Index, Searches for online education surged during self-isolation period (Jan.- Feb. 2020, varies by cities) in China

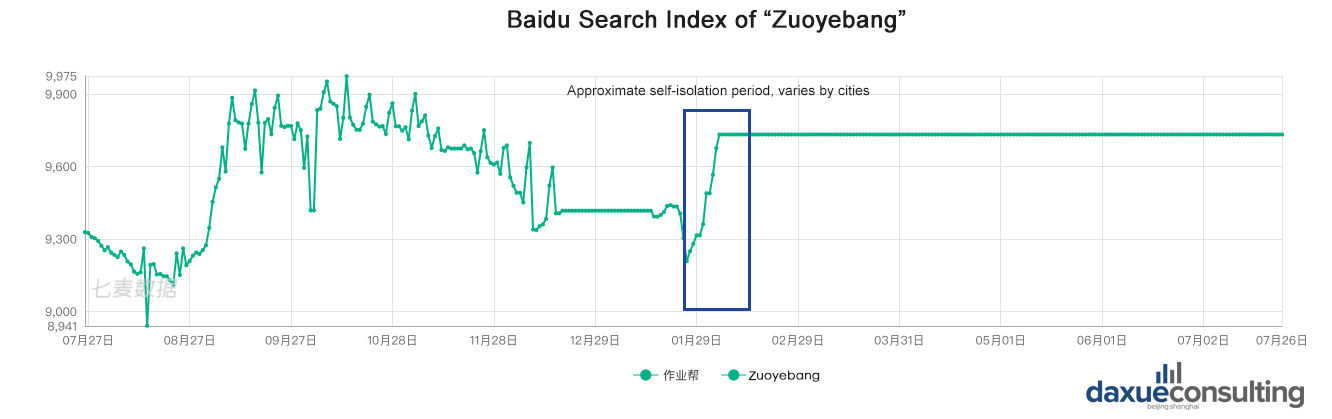

Searches for online education on Baidu surged from late January to early February 2020. Moreover, searches for online education applications on the Apple Store, such as Zuoyebang and Xue’ersi, also increased significantly during this period of time. Yuanfudao, a leading online education platform, had advertized heavily on CCTV channels during COVID-19, leading to an increase of searches on the app store.

Data Source: Qimai.com, Searches for Zuoyebang, Xue’ersi, and Yuanfudao searches on the Apple Store rose significantly during the COVID-19 self-isolation period. Zuoyebang remained the most popular online education application, whereas Yuanfudao showed the most dramatic growth thanks to its massive advertisements during the self-isolation period.

Despite market growth, homogenization, rough user experience, and fuzzy results still remain the core issues that hinder in-depth expansion of the online education market in China. With the intensification of homogenized competition, injecting huge capitals to boost growth has gradually weakened, whereas promoting growth through word-of-mouth and operation have received more attention. Online science eduation in China has lagged behind English tutoring, however we look at how COVID-19 boosted this market.

Education System for Sciences in China is exam-oriented and routine

The education system for sciences in China is routine-oriented. From Year 1 to Year 6, students study Maths as a compulsory subject. After students enter secondary schools, all have to study Biology in Year 7, Physics in Year 8, and Chemistry in Year 9, in this order. Basic skills of Computer Science are taught from Year 7 to 9. These subjects are also tested in the Senior High School Entrance Examination, along with Chinese, Maths, English, Moral Character, History, Geography, PE.

When students enter Year 10 study, they have not yet chosen their orientation. Hence, students have to study all the subjects until Year 11, when they choose between either arts or sciences. Subjects under the sciences stream are Physics, Chemistry, and Biology, along with Chinese, Maths, and English. Students who chose the sciences stream don’t need to study arts subjects (Politics, Geography, and History). In Year 12, students continue to study the subjects under their chosen path.

In the College Entrance Examination, science students are tested on Physics, Chemistry, and Biology, along with Chinese, Maths, and English for the written part. It’s worth noting that arts students and sciences students work on different maths exam papers in the college entrance examination. Generally speaking, science education in Chinese high schools are fairly routine and exam-oriented, wherein students practice heavily on designed questions.

Limited scope of science education in schools gives birth to China’s online science education market; online Maths education market burgeoning

Due to the limited scope of science education in China, some parents will get their children involved in extracurricular learning clubs, such as robotics and coding. The ages of children attending such extra-curriculars is getting younger. In recent years, there are increasingly more K12 online sciences education platforms for the youth, especially online Maths education platforms.

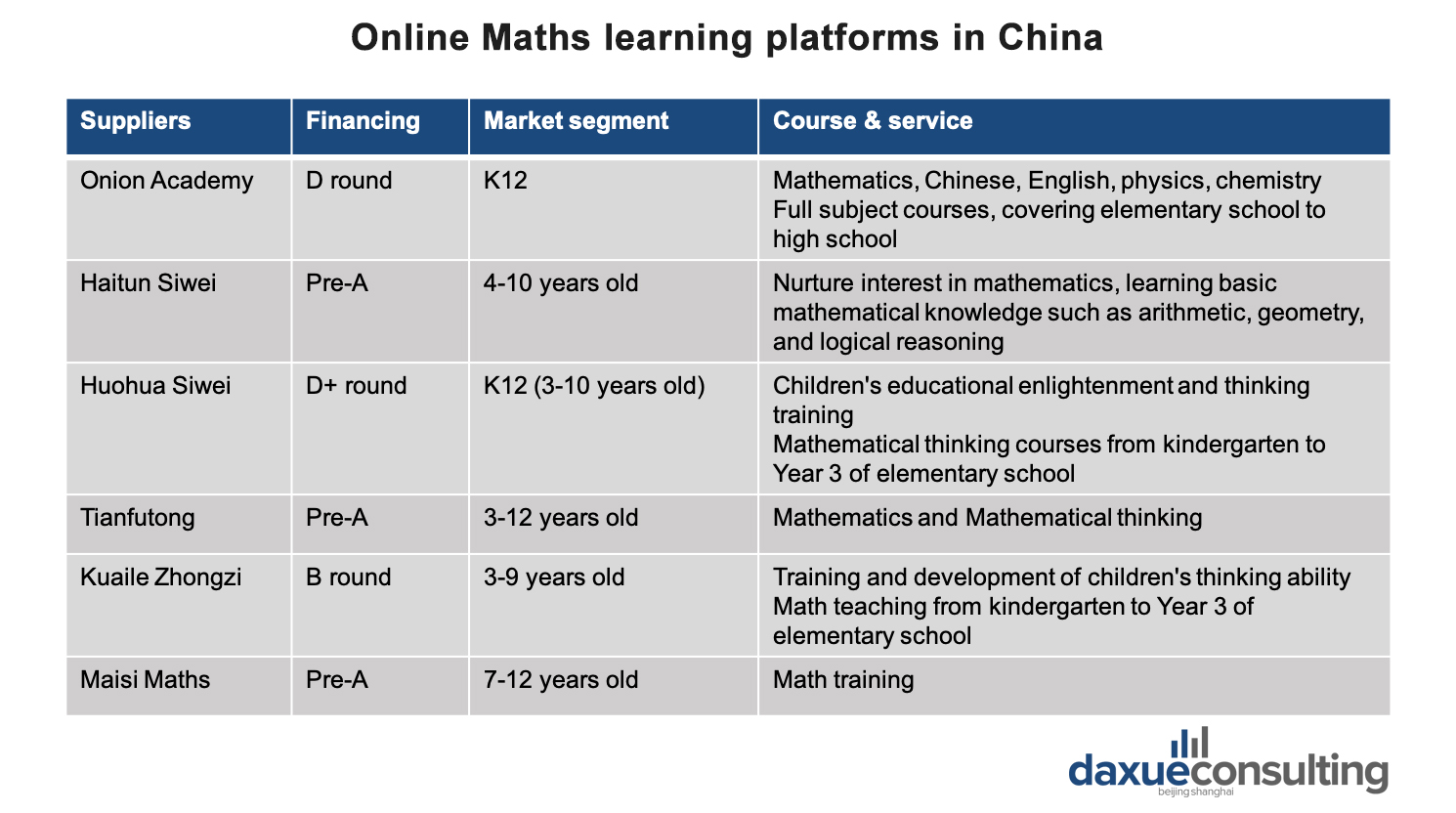

The market segment and course types provided by online Maths learning platforms are quite similar, reflecting fierce competition in a homogenous market.

By October 2018, there were four financing activities in the K12 online programing education sub-sector and 11 in online Maths learning sub-sector. 7 out of 11 suppliers gained capital, and most of them have large amounts of capital with over 10 million RMB. Compared to the online English learning market, which was developed much earlier and has entered into saturation, online maths education and programming training have become the hotspots of capital.

Zuoyebang, Xue’ersi, and Yuanfudao are the three leading online education platforms. However, instead of specializing in sciences education, these platforms provide full-disciplinary learning guidance services for elementary and middle school students. Yangcong Xueyuan (Onion Academy) is a leading online education platform focusing on K12 sciences education in China. Chengzhangbao is focusing on the training of children’s logical thinking and mathematical logic.

An interesting phenomenon is that people tend to enroll in classes across different platforms. Although these platforms are offering similar products and services, they still have minor differentiations regarding human resources, technology, user management, and foci of study. The demand for essay writing services and similar services has also increased.

The prospect of online education market: An investment opportunity?

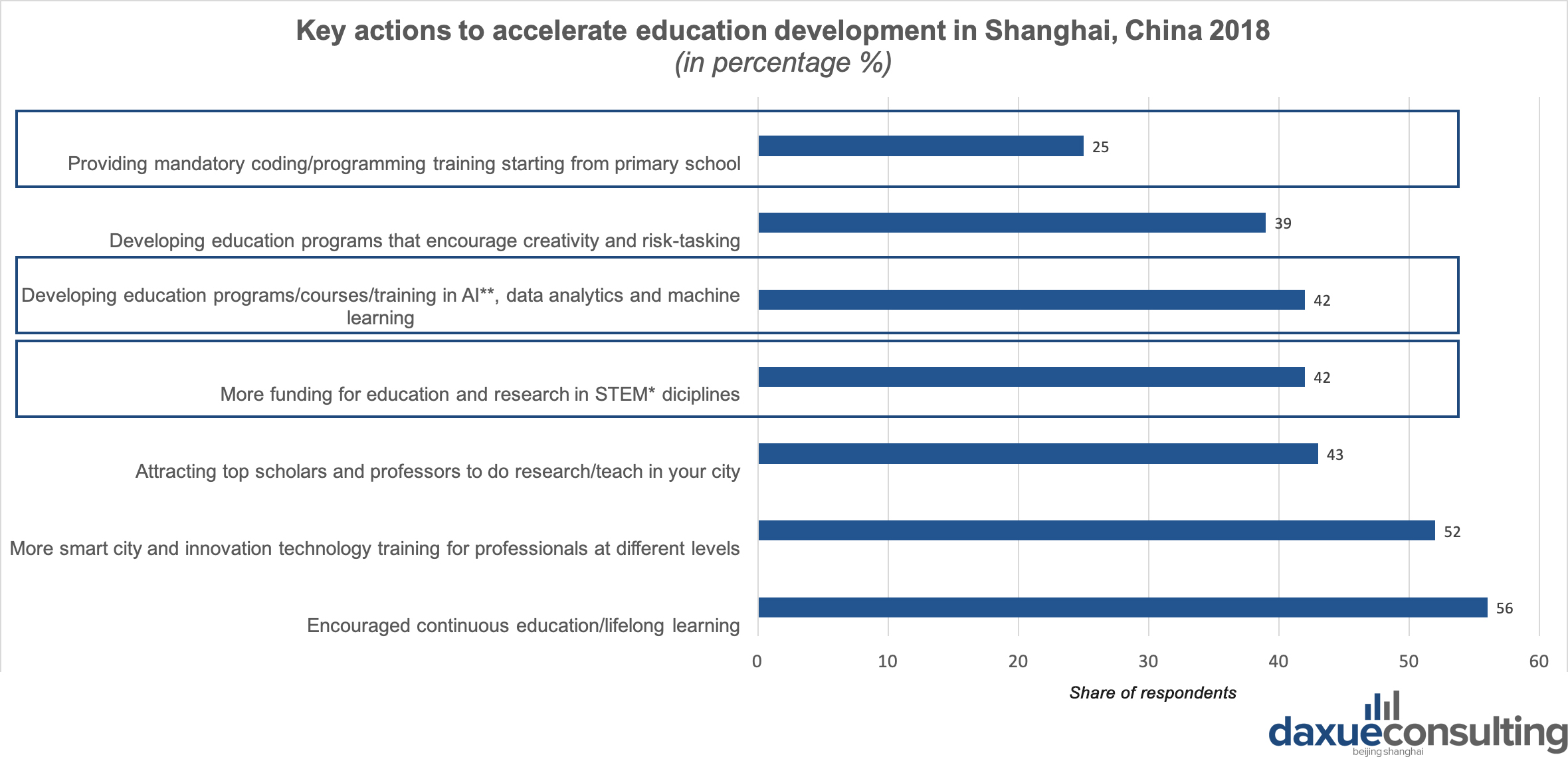

While there still remain core issues to solve in the online education market, we have seen emerging trends these years. The majority of online education platforms in the market offer an integrated solution to students, i.e. a comprehensive range of subjects, after-class homework, tutors, and online communities. There are increasingly more platforms specializing in science education, especially Maths learning, which are attracting significant investements. Moreover, the market has witnessed emerging trends of programing learning in early ages and adults learning data analysis for vocational needs.

Data Source: YouGov, A survey results show that code/programming training starting from primary school as well as data analytics training and STEM education are considered to be the key accelerators for education development in Shanghai, China.

Third-party (B2B2C) online education platforms, such as CCtalk, Tencent classroom, jioayu.taobao.com, which focus on adults’ education, also displayed a competitive advantage over traditional platforms in the market. Such platforms generally do not provide courses directly, but assume the role of middlemen, allowing the free inflow of a diversity of course types. They partner with educational institutions or individual teachers on one side and deliver content to end-users on the other.

The courses provided by these platforms varied from e-commerce marketing, Java to interior design, to name just a few. While the traditional B2C online education players tried to differentiate in various segmentations, such platforms, backed by their Internet parent companies, aim at covering all usage scenarios and leverage online traffic to enter the market.

It’s expected that the growth rate of the online education market in China will remain at about 20% in the short term, with higher education and vocational training continuing to lead the market. However, there were many e-learning companies undergoing a state of loss, including Liulishuo and 51Talk. Loss is common in the e-learning market in recent years. However, the rate of loss has narrowed, and profitability is not indefinite.

In the future, online education companies are expected to achieve profitability, but the premise is to solve the fundamental problems of rough user experience and unpredictable results in order to further realize the survival of the fittest, increase market concentration, and ensure steady growth.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast