New era parents in China put paramount importance on growing individually in their careers, their health and beauty with are willing to pay a premium for convenience.

According to a report published by Alarice most parents in modern China spend approximately 1,000 to 5,000 RMB on their children every month, with expenditures on education and daily necessities being given equal importance.

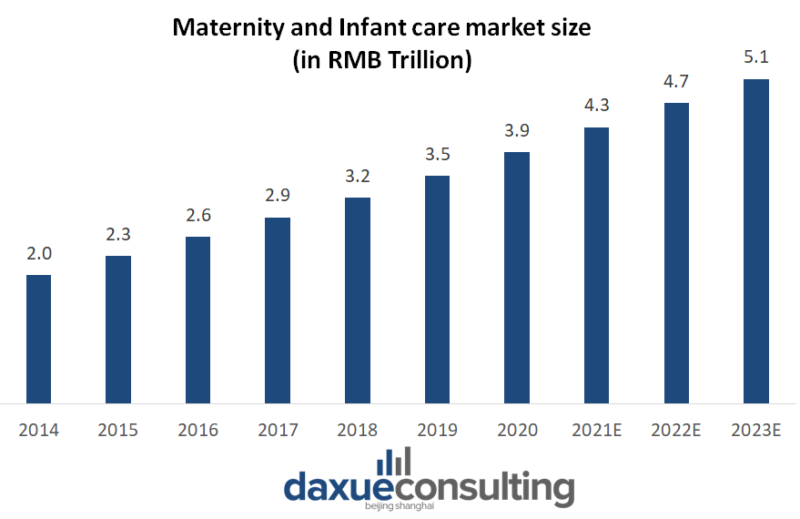

As Chinese parents begin parenthood in the heart of the two-child policy in China, which began in 2015, there are talks amongst Government officials in China for a three-child policy which could potentially address China’s aging problem. This has spurred the growth of maternal and children product market in China. The most important issues that super parents in China concern themselves with are raising healthy families. This coincides with a growing health and awareness in China.

Getting to know the new era parents in China

Source: YouTube screenshot, the character Gujia from the Chinese drama ‘Nothing but Thirty’ is a quintessential supermom. She makes social sacrifices to put her son in the best pre-school and considers hiring a full-time nanny for him and entertains the idea of pursuing her entrepreneurial dreams in order to provide her son with the best life possible.

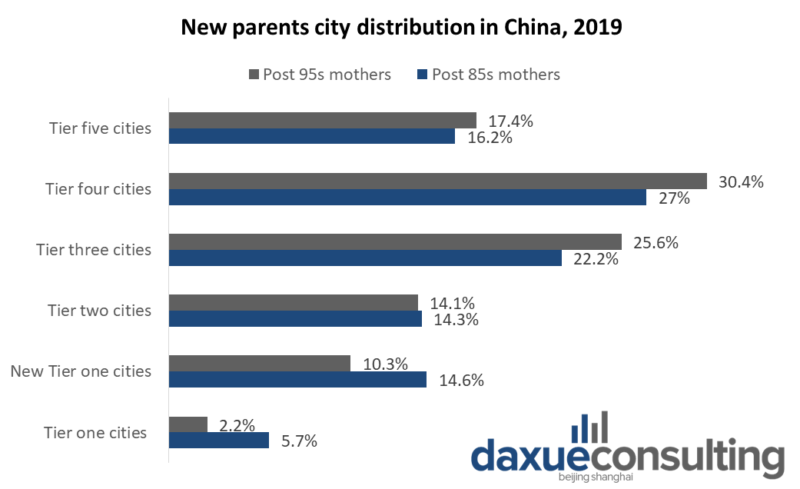

Where modern Chinese parents live

Because of China’s hukou system which restricts families from easily moving from city to city, migrant workers who moved to tier-1 cities to earn money must raise their children in their home town where they have a hukou. The hukou gives a child permission to receive free education and take the gaokao (China’s centralized college exam) in that city. This means that the 20% of the Chinese population that live in a city they don’t possess a hukou for will have to return home (usually to a lower-tier city) to raise children. However, this leads to another phenomenon of ‘left behind children’ (留守儿童). These children remain in their parent’s home town to be raised by their grandparents, while the parents live in work in a large city with a higher salary.

As the system nudges parents to raise children in their hometown, more than half of Chinese parents with children under 12 live in tier 3 cities and below. Additionally, parents born between 1985 and 1995 are more likely to live in tier-3 cities and below than parents born earlier than 1985.

Data source: CBNData, 85s and 95s Mothers Report, new parents city distribution in China

Chinese parents with children under 12 account for 300 million active mobile internet users, and their internet usage is increasing. According to a recent report from QuestMobile, they spent more time on the internet with a 13.1% YoY increase in April 2020.

Chinese parents normally purchase their children’s products on e-commerce websites and apps. Key factors that propel purchase decisions are word-of mouth references coupled with quality assurance.

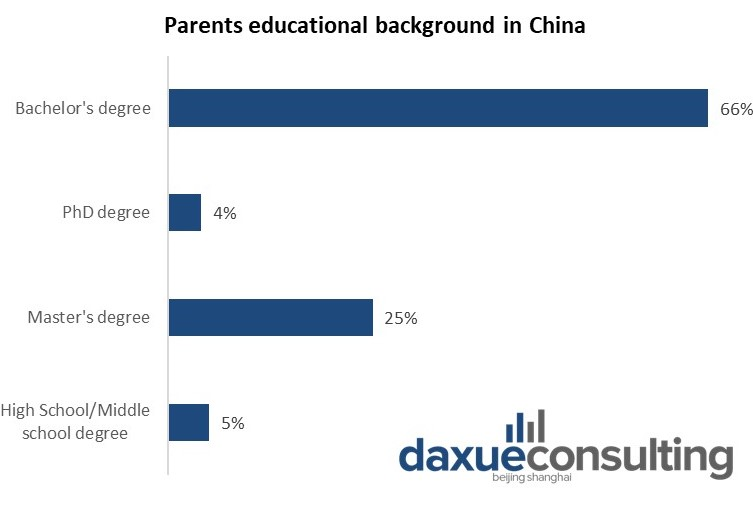

More than half of the parents in China hold a basic bachelor’s degree allowing them to find suitable jobs with suitable incomes. Their consumption focus is mostly on purchasing children’s products, nutritious food and supplements, educational products, high-tech wearables and fitness related products.

Data source: iResearch, 2020 China Internet Maternal and Child New Generation Research, Chinese parents education level (2020), based on parenting app user data

New era moms in China are living on their own terms

The majority of mothers in China are millennials increasingly known as “hot mamas” and “spicy moms”. These nicknames mean that they do not bow down to any traditional norms like their previous generations did. Rather, they live life on their terms and do not feel the need to give up their hobbies, interests, fitness, and fashion just because they have become mothers.

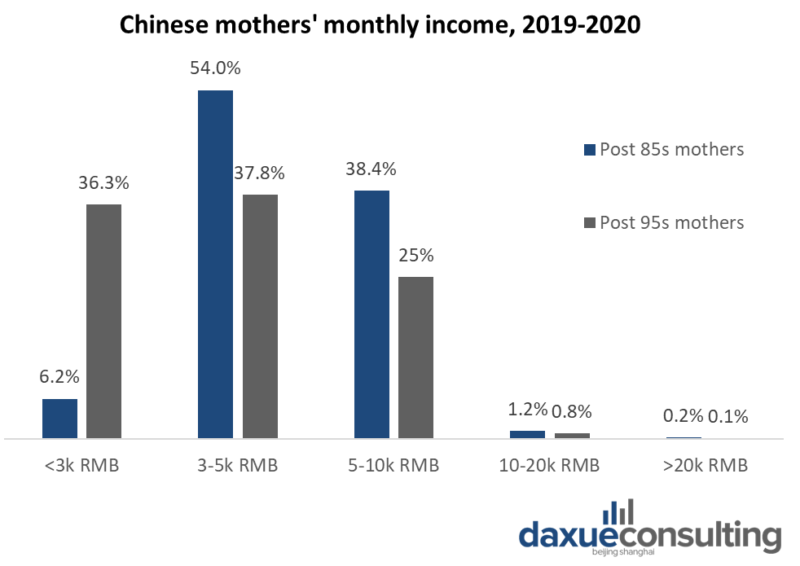

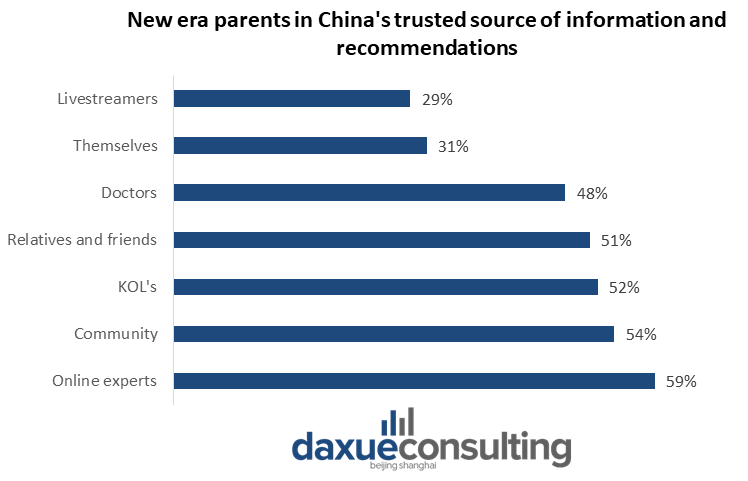

Mothers in China are tech savvy and trend-savvy. They more often turn to social media and follow popular online parenting advice rather than listen to their own parents. Since more than half of mothers in China hold a bachelor’s degree and have managed to secure a professional career, they have become less price sensitive, especially when it comes to spending on their children. Quality and safety are top priorities. New era mothers in China have decent incomes and with more and more avenues opening due to e-commerce, social media post 95s super moms are fast catching up with high earning post 85s.

Data source: CBNData, 85s and 95s Mothers Report, income of Chinese mothers.

According to research carried out by Nielsen, mothers in China are focusing on spending their money on four categories of vacations, education, recreational activities and self-improvement. Brands must realize this is a rapidly growing market in all tiers of cities in China with quality and safety in products a key factor to dominate this target market.

New era dads in China are creating their own unique consumer profile

Chinese fathers are very similar to the new era mothers in China and brands need to understand this growing consumer sector carefully before marketing products. According to a consumer report by iiMedia the key features of new era dads in China are as follows:

- Chinese dads are usually between 25-40 years old. Like Chinese moms, they are self-indulgent, love caring and spending on their families while still making their own need a top priority

- Chinese dads are increasingly pursuing the trends of self-improvement and keeping themselves updated with trending influences in society and how it impacts their overall surrounding environment

- Chinese dads are not price sensitive and put more importance on product quality amidst increasing sophisticated tastes.

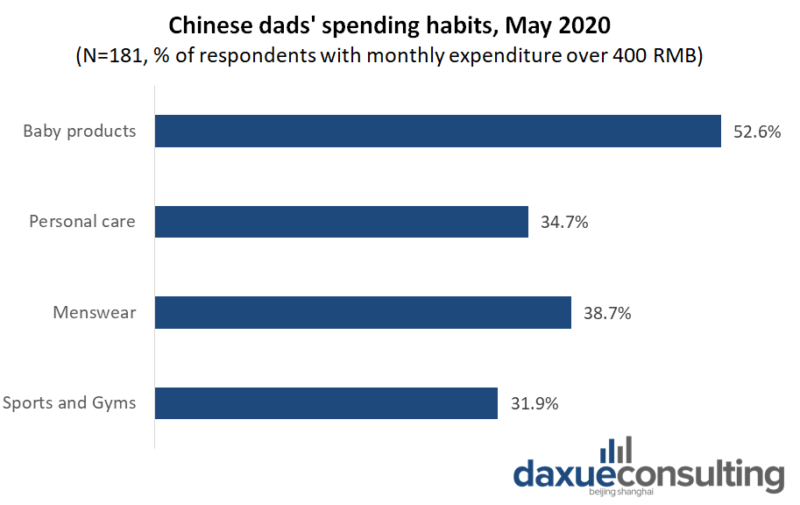

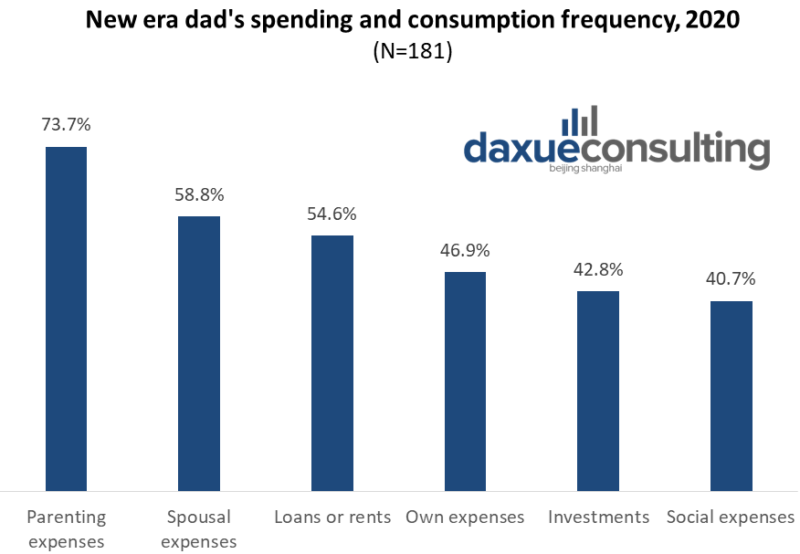

Chinese fathers’ spending preferences

Apart from being responsible parents and investing in children’s products, dads in China purchase a range of products to satisfy their own needs. Along with baby products, three areas where they spend the most of their money is menswear, personal care and sports and fitness products and services.

Data source: iiMedia, 2020, China’s “New Manny” Consumption behavior and trend analysis report, Chinese fathers’ spending habits based on areas in which they invest more than 400RMB a month

Apart from fulfilling their family responsibilities and spending on themselves, there are a host of other products and services in which they are willing to spend money. The market is expected to experience constant growth and be extremely competitive.

Data source: iiMedia, 2020, China’s “New Manny” Consumption behavior and trend analysis report, consumption frequency of Chinese fathers by product group

New era parents in China spend big on maternity and infant care

According to a Maternity and Child industry white paper by iiMedia the maternity and infant care market in China is booming and expected to be have a market size of approximately 5.05 trillion RMB by 2023.

Data source: Maternity and Child industry white paper Maternity and Child industry white paper, the MIC market in China

For instance, a consumer report published by iiMedia shows that Chinese dads purchase interest and rate for buying baby diapers grew significantly from 2016-2019. A popular brand called Daddy Baby had revenues worth 573 million RMB by the end of 2019. Daddy Baby is among the most popular diaper brands in the growing diaper market of China.

New era dads in China’s purchase behaviour for baby diapers has created a great potential in the domestic market fuelling more competition and influencing the market in an upward positive trajectory.

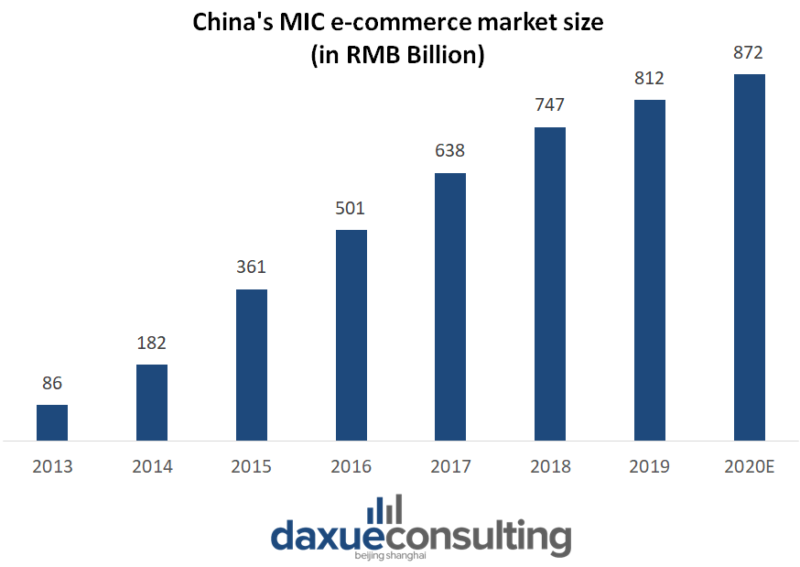

New era parents in China mostly use e-commerce for their shopping needs

The e-commerce market for China’s maternity and infant care (MIC) was expected to be approximately 872.37 billion RMB by the end of 2020. According to iiMedia, e-commerce coupled with social media marketing on popular applications like Doyuin and Kuaishou have not only educated parents in China but also created a surge in their online buying behaviour. The growth in the MIC industry is expected to continue and e-commerce will be at the core of the business.

Data source: iiMedia, Chinese Maternal and Child Industry white paper, 2020, the e-commerce MIC market size in China

Differentiation coupled high product quality and trust are important factors to garner market share. According to CBNData, the majority of post -95 mothers prefer to buy international products and spend more time shopping for fresh foods on e-commerce websites.

Post-85 mothers on the other hand prefer MIC related e-commerce platforms, retailers and sharing platforms for their purchases. New era parents in China are also disruptors when it comes to consuming information about their preference on products and services. Unlike traditional means of listening to what brands market, or falling for old marketing tricks, these tech savvy group of consumers rely on key information from the online community of online experts, KOL’s, relatives and friends to make informed decisions in the best interest of themselves and their families.

Data source: iResearch, 2020 China Internet Maternal and Child New Generation Research, sources where Chinese parents receive information

The surge in e-commerce shopping is here to stay

According to CBNData Chinese parents have been spending in several sections of the MIC market in 2020, the expenditure on organic products doubled since 2019.

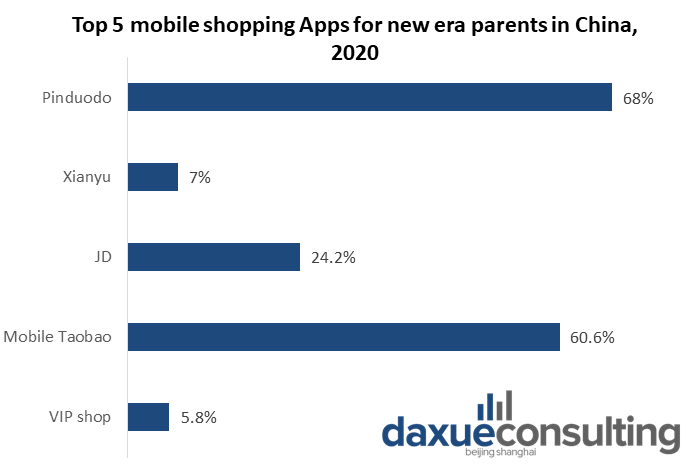

Some of the top applications where Chinese parents shop are Pinduodo, Taobao and JD.

Data source: Questmobile, top five e-commerce platforms for Chinese parents

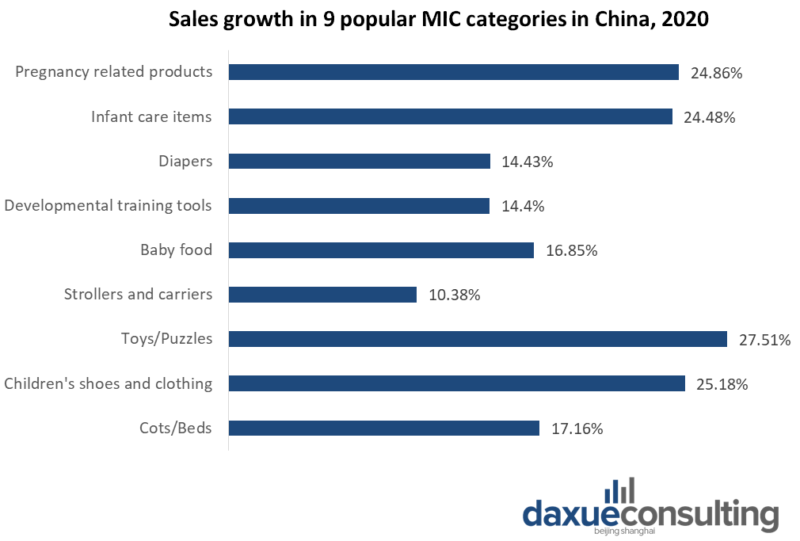

Chinese parents also need to purchase children’s shoes and clothing, toys, puzzles, and other development training tools that help add more value to their children’s lives. In 2019, a children’s clothing and shoes among others accounted for a combined total of approximately 538.8 billion RMB.

Brands need to pay attention to the growing purchasing power exhibited by parents in China. They are the largest spenders amongst the upper middle class in China and lead by example. As a possible three child policy is in talks amongst Government strategists the MIC market linked with e-commerce and social media is set for a positive boom.

Data source: CBNData, 2020, YoY sales growth in 9 popular MIC categories in China.

Chinese parents put a lot of emphasis on their families well being as children’s clothing and shoes, toys/puzzles and pregnancy related products accounting for most of the sales

Key takeaways

- New era parents in China are premium consumers who are creating an identity for themselves and not resorting to traditional ways of life.

- Chinese parents are confident, successful, well informed and are ready to pay premium prices for safe and top-quality products that benefit them and their families.

- New era parents in China are social consumers, tech savvy and intricately connected to social media and rely on information from trustworthy sources and not mainstream traditional marketing.

- Chinese parents rely on their friends, relatives; KOLs and live streamers to stay updated about the quality and information of products.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about the maternity and infant care market in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast