Mobile payments in China have become a key part of daily life, causing a clear shift to a cashless society across the nation. This change is reshaping city living and making it simpler for foreign guests to adjust. As China keeps opening up, including the recent growth of its visa-free transit program, travelers from other countries can now use mobile payment apps that Chinese citizens used before. These apps let foreigners pay for everything from transport to shopping without needing cash or foreign credit cards.

This shift is part of China’s broader push to modernize its financial infrastructure, creating a more inclusive and accessible economic environment. As visa policies become more flexible and China’s payment system is more user-friendly, foreign visitors are finding it easier to adapt to China’s cashless society. This fosters smoother interactions and greater global connectivity.

Download our report on the She Economy in China

China’s mobile payment methods

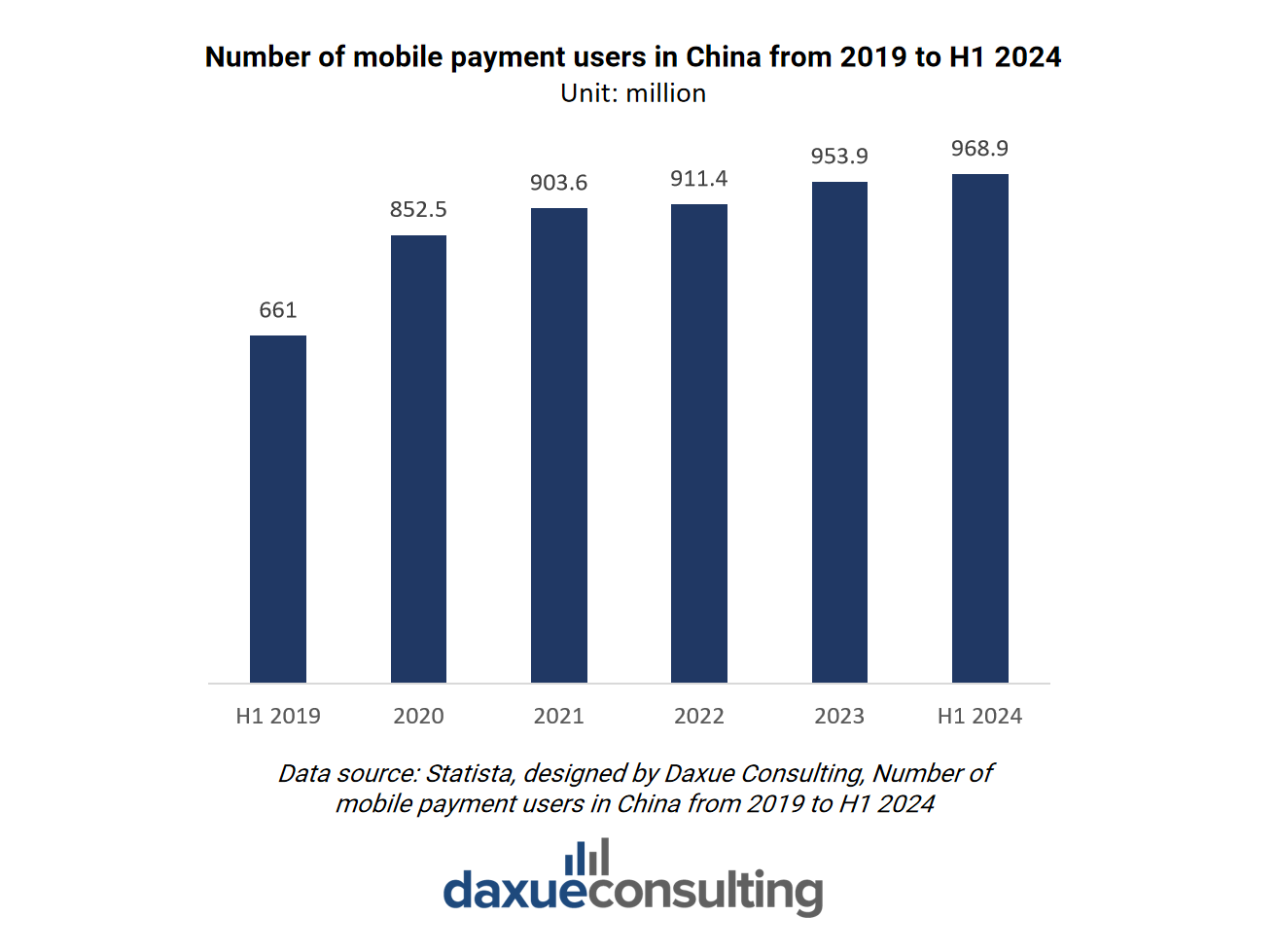

According to iiMedia Research, in 2024, mobile payments were the most widely used payment method among Chinese consumers, accounting for 73.20% of transactions. Cash payments (63.46%) and physical bank card swiping (46.40%) ranked second and third, respectively, while 14.06% of consumers used smartwatches for payments. Chinese individuals widely utilize mobile payment platforms for various purposes, including settling restaurant bills, ordering food delivery, making online and offline purchases, as well as paying bills and for various services. As of June 2024, approximately 953.86 million individuals in China were actively utilizing mobile payment services.

Consulting, Number of mobile payment users in China from 2018 to H1 2024

China’s mobile payment landscape: The dominance of Alipay and WeChat Pay

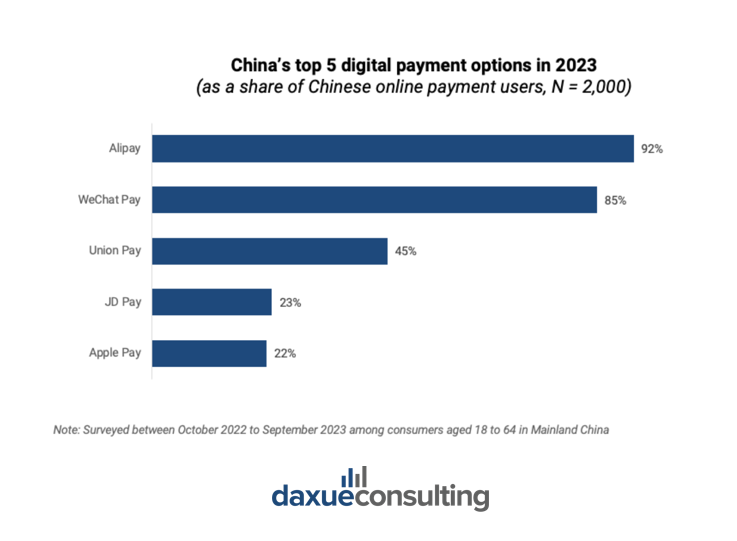

In Q3 2023, Alipay and WeChat Pay recorded transaction volumes of RMB 118.19 trillion and RMB 67.81 trillion, respectively, accounting for over 94% of the total market share. UnionPay, associated with a significant state-owned card payment network, secures the third position, with 45% of respondents opting for its services.

Alipay

Alipay was launched by Alibaba Group in 2004. As of mid-year 2024, it is a prominent online payment platform with 1.43 billion users worldwide. It integrates online and offline services, offering features like instant credit, installment payments, and cash back. Many major websites use Alipay as an e-commerce payment method, such as Taobao, Amazon, JD.com, and AirAsia.

Furthermore, Alipay has gained popularity by leveraging advanced biometric technology. Its facial recognition payment option is especially popular among consumers who prefer offline transactions. This innovation enables consumers to shop without the need for a mobile phone, offering added convenience.

In late 2024, Alipay launched a new feature called “Tap to Pay” or Alipay Tap!, which is an evolved form of QR code scanning. It was made possible through NFC technology, which allows users with enabled phones to pay by simply tapping a merchant device without opening the app. Within 11 months, user numbers surpassed 100 million, with 80% preferring “Tap” when both options (QR code vs NFC payment) exist. This feature targets efficiency-seekers, seniors, and tourists who prefer simplified mobile payment processes.

WeChat Pay is a popular digital wallet in China introduced by Tencent’s WeChat in 2011. WeChat’s success is attributed to its versatile interface. It integrates social media and mobile payment services, along with compatibility with various in-app applications such as WeChat Mini Programs. WeChat Pay extends its services in China to include a range of financial products. From investment funds to insurance, enabling users to make payments directly within the app. In 2022, around USD 400 billion in transactions were done through WeChat.

UnionPay

China UnionPay (UnionPay) ranks among the top three payment methods in China. As the exclusive domestic bank card issuer in China, UnionPay links ATMs of major and smaller banks across mainland China, functioning as an Electronic Funds Transfer at Point of Sale (EFTPOS). Unlike Alipay and WeChat Pay, UnionPay is not a digital wallet; it is the sole issuer authorized for card payments in China.

Scan, pay, go: The ubiquity of QR codes in China’s mobile payment system

In China, QR Codes are widely used for making and receiving payments. Even street musicians provide their QR codes to receive money. There are two simple ways to pay using QR Codes:

- Customers scan the seller’s QR code, usually visible at the checkout, on restaurant tables, or on products in stores. After choosing the amount, they can send the money directly to the seller and show the confirmation to the seller.

- Customers display their own QR codes on their smartphones. The seller selects the amount, scans the QR code, and the transaction is done. This method is faster, as it skips the extra step of transaction confirmation.

Unlike Apple Pay, which needs special equipment for sellers to receive payments, in China, a basic piece of paper with a QR code is sufficient. This simplicity and accessibility have fueled the widespread adoption of mobile payments in China, making it easy and fast for anyone with a mobile device.

How safe are mobile payments in China? Navigating the risks in mobile payment methods

China UnionPay’s report released in early 2023, reveals a reduction in unsafe user habits, dropping from an average of around 2 per user in 2021 to 1.2 in 2022. Declines are seen in behaviors like using identical passwords and scanning promotional QR codes.

Respondents demonstrate high awareness of personal information security, with less than 10% engaging in potentially unsafe bank card-related actions. Almost 50% express a willingness to report issues through the National Anti-Fraud Center app.

However, telecom fraud remains a significant concern, affecting two-thirds of respondents. Profit-return fraud, especially “part-time brushing fraud,” is prominent. Emotional fraud, targeting those under 25, persists, with both this group and those over 55 identified as high-risk demographics. The younger demographic shows lower awareness of smartphone and bank card protection. Meanwhile, the older group is vulnerable to scams involving false medicine and health products.

Frequently asked questions for foreigners regarding China’s payment methods and system

What is the latest travel visa policy?

China’s latest visa-free transit policy, effective December 17, 2024, extends the stay for eligible foreign visitors from 72 and 144 hours to 240 hours (10 days). The number of applicable entry and exit ports has increased from 39 to 60, covering 24 provinces, including newly added regions like Shanxi, Jiangxi, Anhui, Guizhou, and Hainan. In the first 11 months of 2024, China recorded 29.2 million foreign entries, an 86.2% year-on-year increase, with visa-free entries rising by 123.3%.

Can foreigners use WeChat Pay?

Foreign residents in China and tourists alike can easily open WeChat Pay accounts, facilitating seamless transactions. For residents, the process involves linking a Chinese bank card and a mobile phone number to the account through the “Wallet” option in WeChat. Approval typically takes around one day, enhancing accessibility.

Tourists visiting China can also enjoy the convenience of WeChat Pay by linking their international credit cards since 2019. Tencent collaborates with major international card organizations such as Visa, Mastercard, American Express, Discover Global Network, and JCB. A nominal service fee is charged for every international credit card linked to the account.

Is WeChat Wallet available for foreigners?

Whilst WeChat Pay refers to the payment tool integrated into the WeChat App, WeChat Wallet refers to the virtual wallet where users store their payment information and money. For foreigners, WeChat Wallet is more limited in terms of usage as it must be linked to a Chinese bank account to use its full functions. Linking it to an international card, such as Visa or Mastercard, can only unlock limited features. For instance, there will be no peer-to-peer transfer function, and the foreign user can only receive small amounts of red packets, but cannot pay or withdraw any. This was due to the verification process of WeChat Wallet, which requires it to be linked to a Chinese local bank account.

Can foreigners use Alipay?

Foreign residents in China can easily open Alipay accounts by linking a Chinese credit card and phone number through the Alipay app, requiring real-name authentication with details like name, date of birth, and a passport picture. For tourists, Alipay offers the option to register with an overseas phone number and an email or Apple ID, alongside linking with an international bank card.

Challenges in payment for foreign visitors

Despite advancements in mobile payments in China, foreign tourists have faced several challenges using platforms like Alipay and WeChat Pay. Registration used to require extensive documentation and sometimes a Chinese phone number, complicating the process for visitors. While international credit cards can now be linked, some regions still have limited support. The Chinese phone number requirement was a major obstacle for tourists. Though recent updates have allowed international numbers for verification, with the caveat that full functionality still requires a local number. In response, cities like Shanghai and Hainan have introduced preferential tax policies to attract foreign direct investment (FDI). This indirectly supports the growth of international payment systems and eases some of these challenges.

e-CNY aiming to shift the global financial landscape

China’s digital yuan, the e-CNY, initiated in 2019, aims to centralize payment systems dominated by Alibaba and Tencent. The e-CNY project, led by the People’s Bank of China, focuses on improving payment system efficiency. It also provides a backup for retail payments and enhances financial inclusion. In January 2022, Meituan, the leading delivery platform in China, started to allow 200 of its offline merchants to accept payments in e-CNY. The merchants include restaurants, grocery stores, cinemas, and hotels.

The digital yuan (e-CNY) remains the largest central bank digital currency (CBDC) pilot globally. By June 2024, its total transaction volume had surged to 7 trillion e-CNY (USD 986 billion) across 17 provincial regions. Its usage spanned across sectors like education, healthcare, and tourism. This represents a nearly fourfold increase compared to the RMB 1.8 trillion (USD 253 billion) recorded by the People’s Bank of China in June 2023.

Cashless revolution: Exploring China’s mobile payment landscape

- Over 968.9 million individuals actively use mobile payments in China as of June 2024. The country also leads the global trend with a 38.3% mobile payments penetration rate.

- Alipay and WeChat Pay are preferred by 92% and 85% of Chinese respondents, respectively. UnionPay secures the third position with a 45% preference.

- QR Codes are widely used for payments in China. Two methods are used: scanning the seller’s QR code or displaying the buyer’s QR code.

- China UnionPay’s 2022 report shows a significant decrease in unsafe habits, averaging 1.2 per user in 2022.

- Instances of risky behaviors like using identical passwords have notably declined. Yet, telecom fraud remains a challenge, with profit-return fraud at a high occurrence rate of 17.7%.

- Foreign visitors can now link international credit cards (Visa, Mastercard) to Alipay and WeChat Pay. However, full functionality often requires a Chinese bank account, creating barriers for short-term travelers.