China’s bakery sector has been expanding rapidly in recent years, underpinned by the country’s rising middle class, the ongoing Westernization of lifestyles and diets, and the increasing demand for convenient food. The baked goods market in China began to gain momentum in 1980 and boomed between 2000 and 2010. During this period, all kinds of foreign brands entered the Chinese market. According to the China industry research institute, the retail value of the baked goods market in China was nearly 217 billion RMB in 2018. Major players operating in the segment are Fujian Dali Food Co Ltd, Paris Baguette, Nestlé SA Grupo Bimbo, and Yamazaki Baking Co. among others. Nowadays, there is a greater demand for premium bakery ingredients, equipment, technologies, and professionals

Characteristic of premium bakery

According to Pierre Gilson, founder of Stoneground Consulting, “China is attracting more and more top-level professionals in this field. It is becoming one of the biggest markets in the world for baked goods.” Unlike mainstream bakery chains, premium bakeries have higher standards in the selection of ingredients. Although the definition of premium bread varies from person to person, the most common denominator is the emphasis on quality and ingredients are the key to determining quality.

Another characteristic of premium bakeries is that they build their own kitchens and make the bread directly in the store, instead of having a central kitchen, thus, just preparing the amount that is going to be sold that day. Indeed, when BreadTalk‘s high-end bakery brand, Wheat Works, entered the market in 2016, it opted for replacing the central kitchen with an open-plan kitchen for in-store baking. Instead, the European-style bakery Fascino vaunts huge floor-to-ceiling glass. “Boutique bakery should first of all create an image of high-end and benchmarking”, says Grace Liu, spokesperson for the bakery. The different breads have straightforward but catchy healthy names, such as “Rye Walnut” or “Rustic Wheat”.

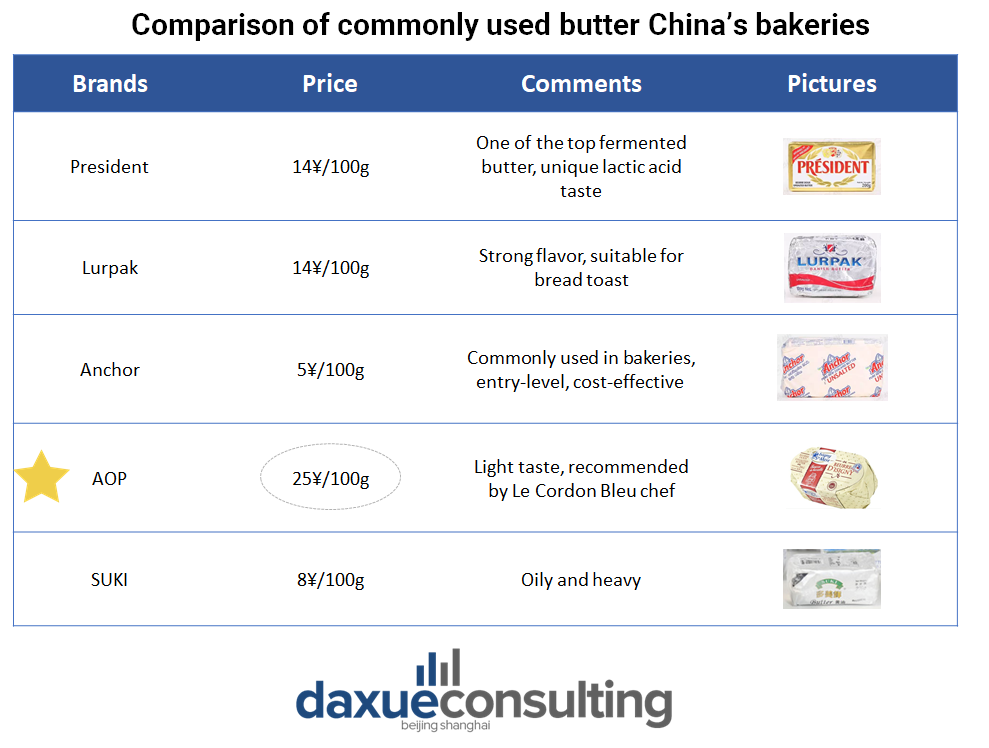

China’s premium bakeries have to import ingredients that are not commonly produced domestically. Butter, for one, is not a part of the Chinese diet. FAS Beijing forecasts a 17% increase in butter imports in 2021 due to the rapid development of China’s bakery industry and its reliance on imported butter.

Data source: Butter brand websites, designed by Daxue Consulting, Comparison of commonly used butter in premium bakeries in China

Mid-to-high-end bakeries are in the spotlight

Rising consumption levels and saturated lower-end markets have fostered the ‘premiumization’ of bakeries. Between 2016 and 2018, per capita spending in the mid-to high-price range continued to climb. In particular, per capita purchases between 31 and 34 RMB were the spending range experiencing the highest increase. In recent years, competition in the baked goods market has been extremely fierce. Nevertheless, with the implementation of the market access system, the entry threshold of the bakery industry has been raised, and the domestic bakery market has gradually moved from vicious price competition to healthy competition with product quality as the core. Therefore, today leading domestic brands are expanding their market share by continuously improving product quality, accelerating new product development and enhancing marketing strategies, instead of engaging in a race to the bottom.

The most common baked goods in China include bread, cakes, biscuits, and cookies. Cakes and bread are the most popular baked goods in the Chinese market. In terms of gender, Chinese women are more interested in bread and cakes than men are, indeed, they accounted for about 65% of sales in 2017. Young people are the main purchasers of bread and cakes in China. They are keen to taste baked goods with different flavors, this is one of the reasons why there is such a wide range of baked goods in China. As consumers tend to favor mid-to-high-end products, the premium bakery market in China is destined to thrive.

The domestic baking ingredient market’s future trend

One of the future trends of the domestic baking ingredients market is the promotion of health, safety, and nutritional balance. As consumption upgrades, consumers pay more attention to a balanced diet and nutrition. By using functional ingredients (dietary fiber, oligosaccharides, sugar alcohols, etc.) to reduce the use of sucrose and lipids, baked goods will switch from high-sugar, high-fat, and high-calorie food to low-sugar, low-fat, and low-calorie products, bringing about changes in the research and development of raw materials for bakery products.

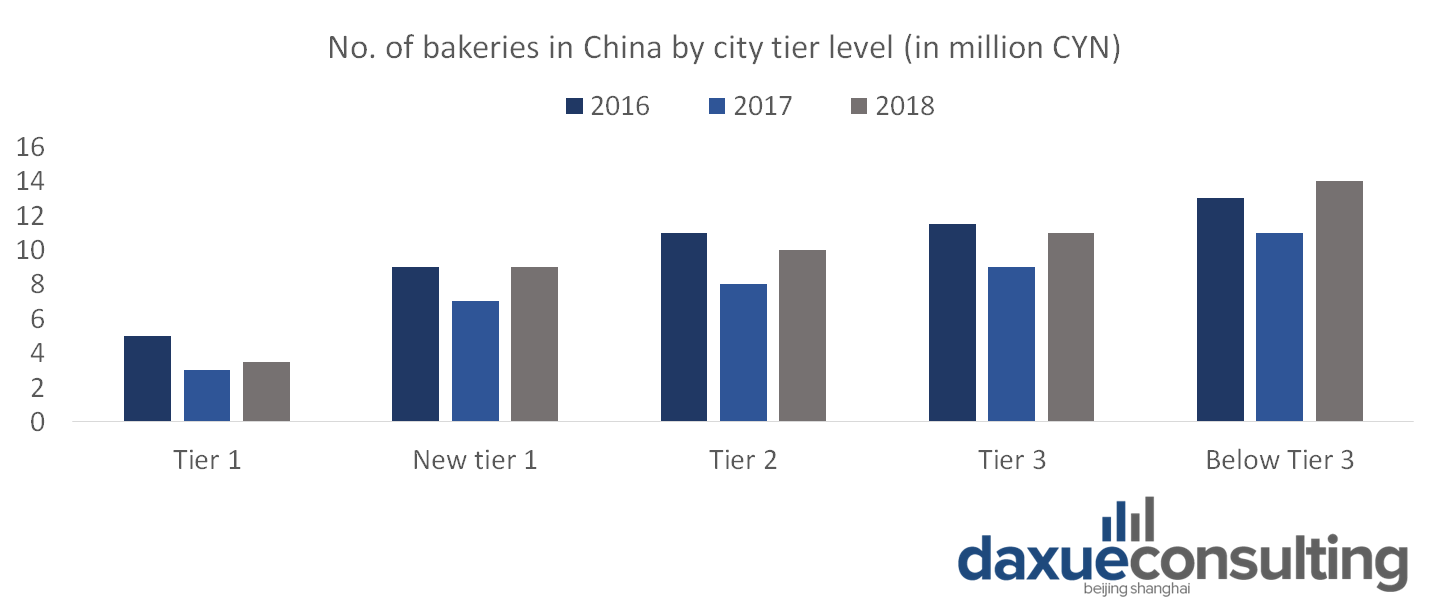

The growing national consumption is driving the demand of mid-to-high-end baked goods, thus giving more emphasis to nutritional balance. Nowadays, consumers are paying greater attention to their health and more than 82% of Chinese consumers are willing to pay more for having healthier food. The sinking market (low tier cities) may be a blue ocean for the development and expansion of China’s baking industry in the future. In 2017, the number of new bakery stores declined abruptly across the entire country, however, in 2018, the bakery market recovered fast in low-tier cities. Nevertheless, in such category of cities, consumption of mid- and low-end baked goods is still the mainstream.

Data source: Meituan, designed by Daxue Consulting, 2016-2018 Bakery stores at all levels of the city in China

Takeaways about the premium bakery market in China

- The Chinese cakes, pastries, and sweet pies market is highly fragmented and competitive.

- Competition among foodservice channels offering customized baked goods and retail companies is fierce.

- Companies are increasingly focusing on new products with healthier ingredients/organic claims as their key marketing strategy.

- Mainstream domestic bakeries pay special attention to the cost-effectiveness of raw materials, while premium bakeries give greater emphasis to the high quality and taste of raw materials.