Two factors responsible for the high-speed-growth of the prenatal care market in China

- Babies from the baby-boom back in the 1980s have become parents themselves in the last decade. They have caused another, bigger baby boom, because of the cancellation of the one-child-policy. In 2016, the universal two-child policy came out, meaning that every couple in China can have 2 children. This is considered as the loosest birth control policy in China since 1980.

- The Chinese emerging middle class is holding stronger purchasing power. According to a study from McKinsey & Company, 76 percent of China’s urban population will be considered middle class by 2022 and the number was just by 4 percent back in 2000.

Chinese consumers trust international brands/products. Western brands are a symbol of high quality and above all safety. When it comes to pregnant women and their unborn babies, Chinese consumers are more than ready to spend a fortune on high-quality products and services. This means huge opportunities for international brands on the Chinese prenatal care market.

Chinese expecting mothers literally wear radiation-protection-clothes in their daily lives

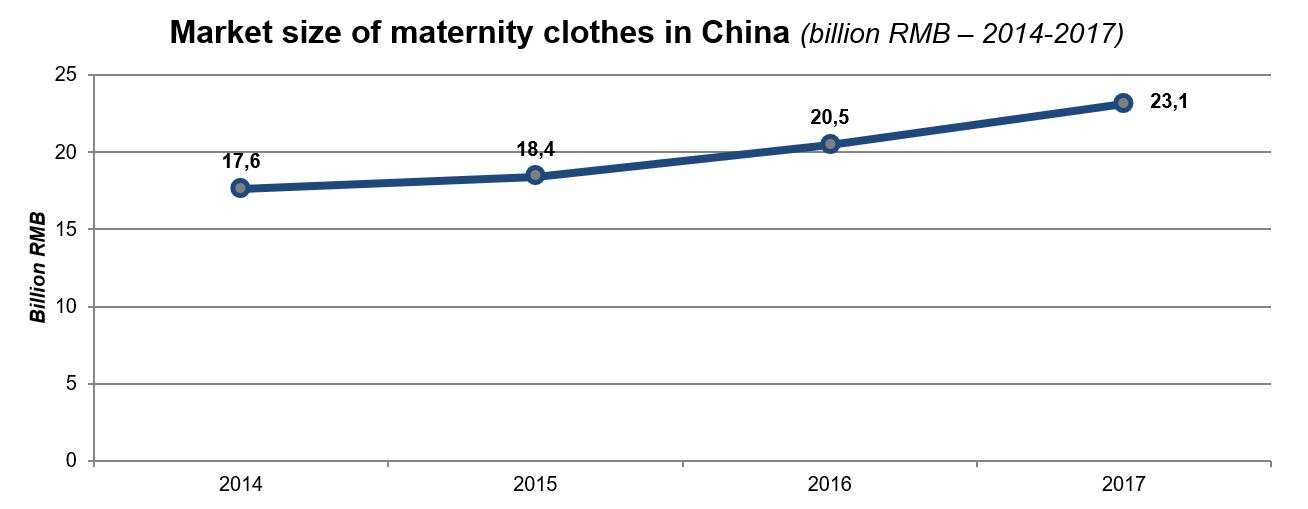

The Chinese maternity clothes market is showing a steady growth trend. Chinese mothers-to-be are searching for maternity clothes which are both good looking and functional. Fabric without noxious chemical substances is especially popular for Chinese pregnant women.

You cannot be too cautious when it comes to babies for Chinese consumers. Due to the high internet and smartphone penetration in China, Chinese people are deeply concerned about the harm that digital devices can do to human bodies, especially for unborn babies. Although modern medicine hasn’t yet proven the harms of radiation caused by moderate use of digital devices like smartphones or PC, many Chinese expecting mothers choose to protect their unborn babies from this potential danger. There are lots of brands for pregnancy clothes claiming to have an anti-radiation function. One of the most popular brands is Joiue Varry from France, which claims to use silver from the Cannington silver mine producing their maternity clothes.

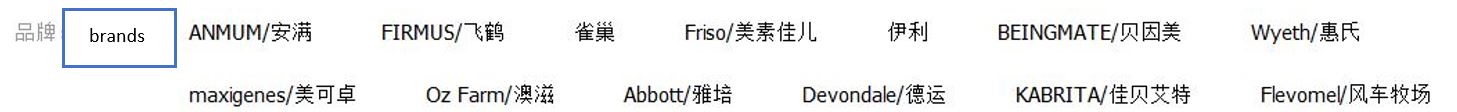

Chinese consumers prefer international pregnancy supplements, formulas are not only for babies but also mothers-to-be

On popular social media platforms in China like WeChat and Weibo, pregnancy supplements are one of the most discussed topics among prenatal care posts. Most recommendations are international brands/products, which have a better reputation among Chinese consumers.

Besides vitamin and DHA, supplements like calcium and iron are also common on Chinese prenatal care market. There are also pregnancy supplements which are untypical in many other countries like pregnancy formula. There is a big market of pregnancy formula in China since many Chinese consumers believe that pregnancy costs the expecting mother a lot of nutrition, especially calcium. Thus, taking in lots of dairy products helps mother-to-be to get enough calcium and other nutrition. There is a big market of pregnancy formula in China.

Searching for “pregnancy formula” on Tmall, the majority of the popular brands popping out are international like Anmum from New Zealand and Nestlé from Swiss land. Chinese consumers have been deeply concerned about dairy safety ever since the Chinese milk scandal in 2008 which was a widespread food safety incident and sickened nearly 300,000 infants according to CNN China. Besides New Zealand and Switzerland, other popular places of origin for pregnancy formula are Australia, Holland, Ireland, French and Denmark.

High-end maternity and infant hospitals show huge opportunities for international investors on the Chinese market

Although most pregnant Chinese women do their prenatal check-ups in local public hospitals, more and more Chinese consumers are turning to high-end private clinics because of the better consultation and all-around services. In the recent years, Chinese public hospitals are generally overloaded and have a poor reputation due to several reasons, e.g. ridiculously long waiting time, relatively low level of hygiene etc.. The Chinese emerging middle class is seeking out private medical facilities to take care of the expecting mothers and their unborn babies.

International maternity and infant hospitals/clinics are much more expensive than local Chinese ones. However, an increasing number of Chinese patients are having private medical insurance/maternity insurance, which can cover a good amount of hospital costs. There are also other reasons for expecting mothers in China to choose private hospital over a public one, for example, Chinese public maternity and infant hospitals are not allowed to reveal the gender of an unborn baby by law.

From all this, it follows that high-end maternity and infant hospitals show the great lucky chance for international investors on the Chinese market.

E-reputation plays a crucial role in the brands’ development in China: Using Chinese social media and e-commerce platforms to engage with consumers

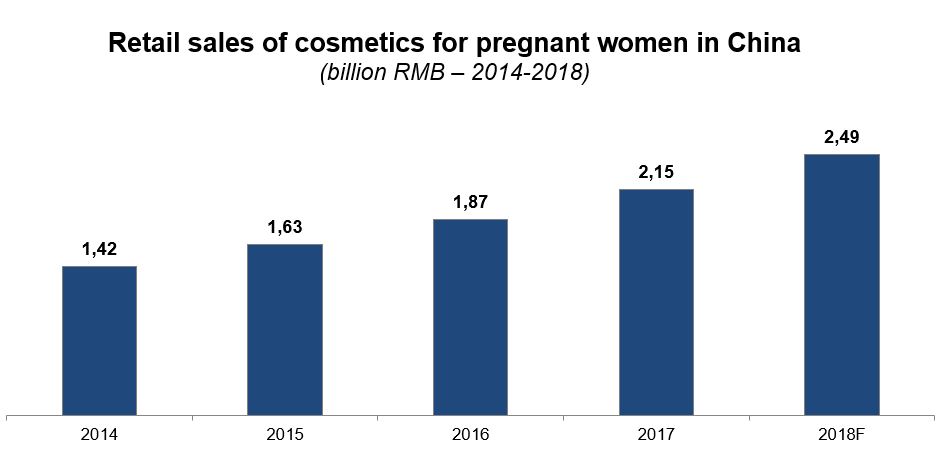

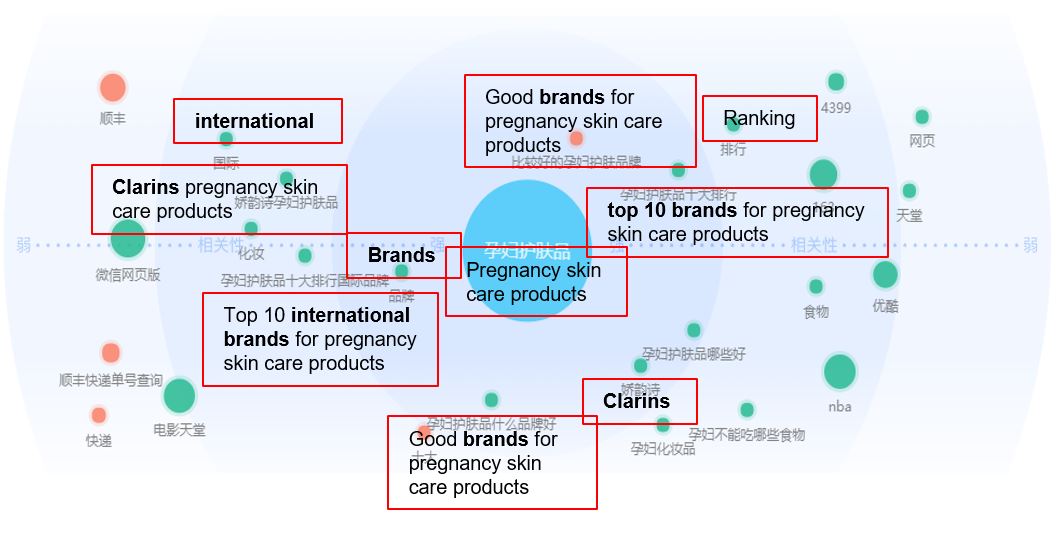

Chinese consumers are becoming more conscious of health and beauty, naturally, expecting mothers care about both their appearance and health during their pregnancy. Therefore, the demands of organic skincare and cosmetic products (specialized for pregnant women) have been consistently increasing on the Chinese market.

The other peculiarity of Chinese cosmetic and skin-care products market is the extremely strong impact of brand reputation on Chinese consumers’ purchasing behaviors. “The word-of-mouth and e-reputation play crucial roles in the development of a brand.” Says Thibaud Andre, project leader of Daxue Consulting. As we can see from the related terms of “pregnancy skin care” on Baidu Index, almost all highly related terms are about brands or brand recommendation. The term “international” and “top international brands” are also among them, the only brand can be seen on Baidu Index is Clarins from France.

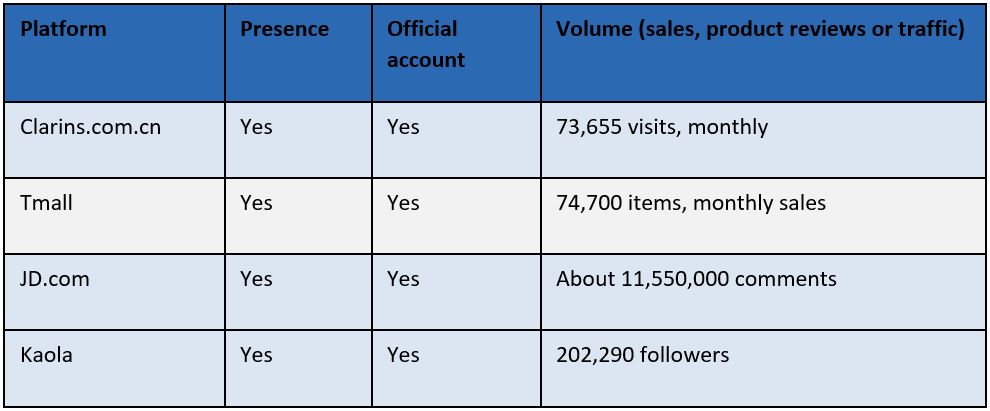

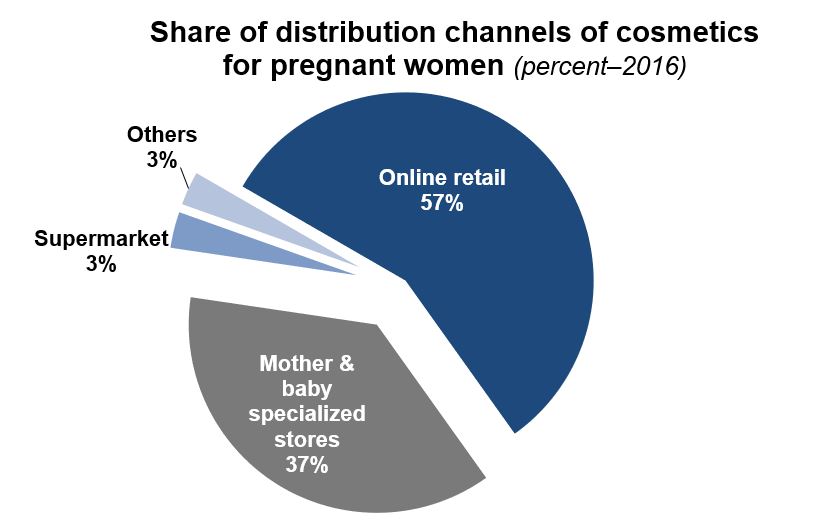

Clarins’ Chinese brand name “娇韵诗” (jiao-yun-shi) sounds slightly similar to the original name, in which “娇” means tender, delicate and dainty, “韵” means rhyme or charm and “诗” means poetry. These three Chinese characters build a romantic and beautiful aura for the Chinese consumers and indicate the products can provide them with graceful body and skin. Taking Clarins as a successful example of an international brand on the Chinese prenatal skincare market, they are active on the Chinese social media, cooperating closed with celebrities and KOLs. Clarins has over 680,000 followers and 27 posts in October 2018 on China’s No. 1 micro-blogging social media platform Weibo. The brand Clarins has also its own official website and is present on almost all important Chinese e-commerce platforms. Which is a crucial factor as online stores have been the most important distribution channel for Chinese consumers to purchase pregnancy cosmetic products.

Although Clarins is selling a wide range of skin care products, because of its clear and trustworthy brand image, Clarins’ product is famous for its safety and effectiveness. Its pregnancy care product like stretch-mark-reducing lotion is especially popular on the Chinese market. On China’s first and biggest Q&A platform Zhihu, when coming to questions like “How to prevent stretch marks?” Products from Clarins are being mentioned frequently.

Chinese families spend a tremendous amount of resources on education: starting with fetal/prenatal education

Chinese parents are willing to invest more financial resources on the well-being and development of a child than an average western parent. That starts long before the baby gets born, Chinese consumers are purchasing products which they think can accelerate the intellectual development of their unborn babies. There is a saying in China which has been used very often in the marketing campaign of many children/baby-related products: Winning at the starting line(赢在起跑线). Given the high concerns of Chinese parents over the academic performance of their children, products claiming to have educational function always capture Chinese parents’ attention, especially which from an international brand.

One of the most popular brands for fetal/prenatal education product on the Chinese market is a brand called BabyPlus from the USA. Its prenatal education system claims to create proprietary and age-appropriate rhythms for fetuses, which deliver many benefits, for example, ability to build consistent sleeping habits and reaching developmental milestones well.

Chinese consumers are looking for international high-quality prenatal products

In 2016, the Chinese government carried out the universal two-child policy, which is considered as the loosest birth control policy in China since 1980. Along with the Chinese emerging middle class’ increasing purchasing power, China’s prenatal care market shows a high-speed growth. No matter if it is a prenatal supplement or cosmetic product specialized for pregnant women, “Chinese consumers obviously prefer international brands.” Says Xiaonan Hua, Project manager of Daxue Consulting: “Part of the international niche brands are popular among Chinese consumers, but their products generally unavailable in China.” E-commerce platforms have been an extremely important distribution channel for international brands to engage with Chinese consumers and market different kinds of prenatal products. Since e-reputation plays a crucial role in the brands’ development in China, leveraging Chinese social media and cooperating with celebrities/KOLs are important for international companies, who want to enter the Chinese market.

Author: Chencen Zhu

Daxue Consulting regularly helps clients optimize their China business development by offering database building assistance, market research, simple distribution analysis, and SEO.

Our staff has strong experience in business development in Shanghai, Beijing, and other tops 50 China’s cities.