China’s increasingly wealthy and health-conscious population is showing large interest in the vitamin and dietary supplement market (VDS). With a rapidly growing middle class, more people are able to afford additional health products such as vitamins, fish oil, protein powder, etc. Such growing demand is showing high potential for the market in a number of areas, such as increasing market value, a wider range of products offered, deeper segmentation, fierce competition, and higher online presence. As the digital landscape of China continues to boom, social media is a popular channel of influence that companies, especially foreign brands, should keep in mind to maximize consumer engagement.

China is one of the biggest producers and consumers of VDS products in the world

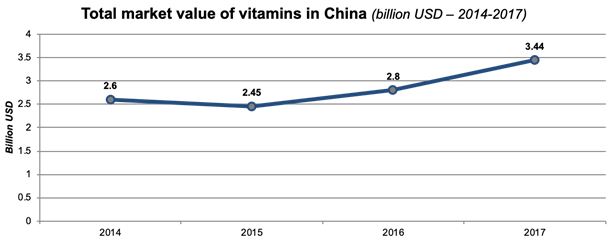

The market value of the VDS market in China is steadily increasing. In 2017, the total market value of vitamins in China reached 3.4 billion USD, an increase of 32% since 2014. By 2020, the VDS market is projected to reach over 22 billion USD or 169 billion RMB. Two vitamin manufacturers in China, CSPS Pharmaceutical and Zhejiang NHU, have not only made China’s list for China’s Fortune 500 companies but now stand as global leaders in the industry. CSPS Pharmaceutical has reached a market value of 12.39 billion USD, while the latter reached 6.09 billion in 2017.

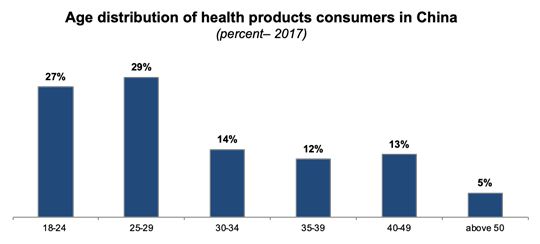

Most VDS market’s consumers are under the age of 30

As of 2017, people under 30 years of age are the main consumers of health products. The aging population, (above 50 years of age) make up the smallest consumer group despite an overall aging population in China, signaling room for growth. Additionally, more than half of consumers are women (56%), which might indicate that women have developed more of health awareness. Despite higher purchases from women in 2017, men still maintain a higher average consumption of health products. In terms of consumer attitude and perception of such products, online communities indicate an interest in a variety of topics related to VDS, from brands to functions, effects, gender appropriate supplements, amongst others.

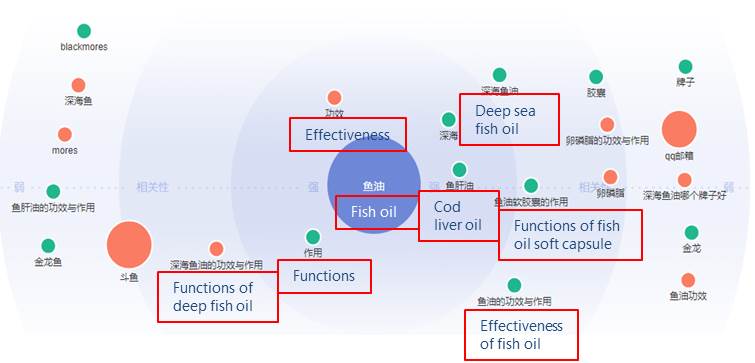

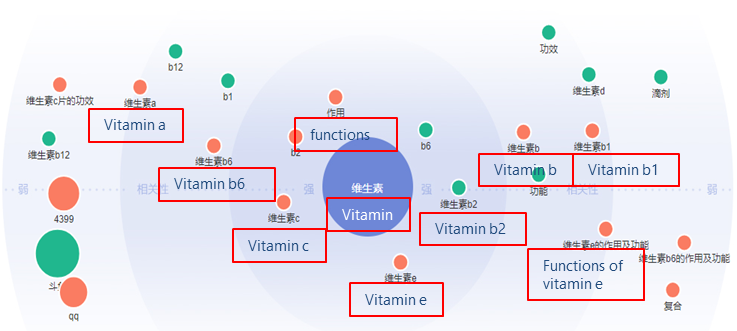

For the Chinese VDS consumer, effectiveness is extremely important

Within social media, the most commonly discussed topic regarding VDS is its effectiveness. Foreign brands are usually more popular due to the perception that foreign brands are more effective. Fake products in China also contribute to this perception, raising questions of quality and high demands of function and benefits from Chinese consumers. On WeChat, discussions are also broken down into questions on the best types of products for certain groups of people, such as elderly people and pregnant women. On Weibo, the main VDS content consists of posts and articles introducing many different types of VDS products and key elements buyers should take note of before purchasing the product. Within these posts, international brands are also more popular among domestic brands. On the Chinese question and answer forum site Zhihu, the consumer concerns about VDS products are heavily engaged in three main questions: 1) How to pick and use dietary supplements, 2) Advantages and disadvantages of vitamins and supplements, 3) Brand introductions- primarily foreign.

Among Baidu searches, Daxue Consulting’s Baidu index semantic analysis also reveals that the most keywords associated with VDS searches related to its function, effect, and brands. The search index for “vitamin D” was also the highest at the end of November 2017, in light of National Heart Failure Day and vitamin D has been shown to improve heart function. Baidu index also revealed By-Health (domestic) and Amway (international) as the brands leading with the highest search number. Amway was also the most searched brand on WeChat, significantly higher than other brands in the last 90 days since November 2018.

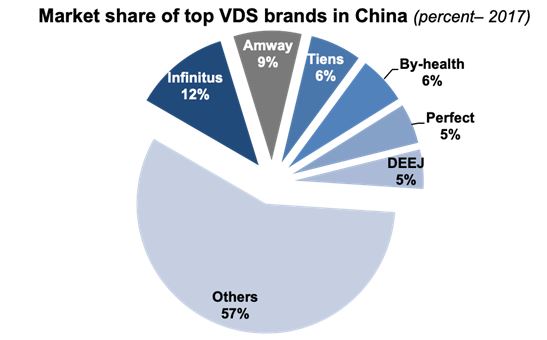

Vitamin and supplement market competition is fierce in China

Currently, the VDS Industry in China is a fiercely competitive environment. The top 6 brands took up a combined market share of 43%; however, the differences in market share among brands was not substantial, with the leading brand Infinitus at 12%, followed by Amway in second place at 9%. The remaining 57% of the market share is occupied by numerous smaller domestic brands. This lack of market domination demonstrates enormous room for market penetration in the VDS industry.

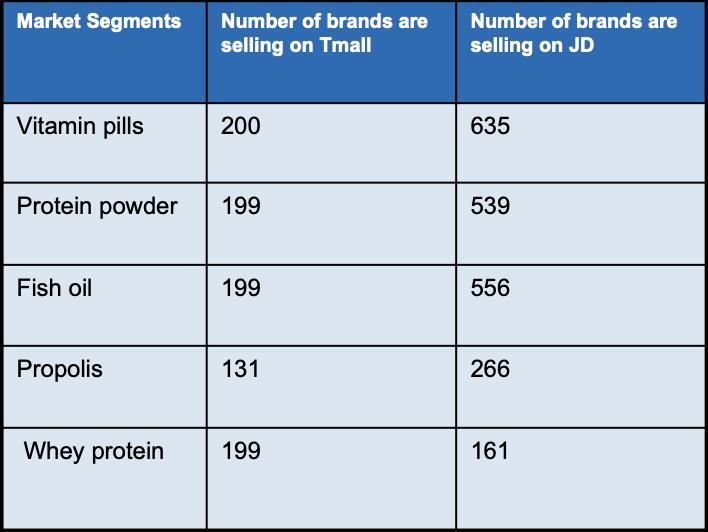

Increasing e-commerce and online purchasing channels point to higher VDS consumption in China

China has witnessed expansion in its online retail coverage of VDS products, in addition to its social media presence. E-commerce giants T-Mall and JD are important purchasing channels for vitamin and dietary supplement brands both domestic and international. In addition, online retail is an important channel of distribution as VDS brands are selling their products through their official websites or flagship online stores on T-Mall or JD.

On e-commerce platforms, foreign brands of a product are more typically expensive than domestic brands. Protein Powder is one VDS sector where foreign brands are preferred more prominently. A protein used for fitness, or mass gainers, is a significant category amongst protein powder products, and while it is currently dominated by Western brands, fitness related VDS is the fastest domestic growing sector. Within the fish oil and vitamin sector, domestic brands have more of a market presence. Many of these domestic companies have a strong presence on social media. The leading Chinese brand of fish oil By-Health has over 2.6 million followers on Weibo.

Caltrate – analysis of a leading international brand on the Chinese market

While many international vitamin brands have not made significant use of their Weibo account, calcium brand Caltrate is an exception, with over 2.3 million followers on its Weibo. It is one of the most well-known international VDS brands in China, as well as one of the first to enter China’s market. It has established a presence through their own website, as well as multiple other e-commerce platforms such as Kaola and Pinduoduo as well as T-Mall and JD. Traffic on its website reached over 80 thousand in the past 3 months, and monthly sales on T-Mall has surpassed 51 thousand. Caltrate has also reached 359 daily sales on Pinduoduo. Daigou Hunter shows that a large number of T-Mall sales were purchased for Daigou – literal translation “buying on behalf of” – which refers to shopping agents who are living overseas setting up unofficial reselling activities, for friends, families, or others.

| Platform | Presence | Official account | Volume (sales, product reviews or traffic) |

| Caltrate.com.cn | Yes | Yes | 80,516 monthly visits during past 3 months |

| Tmall | Yes | Yes | Monthly sales are 51,995 items |

| JD.com | Yes | Yes | About 13,200,000 comments |

| Kaola | Yes | Yes | 6,149 followers on Kaola |

| Pinduoduo | Yes | No | Daily sales are 359 items |

What is crucial for foreign VDS brands on the Chinese market?

With VDS safety, effectiveness, and health benefits in the minds of Chinese VDS consumers, it is very important to have a pleasant and evocative brand name. The corresponding Chinese name of VDS brands should strategically match the phonetic pronunciation with a positive meaning related to health and safety. Anyway or 安利 anli, has extended its popularity and persistent sales method in China through its strategic Chinese brand name: 安 a meaning safe, and 利 li meaning easy. Inasmuch as anli is now used in Chinese vernacular as a language of promotion. Caltrate and Centrum, or 钙尔奇 gaierqi and 善存 shancun are examples of two other international brands that have demonstrated strategic and effective Chinese brand naming.

Efficient distribution channels for vitamins and supplements in China

While its online presence in both social media and e-commerce has been steadily on the rise, its main purchasing channels on the Chinese market are still predominantly physical stores. In 2017, half of the retail sales of dietary supplements came from direct sales. Online sales took up ⅓ of total VDS retail sales in China, thus it is an important sales channel with growth potential. Specialized stores for vitamin and dietary supplements are also the main distribution channel. A search on Dianping (similar to a yelp in China) for VDS in Shanghai shows 800 results. Within stores in Shanghai, vitamins and protein powders are the most common in-store products.

International brands should leverage online sales and promotion channels to achieve success on the Chinese VDS scene

Just as there are a number of offline specialized VDS stores, online promotional channels are also an effective environment to leverage, especially for foreign brands looking to expand into the Chinese market. Some dedicated websites include iHerb.com, China-puritans.com, J1.com, and Kuailedo.com. Specialized magazines also function as strategic promotional channels and informational platforms.

Diversified demands, deepening VDS market segments, increasing room for market penetration

An expanding awareness for healthy living, higher disposable income, and higher demands of quality products worthy of its value are all factors that are driving the rapidly expanding middle class to have increasingly diversified demands in the VDS market. As a result, the Chinese VDS market is seeing more range in its products offered. Its vertical market segments are deepening to meet more particular demands, for more specific groups of people. Companies are entering the market positioning for new market segments such as age, functions, and ingredients. New Products are satisfying age group demands by targeting teenagers and the elderly. They are also accommodating for functional demands with products offering specific abilities, such as muscle gainer, immunity boosters, and anti-aging supplements. Natural products are also entering the market to satisfy demands in the all-natural less-processed segments, for consumers concerned with the safety of Chinese product ingredients.

Author: Julia Qi

Daxue Consulting performs market sizing as part of strategy-oriented projects Whether you are an international company that wants to enter the Chinese market, you already established operations in China or you have already a large history and experience in the Chinese market, you always need to be aware of the current size of the market and the opportunities that arise from it. No matter if it is a market analysis, a marketing research or it is a market entry study – our research at Daxue Consulting includes market sizing methodologies.