As pet ownership continues to rise, the pet consumption market in China has experienced significant growth, reaching a scale of RMB 311.7 billion in 2022, marking an 85% increase compared to 2018. According to JD.com’s August 2023 report on the latest trends in China’s pet industry, over 70% of consumers purchasing pet-related products on JD Supermarket are individuals under 40 years old, with a notable surge in contributions from Generation Z. Geographically, nearly 70% of pet-related purchases were made by consumers in Tier 1 and Tier 2 cities.

Download our report on Gen Z consumers

Surge in private pet care for Spring Festival

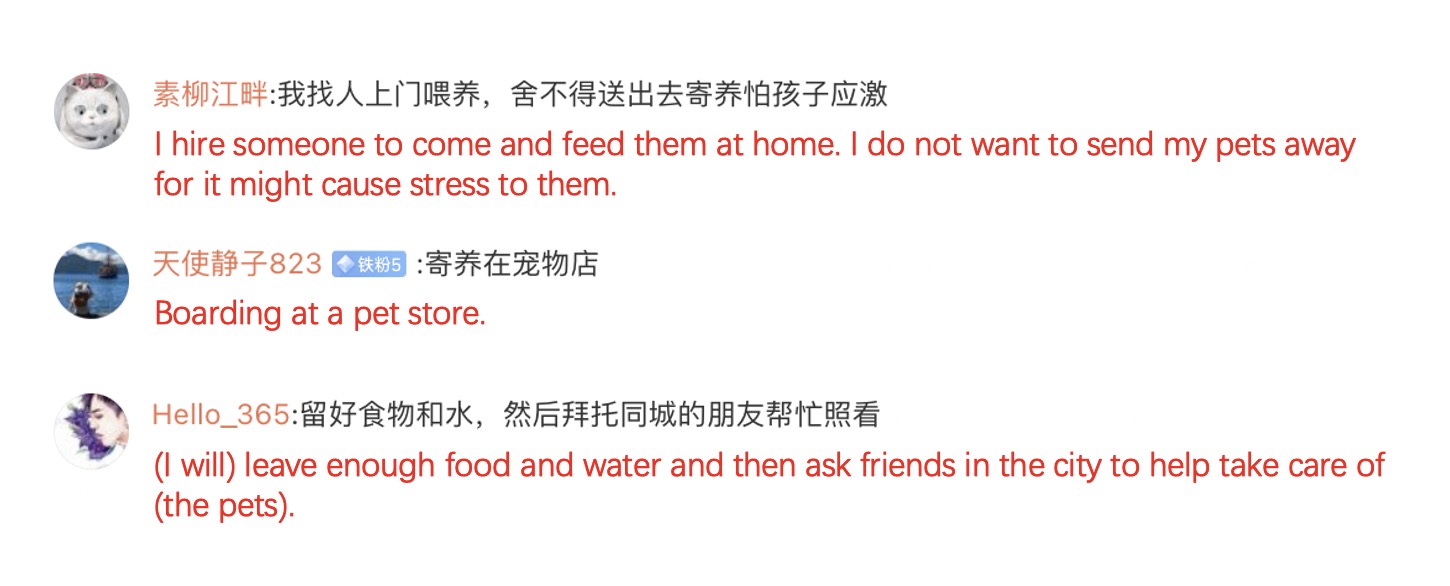

In the last week of January, netizens were having a heated discussion on #the surging demand for private pet care services during the Spring Festival# (春节期间宠物上门喂养服务订单火爆), garnering over 1 million views on Weibo. With the Spring Festival approaching, there has been a growing demand for both private pet care and feeding services, as well as traditional pet boarding services, due to pet owners having to leave their pets at home while spending time with family.

However, many young pet owners prefer private pet care services, considering them more convenient for the pets, as there is no need for adjustment to a new environment. Private care also tends to be more cost-effective than boarding services, especially since it is only required a few times during the holiday, with charges ranging from RMB 30 to 50 per visit. However, if pet owners opt for boarding services for their pets throughout the Spring Festival holiday, the usual cost is around RMB 400.

Implication to the pet industry

Given that almost 70% of purchases related to pets originate from consumers in Tier 1 and Tier 2 cities, it implies that businesses can focus their marketing initiatives and distribution networks on these urban areas. An understanding of the particular needs and preferences of urban pet owners will facilitate the development of tailored products and services. Given the tech-savvy nature of the target demographic, technology can be integrated into private pet care services. This may include mobile apps for scheduling, real-time updates on pet care activities, or even incorporating smart home devices to enhance the overall pet care experience.

What to know about private pet care in China?

- Pet ownership in China has surged, leading to significant market growth, with the pet consumption market reaching RMB 311.7 billion in 2022—a notable 85% increase from 2018.

- Over 70% of pet-related purchases on JD Supermarket come from individuals under 40, with a surge from Generation Z. Young pet owners prefer private care, finding it more convenient and cost-effective compared to traditional boarding services during holidays.

- Geographically, nearly 70% of these purchases are from consumers in Tier 1 and Tier 2 cities, indicating the importance of targeting marketing efforts and distribution channels in urban areas.