What is Programmatic Advertising?

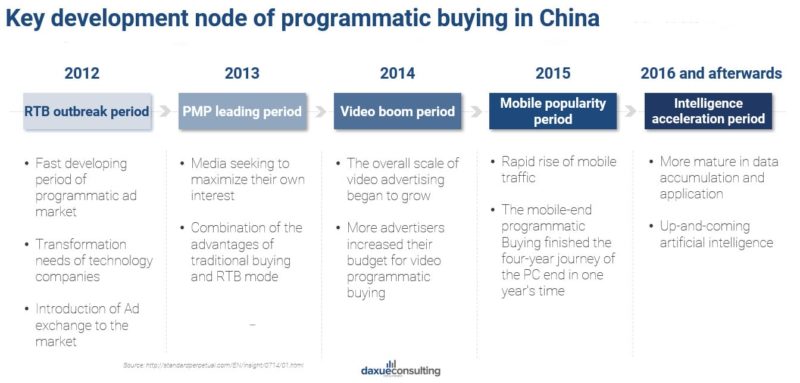

Programmatic advertising is buying digital advertising space automatically, with computers using data to decide which ads to buy and how much to pay for them. The programmatic advertising economy has experienced five key development nodes which embraces room for future growth.

Download our report on the programmatic advertising ecosystem in China

How programmatic advertising works

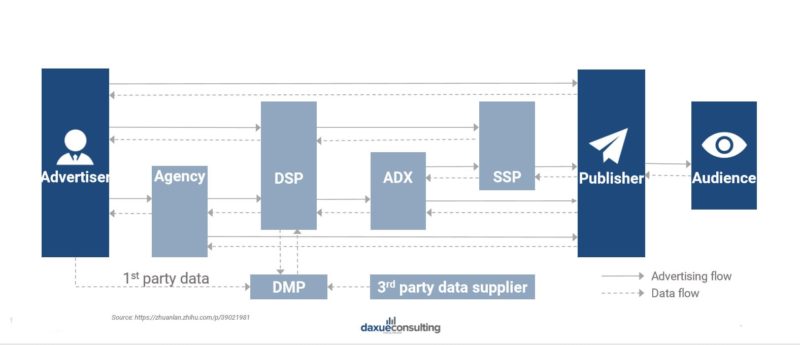

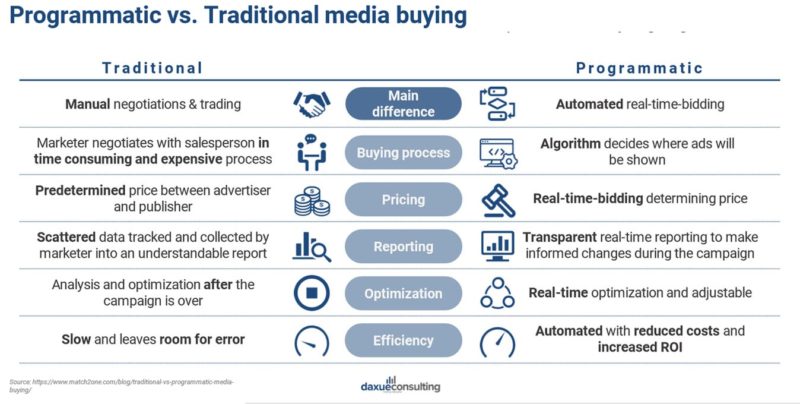

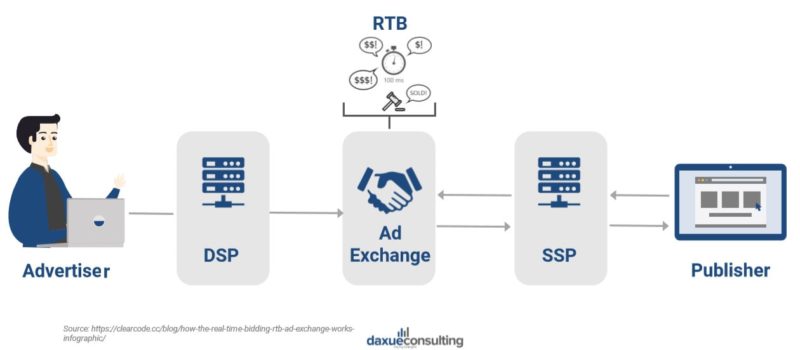

Programmatic advertising is designed to replace human negotiations with machine learning and AI-optimization. The goal is to increase efficiency and transparency to both the advertiser and the publisher. In the early days, since the market had low awareness of programmatic ads, people mistakenly think that programmatic ads is DSP (demand side platform), or that programmatic ads is RTB (real-time bidding). Now, after seven years of development, the Chinese market has a more clear and in-depth understanding of programmatic ads as well as its relationship with DSP, AdX (ad exchange), RTB (real-time bidding) and Non-RTB (non-real-time bidding).

Programmatic vs. Traditional media buying

Compared to traditional media buying, programmatic advertising is faster, more efficient, and cheaper. Programmatic ads could be helpful for the consumption structure development in China by targeting the ads on the right group of people.

Programmatic advertising in China market overview

The selling point of programmatic advertising in China is more about precision and results than automation. China’s programmatic scene is packed with hybrid “one stop shops”: Ad Network + DSP, DSP + DMP, Private Exchange + DSP, etc. Along with these hybrids, there is greater conflict of interest for advertisers due to a lack of boundary/transparency across disciplines. However, advertisers can quickly experiment with programmatic advertising in China without a heavy investment/understanding in technology.

Industrial Chain in China

Despite the emergence of transparency, security and other issues, the budget investment from advertisers on Programmatic Buying has not been substantially reduced. Advertisers are actively seeking to apply private data to advertising optimization and some large advertisers even build their own DSPs.

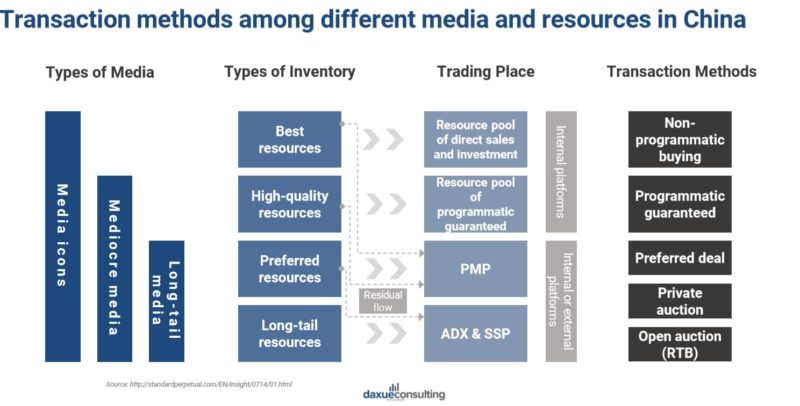

For publishers, the Matthew effect is more obvious in the supply side. The social, content media and video products of media icons occupy more of users’ time, and more high-quality resources are provided to the Programmatic Buying market through the development of information flow and other advertising products.

The providers (third-party platforms) of programmatic creative received more attention from the market and more and more new independent data service providers entered the market. Due to the strategy adjustments of Baidu and Ali, BES and TANX are gradually turned to internal supply and gradually faded out of the market, which is a good opportunity for other third-party independent platforms.

BATT in programmatic advertising in China

China’s programmatic advertising marketplace has its own dominant players. Baidu, Alibaba,Tencent and Toutiao. They dominate rich search, e-commerce, social, and news and information, respectively.

Unlike in the west, where publishers plug in to a third-party technology vendors to manage the ad sales process, in China, publishers build their own programmatic ad technology. As BAT consists of the dominant publishers in China, they each have their own platform to control advertising, and they operate as silos independent of one another.

Market size of programmatic advertising in China

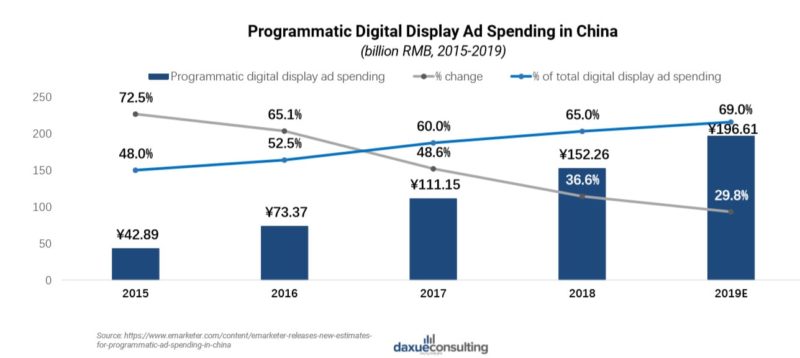

Programmatic advertising spending in China totaled 151.46 billion yuan in 2018, a 36.6% increase over 2017. It is estimated to reach 196.61 billion yuan in 2019, taking 69% of the total digital display ad spending. In the long run, China’s programmatic advertising market is still in the early stages of development and has a larger room for growth in the future, but its growth model will change from the past high-speed burst growth to medium- and high-speed steady growth.

Rising mobile programmatic advertising in China

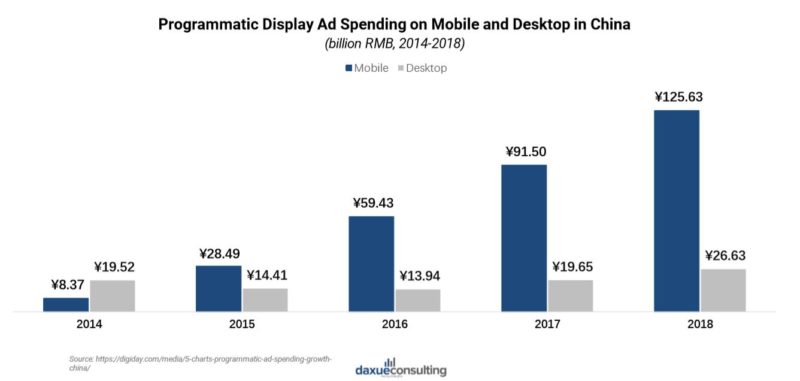

Mobile programmatic advertising increased to 125.63 billion RMB in 2018, accounting for 83% of programmatic spending in China. From 2015-2018, the main driving force for programmatic advertising in China was mobile programmatic advertising.

Factors of rapid popularity of mobile programmatic advertising in China

The popularity of mobile programmatic buying in the past was jointly promoted by multiple factors including the rapid growth of traffic of the mobile end, budget restructuring of advertisers, Hero App’s strong demand for cashing and the upgrading of data application ability.

Rapid Growth of mobile devices– In the past four years the number of mobile internet users increased to 829 million from 688 million, with 98% of them accounting for mobile. The sharp growth of traffic became the base of the development of the mobile-end programmatic buying.

More budget from advertiser– Advertisers of APP promotion and e-business are the early advertisers in mobile advertising, and the budget of brand advertisers turned to mobile-end programmatic advertising as well, with the perfection of conditions in mobile-end monitoring.

High willingness of hero APP– With the huge demand for cashing ads without the historical burden, mobile APPs are more easily to accept and more willing to open to programmatic advertising.

Data application ability enhanced– The features of mobile-end provides programmatic advertising with a larger amount of data and richer data dimensions, which enhance the data application ability of Programmatic ads.

RTB vs. Programmatic Direct share in China

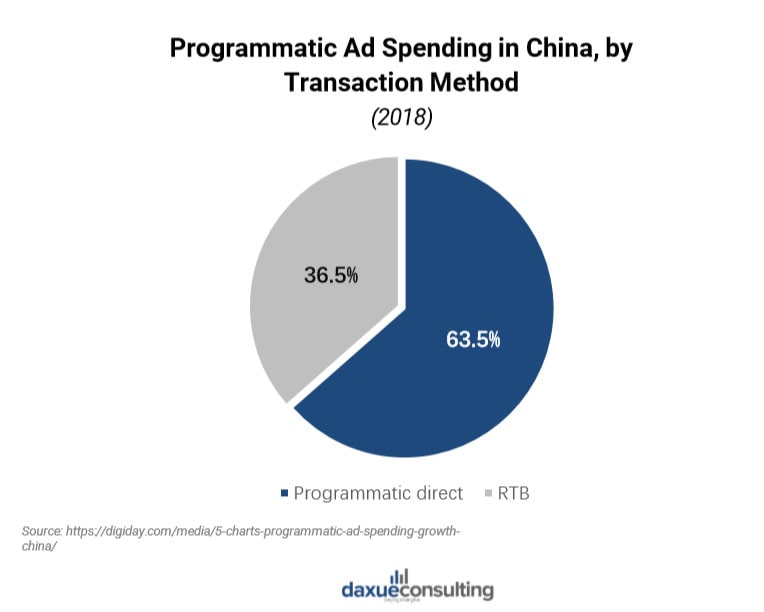

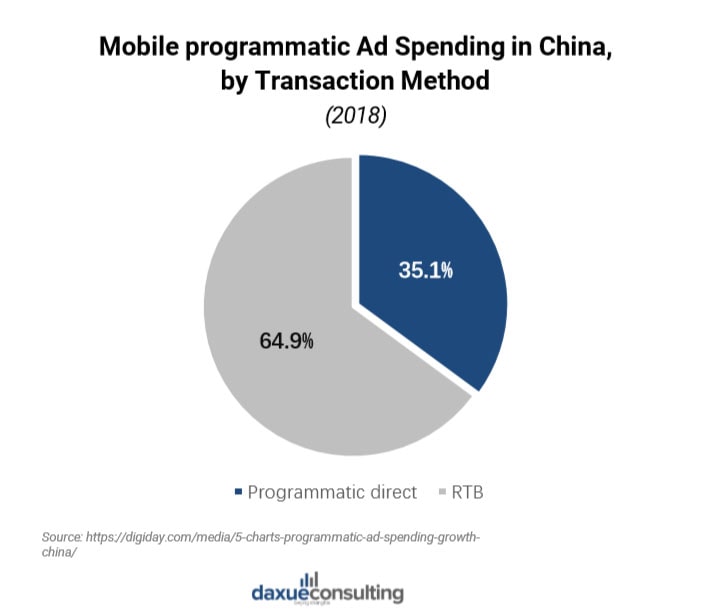

Programmatic advertising in China is transitioning from RTB to non-auction-based programmatic direct. However, when it comes to mobile programmatic buying though, RTB is more popular than programmatic direct.

Advertisers prefer programmatic direct because media icons like BAT can prove high-quality resources as well as premium technology support.

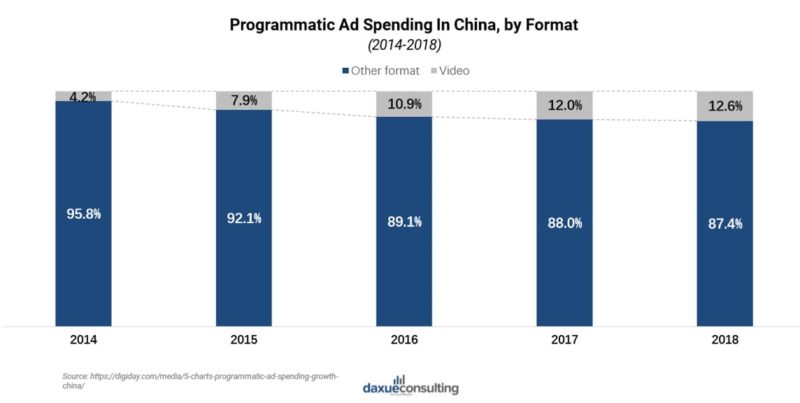

Programmatic video advertising in China

Programmatic video is gaining popularity. In China, programmatic video represented 12.6% of the country’s overall programmatic spending. Some hero short-video APPs like Kuaishou and Douyin are successful in this area. These video ads are information-intensive and are good at attracting target audiences’ attention.

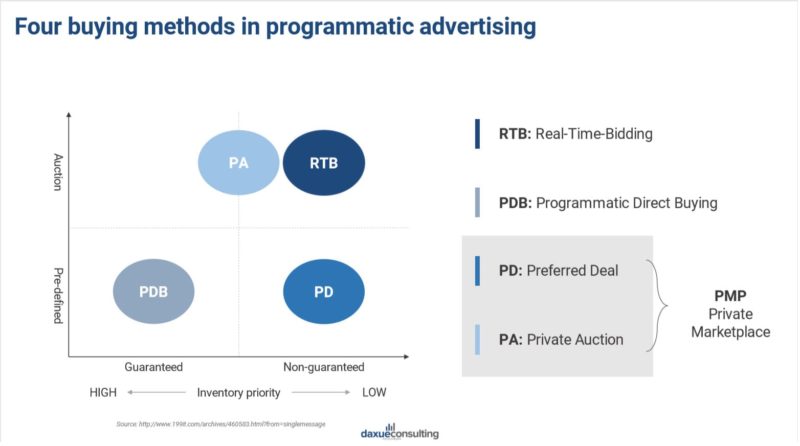

Buying methods– there are four methods for buying programmatic advertising. These four different methods are not competing, but complementary models designed to address the different needs of publisher and advertisers.

Transaction methods among different media and resource in China- In most recent cases in China, the media would cash the long tail traffic that is hard to be sold directly in the open market and sell the high-quality resources through the traditional direct customer channels.

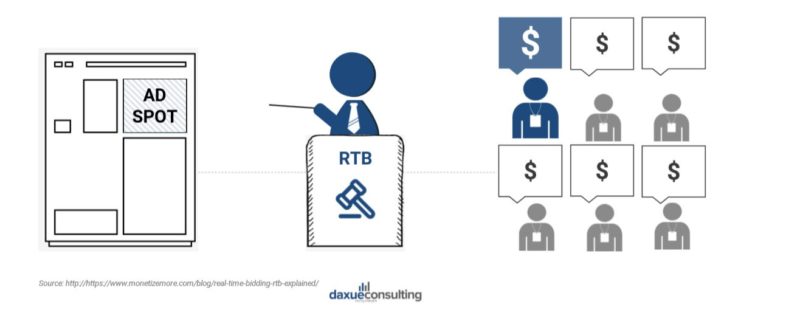

What is Real-Time Bidding (RTB)?

RTB is an auction-based bidding protocol in which advertisers compete against each other to display ads to specific users. RTB offers a lot of capabilities and use of data, vast types of inventory. In China, RTB is gradually losing its position in the programmatic buying ecosystem by facing the pressure from closed ecosystem and media icons. These giants possess rich resources and more right to speak in the industrial chain.

How does RTB work?

When a user visits a page, the browser sends a corresponding bid request. Then the DSP bids on the ad request (impression). If the DSP wins the bid, then the ad is sent to the publisher and displayed to the user. Lastly, the publisher sends an ad request to the ad exchange via the SPP.

Benefits of RTB

Per-impression buying process– Real-time bidding allows brands to bid on individual impressions rather than agreeing to a predetermined fixed price. Buying in real time is cost-effective, reduces waste, and can prevent advertisers from overpaying for media.

Single dashboard- Advertisers and publishers use a single dashboard on their DSP or SSP to control their campaigns, rather than having multiple relationships with different partners.

Easy testing and adjusting– The impression-level data obtained allows advertisers to analyze the efficacy with certain consumers, context, and creativity. This can ultimately lead to a more adaptable strategy.

Insights– Publishers have real-time information about their best-performing segments and know which inventory is more coveted by advertisers.

Ability to sell remnant ad space- As RTB auctions are triggered automatically by the arrival of a target visitor, inventory that was previously unwanted and unsold can always be sold and “saved” from wasting.

What is Private Marketplace (PMP) and how does it work?

Private marketplace is an invite-only variation of the RTB model. It is an auction process in which just a handful of advertisers bid against one another to buy a publisher’s inventory. This method is typically offered by publishers with more premium inventory. PMP combines the advantages of traditional advertising purchasing and Programmatic Buying. Since advertisers in China would like to maximize their own interests, PMP is actively promoted.

Private Auctions (PA) vs. Preferred Deals (PD)

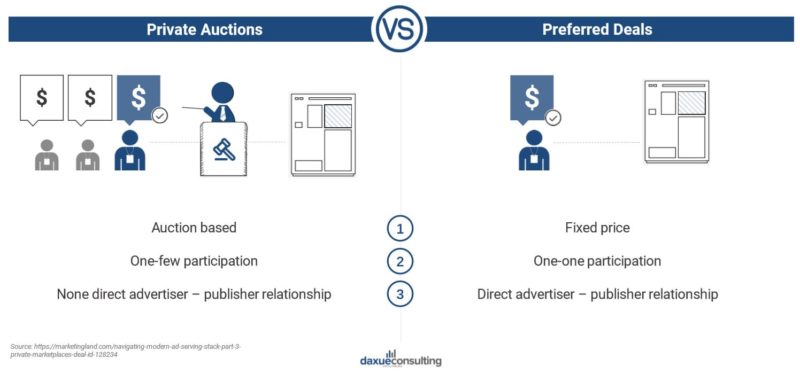

Within the realm of prove marketplaces, there are generally two types of deals in which an advertiser can participate: private auctions and preferred deals.

Benefits of PMP

Transparency on purchased inventory and pricing– The publisher and advertiser both have a very clear idea of what kind of inventory they are buying, what CPM needs to be paid, and the type of creative that is being displayed to users.

First look– PMP is a great way for advertisers to get the first opportunity to purchase inventory before it ends up on the open market.

Integrated buying– The PMP is operated within the RTB ecosystem, meaning campaign data sits alongside other RTB campaigns, giving a holistic view of campaign performance, as well as making global frequency capping and cleaner attribution possible.

Powerful targeting– The PMP can layer on additional targeting. While some publishers use private marketplace to essentially create private exchanges, by pulling their inventory off the open market, others use it as a way to bundle their inventory in novel ways.

What is Programmatic Direct Buy (PDB)

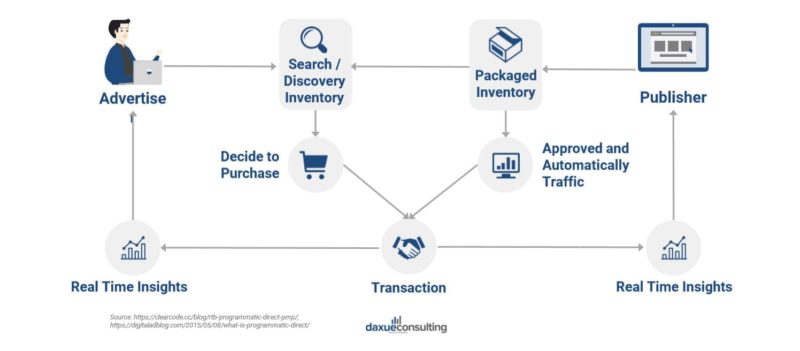

Programmatic direct is a one-to-one media-buying process much akin to the traditional method whereby salespeople met with advertisers in person to strike a deal. It is a very similar model to the private marketplace, with the exception that advertisers and publishers agree on specific inventory based on a fixed CPM. Ads sold through programmatic direct are often tied to premium publishers (think Forbes in west and China Daily in China) who reserve a certain percentage of their inventory they prefer not to sell on the open market because they can demand a premium price from advertisers, who get guaranteed ad space in return.

How does PDB work?

First, an advertiser browses through a shop-like catalogue of websites. They configure flight dates and volume of impressions, then places an order on the platform. Lastly, the publisher audits and verifies the campaign.

Benefits of PDB

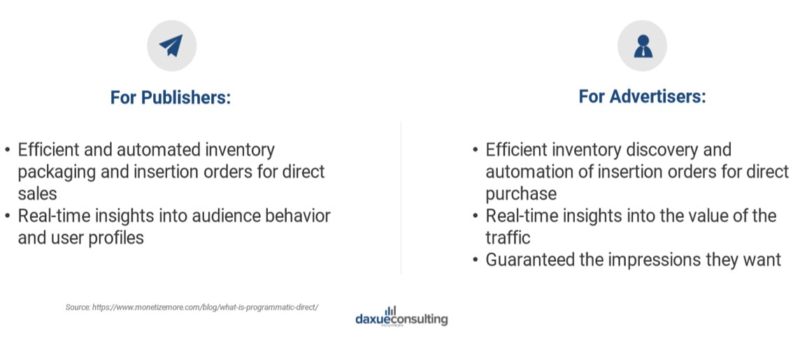

- The ability to automate insertion orders and ad-code configuration can help both publishers and advertisers to improve efficiency and eliminate human error in the entire process.

- Both advertisers and publishers get more opportunities to control the process and outcome of media buying through real-time data stream.

- All benefits of PDB make independent companies in China hard to compete with giants as well as get high quality resources

Adtech Platforms in RTB Transaction

What is Demand-side platform (DSP)?

A demand-side platform is a tool or software that allows advertisers to buy ad placements automatically. Main functions provided to media buyers consist of:

- Create, run and manage many campaigns simultaneously across multiple SSPs and ad exchanges and control them from a single centralized user interface.

- Auto-optimize (via algorithms) the campaigns to increase ROIs.

- Use third-party data from DMPs to improve targeting.

- Provide real-time reporting via advanced analytics.

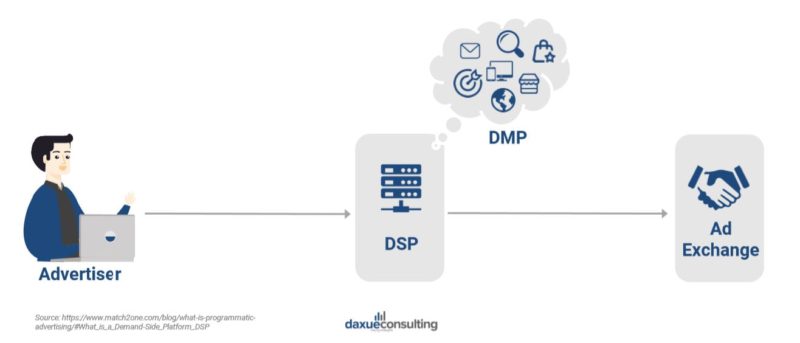

How does DSP work?

An advertiser signs up with a DSP, that in turn is connected to an ad exchange. DMP collects and manages web browser cookies and help to make buying decisions. When the advertiser reaches the website, an auction signal us sent to the exchange. The exchange then asks the DSP if the advertiser has any ads that might fit the placement. If it does, the DSP sends a signal to enter RTB auction.

How does targeting work in a DSP?

There are several ways an advertiser can run targeted ad campaigns with a DSP, but at the heart of it all is data. The DSP would sync cookies with the DMP to exchange user data, which can then be used for targeting. The DSP could help advertisers to target users based on this data:

Behavioral data- Includes information about the user’s behavior and interests, such as websites they’ve visited, what products they’ve purchased, which ads they’ve interacted with, etc.

Contextual data- Includes information about the website or mobile app, such as USL, categories, and the content on the page.

Demographic data- Includes information about the user’s location, age, job title, gender, and so on.

What advantages do DSPs offer media buyers?

Wide and efficient audience targeting- The DSP provide opportunity to media buyers to reach audiences on a lateral and bilateral basis, so they can reach their target audience more effectively plus reach a wider audience.

More inventory accessibility- The ability to access a larger amount of available inventory and display their ad on a larger number of websites by connecting to a variety of ad exchanges and SSPs.

Free to optimize- Media buyers can manage and optimize the efficiency of their campaigns by adjusting the settings.

Real-time reaction- The ability to react in real-time to certain outside conditions such as weather, news, stock market activity, allowing the media buyer to serv the most relevant advert to the user.

Data integration- The option to integrate third-party data brokers and data management platforms into the DSP to allow media buyers to further optimize their audience targeting capabilities.

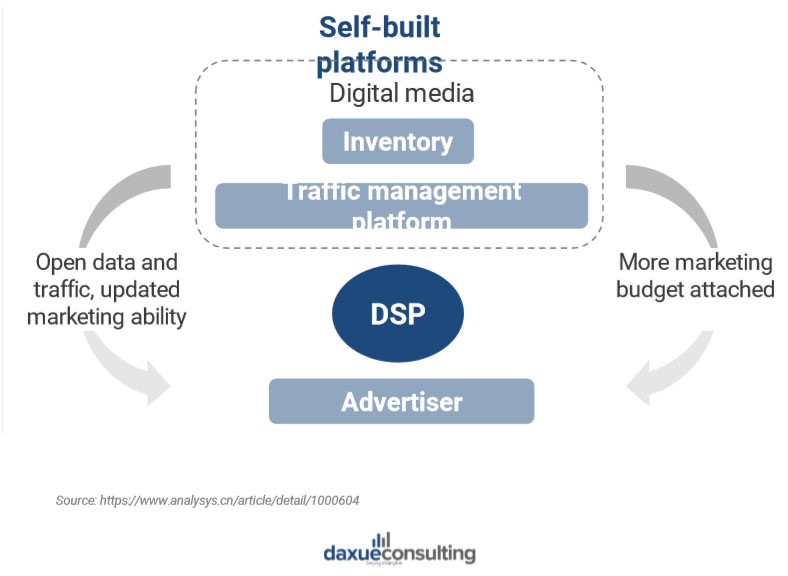

The DSP market in China

The self-built Programmatic Advertising platform by media can promote the overall market and the third-party DSPs still have its unique value. Third-party DSPs’ core existing value is to provide cross-media and cross-platform solutions for the advertisers. Part of independent DSPs set transparent transaction as the main focus and improve marketing service capability with differentiated services.

Self-built platforms have stronger control private high-quality ads and traffic resource, and rich accumulation of user data. Part of media programmatic platforms with large traffic consumption and fast growth also began to access external, traffic resources when consuming their own ones.

Main DSP players in China

The top integration platforms in China are:

- YOYI Digital: specializes in the research and development of online precision targeting technology and internet marketing services. It provides both impression-based and performance-based advertising solutions and has developed a network of top publishers in China.

- iPinYou: Beijing iPinYou Information Technologies Co., Ltd is now China’s largest DSP. It has built world class RTB technology and algorithm, proprietary cloud computing platform and patented audience profiling technology. It is established as a leading provider of audience based programmatic advertising technology

- AdSame: AdSame is a digital marketing agency offering advertising, data insight, and publishing solutions. It helps customers to be more concise and efficient in digital marketing. It has extended the business chain to mobile internet advertising and established a corresponding relationship between PC and Mobile users’ data.

The top mobile-focused platforms in China are:

- Limei: Beijing Limei Advertising Co. Ltd. is a provider of mobile marketing solutions in China. It’s targeting capabilities include location, device model, device OS, user Tags, Operators, Wi-Fi, etc. It has also invested in seven professional mobile internet technology development companies.

- Lomark: Media Lomark point is China’s leading local mobile advertising platform. It mainly focuses on the local market, with big data analytics, cloud computing, behavioral targeting technology, crowd recognition technology and other cutting-edge technology model.

- Domob: Domob Network Technology (Beijing)Co., Ltd. is a Chinese advertising platform for smartphones. It devotes to promoting products on the smartphone platform and providing efficient services for branded advertisers. It also provides application developers with product promotion services and benefits.

What is Ad Exchange and how does it work?

An ad exchange is a technological platform that allows the buying and selling of digital inventory. It functions much like the trading floor of a stock market, but for digital display advertising. First, visit the website. Exchange will then announce available bid, evaluating available bidders (advertisers). Real-time auction of all bids occurs. Then the winning bid displayed on website.

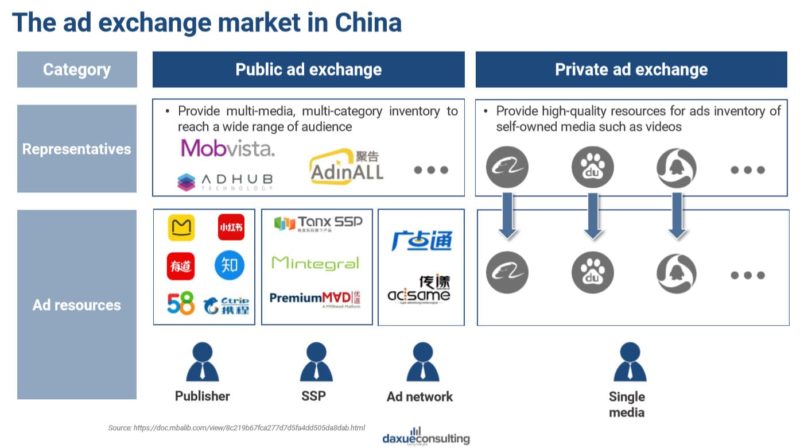

The ad exchange market in China

Public and private are two typical types of ad exchange.

The value of the ad exchange platform

Ad exchange makes advertising transactions more efficient. For advertisers, it provides:

- massive, cost-effective media resources and delivery options

- accurate control of ad space and target audience

- single payment source increases efficiency and reduces transaction costs

- flexible price with high transparency

For publishers:

- connects buyers from different industries with various needs

- improve profitability by having better capability on traffic monetization

- improves operations efficiency of trade platforms

- better control of advertisers, ads format, and bid types.

Main Ad Exchange players in China

The top integration and mobile-focused platforms in China are:

- Baidu Exchange Service: Baidu Exchange Service (BES) is a ad transaction platform based on Real Time-Biding protocol, which covers rich resources and targets on wide range of audience. BES provides multidimensional data support for agency companies and DSP platforms

- Tencent AdExchange: AdinALL has been focusing on creating an intelligent and efficient ad-traffic exchange platform that allows advertisers and developers to trade multiple ways for each impression and click. Advertisers can buy inventory in real time from a wide range of media, while developers can get more favorable price and rich ad filled with global brand and performance advertisers.

- Mobvista: Mobvista is a leading global mobile ad network dedicated to helping advertisers, publishers and affiliates achieve goals and maximize revenue. It is specialized in mobile advertising and game publishing. •It operates a worldwide mobile ad network, integrates ad spots from apps and websites covering 236countries.

What is Supply-side platform (SSP) and how does it work?

A supply-side platform is a tool or software that allows publishers to manage, sell and optimize available inventory (aka ad space) automatically. A publisher wants to sell its display space, SSP connects to several different ad exchanges and tells them what kind of inventory is available, and through real time-bidding, inventory is automatically auctioned off to the highest bidder.

Currently, there is few purely independent companies representing the interests of the publisher in the Chinese market. In the domestic market, the boundaries between SSP and ADX are becoming increasingly blurred.

What advantages do SSPs provide publishers?

Automated selling of inventory- SSPs help streamline the process of selling and buying inventory by completely removing manual work from the process, thus publishers can sell all of their inventory to advertisers automatically.

Detailed reporting- The ability to offer deeper insights about the value of their inventory for particular advertisers by giving publishers details on who is bidding, how much their inventory is being bought for, and how much individual advertisers are buying.

Aggregation of multiple networks- The ability to help achieve better yield by connecting to multiple networks, ad exchanges, and DSPs to allow more buyers to take part in the real-time bidding process.

Yield optimization with price floors- SSPs allow publishers to offer their inventory to more buyers and give them better control of pricing by price floors to ensure that their inventory is not sold under certain prices.

Brand safety- SSPs offer better brand safety for publishers by blocking unwanted ads from showing on their website.

Main SSP players in China

Top integration platforms are:

- Tanx SSP : Tanx SSP provides a full range of display promotion services. It provides real-time bidding technology, promotion content controlling, promotion resource management and precise targeting. It has a high-yield product called Window Promotion. It is based on the real-time bidding market and uses the real-time bidding CPM as the billing model.

- AdView : AdView is a leading mobile SSP & exchange headquartered in China. •It has a mobile ad network exchange center and big data computing platform. It supports various mobile advertising forms, RTB real-time bidding, PMP private transactions, and has a database of behavior characteristics of mobile advertising users.

- Adin SSP : Adin SSP is a high-quality supplier side platform in China. It integrates high-quality media resources, and conducts data processing of traffic category definition, media ad space optimization, and inventory orientation distribution. It optimizes diversified inventory to more suitable demanders or puts them in the traffic exchange market for programmatic RTB sales.

Top mobile-focused platforms are:

- Mintegral : Mintegral is the leading mobile advertising platform in Asia. It is powered by AI technology and provides user acquisition, monetization and innovative creative solutions to advertisers and mobile developers worldwide. It has exclusive high-quality APAC traffic resources to help developers grow their mobile app business in APAC.

- PremiumMad : PremiumMad is a mobile advertising management platform with focus on high quality traffic. It provides rich original advertising forms, one-stop inventory management, global and domestic premium brand advertisers and the best quality mobile media resources.

- Yumimobi : Yumimobi is a one-stop ad monetization platform. It provides top demand resources by collaborating with top ad networkers, DSPs, exchanges and direct buyers to provide high fill rates. It provides automatic optimization by multidimensional algorithm to ensure ads income.

What is Data management platform (DMP) and how does it work?

A data-management platform is a technology platform that collects data from a range of different sources, classifies and categorizes it, puts it into different groups (segments), and then uses those segments to achieve certain goals. DMP collects first- party, second party and third-party data from different sources including online and offline data sources. DSP groups certain pieces of data together based on similarities and then uses the segments to target different audiences. DMP activates data and puts in into work.

Who needs a DMP and why?

A data-management platform can be used by advertisers, marketers, and agencies to optimize their media buying processes. Even companies that don’t operate directly in the online advertising space can still greatly benefit from a data management platform.

Ad campaigns Management- Manage online advertising campaigns that involve connecting with other ad-tech platforms (e.g. ad networks, DSPs, ad exchanges, and SSPs, etc).

Conversion rate improvement- Want to increase conversion rates, improve the user experience on their website or apps, and increase brand recognition and conversion rates.

ROI maximization- Want to lower advertising costs and improve campaign ROI across display, mobile, video, and social.

Personalized Content Delivering- Want to personalize messages and content shown to customers through advertising, remarketing, and other brand interactions to increase engagement.

User information learning- Want to learn more about their existing users and customers to help shape product offers and services.

SCV creation- Want to connect offline data with online data to create a Single Customer View (SCV).

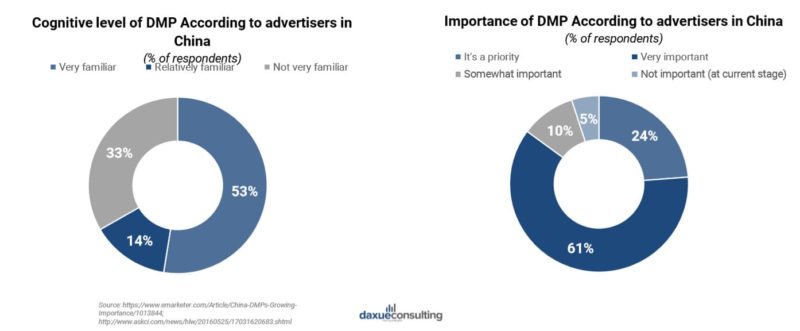

DMPs are growing in importance in China

Getting a DMP in place has become critical for marketers in China. A quarter said having one was a priority, and an additional 62% called it “very important”. One major reason is to glean product-related information. Advertisers were interested in deriving such data from a DMP.

Main DMP players in China

The top integration platforms are:

- AdMaster : AdMaster is a third-party provider of solutions for marketing massive data in China. It aims at helping advertisers to realize the monitoring and optimization of digital marketing effect as well as improving the overall marketing ROI by technology-driven massive data perception research.

- Miaozhen Systems : Miaozhen Systems is the leading third-party advertising technology company in China. It has the exclusive Moment Tracking Technology to help advertisers, agencies and publishers in efficiently measuring online campaign impact, and enhance their online advertising returns.

- DAMOPAN : DAMOPAN is a data management cooperation platform. It realizes insight and analysis of various users and establishes personalized user segmentation and precision marketing. It provides supporting data access, data integration and management solutions. It uses massive data to provide customized services to meet personalized marketing needs.

Top mobile-focused platforms are:

- TalkingData : TalkingData is China’s largest independent Big Data service platform with focus on the mobile Internet. It offers the best-in-class Big Data products. It has advanced data statistics and analytic software to provide the most data-rich, reliable and profound market reports that have powerful insights into the Chinese Mobile Internet market.

- Umeng+ : Umeng+ is a leading third-party provider of universal data in China which provides mobile application analytics solutions. It is focused on providing professional mobile-applied statistics analysis tools, utility components, and promotion services for developers in China.

- More Than Data : More Than Data is a third-party platform with focus on mobile data monitoring and analysis. It has a third-party advertising effect tracking and monitoring platform called Tracking IO. It helps advertisers with mobile advertisements attribution, full process monitoring of promotion activities and anti-cheat system to improve ROI.

Case study: International players in China

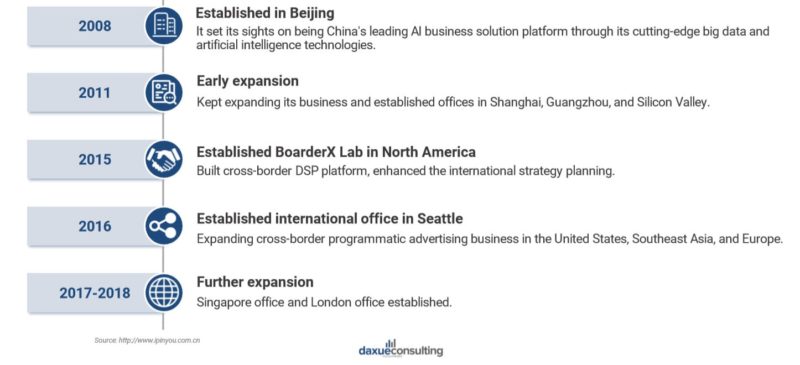

iPinYou

iPinYou is an overseas expansion limestone. It is China’s largest DSP with real-time bidding, cloud computing, and audience profiling technology solutions.

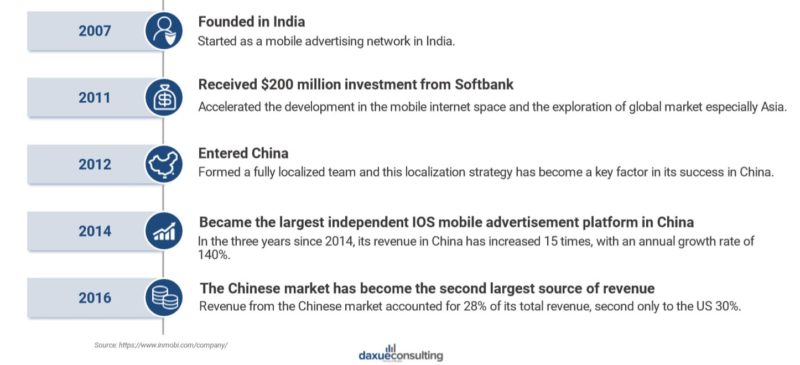

InMobi

InMobi is a domestic expansion limestone. It is the world’s leading mobile marketing and advertising platform provider.

What’s next for programmatic advertising in China?

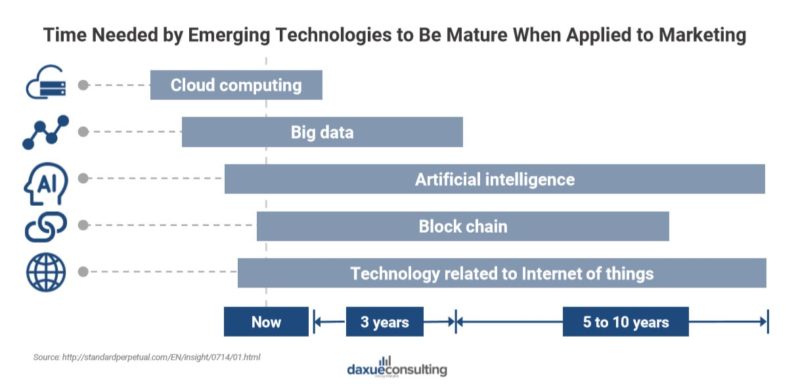

Intelligent marketing will emerge soon

Cloud computing, big data and artificial intelligence has been promoting the development of intelligent marketing. Blockchain technology has begun to solve the transparency and security issues in marketing. With the maturity of technology related to Internet of things, in the environment of intelligent perception, marketing will be more ubiquitous accompanied by the changes in scenes.

Local and medium and small advertisers become a new growth point

With the general decrease in Internet users and channels, local, medium, and small advertisers will become a new growth point of demanders in the programmatic buying market. In the long term, this momentum will not stop. However, in the short term, it still faces the challenges of multiple factors such as the imbalance of regional economic development and the low degree of awareness of advertisers.

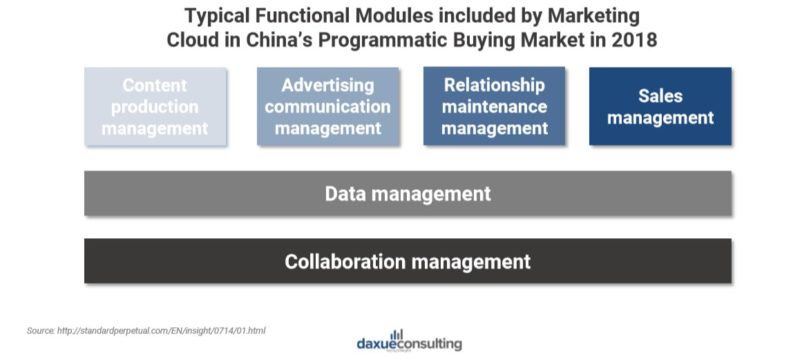

Marketing cloud possibility in China

The essence of Mar-Tech is data driving marketing activities, depending on the artificial intelligence, large data and cloud computing supports at the bottom. Mar-Tech‘s rapid development will promote the realization of marketing cloud. The realization of the organic combination of six management modules is an important direction for the future development of the marketing cloud.

Key takeaways of programmatic advertising in China

- Think mobile, a majority of entertainment is consumed through mobile phones in China. From e-sports to watching movies or reading the news, China’s programmatic advertising ecosystem is catering to mobile advertising.

- Video advertisements are in. On top of the mobile environment, an increasing amount of content is absorbed through video, such as Douyin (TikTok), or any video watching platforms like Youku, AiQiyi, and Bilibili.

- Closed advertising ecosystem, Baidu, Alibaba, Tencent and Toutiao operate as silos independent of one another and there is little to no exchange of data laterally.

- It is just the beginning for automated ads in China. AI and block chain technology will take years to mature in China’s programmatic advertising ecosystem.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm in iTunes