Single’s Day is the largest online shopping event in the in China. It started in 2009 by Alibaba on the Taobao Mall (Tmall) platform, and has since then, been held annually. 2021 became the largest year for Single’s Day in China, with 290,000 brands participating in Tmall. However, Single’s Day 2021 was different from every year in the past. Due to the recent crackdown on tech, there was less pizazz for the large platforms, while smaller platforms had more opportunities.

Although sales still increased from the previous year, the growth rate for China’s Single’s Day 2021 slowed down. Alibaba reported a total gross merchandise (GMV) of USD 84.54 billion, which is a year-on-year increase of 8.5%, much lower than the 26% rate from 2019 to 2020. Alibaba’s competitor Jingdong performed better, with a GMV worth of USD 54.6 billion. It is an increase of 28.6% from 2020, which is also slower than the 33% growth rate from 2019 to 2020.

What was new in the Single’s Day 2021 in China

Attractive promotions weren’t the focus

Single’s Day 2021 was not heavily focused on attractive promotions. Alibaba rather promoted sustainability and inclusiveness, which aligns with the government’s efforts for social equality and reduced carbon missions. It encouraged consumers to buy more environment-friendly products. For instance, according to its statement of October 21st, 2021, it would offer about USD 15.6 million worth of vouchers to incentive customers to “green” products. They also introduced “senior mode”, with an interface catered to the silver generation. Voice-assisted technology, simplified navigation system, and eye-friendly font sizes are some of the new options.

Consumption from tier-2 cities and below showed increasing growth

Although tier-1 and new tier-1 cities are still the main consumers like Shanghai, Beijing, and Hangzhou, non-tier 1 cities like Chengdu and Wuhan showed increasing growth. Both Alibaba and Jingdong observed growth in purchases from rural areas. Alibaba stated that from November 1st to the 3rd, consumer spending from lower-tier cities and rural areas rose by about 25% from 2020. According to Jingdong, 77% of all shoppers were from the lower-tier cities who mainly consumed home appliances, medicine, and home decoration supplies.

New small- and medium- sized brands supported, aligning with Common Prosperity’ policy

In an effort to promote China’s ‘Common Prosperity’ policy, Alibaba and Jingdong supported new small- and medium-sized brands. Among the 290,000 brands who participated in Single’s Day, 70,000 joined for the first time, four times higher than in 2020.

Single’s Day 2021 was not a single-day but a multi-day festival

Many brands participated in earlier in the pre-sales stage of the China’s Single’s Day 2021 to increase their sales. On Tmall, pre-sales increased from 2020 to 2021. Statistics from Amoy show that in October 2021, beauty skin care, make-up, women apparel, and sports industries experienced a pre-sales increase of 115%, 57%, 166%, 111%, respectively, compared to 2020.

Consumer trends of Single’s Day 2021 in China

Consumption of domestic brands increased

Along with the Guochao (国潮) trend, increasingly more consumers are showing interest in domestic brands. Cosmetics brands PROYA (珀莱雅 in Chinese) and WINONA (薇诺娜), sports brands Li-Ning (李宁), Anta Sports (安踏), and FILA, were among the top domestic brands who showed notable growth. Anta Sports and Li Ning, for example, ranked higher in Tmall’s top ten sales brands in 2021 than Adidas. Regarding beauty and skincare products, the overall growth rate of foreign brands was 26.8%, much lower than the rate of 78.9% of the local brands.

Consumers had become more rational

Consumers had become more rational. Searches for price comparison increased by 28% from 2020 to 2021, according to data from China’s search engine Baidu. Also, among the trending topics searched were questions regarding the validity of cheaper prices of products and ways to avoid Double Eleven tricks.

Anti-consumption users discouraged consumers from joining Single’s Day in China

In a social networking service website Douban, a group known as the “Consumerist Retrograde” group (消费主义逆行者 in Chinese) were among the consumers who were “rational” decisions makers. They promoted saving and discouraged buying driven by impulse across the platform.

Top foreign brands and product categories during Single’s Day 2021 in China

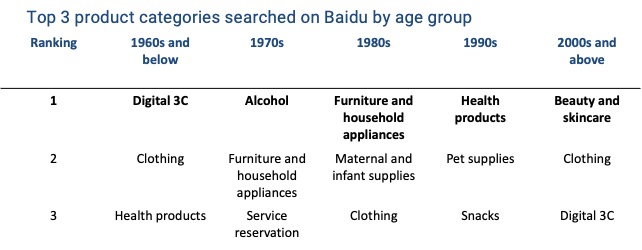

Online search for different products varied by generation

Consumers of different age groups showed interests in different products. Individuals from post-2000s generation showed interested in beauty and skincare products; those from the 1990s in health products; from 1980s in furniture and household appliances; from 1970s in alcohol; and from 1960s and below in digital products.

Source: Ping West, Trending categories 30 days before 2021 Single’s Day in China

The top product categories were household appliances

The top product categories on 2021 Single’s Day in China were household appliances, mobile phone digital, men’s and women’s clothing, and personal cosmetics, which are the same as in 2020.

Tmall and Jingdong are the main platforms used

The main e-commerce platforms in 2021 Single’s Day in China are Tmall, Jingdong, and Pingduoduo. Among the B2C e-commerce platforms, Tmall ranked first accounting for 57.59% of sales, Jingdong for 27.06%, and Pinduoduo last for 6.40%. On Tmall, from Nov 1st to 11th at 0:45, 382 brands, including international brands like Apple and L’Oreal, experienced a turnover of over USD 15.6 million.

Key takeaways of Single’s Day 2021 in China

- Single’s Day sales increased from 2020 to 2021, although the growth rate slowed down. The focus is shifting from large brands and large platforms to smaller brands and smaller platforms.

- There was an increased focus on sustainability and inclusiveness – rather than attractive promotions. At the same time, consumers have become more rational. This hints towards an overall shift away from materialism and towards values. On one extreme, an anti-consumption group emerged on the internet.

- In line with the greater Guochao trend occurring in China, sales of domestic brands continued to increase.

Author: So Ry Park