According to a survey from Japanese skincare firm Shinseido, the top four concerns of Asian women all relate to skin tone darkening. The top point of issue for Chinese women is yellow, sallow skin. On the men’s side, demand for sunblocks and whitening agents are also rising.

The fascination with fair skin in China has only grown over the years, with cosmetics products helping lead the trend. The sale of skin whitening products is expected to reach a whopping 7.8 billion US dollars by 2030, according to market research firm Global Industry Analysts. This passion for pale skin can be seen through the multitude of whitening options available to consumers across all cosmetics categories – from foundations, powders, and day creams to moisturizers.

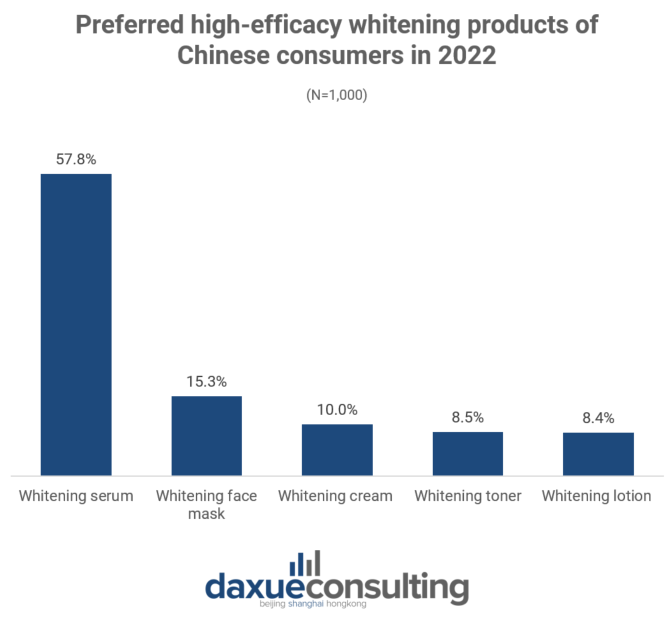

Skincare products, such as face masks, toners, and essences, take up the most part of the cosmetics market in China. The primary objective of whitening is to achieve gentle and effective results. Based on the comprehensive data from iResearch survey, in 2022, the majority of consumers’ demand for whitening effects remains strong compared to pre-pandemic times. Over 70% of consumers believe that their whitening needs have increased, with the top 3 best sellers being serums, masks, and moisturizers. This trend demonstrates a normalized and all-encompassing development direction.

Download our China beauty industry white paper

Skin whitening as a major function in skincare market

China’s facial skincare industry has continued to grow, reaching an overall scale of 258.7 billion RMB in 2021. Skin whitening has surpassed other effects like antiaging or water replenishing, ranking first in user attention.

In recent years, beyond the foundational benefits of cleansing and hydration, consumers care more about the advanced skincare effects, prioritizing these effects over factors like cost-effectiveness, brand, or price. It is estimated that the penetration rate of the skin care product in China’s market is 89%, with a 8.1% YOY growth rate. As the demand for the skin care products as well as the advanced effects rises, it brings about greater sales growth potential, heightened technical challenges, and increased efforts from leading enterprises in their deployment.

High-efficacy whitening serums as the best seller in the China’s skincare market

In China’s evolving skincare landscape, serums have emerged as sought-after solutions for effective skin whitening. With a growing emphasis on ingredient efficacy, serums have become a favored choice for achieving targeted skincare goals.

Companies are focusing on making strong skin whitening serums and adding other products like masks and moisturizers. In recent years, as consumers pay more and more attention to product ingredients, anti-aging beauty products that use natural extracts have become more popular. “Natural” and “safe” have become the two major keywords for the demand for beauty products.

For natural plant-derived skin whitening serums, mildness, safety, and effectiveness take center stage in consumer satisfaction, with a strong emphasis on ingredient gentleness and high safety.

In the competitive skincare market, this trend toward efficient and specialized skin whitening solutions mirrors consumers’ growing understanding of ingredients and their desire for noticeable outcomes. As brands continue to enhance their offerings and emphasize user contentment, the significance of serums as effective tools for skin whitening is poised to rise.

Gu Yu’s journey in the China’s skin whitening trend

Gu Yu is a pioneer that created a plant extract-based whitening brand tailored for Chinese skin. It all began in 2007 with Gu Yu Skincare Lab, exploring plant extracts. In 2016, the Gu Yu brand emerged as the first domestic skincare brand centered on Glycyrrhiza Glabra for whitening.

The Chinese brand includes product specialization and brand positioning in its strategy. It specializes in skincare products with Glycyrrhiza Glabra. In addition, it expanded its development experience to rare botanical extracts, forming its unique plant extract matrix, and positioning itself as a brand who cares about the safety and the health of the customers.

“Visible effects” have become the primary driving factor for users to choose Gu Yu, reflecting the successful cultivation of Gu Yu’s presence in user awareness. In 2021, it was awarded “Most Competitive Brand of 2021” at China Cosmetics Conference and has 99% positive feedback in Tmall. Backed by strong research, development, and collaborations, Gu Yu is recognized as a domestic whitening expert, focusing on safety and user satisfaction.

Stricter regulations in China’s skin whitening market to elevate entry barriers

China’s skin whitening market is experiencing a shift towards more stringent regulations, aimed at raising the barriers of entry in order to prioritize public health. This focus on corporate responsibility extends beyond just artificial products, encompassing natural ones as well.

An important distinction needs to be made: the term “natural” should not be equated with “safe”, but in Chinese consumers’ perception, it does. This is particularly evident in the proliferation of numerous oral whitening brands within the Chinese market. These products, including whitening pills, whitening strips, and anti-glycation oral liquids, have gained popularity among young consumers, establishing oral whitening products as a significant player in the whitening industry. Nevertheless, the potential adverse effects associated with these oral whitening products cannot be dismissed.

To foster a high-quality and healthy industry development, the new “Cosmetics Supervision and Administration Regulations” and “Cosmetic Efficacy Claim Evaluation Standards” were officially implemented from 2021 and 2022 respectively. The former not only emphasize the licensing and standardization of skin whitening products but also establishes a new registration and a review mechanism for new whitening ingredients. The latter has witnessed comprehensive tightening of regulations ranging from research and development to efficacy claims.

The 377 prohibition is one of multiple rules introduced in May 2021 to better regulate the cosmetics industry. Interestingly, while Western regulations simplify the complex regulatory landscape of cannabidiol (CBD), China’s proposed ban on it in cosmetics aligns with strict oversight in other Asian countries. Subsequently, the following month saw the unveiling of a draft law pertaining to cosmetics products designed for children.

China’s skin whitening demand continues to rise

- China’s fascination with fair skin has driven a significant market for skin whitening products, projected to reach 7.8 billion US dollars in sales by 2030. Skin whitening has become a major function in China’s skincare market, reflecting a steady and favorable industry outlook.

- Serums have emerged as the best-selling products in China’s whitening skincare market, offering potent solutions for effective skin whitening. With over 70% of consumers prioritizing high efficacy, serums, masks, and moisturizers have gained popularity, driving the development of potent ingredients and high-potency products.

- Gu Yu’s journey exemplifies successful brand creation and growth in the Chinese whitening skincare market. By focusing on effective plant extract skincare, particularly Glycyrrhiza glabra-based whitening, Gu Yu established itself as a domestic whitening expert, emphasizing safety and user satisfaction.

- Stricter regulations have been introduced in China’s cosmetics industry to ensure health and safety. This includes licensing, standardization of products, and a new mechanism for reviewing novel whitening ingredients. The prohibition of certain ingredients and enhanced oversight contribute to the overall high-quality and healthy development of the industry.

Author: Howard Lai