In South Korea’s aging population, people have started to pay more attention to the consumption habits of the elderly. Industries ranging from healthcare, leisure, retail, and technology are being influenced by the emergence of “active” seniors. Analyzing the elderly consumption habits not only provides valuable insights into the nation’s shifting market dynamics but also unveils the broader societal and cultural shifts.

Read our Korea’s consumer trends report

South Korea’s graying population: experiencing one of the fastest among OECD nations

South Korea has one of the fastest aging populations among the OECD (Organisation for Economic Co-operation and Development) nations. It has witnessed a remarkable increase in its elderly population, defined as those aged 65 and above. The current median age of its citizens is 44.5 years old. This is higher compared to the 25.8 year median age in 1990. As of 2023, South Korea’s elderly population stands at 9.5 million people. With improved innovation in healthcare and medicine, the age expectancy of these seniors is expected reach 62.2 years old in 2070.

Emergence of “active seniors”: a growing force reshaping South Korea’s retirement landscape

The term “active seniors” has emerged recently. It refers to healthy and affluent seniors who participate in the workforce and economy through their consumption habits. Active seniors have more disposable income to buy goods and services and to participate in leisure activities post-retirement, compared to seniors in previous generations.

In 2022, the employment rate for those aged 65 and older was 36.2%, a 6.1% increase over the past ten years. South Korea has the highest elderly employment rate amongst the OECD member countries as of 2021. Among those who choose to stay in the workforce, a main factor driving their desire includes their positive perception and experience of health among working individuals aged 65 and older. Working seniors stated that they thought that their health was better compared to their retired peers. In 2021, a study found that 93% of working seniors bear their living expenses themselves and with their spouses, and only 13.9% were satisfied with their consumption.

South Korea’s insufficient senior pension and financial assistance plans leading to high poverty rates amongst seniors

There are active seniors with higher disposable incomes than those previous generations. However, there is also a large group of elderly without them, relying on government pension plans or who fall under the poverty line lack comparable financial freedom. Instead of working for more disposable income, most of these elderly work to sustain basic needs and largely rely on government pensions and financial assistance services. South Korea has an elderly poverty rate at over 40%. It is not only higher than the OECD average elderly poverty rate of 13% but also the highest amongst the OECD nations. A main driver of this alarming statistic is South Korea’s relatively recent public pension scheme for the elderly, coupled with the stringent eligibility criteria to receive government support.

South Korea’s pension and retirement plans

A high poverty rate in South Korea’s aging population means less disposable spending on lifestyle goods and services and post-retirement traveling. The elderly rely on two pivotal public programs for financial support. The first one is the Basic Livelihood Security Programme, aimed to aid citizens in absolute poverty. The second one is the National Pension Scheme (NPS) initiated in 1988. The Basic Livelihood Security Programme falls short in providing comprehensive relief to the elderly due to its stringent acceptance criteria. The NPS, though expanded to include various categories of employees and the self-employed, still leaves a substantial portion of the elderly population without old-age pensions.

The NPS initially required companies with at least ten employees to participate. Over time, it gradually included smaller companies and the self-employed. However, its coverage remains incomplete. Only about half of those aged 65 and above and a mere 26% of those aged 85 and older, are beneficiaries of old-age pensions from the NPS, according to a Statistics Korea’s 2020 report.

From support to self: Post-retirement life and increased leisure and luxury spending

Unlike the elderly from previous generations, there is less emphasis on building post-retirement life around the support from children. Active seniors today are leaning more towards personal consumption choices. The Korea Health Industry Development Institute predicted the size of the senior friendly market. It expects that the market will more than double, from KRW 72 trillion in 2020 to KRW 168 trillion in 2030.

Many South Korean companies are taking the opportunity to target active seniors. They are promoting anti-aging skincare products and services, health supplements, and trendy clothing. Their marketing strategies, however, preserves the idea of “prolonging youth.” Companies appeal to the elderly’s desire to look younger without making it seem like their products are exclusively for old people. Moreover, the elderly are also spending more on leisure and travel. Their spending increased by 94.6% and 83.5% in travel and duty-free spending, respectively, between January and August in 2023 compared to that of the previous year.

Intergenerational involvement: The growing role of active seniors in child-rearing consumption

Active seniors are also allocating more money in child-rearing services and products. South Korea’s fertility rate is low and its stronger family-first culture among the elderly. This drives people over 60 to spend more on their grandchildren. Their spending increased by 54.7% in kids cafes, 50.6% in pediatric hospitals, and 27.3% increase in private education, between January 2023 to August 2023 compared to that of the same period in the previous year 2022. This shows that grandparents are increasingly becoming more involved in their grandchildren, both in terms of time and spending. Notably, the total share of spending in child-rearing related costs from active seniors was significantly higher than that of any other age group.

Cash vs. Card? Popular payment methods amongst the elderly

Cash remains a preferred payment method among South Korea’s elderly. This preference arises from the financial struggles and technological challenges faced by many elderly individuals, making internet banking less accessible and difficult to navigate for them.

This inclination extends to elderly small business owners in Korea as well. SMEs take up 99% of the total number of enterprises, while individuals aged 50 to 65 years old make up around 20% of the total business owners. Many own small businesses like restaurants in South Korea’s foodservice market and Korean traditional markets that the elderly frequently go to. Typically, these businesses prefer cash transactions, as card payments often involve a nominal fee. Alternatively, some businesses incentivize cash payments by extending discounts to customers who pay cash.

However, there is a shift towards digital payment solutions. Cash-free buses that only take T-money and bank transfer payments, along with self-serve digital kiosk machines, are some of the everyday scenarios where the transition is taking place.

This reflects the wider societal trend favoring convenience and efficiency in a rapidly modernizing economy. In line with this shift, encouraging the use of cards and mobile payments amongst the South Korean elderly can open new e-commerce possibilities, specifically targeting the active seniors.

Preferred shopping channels of the South Korean elderly

For many South Korean elderly, shopping is not merely a transaction but rather a social activity that many online platforms struggle to build. South Korean culture emphasizing face-to-face interactions and interpersonal relationships is particularly stronger among the elderly. The elderly tends to favor the tangible shopping experience provided by brick-and-mortar stores. Trust and familiarity are also important to South Korean traditional culture, with many seniors finding comfort in the reliability of physical stores and the ability to inspect products firsthand.

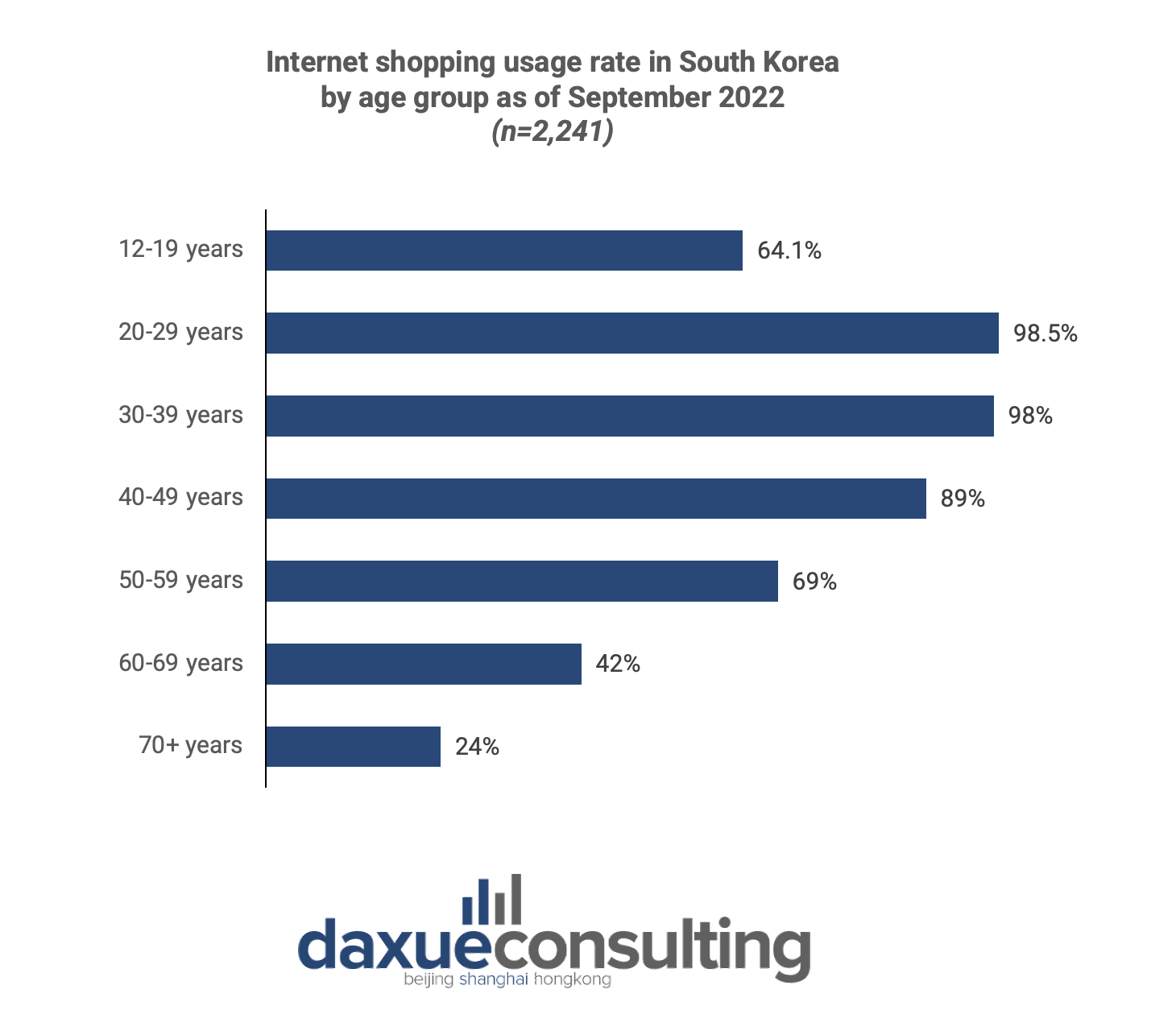

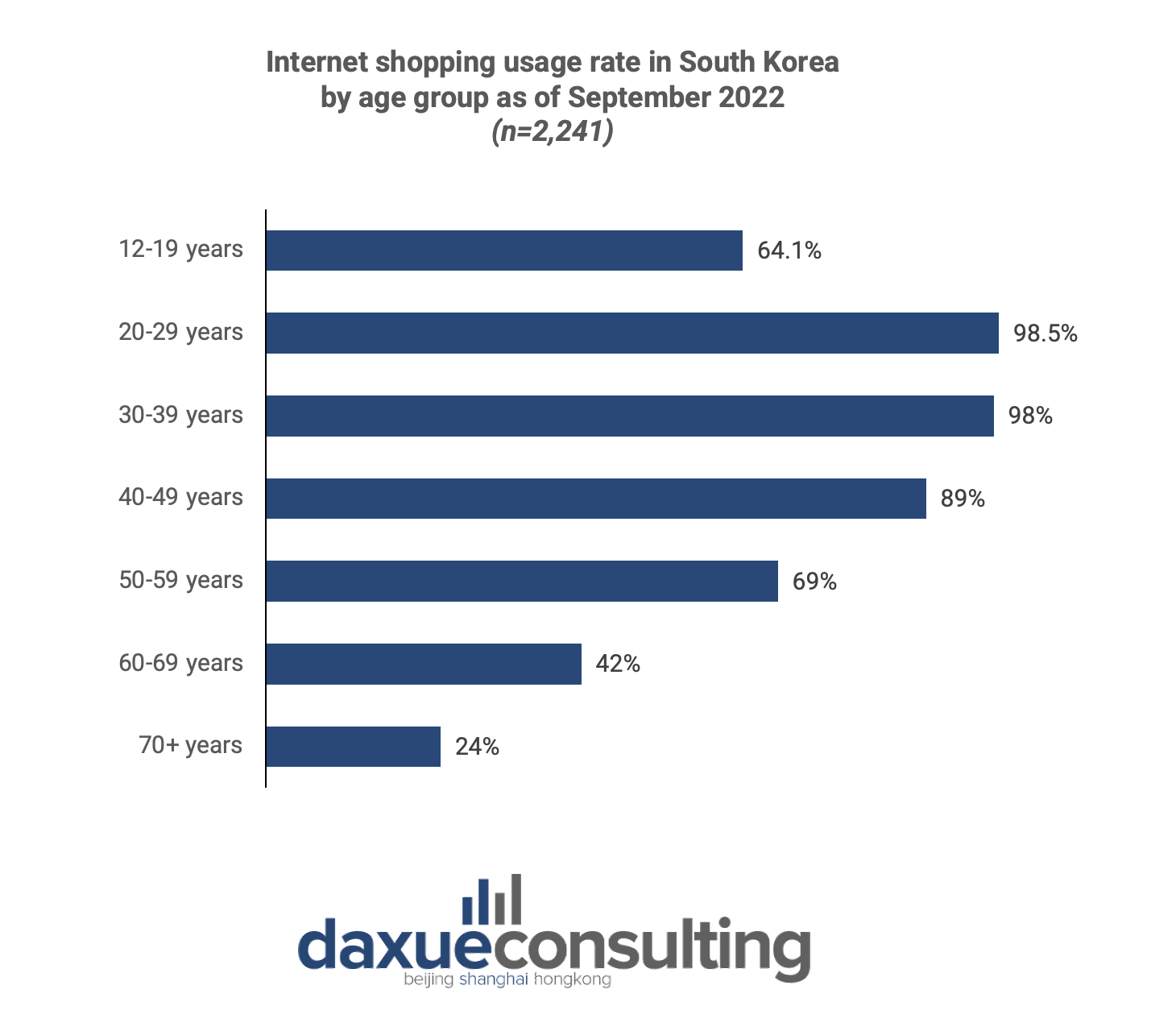

As of September 2022, 69% of those aged 50 to 59 years old have reported to have shopped online, whereas only 24% of those aged 70 and older have done so. Technological barriers, including difficulties navigating online platforms, contribute to the resistance against internet shopping. However, equally or even more important is the limited engagement. The elderly seek more personalized assistance, the sensory experience of physical stores, and the social nature of shopping, elements that are typically found in traditional retail.

Spending power of active seniors in South Korea’s aging population

- “Active seniors” in South Korea are becoming significant spenders, particularly in leisure and child-rearing services, reflecting increased disposable income and willingness to spend on themselves and their grandchildren.

- South Korean elderly prefer traditional retail over online shopping due to cultural emphasis on face-to-face interactions, trust, and familiarity.

- Traditional businesses, especially in markets frequented by the elderly, are witnessing a shift towards digital payments, reflecting societal trends favoring convenience.

- South Korea has the highest employment rate among the elderly in OECD countries. The aging population pressures many seniors to continue working. However, there is also a notable group who voluntarily work and have position perception about working.

- Challenges in South Korea’s public pension system contribute to a high elderly poverty rate, emphasizing the need for reform and addressing financial insecurities.

- Active seniors contribute to increased spending on anti-aging products, health supplements, trendy clothing, and leisure activities, reshaping post-retirement life.