It is no secret that food plays a massive role in shaping the lives of many Koreans. Watching “Mukbang” (eating shows), attending “Hweshik” (company dining and drinking events), and having “Honbap” (eating alone), are common.

While traditional Korean cuisine still occupies a significant portion of the culinary landscape, western influenced food is emerging in South Korea’s foodservice market. Understanding the market is crucial for comprehending the shifting dietary preferences of Koreans as well as the role of global cultural influences on their food preferences and behaviors.

Locals and foreigners driving the foodservice market in South Korea

Demand for prepared food and beverages for immediate consumption, including both dine-in and take-out options, is expected to experience significant growth. The market is expected to reach USD 85.42 billion in 2023 and USD 107.11 billion by 2028, with a CAGR of 4.63%. With the increasing influence of Western culture, South Koreans consumers are preferring more fusion and exotic cuisines. The rise of tourists has also further fueled the market, as they are keen to experience unique Korean dishes.

The rise of convenience: How fast food satisfies the needs of busy Koreans

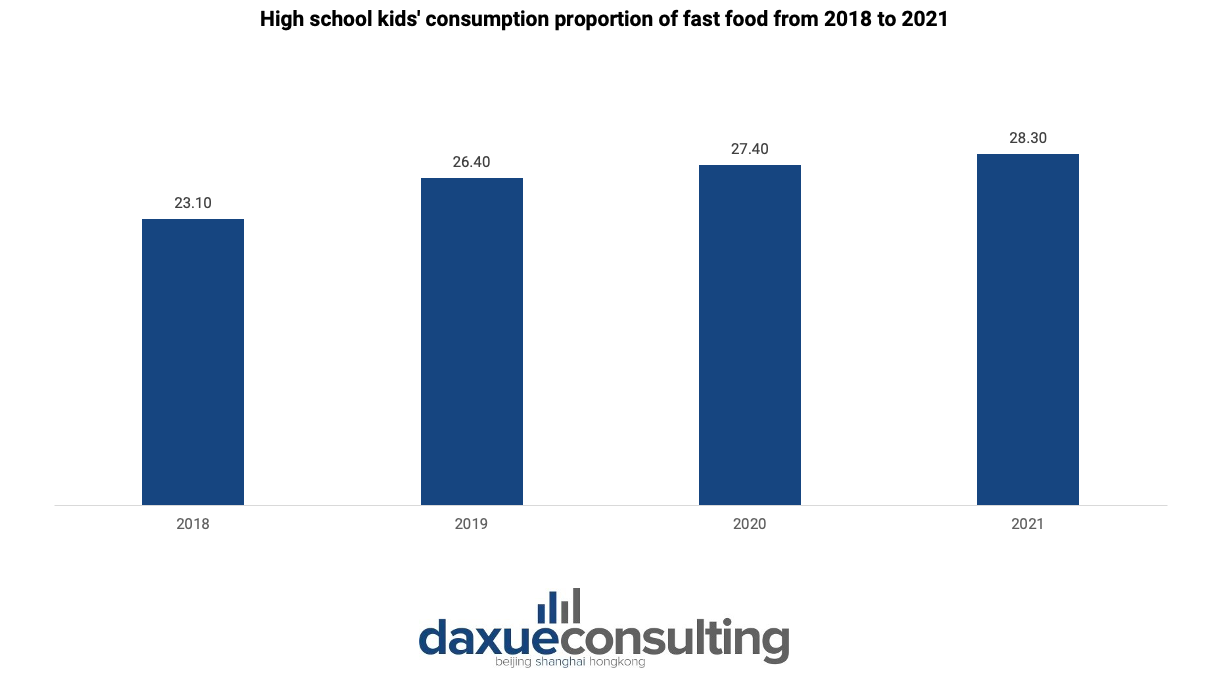

Among the fastest-growing segments in the foodservice market in South Korea is the fast food restaurant. South Korea’s fast food market is estimated to have a CAGR of 4.6% between 2023 and 2028. This growth is driven by various factors such as busy lifestyles and high demand for convenience. The appeal of online orders, home delivery, and discounts has also made fast food a top choice for individuals, including students and those seeking quick and satisfying meals. Additionally, limited meal prep time, high disposable incomes, and COVID-19 have further fueled this trend.

Additionally, the “Honjok (혼족)” lifestyle, where individuals choose to stay single and live independently, has gained popularity. In 2020, 31.7% of people in their 20s and 30s preferred single-person households, leading to the trend of “Honbap (혼밥)”, where people choose to eat alone. Unlike preceding generations, who leaned towards a more communal food mindset, the MZ Generation is challenging societal norms by adopting a more individualistic approach. This shift is fueling the demand for convenient foods and the expansion of South Korea’s fast food market.

Local vs global: The popularity of fast food chains in South Korea

The country’s rapid economic development and Westernization have brought about the rise of Western-style chains in South Korea’s foodservice market. International fast food chains like McDonald’s and KFC have adapted their menus with local flavors such as bulgogi burgers and kimchi pizzas. Local fast-food chains also hold great popularity and market share. Chains such as Lotteria, Isaac Toast, and Mom’s Touch have successfully tailored their menus and offerings to cater to the local palate and cultural preferences. In addition to localizing the food, companies also develop innovative services, including online food ordering and customizable meal options, to become even more attractive.

Each type of restaurant adopts different strategies to succeed in the fiercely competitive the foodservice market in South Korea. Independent restaurants dominate in terms of volume, primarily due to their focus on local cuisine. Local restaurants are striving to expand their reach by establishing chain restaurants. Meanwhile, global players hold a substantial market share in terms of value and are aiming to strengthen their position by expanding their restaurant chains.

The changing fast-food landscape in South Korea: COVID-19’s impact and health-conscious and delivery trends

COVID-19 brought about significant changes in consumer trends in South Korea, impacting various industries, including the fast food market. For instance, there was a noticeable change towards adopting healthier habits and relying more on food delivery services. This competition drives continuous menu innovation, promotional campaigns, and the introduction of limited-time offers to attract customers.

Embracing health: Fresh ingredients and low-calorie alternatives in fast food

The pandemic thrusts health into the spotlight’s. An increasing number of Koreans are now becoming more health conscious, selecting more nutritious food. For example, in the F&B industry, GS25, a popular convenience store chain, noticed a rise in salad-related purchases alongside alcoholic beverages. In response, the company introduced the “Chicken Salad Wrapped in Wraps,” a healthy and low-calorie option that serves as an anju (안주), a type of Korean food often enjoyed alongside alcoholic beverages.

Fast-food chains responded to the shifting trend by introducing innovative menu items that incorporated fresh ingredients, offered low-calorie alternatives, and emphasized customization to cater to individual dietary preferences. Shinsegae Food’s “Better Burger” at its No Brand Burger chain, featured plant-based ingredients developed in-house, such as a ground Better Meat patty and plant-based cheese. Another renowned local fast food chain, Mom’s Touch, avoids using trans-fats and monosodium glutamate (MSG) in its food and prioritizes freshness by exclusively using fresh chicken instead of frozen. Mom’s Touch also offers personalized burgers with various ingredients and spice levels. Thus, customers have the freedom to create their own unique burger combinations.

Meal Kit market soars in South Korea: A convenient home cooking trend

Meal Kit (밀키트) is a popular and convenient way to have healthy meals at home in South Korea. It has shown steady growth since 2015, especially among small households and dual-income families. According to the Korea Agro-Fisheries & Food Trade Corporation, the Meal Kit market’s value increased from USD1.8 million (KRW2 billion) in 2017 to USD150.4 million (KRW188 billion) in 2020, and it is expected to keep growing at an average annual rate of 31% until 2025.

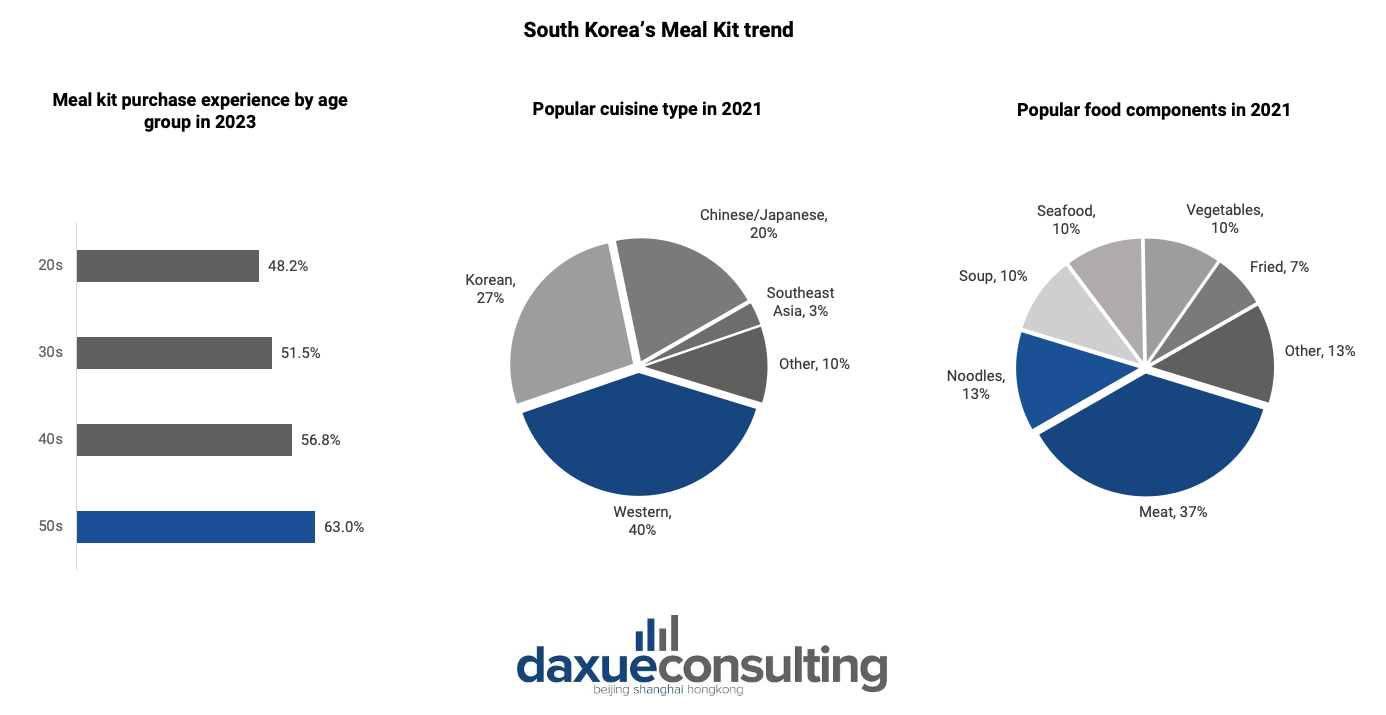

The popularity of Meal Kit products varies among age groups, with 63.0% of respondents in their 50s purchasing them, while the percentage is lower for those in their 20s and 30s. The difference can be attributed to the older age group’s higher inclination to cook at home, leading them to opt for Meal Kits to ease meal preparation.

The top-selling categories are “Western” dishes, with “Steak” dishes maintaining consistent demand in 2021. Meal Kit purchases are highest at the beginning of the week as consumers tend to plan their weekly meals during this time and buy around 2-3 Meal Kits per week. Regarding sales channels, while “Online Malls” remain the dominant channel for Meal Kit purchases, the percentage of consumers directly purchasing Meal Kits from “Offline Retailers” increased from 2.6% in April 2021 to 36% in November 2021.

From click to craving: The impact of the delivery culture on South Korea’s fast food market

The convenience-focused lifestyle of busy South Koreans has led to an increasing desire for online meal delivery services. In 2020, online foodservice transactions reached approximately $7.5 billion, experiencing a significant 78% growth, primarily driven by young adults in their 20s and 30s and single-income households.

Fast food chains in South Korea have also adjusted their operations to meet the increasing demand for convenient food delivery. They have implemented streamlined delivery systems and collaborated with delivery platforms, ensuring that customers can enjoy their preferred fast food conveniently at home. While Baedal Minjok, Coupang Eats, and Yogiyo dominate the delivery market, some restaurants and franchise brands, such as McDonald’s, Burger King, and Domino’s Pizza, have also established their own delivery systems. McDonald’s, for example, has its own dedicated delivery fleet and website where customers can place orders for their iconic burgers and fries.

The perfect breakfast sandwich: Where high-quality ingredients meet quick service at Isaac Toast

Isaac Toast is a popular breakfast sandwich chain in South Korea’s foodservice market, known for its toasted egg sandwiches. It offers a simple menu featuring grilled sandwiches made with eggs, cheese, and a variety of toppings. It has garnered a strong reputation for using high-quality ingredients, offering unique flavors, and delivering fast service. The chain has gained international attention after being featured on The Korean Englishman’s YouTube channel.

The success of Isaac Toast in South Korea is rooted in its emphasis on customization, enabling customers to craft personalized sandwiches by choosing from a wide array of ingredients. The brand highly values the use of fresh, locally sourced ingredients, ensuring the sandwiches’ top-notch quality. Customers value the sandwiches’ made-to-order approach, delivering warm, crispy, and perfectly grilled options. Furthermore, Isaac Toast’s affordable offerings make it an attractive option for breakfast or quick meals on the go.

In terms of marketing and branding, Isaac Toast has crafted a distinctive and recognizable image. Its vibrant yellow signage and logo make the chain easily identifiable, setting it apart from other food establishments. Additionally, Isaac Toast strategically positions its stores in busy areas, targeting a diverse customer base that includes office workers, students, and tourists.

South Korea’s foodservice market: A growing industry in an increasingly busy and convenience-oriented culture

- South Korea’s fast food market is experiencing significant growth, driven by the demand for quick, convenient meal options in a culture of long working hours and busy schedules, and the high disposable income of South Koreans.

- The “Honjok” lifestyle, where individuals choose to stay single and live independently, has contributed to the demand for convenience foods and the growth of the fast-food market.

- The COVID-19 pandemic has influenced South Koreans to become more health-conscious and rely on food delivery services, leading to fast-food chains offering healthier options and partnering with delivery platforms.

- Isaac Toast, a breakfast sandwich chain, has gained popularity in South Korea and internationally by focusing on customization, high-quality ingredients, quick service, and strategic branding and positioning.

Enter your email to download our full Korea Consumer Trends report