Covid-19 has reshuffled the cards in many industries and the Korean F&B market is no exception. With more and more of the population living alone and staying at home, industries such as snack, food delivery and HMR (Home Meal Replacement) are growing. Similar to Korea’s beauty market, the food and beverage market is the starting point for many global trends.

What’s in the report?

From Mukbangs to Dalgona coffee, Korea’s F&B trends ripple worldwide. Here’s what we found in the report:

Download to learn:

- What F&B products South Koreans consume the most

- How brands stand out in the mature markets, such as coffee and alcohol

- The eating out and dining in habits of Korean consumers after the COVID-19 pandemic

- The snack preferences of South Korean consumers of different age groups

Key Stats on the South Korea F&B market:

- Per capita coffee consumption in South Korea is 12.3 cups per week

- 57% of Koreans are trying to lose weight through diet management

- South Koreans consume, on average, 10 liters of alcohol per person per year, which is the second highest in Asia after Laos.

- 42.7% of Korean families dined out as a family at least once a week in 2020.

Covid-19 has reshuffled the cards in many industries and the Korea F&B market is no exception. With more and more of the population living alone and staying at home, industries such as snack, food delivery and HMR (Home Meal Replacement) are growing. As South Korea is a trend-setting nation, this report on Korea F&B market trends is relevant world-wide.

South Korea per capita coffee consumption is among the highest in the world

In 2019, 12.3 cups of coffee per week were consumed by the average Korean. The market revenue reached $10 billion USD (59% instant coffee, 41% roast coffee) in 2020. Thus, the market competition is fierce, and in order to stand out, brands emphasize user experience and convey an elaborate brand image.

For example, market leader Starbucks successfully established itself in Korea by designing comfortable and convenient spaces that aim to be the third social spot separate from home and workplace. Their expensive brand image has made them a coveted product and led them to the successful sales of their limited-edition goods.

Source: Starbucks Korea Official page, Starbucks Yangpyeong in South Korea

South Korea’s food delivery market struggles to meet demand

Though the country is known to have a very developed food delivery system, since COVID’s boost of the stay-at-home economy, it has recently struggled to meet the increasing demand.

Adding the shortage of delivery workers and the increase of the labor cost, this led to more competition, tight profit margins and increased delivery fees (+30% in 2022).

Korea’s Home Meal Replacement (HMR) market is rising as more people eat alone

More and more people eat alone, known as “Honbap” (혼밥) in Korean. The other drivers of meal replacement include the increasing number of convenient stores, improved quality of products, higher penetration of air fryers, long working hours, rise in the labor participation rate for women and social distancing.

Korea F&B culture has ridden the Hallyu to reach a global audience

South Korea has been sending food trends all around the world, via the Hallyu (한류), which can be translated as the “Korean Wave” and refers to the global craze for Korean pop culture.

One example are Mukbang (먹방) which are livestreaming eating show that started in Korea in 2010 and that influenced many Chinese, US and European Youtubers. Some other example includes the Dalgona coffee recipe that went viral during quarantine, the popular Korean spicy instant noodle Buldak Bokkeum Myun challenge and Chapaguri noodle which sales skyrocketed after being featured in the Korean movie “Parasite”.

Seafood is central to Korea F&B culture

Surrounded by ocean on three sides, it is no wonder that Korean seafood consumption is among the highest in the world (on average 55 to 70 kg per capita per year). Some of the most popular seafoods are Alaska Pollack, squid, mackerel, shrimp, crab, monkfish, anchovy, flat fish, oyster, and octopus.

Drinking is an important aspect of South Korean culture

10 liters of pure alcohol is consumed per person and per year in South Korea, which places it in second place among Asian countries (after Laos).

The most popular alcohols are by far soju and beer, followed by traditional drinks such as makgeolli. Recently, sales of western alcohol such as wine and whisky also increased especially with the homesul (홈술) or “drinking at home” trend.

Alcohol plays a significant part in Koreans social and business life: many workers participate in hoesik or after-work drinks, and following Korean drinking etiquette, drinking with colleagues is mandatory.

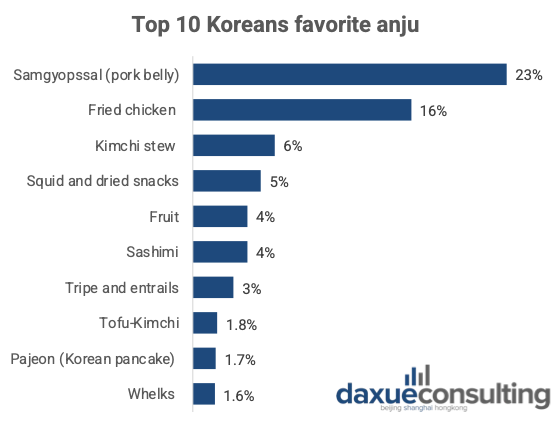

Anju (안주) are snacks that often accompany alcohol. Common anju snacks are grilled meat, fried chicken, french fries, nuts, dried snacks, fruit, and they are chosen according to the type of drink.

Source: Gallup Korea (2019), N=1,700, the top 10 anju chosen by Korean conusmers

Plant based diet is a rising Korean F&B trend

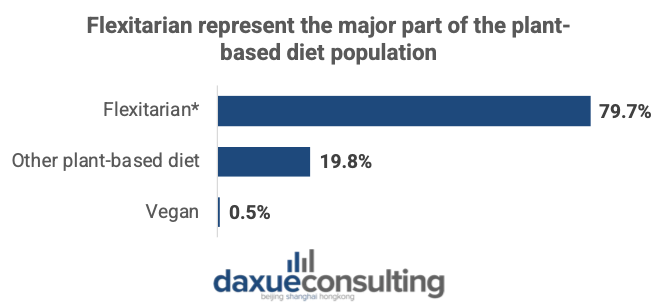

With the influence of healthy lifestyle figures and social media, plant-based diets are gaining popularity in Korea. There are only around 500,000 vegans and 1.5 million vegetarians and other plant-based eaters, but adding the flexitarian population (plant-forward eaters who make some exceptions), the number rises to 10 million.

Source: Source: Ministry of Agriculture, Food and Rural Affairs; Korea Agro-Fisheries & Food Trade Corporation (2021), N=417

Change in diet key motivational factors are health, animals and environmental concerns and weight loss. This trend has resulted in the surge of fake meat sale, which are getting more and more popular these days.

Korean snack market bouncing back thanks to the pandemic

Due to COVID-19, the snack market has been growing well over the past two years. Since more people choose to stay at home/drink at home and that the main entertainment activity has become online screen content (dramas, Youtube, Netflix), snack consumption increased alongside.

Snacks first distribution place is convenient stores, which are preferred to supermarket since they are more easily accessible and have loyalty programs.

For Korean snacks, it is important to have interesting texture and flavors. Recently, key trends have been sweet potato, chewy/crispy texture, traditional snacks, healthy snacks and homesul snacks (snacks to pair with alcohol).

Key takeways about South Korea’s F&B market

- Covid-19 increased the time spent alone and at home. Thus, it has been a booster for convenient and ready-to-eat food (snacks, delivery food, meal replacement) mainly purchased in convenient stores.

- The meal replacement industry has been adjusting well to the demand and come up with a wide variety of options (vegetarian, sea-food based ready-to-eat meal, snacks, instant noodles).

- Korea’s coffee market very mature market but is still growing. Brands that put effort into customer experience and brand image are the most successful.

- Korean food is becoming more and more trendy all around the world, particularly thanks to social media and the Hallyu.