South Korea has become a pivotal player on the global stage in the automotive sector, boasting a remarkable journey of growth spanning the past three decades. Rooted in a history that dates back to 1958, when the first locally assembled car rolled off the production line, the automotive industry in South Korea has evolved into a dynamic force of innovation and competition. Hyundai and KIA emerged as prominent manufacturers. Delving into the intricacies of this market is not only crucial for understanding its historical significance but also for harnessing the manifold opportunities that lie within.

Rising to the top: South Korea as the fifth largest automobile manufacturing country

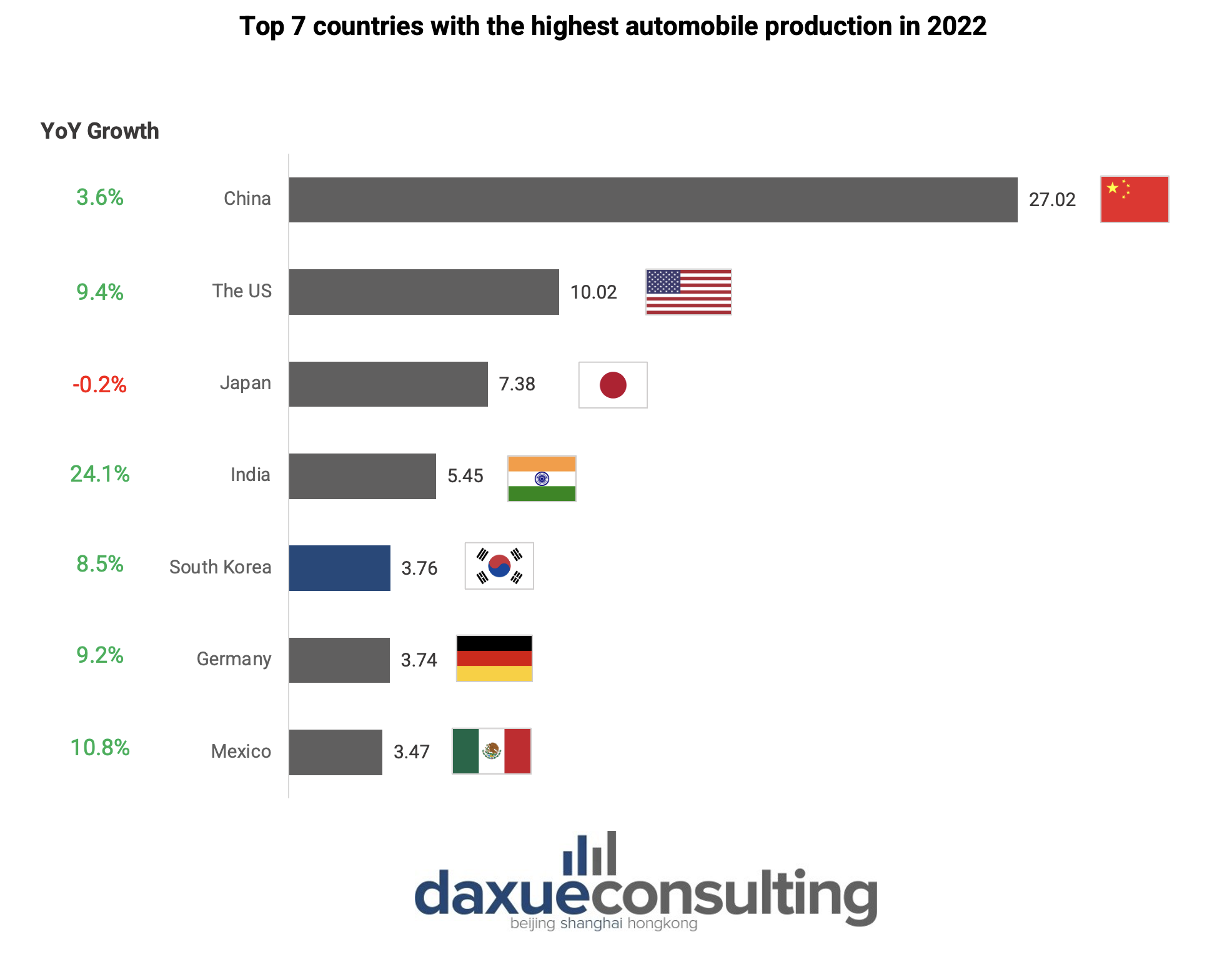

Based on the 2022 “Korea Automobile Industry Annual Report” published by the Korea Automobile Manufacturers Association (KAMA), domestic vehicle production increased by 8.5% to 3.76 million units. Since 2020, the country has secured its position as the fifth largest automobile manufacturing country in the world, trailing just behind China, the United States, Japan, and India. In April 2023, South Korea’s automobile industry witnessed an impressive upswing, with vehicle production surging by 24.7% and reaching a significant milestone of 382,000 units compared to the same period in the previous year.

Download our full Korea Consumer Trends report

South Korea’s automobile industry’s export is on the rise

The automotive industry, along with South Korea’s semiconductor industry, is a crucial driver of the nation’s export growth and overall economic development. After integrated circuits, cars are the second largest export sector. According to the Observatory of Economic Complexity, cars accounted for approximately USD 44.73 billion, or 6.85%, of the total export value in 2021. The primary export destinations are the United States, followed by Canada, Russia, Australia, and the United Kingdom.

In April 2023, South Korea’s automotive export value soared to an impressive USD 6.16 billion, marking a remarkable 40.3% increase compared to the same month in the previous year. Consequently, the cumulative export value for the first quarter of 2023 reached a record-breaking total of USD 23.2 billion. Two top players in the automotive industry in South Korea, Hyundai Motor Co. and Kia Corp, significantly contributed to the remarkable export performance. Hyundai’s exports surged by 18.0%, with 103,169 units shipped, while Kia experienced a remarkable growth of 33.2%, shipping 95,398 units. GM Korea and KG Mobility also demonstrated robust export growth rates of 115.9% and 30.7%, respectively.

In terms of imports, South Korea brought in cars worth USD 12 billion in 2021, or around 2.1% of the total import value, positioning itself as the 14th largest global car importer. These imports were mainly sourced from Germany, the United States, Japan, the United Kingdom, and Mexico.

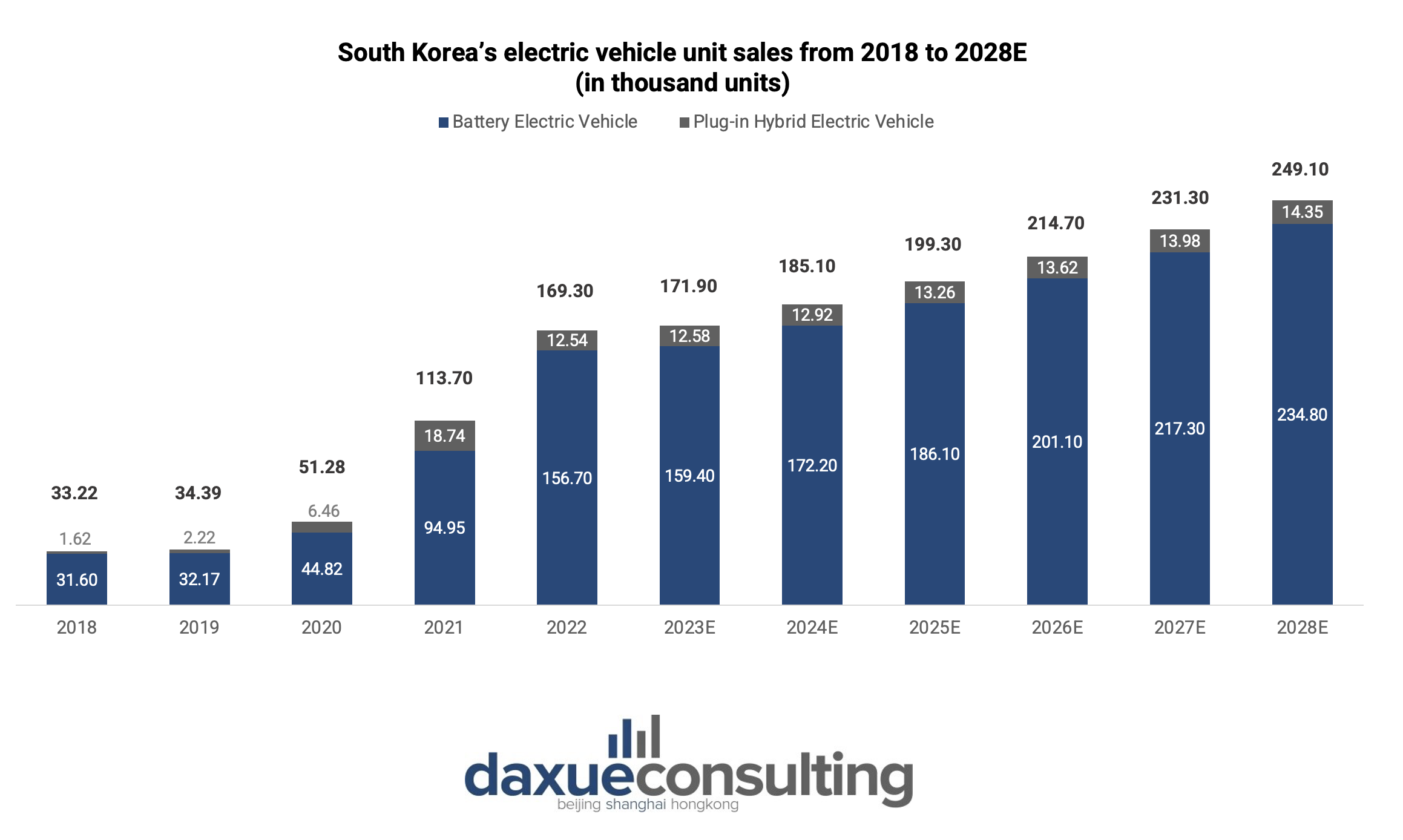

South Korea’s commitment to carbon neutrality: Driving the growth of EV adoption

South Korea is one of the countries with significant greenhouse gas (GHG) emissions, ranking 12th globally in 2018. During that year, the country’s total GHG emissions amounted to 758.14 million tons, making up approximately 1.58% of the world’s total emissions. However, the automotive industry in South Korea is increasingly becoming more committed to achieving carbon neutrality.

In October 2019, South Korea introduced the “Future Vehicle Industry Development Strategy 2030 Roadmap,” emphasizing electric vehicles (EVs) promotion and technologies. The roadmap is divided into three stages: boosting domestic sales of electric and hydrogen vehicles, completing infrastructure for self-driving cars by 2024, and investing in key technologies with KRW 60 trillion (around USD 47 million) over the next decade. Additionally, in October 2021, the South Korean Ministry of Environment solidified its commitment to combating climate change by approving the “2050 Carbon Neutrality Plan” and the “2030 National Greenhouse Gas Emission Reduction Target“. Both of these policies also impacted the country’s EV industry and would naturally promote the growth of EVs in South Korea.

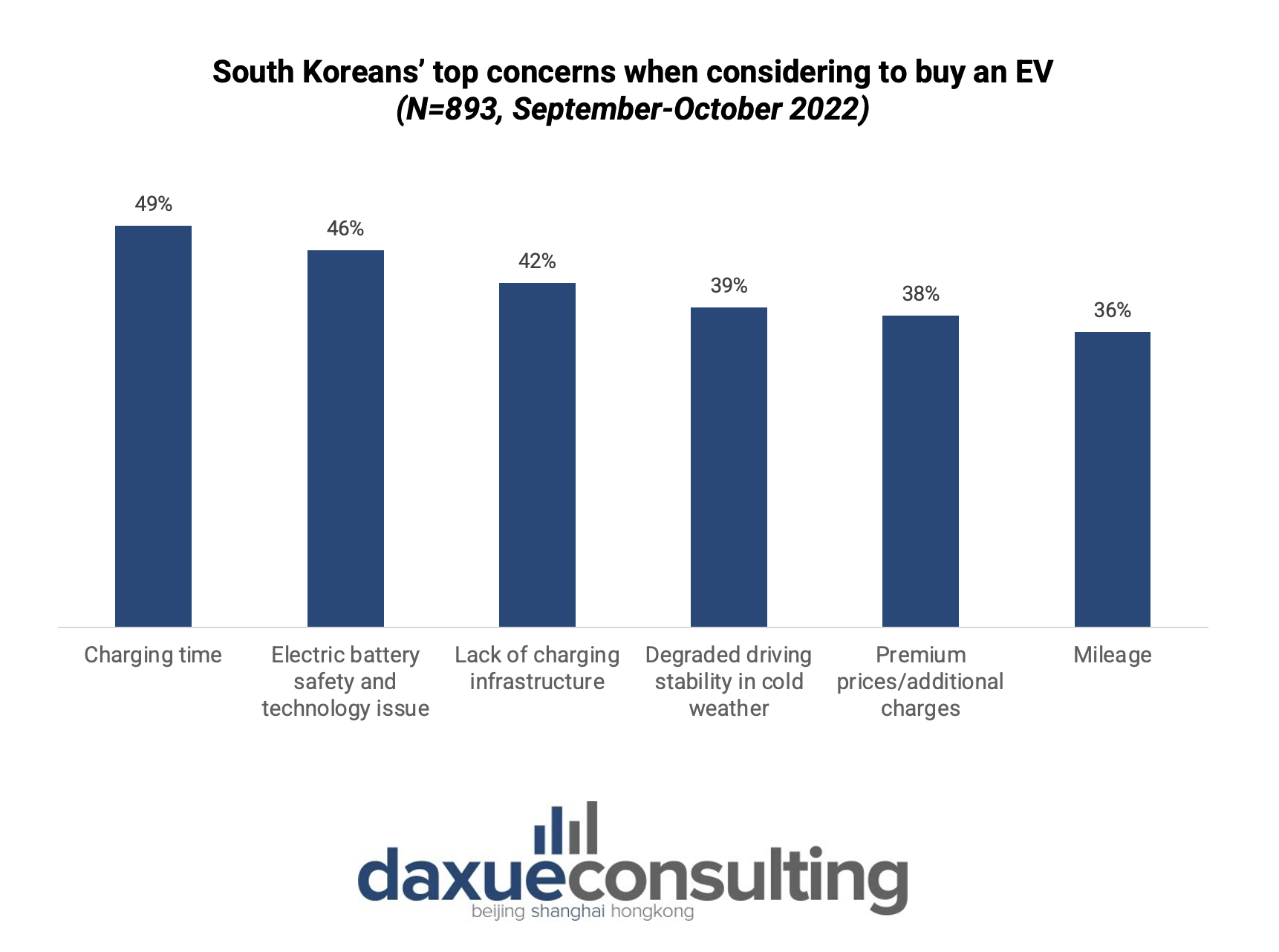

Despite the government’s support and manufacturers’ efforts to promote EVs, South Koreans are still concerned about adopting these vehicles. According to Deloitte’s 2023 Global Automotive Consumer Survey, 49% of South Korean respondents are concerned about EVs’ charging time. Electric battery safety and technological issues are also major concerns, cited by 46% of respondents. Additionally, 42% of South Koreans are worried about the lack of charging infrastructure, which could hinder the widespread adoption of EVs.

A snapshot into South Korea’s automobile industry: Understanding demographics and preferences

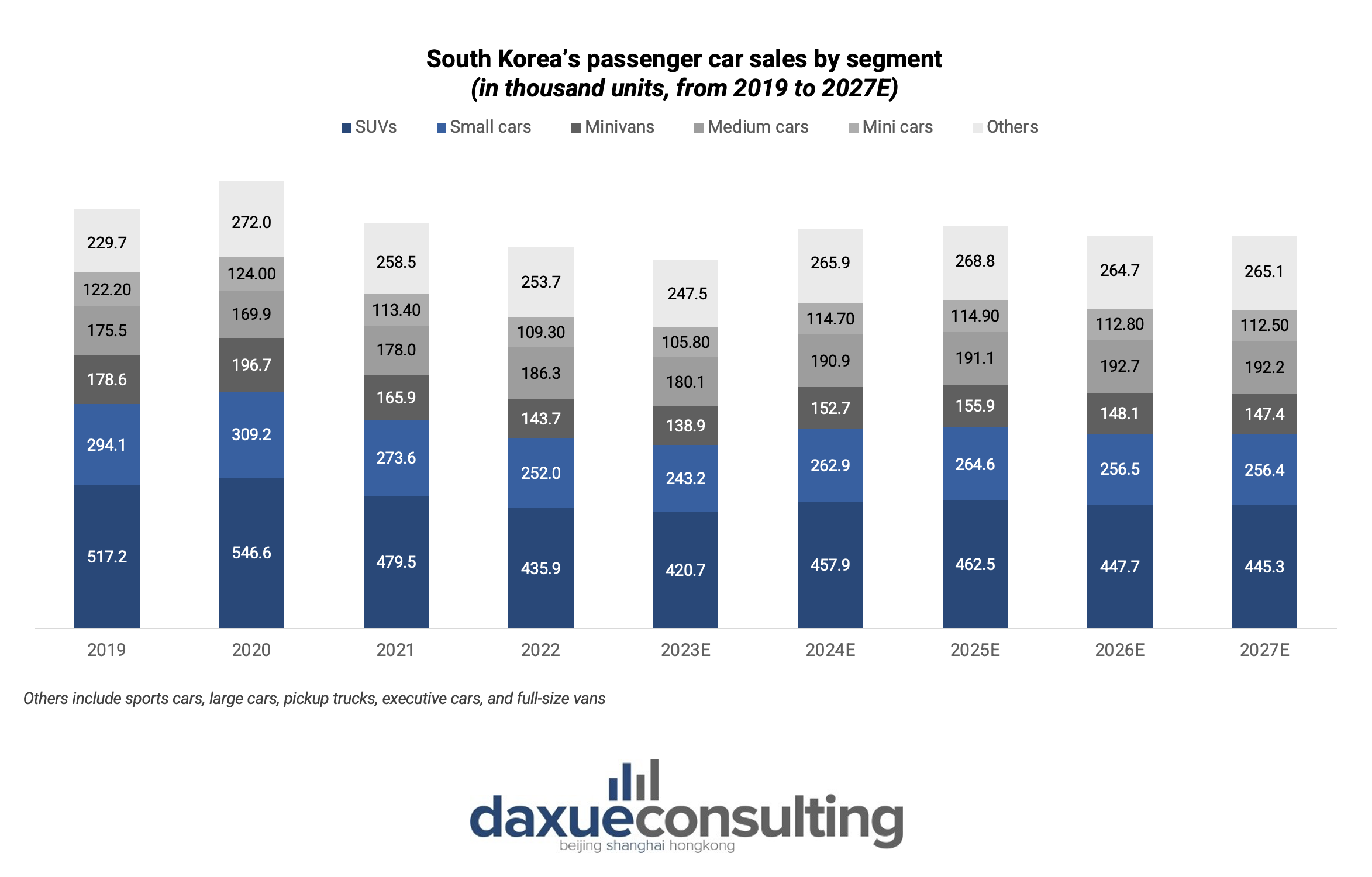

SUVs have consistently been the top choice among South Korean car buyers, maintaining their status as the fan favorite since 2014. While the numbers may fluctuate from time to time, SUVs consistently hold the largest market share in terms of car sales, making them a popular and enduring choice among South Koreans.

Following the COVID-19 pandemic, the popularity of SUVs grew with more people pursuing outdoor leisure lifestyles, according to Professor Park Cheol-Wan from Seojeong University. Individuals showed growing interest in outdoor activities like camping and fishing, using their cars for not only commuting to places but for “chabak (차박),” or car camping.

Source: 차박에빠진여자, YouTube user @campinggood with 20.1K subscribers goes “camping alone in the car in the pouring rain”

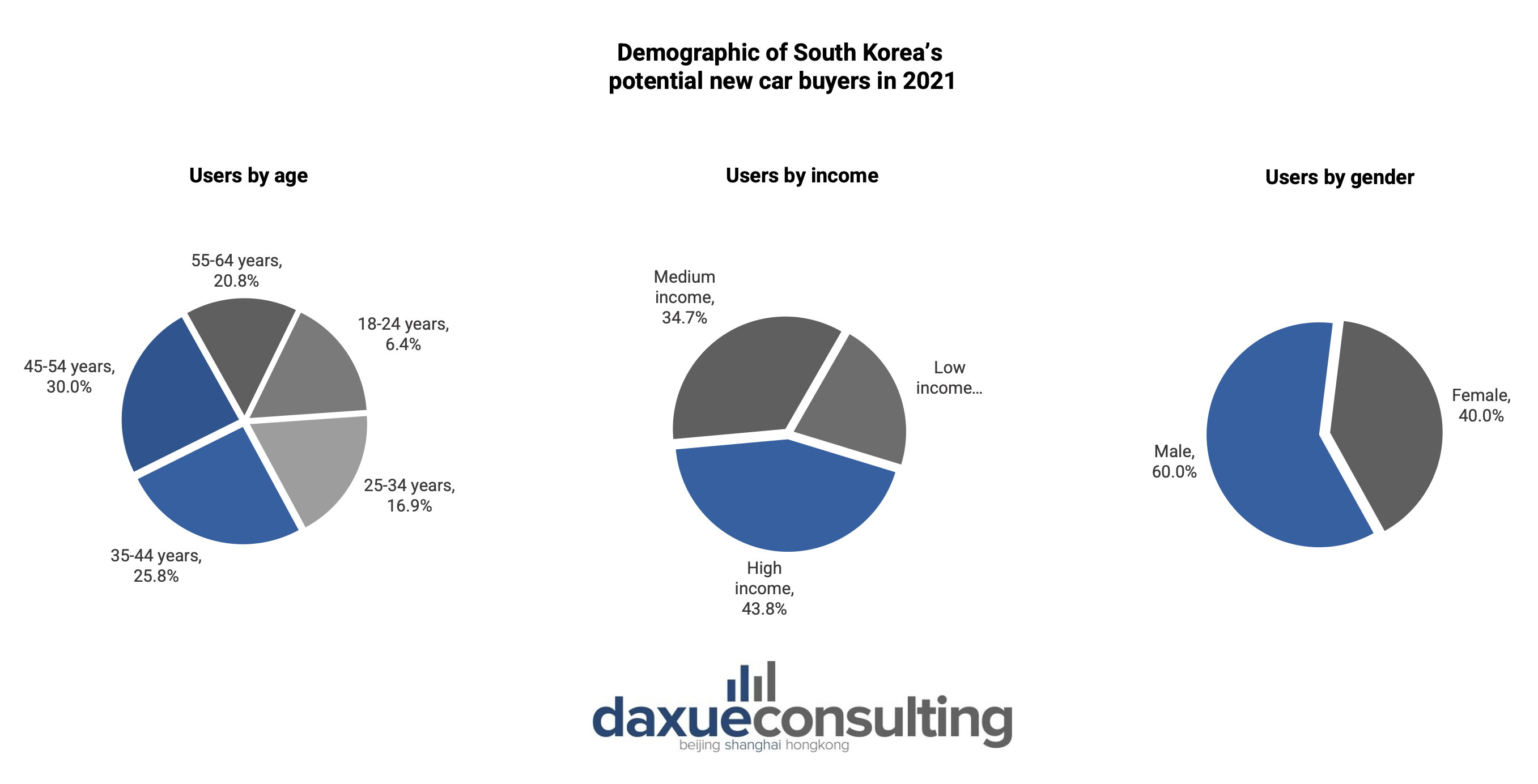

In 2021, when analyzing the demographics of potential new car buyers in South Korea, it was observed that individuals aged between 35–44 and 45–54 accounted for a significant share, collectively representing 55.8% of the market. Additionally, higher-income individuals showed a stronger preference for purchasing new cars, and males were more likely to buy new cars compared to females.

Domestic brands are dominating South Korea’s automobile industry

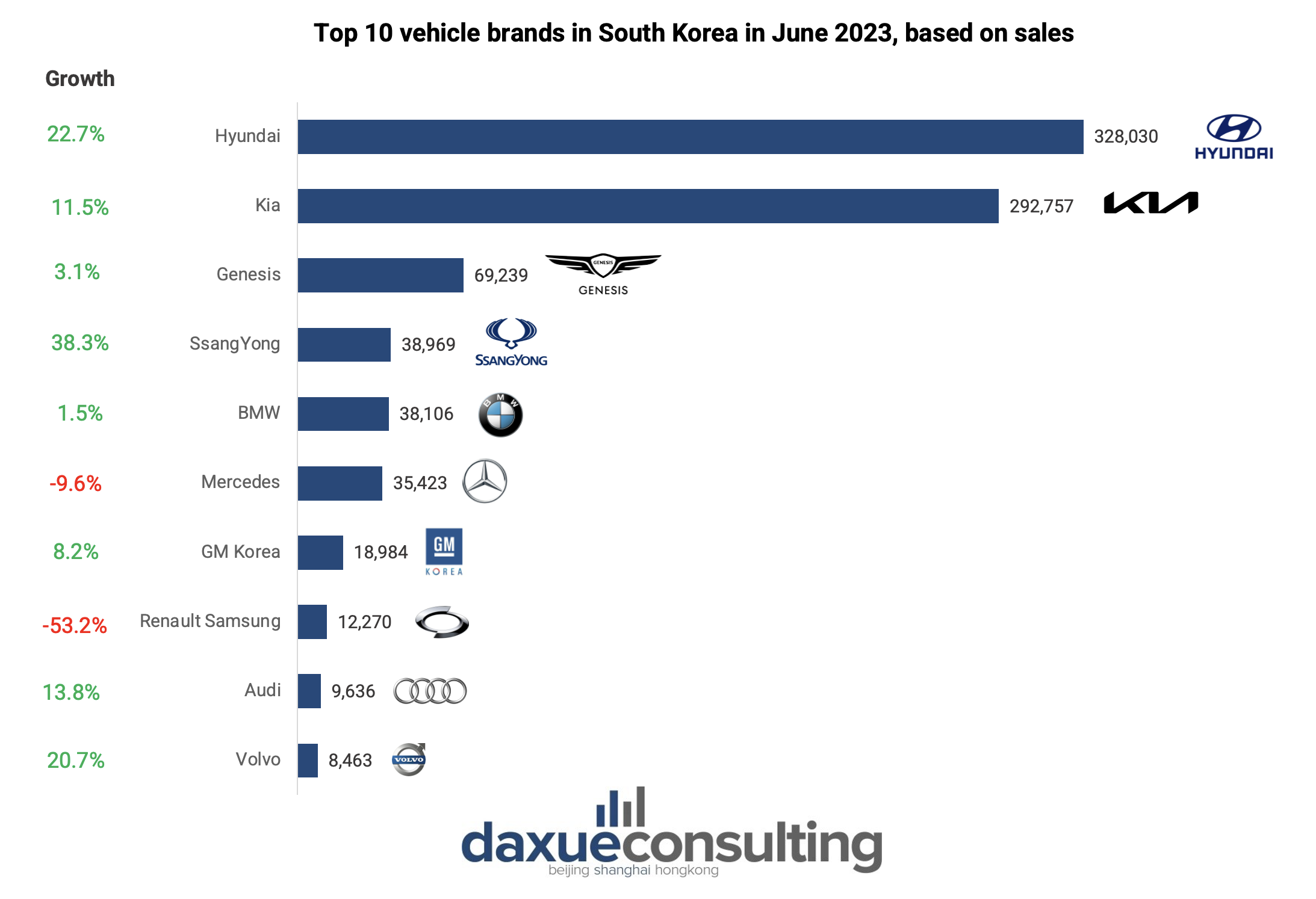

South Korea’s automobile industry is dominated by local brands, with Hyundai and Kia leading the charge. These two homegrown automakers have taken the market by storm, selling more than 328 thousand and 292 thousand vehicles, respectively in June 2023. In third place is Genesis, Hyundai’s luxury vehicle division. Despite ranking third, there is a huge gap with the second rank, Kia.

South Korea’s car color palettes, with white’s reign and blue’s ascent

Historically, white has consistently claimed the title of the most popular car color in South Korea. In 2018, Axalta Coating Systems, a global automotive paint supplier, revealed that a remarkable 32% of all passenger cars sold in the country were white. Following white, the colors gray, black, and silver ranked next in popularity, accounting for 21%, 16%, and 11% of car sales, respectively. On the other hand, vibrant colors found less favor among South Korean car buyers, with blue at 9%, red at 6%, brown/beige at 3%, yellow/gold at 1%, and green making up less than 1% of the choices. Yet, there has been a notable increase in the popularity of blue-colored cars. In 2022, Hyundai Motor Group reported that blue is a highly favored color for compact car models, especially among young consumers. Notably, 40% of Avante N (M/T) sedan buyers chose ‘performance blue,’ while 33% of Kona N subcompact SUV buyers opted for ‘sonic blue.’

Case study: The timeless allure of Hyundai Grandeur

The Hyundai Grandeur, sometimes known as Hyundai Azera, holds a significant place in South Korea’s automotive history and is affectionately nicknamed the “father’s car”. It was introduced as a luxury sedan in 1986, gaining popularity for its timeless design, comfort, and value. The model has been also favored by businessmen for its spacious trunk, capable of accommodating four golf bags, and its luxurious interior, spacious enough for a whole family.

Over the years, the Grandeur has undergone various developments. In 2016, Hyundai launched its sixth generation and six years later, in November 2022, the seventh generation of Hyundai Grandeur was released. Within a month of opening the pre-order period, Hyundai received nearly 110,000 pre-orders, which greatly exceeded the company’s initial target of 11,000. This strong and overwhelming response is even closer to Hyundai’s ambitious 2023 sales target of 119,000 units.

The Hyundai Grandeur’s allure stems from its advanced assistance technology, ensuring safety and convenience through features like highway driving assist and parking collision-avoidance. Its sleek design, smooth driving, and swift acceleration captivate modern car buyers. Equipped with advanced safety features, including front collision avoidance and 10 airbags, the sedan becomes a coveted option for those seeking luxury and safety.

The upgraded New Grandeur is also the country’s most popular clean energy vehicle. With four different engine options, including a gasoline hybrid. In January and February 2023, 8,109 Grandeur hybrid models were sold, accounting for about 43% of its total sales. This surge in popularity can be attributed to the rising demand for fuel-efficient cars, as hybrid vehicles can consume up to 50% less fuel than traditional gasoline or diesel models. As the demand for cleaner and greener cars continues to grow, the Grandeur’s spaciousness and eco-friendly design have positioned it as a leading choice among South Korean consumers.

South Korea’s automobile industry: Global manufacturing powerhouse

- The country’s domestic automobile production increased by 8.5% to 3.76 million units in 2022, solidifying its position as the fifth largest in the world.

- South Korea’s automobile industry is a crucial driver of export growth, with car exports accounting for 6.85% of the total export value in 2021, equivalent to around USD 44.73 billion.

- The nation is committed to achieving carbon neutrality, promoting EVs through various policies and investments. Yet, despite the support for EVs, concerns persist among South Korean consumers, including charging time, electric battery safety, and the lack of charging infrastructure.

- SUVs are the preferred choice among South Korean car buyers, consistently holding the largest market share in terms of car sales.

- Local brands, particularly Hyundai and Kia, dominate South Korea’s automobile industry, leading in the sales chart by a large margin.