As the world advances in the digital era, semiconductors have become the fuel to powering the data-driven economies – much like oil during the industrial economy of the previous century. According to Gartner, the global semiconductor market sales was worth USD 594.96 billion in 2021, a 26.3% increase from 2020. South Korea’s semiconductor industry made up about 19.3% of the global market, propelled by its memory market. It is a potential game changer that could transform businesses including South Korea’s luxury goods market and consumers including the MZ Generation.

The semiconductor industry and its classification system

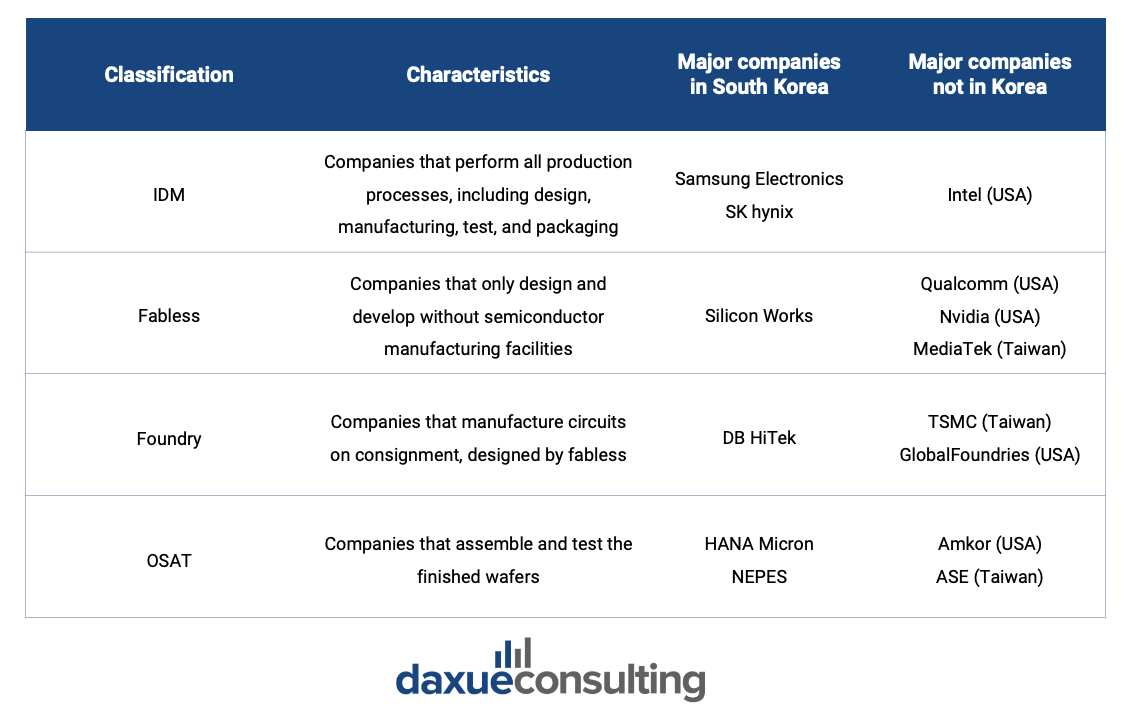

The semiconductor industry can be classified into four major groups: IDM, fabless, foundry, and OSAT. IDM (short for Integrated Device Manufacturer) companies are responsible for the entire process of semiconductors, from the planning to manufacturing and sales. Leading companies are Korean chaebols Samsung Group’s Samsung Electronics (삼성 전자) and SK Group’s SK Hynix (SK 하이닉스).

Whereas fabless companies like Silicon Works only design the semiconductors, the foundry companies like DB HiTek (DB하이텍) only manufacture them. OSAT (Outsourced Semiconductor Assembly and Test) companies like HANA Micron and NEPES provide packaging and testing services.

The classification of semiconductors and South Korea’s leadership in the memory market

Although there are different ways to classify them, semiconductors can be grouped into memory, which stores and memorizes data; system, which performs data processing; and optical and discrete, such as LEDs and transistors and diodes.

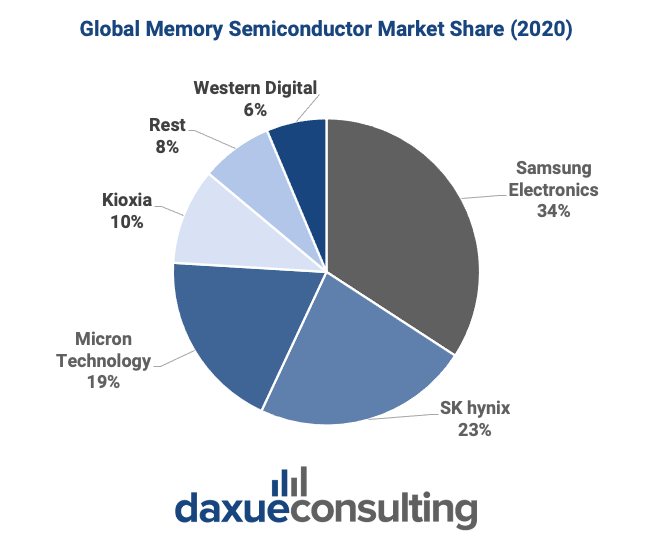

South Korea is the leader in the memory segment. In 2021, it accounted two-thirds of the global memory market. However, as the global semiconductor market shifts from the memory to the non-memory segment with the development of Industry 4.0, it has become a problem to South Korea who is heavily dependent on the memory market. Therefore, South Korea aims to develop its non-memory sectors, becoming the global semiconductor powerhouse by 2030.

In 2022, the government announced it would provide tax incentives and subsidies and build a semiconductor engineering training center to help South Korean companies raise their market share in the non-memory chip market to 10% by 2030.

of South Korea’s semiconductor industry

South Korea’s potential entry into the Chip 4 alliance

South Korea may join the Chip 4 alliance, first proposed by US President Joe Biden. The alliance aims to build connections among the global semiconductor leaders: the United States, South Korea, Japan, and Taiwan. They all together cover all major steps in the supply chain. However, discussions and decisions are pending. It is not certain whether South Korea will join for various reasons, including China’s response and unresolved tensions between South Korea and Japan. South Korea’s largest semiconductor trading partner is China, with over 48% of its memory chip exports being sent there. South Korea and Japan have a complicated ongoing conflict that dates back to more than 100 years ago.

Samsung, the top memory semiconductor, plans to develop its non-memory sector

Samsung Electronics (삼성 전자), the largest memory semiconductor company and one of the Korean chaebols, is making investments to develop its non-memory sectors as it faces competition and economic slowdowns. In the first quarter of 2021, chaebol owned 17% of the global foundry market, largely falling behind by a major competitor Taiwan’s TSMC who has a market share of 55%. Its key products mainly include the memory DRAM and NAND chips, which are mass produced and less differentiated than the non-memory chips. In 2022, Samsung announced that it has started to produce 3-nanometer process-based chips, a little earlier than TSMC.

However, the more urgent issue between Samsung and TSMC is securing foundry customers. Major foundry clients including Qualcomm, Nvidia, and Tesla intend to rely less on one specific foundry company. In connection with this, it was reported that Qualcomm will have both TSMC and Samsung Electronics supply the Snapdragon 8 Gen 2, which will be produced through the 4-nanometer. This will result in two versions: the standard version by TSMSC and the customized version with greater performance by Samsung Electronics.

After the 3-nm process, Samsung Electronics still has an aggressive future plan. In 2022 forum, it said it aims to mass produce 2-nanometer chips by 2025 and 1.4-nanometer chips by 2027.

South Korea’s semiconductor industry still faces hardships

Despite the advancements, the semiconductor industry still faces numerous challenges involving labor, technology, and equipment and materials. According to the Ministry of Trade, Industry and Energy, there is still a need for the labor force to meet the demands of the industry in terms of both quantity and quality. South Korea particularly needs more design experts. While the United States’ Qualcomm has over 20,000 workers, 200 fabless companies in South Korea compete for 10,000 design workers. South Korea is making plans to nurture more semiconductor talent, such as by offering or developing courses at top universities.

South Korea needs to advance its tech and localize more of its equipment and materials

Even though South Korea is leading the memory semiconductor industry, its position is weakening with growing competitors like China’s YMTC and United States’ Micron and relatively less technological strength in the non-memory sectors.

Another vulnerable area involves the equipment and materials need to make the final products. South Korea still heavily relies on other countries for certain parts. In fact, it is estimated that only 20% of the equipment and 50% of the materials are localized.

Key takeaways of the South Korea’s semiconductor industry:

- South Korea’s semiconductor industry is one of the largest in the world, and dominates the memory sector. However, as the world moves into Industry 4.0, it has become important for South Korea to shift into the non-memory sectors, competing against Taiwan’s TSMC and others.

- Korean chaebols Samsung Group’s Samsung Electronics (삼성 전자) and SK Group’s SK hynix (SK 하이닉스) are the dominant players in the memory sectors, and they are making aggressive plans into becoming the winners of the non-memory semiconductor industries. South Korea has started production of its 3-nanometer process-based chips and plans to create the even more powerful 2-nanometer chips by 2025 and 1.4-nanometer chips by 2027.

- The government plans to take part in the advancement of South Korea’s semiconductor industry, which can revolutionize South Korea travel trends and embedded marketing in South Korea, among other fields. Providing tax incentives and subsidies and building training centers are among some of the plans.

- Although advancements have been made, South Korea still struggles to become the number one semiconductor powerhouse in the world. Some of the major challenges include the lack of talent, advanced technology, and localization of equipment and materials.

Enter your email to download our full Korea Consumer Trends report