Many people in South Korea put a lot of attention into how their hair looks. In fact, even more young men in comparison to Western men, put a lot of attention into their hair styles. This even further amplified by the fashion and pop culture and the desire for them to express their style through hair. However, increasingly more people are not only taking care of their hair appearance but also the health of it. This cultural transition is a driving force behind South Korea’s hair care market, where an increasing number of individuals are embracing dedicated routines and seeking innovative treatments for a more comprehensive and fulfilling approach to hair care.

Read our Korea’s MZ Generation report

South Korea’s hair care industry: From salons to self-care

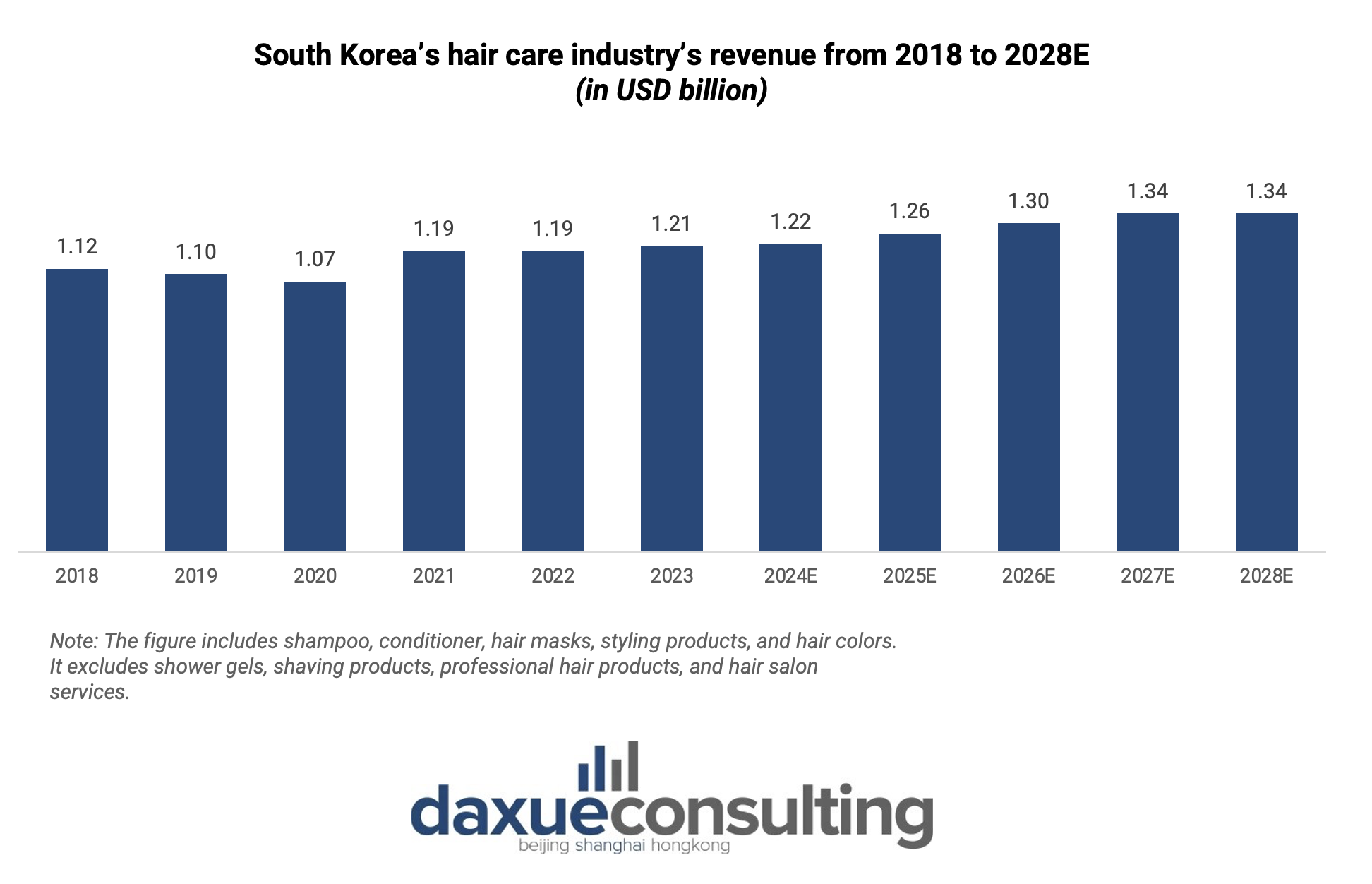

With consumers showing greater interest in hair care, South Korea’s hair care industry was worth USD 1.19 billion in 2022. It is anticipated to reach a revenue of USD 1.22 billion in 2024, with a projected CAGR rate of 2.37% from 2024 to 2028. Pre-Covid, Koreans prioritized hair care, but the pandemic’s influence, characterized by increased home time and a focus on holistic health, has driven more people to care for their hair at home. This surge in interest extends to advanced hair treatments and beauty products, serving as complements or substitutes for salon services.

From scalp to style: A typical hair care routine in Korea

Similar to having a skincare routine, people maintain a hair routine that focuses on keeping it clean and healthy. Based on user posts and conversations on Naver Blog, a typical haircare routine begins with shampooing using lukewarm water to cleanse the hair and scalp. It is then followed by conditioner to nourish and soften the strands. Many also add a hair mask once a week into the routine for deep conditioning and repair. When styling one’s hair using heat-based styling tools, Korean consumers use heat protectors to keep their hair safe from damage.

Demand for tailored products and ingredients: A case concerning scalp health

Korean consumers seek tailored products for specific scalp needs. Blogs on Naver often discuss understanding and addressing one’s scalp issues and choosing products accordingly. Two common scalp issues often encountered are a dry scalp and an oily scalp. These conditions represent opposite ends of the spectrum, with a dry scalp characterized by a lack of moisture and oiliness, while an oily scalp involves an excess of natural oils.

Many netizens expressed interest in products containing aloe vera, tea tree oil, and herbal extracts for deep hydration. Popular dry scalp shampoos in South Korea include those with tea tree oil, aloe vera, and herbal extracts. Ryo (료), Amos (아모스), and Kerasys (케라시스) are reputable South Korean brands addressing dry scalp concerns.

For those with oily scalp issues, sought-after shampoos feature ingredients like tea tree oil, salicylic acid, or charcoal to control excess oil. Aromatica (아로마라카) and Ryo are recognized South Korean brands catering to oily scalp concerns. The American brand Head & Shoulders is also popular.

Hair loss concern is a concern – even for young people

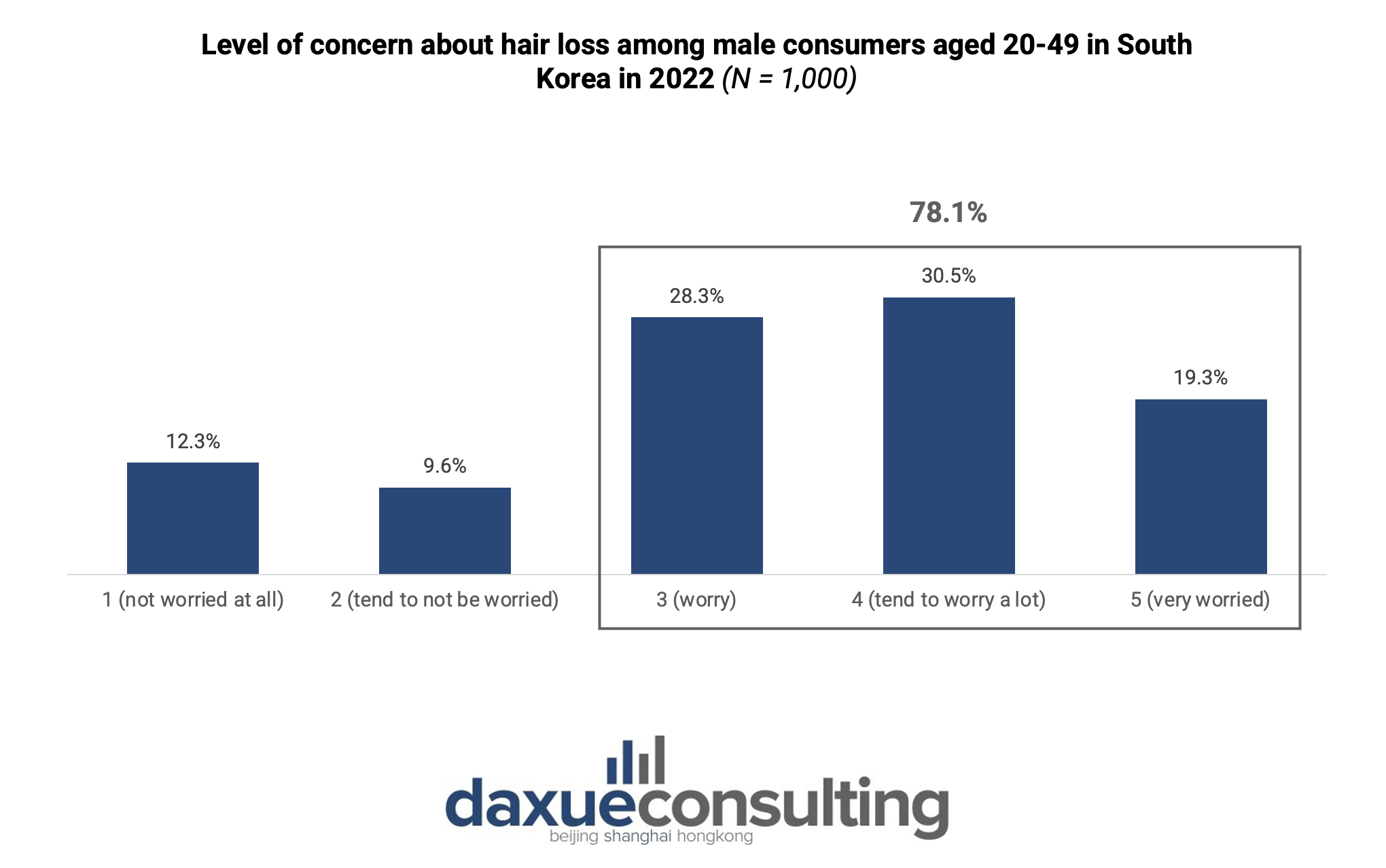

Hair loss is one of the primary concerns for individuals in South Korea. Traditionally associated with aging, the issue is increasingly becoming a more prevalent concern among the younger MZ Generation males. In a 2020 survey of 1,000 Korean males aged 20-49, nearly 80% were moderately worried to very worried when it comes to hair loss.

In 2021, approximately 27,000 males sought medical attention at hospitals for male pattern hair loss, according to the Health Insurance and Assessment Service. Notably, 50% of these patients were in their 20s and 30s. This contrasts with broader trends in East Asian populations, where lower rates of hair loss typically start later in life. The early onset of hair loss in South Korean men in their 20s and 30s suggests a deviation from regional norms. While genetics play a role, environmental factors such as stress, poor diet, lack of sleep, and smoking also contribute. This highlights a complex interplay influencing hair loss concerns in young South Korean men.

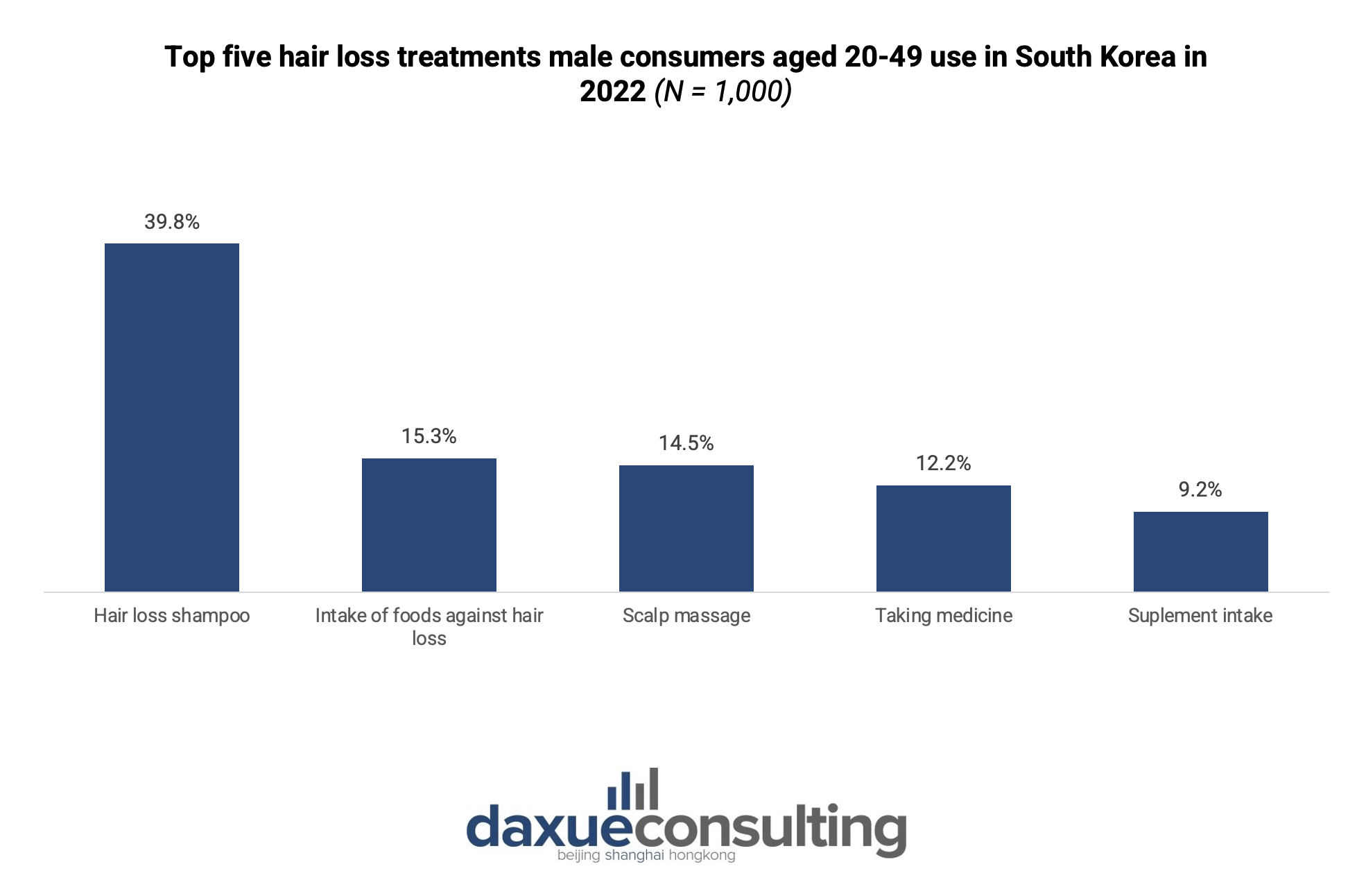

Among the surveyed males, the most widely adopted method (39.8% of respondents) for addressing hair loss is the use of anti-hair loss shampoo. Shampoo, being a topical solution, is often perceived as a simpler and more accessible first step in addressing hair loss concerns. South Korean brands including Kundal (쿤달), TS, Daeng Gi Meo Ri (댕기머리), Mise en Scène (미쟝센), commonly feature a blend of herbal extracts, ginseng, biotin, and other ingredients recognized for their potential to reduce hair loss and enhance overall hair health.

The rising demand for anti-grey solutions

Hair dyeing is widespread in South Korea, and it is not limited to young people who do them to follow fashion trends. Amid South Korea’s rapidly aging population, older people, in fact, dye their hair to cover their greying hair. The increasing prevalence of hair-related concerns, particularly premature greying, is a significant catalyst for market growth. In 2022, leading cosmetic giants in South Korea, Amorepacific and LG Household & Healthcare, introduced shampoos designed to conceal grey hair effectively. Amorepacific’s RYO Double Effector Black Shampoo and LG’s ReEn brand garnered positive responses, with Amorepacific’s pre-launch sales selling out, and ReEn selling over 200,000 units within three weeks. This success indicates a substantial demand for anti-aging hair care products

South Korean salons: Bridging the gap between beauty and education

While home hair care is growing in Korea, people still continue to go salons. In additional to smaller hair salons, there are chain hair salons, such as Rian Hair (리안헤어), Juno Hair (준오헤어), and Llyod Balm (로이드밤). These salons offer an entire experience that goes beyond just haircuts, perming, and coloring. They also serve as educational hubs. Given that the hair salon people have more professional knowledge and skills, people consult about their specific hair concerns. Moreover, before using any hair products, salon staff typically introduce and explain them, detailing their ingredients and benefits for a more informed experience.

Clients seek guidance on specific hair concerns, capitalizing on the expertise of salon professionals. The consultation process serves as a valuable interaction, allowing individuals to address their unique hair needs. Furthermore, these salons elevate the customer experience by introducing and explaining various hair products. This detailed discussion encompasses insights into ingredients and benefits, empowering clients with a more informed approach to their hair care routines.

Tresses and trends: Investigating South Korea’s hair care market

• The hair care industry in South Korea is thriving, with a revenue of USD 1.19 billion and a projected revenue of USD 1.22 billion in 2024.

• Pre-Covid, Koreans prioritized salon hair are, but the pandemic increased focus on holistic health and home case. Surge in interest includes advanced hair treatments and beauty products as substitutes or complements for salon services.

• Similar to skincare, Koreans maintain a hair routine emphasizing cleanliness and health. A typical hair care routine in South Korea involves shampooing, conditioning, and weekly use of hair masks for deep conditioning.

• Consumers seek tailored products for specific scalp needs. Common scalp issues include dry and oily scalp, each requiring specific ingredients in shampoos.

• Hair loss is a prominent concern in South Korea, even among young males. Anti-hair loss shampoos, featuring herbal extracts and other beneficial ingredients, are popular solutions.

• Hair dyeing is widespread, driven by fashion trends and a desire to cover greying hair.

• Salons in South Korea serve an educational role, providing product information and addressing consumer concerns.