Starbucks’s history began in 1971 with its first store opened in Seattle. Since then, the chain has continuously developed and, as of 2023, it has over 32,000 stores in 80 countries. In China, it opened its first store in Beijing, which was also the first ever foreign coffee shop to enter China. It grew so popular that, as of September 2024, China has the second highest number of Starbucks stores in the world. It has 7,596 stores, or 19% of all stores worldwide. However, Luckin Coffee surpassed Starbucks in China in June 2023.

Download our China F&B White Paper

How Starbucks entered tea-dominated China

Although the tea market in China is deeply rooted in Chinese culture, since the early 1990s, more and more consumers have been turning to coffee primarily because coffee is more suitable for individuals dealing with intense pressure from work. Starbucks has been playing a pioneering role in this trend inversion.

Despite having opened its first store in 1999, the history of Starbucks in China began four years earlier, when the American company began to sell coffee samples in many hotels across Beijing. This move exposed Chinese consumers to the “foreign” coffee lifestyle and drove their desire for this new cultural phenomenon. It took three more years for Starbucks to set a shop in China through three different joint venture operations. Firstly, at the end of 1998, the US coffee shop chain cooperated with the Beijing Mai Da Coffee Co. to establish its first coffee bar in Beijing, which was subsequently opened in 1999. In the same year, Starbucks opened a store in Shanghai in collaboration with Uni-President Group. This strategic partnership helped Starbucks gain traction in another key city in China, further solidifying its presence in the market. Continuing its expansion strategy, the US chain made significant strides in southern China in 2000. This time, the company joined forces with Mei-Xin International Ltd. to open various coffee shops, extending its reach and influence in the region.

Localization and constant innovation are key to Starbucks’s success in China

Localization was one of the main strategies used by Starbucks to make its own name in the Chinese market. This involved adapting its products to cater to the preferences of local consumers. For instance, Starbucks diversified its menu by incorporating various tea flavors and local ingredients. This strategy aimed to make the drinks more “familiar” and appealing to the Chinese palate.

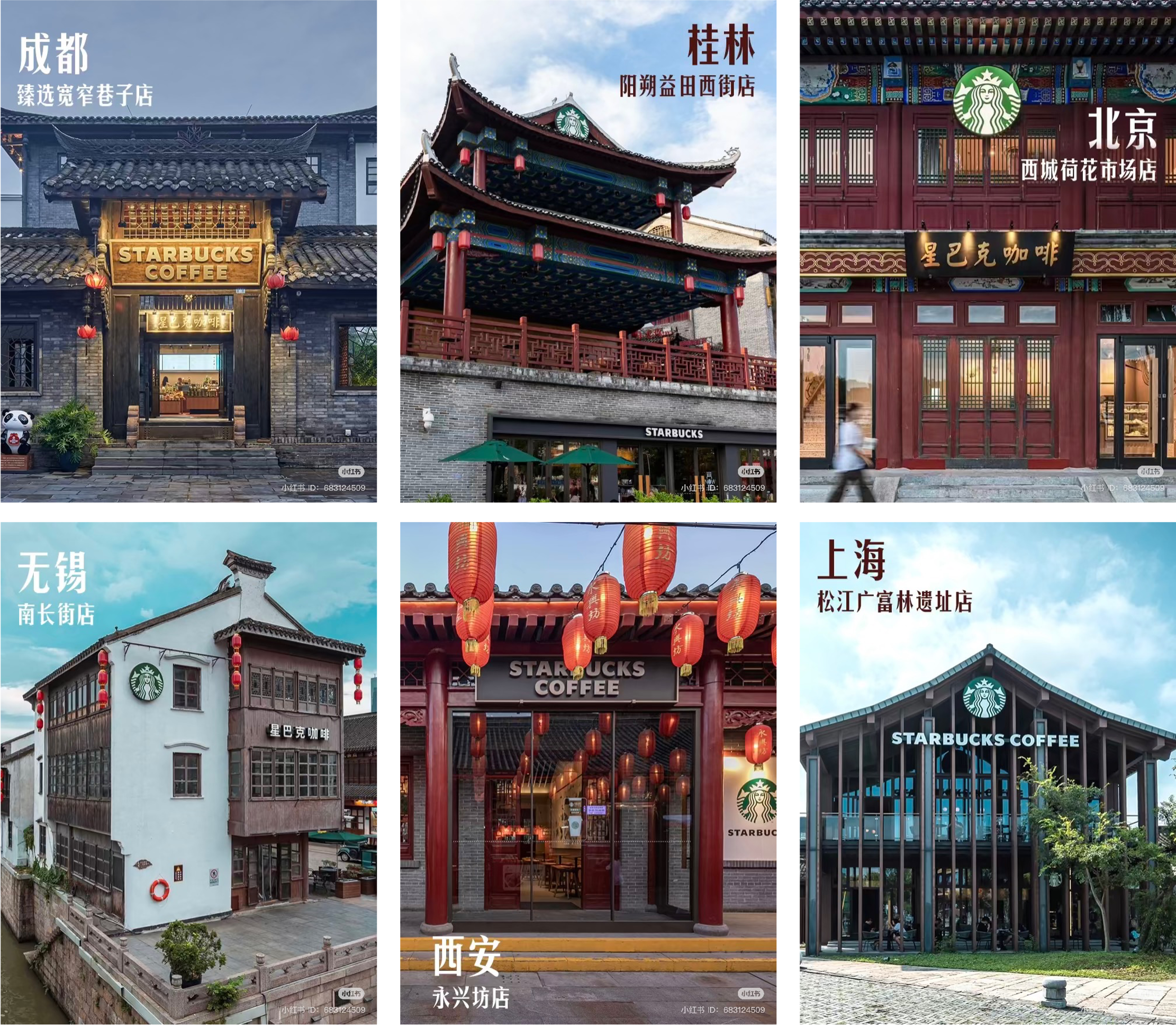

Beyond menu adjustments, Starbucks also focused on integrating Chinese elements into its coffee shops. Many Starbucks outlets in China feature local architectural and design elements, creating a unique and culturally immersive experience for customers.

Moreover, in December 2017, Starbucks opened its second reserve roastery in Shanghai, three years after it opened its first roastery in Seattle. As of December 2024, there are six roasteries in the world, and the one in Shanghai is one of the two in Asia. The roastery aims to offer the best coffee and tea experience, featuring three coffee bars, a special Teavana tea bar, and an augmented reality experience designed by Alibaba.

The Seattle-based coffee shop chain’s USD 220 million investment in Jiangsu’s Coffee Innovation Park

Starbucks’ investments in China extended beyond its stores. In September 2023, it invested more than USD 220 million to build a Coffee Innovation Park (CIP) in Jiangsu province. The building consists of different structures, such as a roasting center, a retail point where consumers can purchase coffee directly from the factory, and an experience center that explains in depth the process behind a coffee cup. Notably, the coffee beans used in the CIP exclusively come from local coffee partners, contributing to the growth of the domestic coffee sector and enhancing the local economy.

Starbucks’ marketing strategies aren’t only bricks and mortar

Starbucks is also very active on Chinese social media like Weibo, where the official account has more than 1.6 million subscribers. It frequently launches new products, with 79 new launches in fiscal year 2024, including seasonal limited-edition or exclusive products, and shares them on social media. In November 2024, it announced its seasonal strawberry products, followed by the release of Christmas mugs in December 2024, in collaboration with lifestyle brand The Beast (野兽派官方).

Apart from Weibo, Starbucks’ digital marketing strategy also relies on WeChat, the biggest multi-purpose app in China. In 2017, the franchise introduced the hashtag #用星说# (Say it with Starbucks) on WeChat mini-programs. The campaign was aimed at creating a social gifting feature, in which consumers send digital gift cards or even Starbucks products to family and friends.

Moreover, in 2020, Starbucks launched further features on the Chinese platform, implementing the delivery option into WeChat Mini programs. By doing so, customers were provided with the flexibility to either have their orders delivered to their preferred location or opt for the “take-away” option, allowing them to pick up their ordered products directly from Starbucks stores.

Starbucks launches delivery system for an elevated consumer experience

Since 2018, Starbucks has been dedicated to refining its delivery system to elevate the overall shopping experience for consumers. In August of that year, the coffee giant entered a strategic collaboration with Alibaba, a Chinese e-commerce giant, to introduce a “virtual Starbucks store.” This innovative feature aimed to leverage Alibaba’s extensive selling channels, including Ele.me, Taobao, and Tmall, to enhance and expand Starbucks’ delivery options.

Building on this foundation, Starbucks continued to evolve its fast delivery service in subsequent years. In January 2022, it partnered with Meituan, an app-based delivery platform. This strategic move further optimized the delivery system, ensuring a seamless and efficient experience for Starbucks customers.

In March 2023, the franchise launched “Starbucks Curbside” together with Amap, a provider of digital map content and navigation systems under the Alibaba Group. This innovative addition allowed customers to track the exact position of their order, significantly minimizing waiting times at drive-thrus. Although the service was initially available at around 150 stores in Beijing and Shanghai, Starbucks has ambitious plans to expand “Starbucks Curbside” to over 1,000 stores.

Starbucks’ sales decrease as it experiences pressure from more price-friendly competitors

In fiscal year 2024, Starbucks in China experienced an 8% decline in comparable store sales, driven by an 8% decrease in average ticket. This means that Chinese people spent less per visit. The decline can be attributed to the growing competition from brands like Luckin Coffee as well as a shift in consumer behavior toward more rational and cautious spending habits.

On social media, consumers criticized Starbucks for its high prices, dissatisfaction with its taste, and lack of appeal on social media, among other reasons. For Starbucks to avoid getting involved in a price war, it may need to provide consumers with a compelling reason to choose its coffee at a premium price over more affordable options.

Luckin Coffee is giving Starbucks a run for its money

Luckin Coffee represents the biggest threat to Starbucks’ dominance in the Chinese coffee market. Founded in Xiamen in 2017, Luckin Coffee is the biggest coffee shop chain in China by a number of coffee shops. In July 2024, it opened its 20,000th store in Beijing. This is more than double the number of stores Starbucks has. However, Starbucks has continued to expand, with new stores in lower-tier cities. In fiscal year 2024, among the 790 new stores in China, half of them were in third-tier cities and below, making a record high proportion. In addition to being highly accessible, Luckin Coffee appeals to consumers with its low price.

Starbucks, on the contrary, is more seen as a high-end brand in the market due to its higher-than-average prices. As an example, while a Luckin Coffee’s coffee cup has an average cost of RMB 10 to 20 (approximately USD 1.40-2.75), the prices of Starbucks are much higher, costing up to RMB 30 (more than USD 4) per cup.

Luckin Coffee is also famous for its cross-industry collaborations. In September 2023, the company collaborated with the most famous spirit brand in China, “Kweichow Moutai” to create a Baijiu-flavored latte. This innovative drink immediately created buzz on social media and sold out a few hours after its launch. Starbucks responded to the rise of Luckin by relying on the capillary extension of its stores across China.

Starbucks in China: Will it succeed in the long run?

- Starbucks’ history began in 1999 after opening its first store in Beijing through a process of joint venture operations. Since then, it has continuously grown, having 7,596 stores, or 19% of the stores worldwide.

- Localization is one of the keys of Starbucks’ success: from using local ingredients to incorporating Chinese elements into its architecture. Plus, the American company invested in new infrastructure for coffee production.

- Starbucks often launches new offers and limited-edition products on social media. In December 2024, it launched Christmas mugs in collaboration with lifestyle brand The Beast.

- Starbucks also relies on a very developed delivery system. This consists of launching collaborations with many digital platforms such as Alibaba, Meituan, and Amap.

- Chinese people are spending less per visit at Starbucks. In fiscal year 2024, Starbucks experienced an 8% decline in comparable store sales, driven by an 8% decrease in average ticket.

- Luckin Coffee is the biggest competitor of Starbucks in China. Having more than double the stores Starbucks has, and appealing to consumers through its low pricing. This raises the critical question of how Starbucks plans to adapt and respond to this challenge.

We offer consulting services for China’s F&B industry

China’s restaurant market is a dynamic sector, influenced by shifting consumer preferences, technological advancements, and evolving dining habits. Daxue Consulting offers expert market research in China, providing in-depth insights into the trends and challenges shaping the restaurant industry.

Our comprehensive consumer understanding helps businesses refine their offerings and craft effective marketing strategies to resonate with local diners. Through our consulting services, we guide you to leverage emerging opportunities and navigate the competitive landscape. Reach out to us to discover how our expertise can drive your restaurant business’s success in China.