In recent years, China’s coffee market has rapidly grown, witnessing the emergence of several local brands challenging traditional Western coffee chains such as Starbucks. Luckin Coffee, in particular, founded in 2017, surpassed the number of Starbucks stores in China in 2019. The Xiamen-based coffee giant has now achieved another significant milestone — surpassing Starbucks as China’s leading coffee chain in annual sales for the first time. In 2023, Luckin Coffee reported an impressive net revenue of RMB 7.06 billion (USD 980 million) in the fourth quarter, marking a remarkable 91% increase compared to the same period in 2022.

Download our China luxury market report

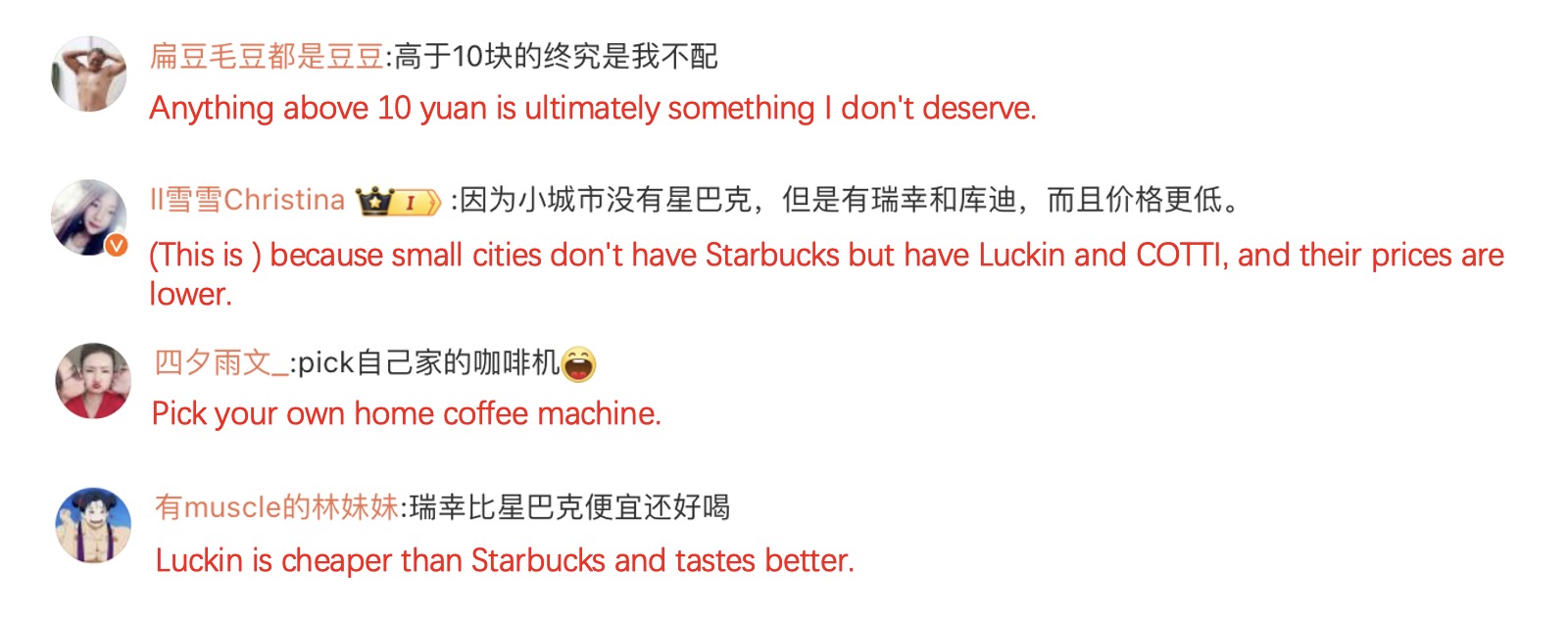

Starbucks vs Luckin: netizens are inclined to cheaper options

According to an ongoing poll on Weibo, asking “which one would you pick, Starbucks or Luckin,” as of March 6th, 72% of respondents favored Luckin Coffee, while only 11.3% chose Starbucks. This phenomenon stirred a heated discussion on Weibo as to #why is Starbucks not as popular anymore# (为何星巴克没那么火了), garnering over 85.5 million views.

Starbucks faces criticism over lack of novelty in coffee offerings

One factor is that Starbucks coffee is considered expensive when there are plenty of more affordable options in the market that likely taste even better. Many netizens have cited brands like Luckin and Cotti Coffee, where a cup of Americano typically costs RMB 9.9 (USD 1.38), and Manner, where it is around RMB 15 (USD 2.08) —still cheaper than Starbucks. For another, Starbucks seems to be gradually losing its appeal, with some netizens finding niche, independent coffee shops more intriguing and worthy of social media posts. Additionally, many netizens also expressed dissatisfaction with its taste and the lack of innovations.

Despite the vast potential for Starbucks to penetrate the untapped sinking market of China in smaller cities where the coffee culture is yet to be established, the question remains whether Starbucks can reclaim the top spot when local coffee chains like Luckin Coffee can offer customized flavors tailored to the Chinese palate, at potentially lower prices.

Lessons from Luckin Coffee for F&B operators in China

The success of Luckin Coffee highlights an inclination towards budget-friendly choices, underscoring the importance for F&B enterprises to formulate competitive pricing strategies while upholding quality standards. Consequently, other food and beverage operators should be mindful of the price sensitivity exhibited by Chinese consumers. Additionally, catering to diverse taste preferences across China can be achieved by introducing localized menus. Luckin Coffee’s achievement with specially crafted flavors designed for the Chinese palate exemplifies the significance of comprehending and adjusting to local preferences.

Takeaways from the challenges faced by Starbucks in the Chinese market

- Founded in 2017, Luckin Coffee has rapidly grown to become China’s leading coffee chain, surpassing Starbucks in store numbers in 2019 and, more recently, in annual sales as of 2023.

- A Weibo poll indicates a shift in consumer preferences, with 72% favoring Luckin Coffee over Starbucks (11.3%).

- Criticisms towards Starbucks include its perceived high prices, lack of novelty in offerings, and diminishing appeal compared to more affordable and innovative local options.

We help brands better understand consumers from Hong Kong and Mainland China

Grasping the nuances of Chinese and Hong Kong consumers’ preferences, behaviors, and expectations is crucial for delivering tailored services and products. The diverse socio-economic landscape across regions, including the distinct characteristics between mainland China and Hong Kong markets, demands thorough and nuanced consumer analysis.

At Daxue Consulting, we specialize in employing advanced research techniques to not only gather consumer insights but also interpret them effectively, ensuring our clients make informed decisions to foster engagement and positive advocacy among their target audience. We offer:

- Extensive consumers research

- Focus groups analysis

- Tribes identification

- In-vivo research

Contact us at dx@daxueconsulting.com to get better results in Hong Kong and China with our help.