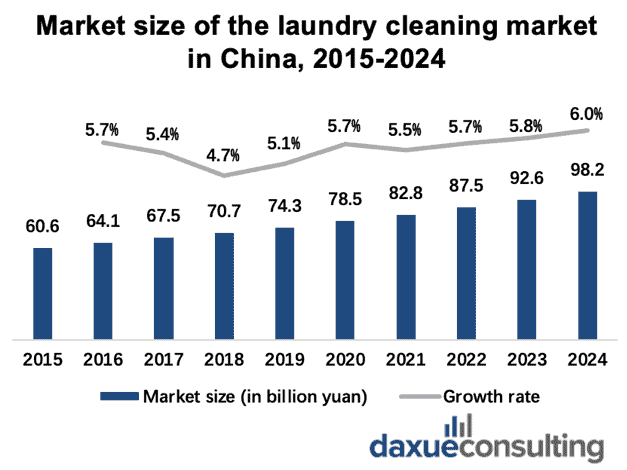

The laundry cleaning market in China has been growing steadily in recent years. According to iiMedia’s report, the market size of the laundry cleaning market is predicted to reach 87.5 billion yuan and continue to grow in the next few years. As the laundry cleaning market in China keeps expanding, laundry detergent brands are increasingly providing new options that cater to the needs of different consumers. For instance, brands like LOVE home AND planet offer laundry detergent products with special fragrances outside of herbal and floral scents, such as coconut water and white peach. Power28, founded in Hubei in 1982, incorporated skincare elements including amino acids and essential oils into its laundry detergent product line, which helped rejuvenate its brand image.

Chinese consumers are taking a greater interest in healthcare when choosing laundry cleaning products

Apart from the need for laundry cleaning products with special scents and skincare components, consumers are paying more attention to the healthy and sustainable values of the products they choose, which is further accelerated by the impact of COVID-19. Chinese consumers’ increasing demand for healthier products and services is also reflected in the rapid growth of the healthcare industry in China, which is expected to become the world’s largest healthcare market, especially thanks to the release of Healthy China 2030. However, despite the growing demand for greener laundry cleaning products, the overall health score of the household & personal care products in China is still relatively low, due to the common perception that laundry cleaning products usually contain chemicals that could be harmful to personal and environmental health. Therefore, it is important to examine the integration of natural and sustainable values in China’s laundry cleaning market to meet the growing demands for greener laundry cleaning products.

How laundry cleaning brands incorporate green values

According to iiMedia’s research, around 74% of the respondents consider “whole health,” including user health, employee health, social health, and environmental health, an important factor when making purchasing decisions. To introduce green characteristics into their products, brands could take the following strategies:

- Brands could add natural ingredients to their products, such as plant extract, plant oil soap base, and natural enzyme, or put an emphasis on no irritants and harmful substances being added to their products.

- In terms of scent, fresh and natural aroma could also be a useful part of the green strategy.

- Adopting environmentally friendly packaging and degradable washing residue could be a strong green statement.

- As for technology, introducing safe formula without adding fluorescent agents, alcohol, and phosphorus could also help enhance a green brand image.

SupNice (超能): A combination of nature and technology

SupNice, founded in 2015, is a high-end laundry cleaning brand owned by Nice Group whose signature product is natural soap powder that is both environmentally friendly and harmless for hand-washing. Due to the use of natural ingredients like coconut oil and frequent technology updates to refresh its brand image every now and then, SupNice manages to maintain a brand perception that is natural, healthy, and innovative. According to a customer, “SupNice is YYDS (a Chinese buzzword which directly translates to “forever God” in Chinese and often used among Chinese young people to describe someone or something outstanding) ! This detergent washes clothes so clean and it smells like the fresh scent of a teenager in a white shirt in summer. The low-foam version washes well and save water by reducing rinsing time, I will repurchase it.”

B&B: “Safe products for babies”

B&B, also known as Baby & Basic, is a Korean brand that provides daily necessities for babies. It is particularly popular among moms due to its use of natural ingredients and the absence of harmful substances. B&B is not only harmless to babies but also to the environment: 70% of the washing residue is biodegradable. “I’ve been using this brand since the baby was born, mainly because there’s no fluorescent agent but strong cleaning power and good smell. I have always used B&B and always trusted B&B!”, a customer commented.

The pandemic is shifting Chinese consumers’ laundry habit

Since the COVID-19 outbreak in 2020, the way Chinese people wash their clothes and linen has largely changed. According to iiMedia’s research on how Chinese citizens handled their clothes differently before and after the pandemic, the percentage of people who would use disinfectants in addition to regular detergent after going to the hospital and taking public transportation both approximately doubled after the pandemic. Around 35.4% of the respondents said that they would keep using laundry disinfectants since the pandemic. In 2020 alone, the online sales of laundry disinfectants increased by 49.6% as compared to 2019.

Key takeaways of the laundry cleaning market in China

- The laundry cleaning market in China is expanding at a rapid speed, due to the growing demand for greener and healthier laundry options among Chinese consumers.

- In response to Chinese consumers’ shifting laundry habits, a variety of natural and sustainable laundry brands and products have emerged and become quite popular among Chinese consumers, which could be reflected in terms of using greener ingredients, natural scents, safer formulas, etc.

- The sales of laundry detergent have surged since the pandemic.