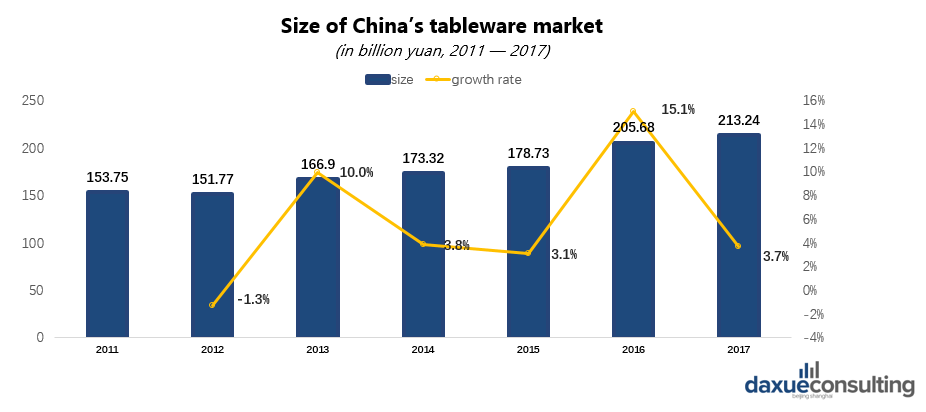

The revenue of the tableware market in China was 213.24 billion yuan in 2017, increasing from 205.68 billion yuan in 2016. The size of the market grows consistently, metal-ware takes up the largest share of the market, ceramics come next and glass is a relatively small share.

Data source: Zhiyan consulting, Size of China’s tableware market

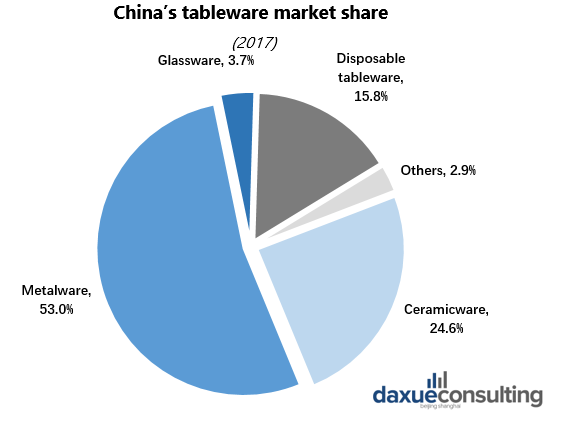

Currently, China’s tableware market is mainly segmented into metal tableware, ceramic tableware, glass tableware, plastic tableware and wooden tableware. Metalware accounted for 53% of the market in 2017, followed by ceramicware (24.6%). Disposable tableware occupies 15.8% of the total market, and the primary product is disposable chopsticks.

Data source: Huajing Industrial Research Institute, China’s tableware market share

Segmentation tableware market in China

China’s main eating utensil – chopsticks

Worldly recognized as central to east Asian culture, Chopsticks are a necessary household item. Chinese chopsticks are normally made of unfinished wood or bamboo. Chinese were taught to use chopsticks long before spoons and forks were invented in Europe (the knife is older, not as an instrument for dining but as a weapon). Chopsticks were strongly advocated by the great Chinese philosopher Confucius (孔子) who believes a dining table should be free of sharp objects. Chinese people, under the cultivation of Confucianism, consider the knife and fork bearing sort of violence, like cold weapons. However, chopsticks reflect gentleness and benevolence, the main moral lesson of Confucianism. Chopsticks make a large part of China’s tableware market, and disproportionately represent the disposable tableware segment.

China’s stainless steel tableware market

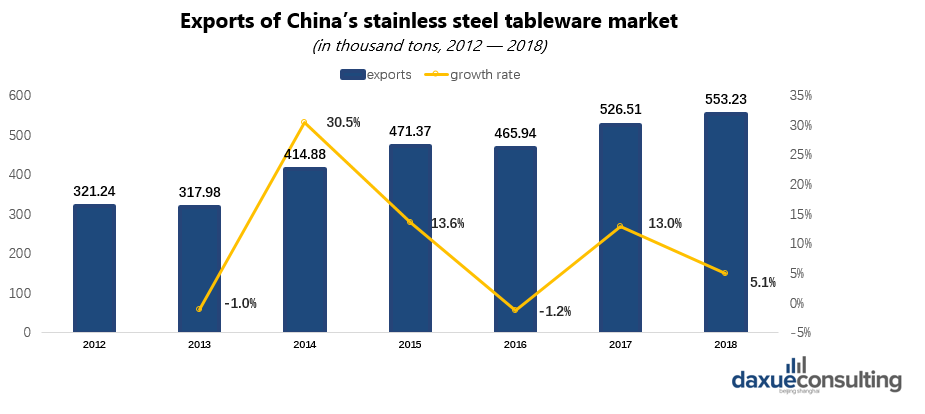

Due to traditional eating habits, Chinese people tend to use wooden or plastic chopsticks and ceramic tableware, while western people use more stainless steel tableware. Following industrial and economic growth, revenue for global stainless steel tableware sales increased from 5.96 billion US dollars in 2012 to 10.38 billion US dollars in 2017. In China’s stainless steel tableware market, exports account for more than half of production volume with increasing growth in recent years.

Data source: China Customs, Exports of China’s stainless steel tableware market

China’s ceramic tableware market

Ceramic tableware is a ceramic product close to people’s daily lives. Recent years have witnessed volatile growth in the size of the industry. According to statistics, the scale of the ceramic tableware market in China increased from 44.45 billion yuan in 2011 to 52.38 billion yuan in 2017, increasing by 17.84%.

The ceramic tableware industry is mainly driven by an increase in the number of households and a rise in the renovation of kitchens. Rapid growth in the food & beverage and home décor market in China is largely responsible for the growth of ceramic tableware consumption.

With increasing quality requirements of imported ceramic tableware products in overseas markets and the overall rising manufacturing cost of domestic manufacturing, ceramic tableware manufacturers that do not pay attention to product quality will face pressure.

China’s disposable tableware market

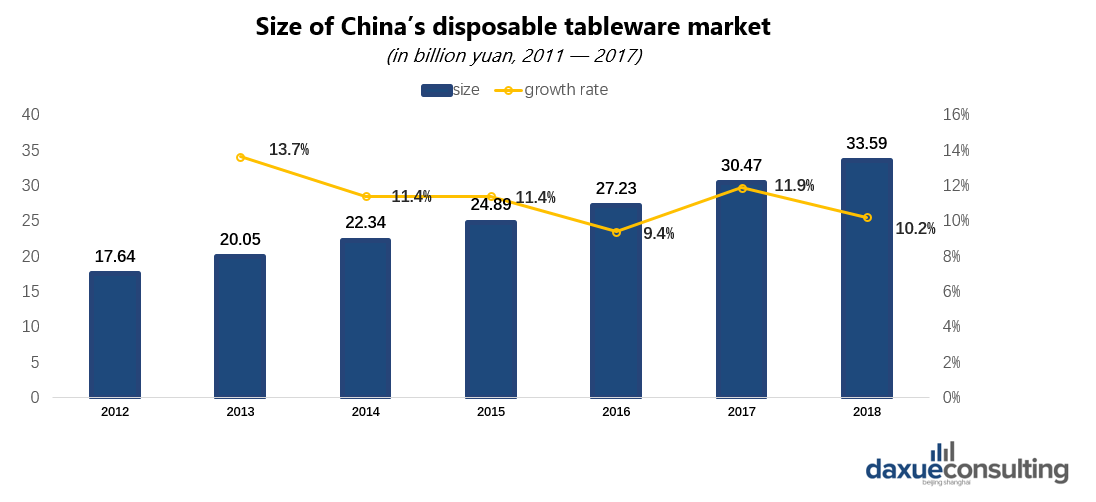

Data source: Huajing Industrial Research Institute, Size of China’s disposable tableware market

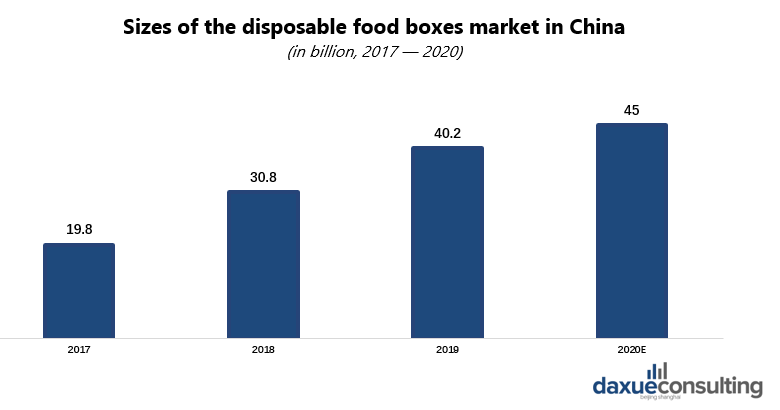

The booming of China’s food delivery market has been contributing to the rapid growth in the disposable tableware market in China. In 2016, the scale of China’s disposable tableware market was 30.47 billion yuan, which increased to 33.59 billion yuan in 2017. According to analysis, one disposable lunch box is consumed for 15 yuan. China consumed 19.8 billion disposable food boxes in 2017, so the consumption of disposable food boxes in China exceeded 40 billion in 2019. It is predicted that this number will reach 45 billion in 2020. Considering the strong growth of China’s food delivery market and takeout industry, the number of disposable tableware driven by the food delivery sector in the future will be huge.

Data source: China Business Research Institute, Size of the disposable food boxes market in China

Relevant eco-friendly policy inhibits the growth

With the tightening of China’s environmental protection policy, the prevention and control of plastic pollution will be further strengthened. In the near future, the raw materials of China’s disposable food box will be converting from non-degradable plastic materials to more environmentally friendly and degradable materials.

On January 19, 2020, the National Development and Reform Commission and the Ministry of Ecology and Environment announced the “Opinions on Further Strengthening the Control of Plastic Pollution“. The policy points out that the use of bio-based products that meet food safety requirements should be encouraged in the food and beverage delivery industry. By the end of 2020, the use of non-degradable disposable plastic straws will be prohibited in the catering industry nationwide. With the introduction of the environmental protection policy, many offline restaurants and online takeaway platforms have responded quickly, saying they would not actively provide disposable tableware.

The outlook of China’s disposable tableware market

Overall, with the growth of the food delivery and takeout sector, China’s disposable tableware market still maintains a steady growth trend, and the market prospects are still good. However, with the conversion of plastic materials to environmentally friendly materials, the cost of disposable tableware will rise. In the future, enterprises that have scale advantages of eco-friendly tableware and can effectively control costs will gain competitiveness in the industry. Small companies with poor quality disposable tableware will be gradually eliminated, and the market share of large enterprises will continue to increase.

Tableware brands in China

One of the top Chinese tableware brands: Supor (苏泊尔)

Supor (苏泊尔) is China’s biggest and the world’s second-biggest kitchenware research manufacture. There are five research bases located in Hangzhou (杭州), Yuhuan (玉环), Shaoxing (绍兴), Wuhan (武汉) and Vietnam, with more than 10,000 workers. The company sells its products in 41 countries and territories. ASD is also a Zhejiang (浙江) company, which was founded in 1978. It mainly produces kitchenware and kitchen appliance. It controls its own research, manufacturing and marketing for its products.

Western tableware brands in China: Zwilling (双立人)

ZWILLING J.A.HENCKELS, founded in 1731, is a knife manufacturer based in Solingen, Germany. Henckels is one of the largest and oldest manufacturers of kitchen knives, scissors, cookware and flatware. It has been a part of the Werhahn-Group since the year 1970. The company maintains several brands, including Zwilling J.A. Henckels, J.A. Henckels International and BSF. Currently, the brand with a long history is still thriving, seeing growth (including acquisitions) of about 8 percent per year since 1995. It earned sales of around €700 million in 2017. In addition, the company independently operates its retail shops, studios and partnerships both in Germany and internationally, with over 200 shop-in-shops in China. In April 2018, ZWILLING opened its world’s largest flagship store in Shanghai. The store includes a shop presenting the full ZWILLING range, a cooking school, a classic elegant bar and a restaurant called ‘The Twins’.

Source: Zwilling’s Weibo account

ZWILLING attaches great importance to the Chinese market due to the growth of the Chinese middle class. “Today, China is the most important and the largest market for the Zwilling world, bigger than the USA and bigger than Germany,” Dr. Schiffers, Zwilling’s global CEO, said.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast