China’s Ecommerce revolution has effectively changed the way Chinese shop, retail stores sell, and how business is conducted. It has further given rise to new entrepreneurs and new businesses which are largely supported by the E-commerce engine. Consider that Alibaba Group, owner of the largest ecommerce web sites as Taobao and Tmall has a value of over $150 Billion, on its way to an initial public offering. An estimated 60% of packages shipped in China are from an Alibaba group affiliate.

The online market in China

In 2012, total online sales in China reached about $200 Billion according to Mckinsey &Co. It is slightly lower than the U.S. which totaled only about $20 billion more at $220 Billion in total online sales. While he U.S. are still ahead, China’s online sales are growing at a very strong pace. Online retailing consists of 6% of all purchases in China as compared to 5.2% in the U.S. China’s digital market penetration was 4.2% as compared with 1.8% in the U.S. Moreover, the market is growing very fast. BusinessWeek argues that China has already superseded the U.S. in online market size (when the 2013 statistics will be available). Moreover, total online sales grew on an average of 71% per year between 2009 and 2012. That is more than 5 times the 13% the American market grew per annum. Projecting forward, the Chinese market is expected to continue to grow at a less but still impressive figure of 32% through 2015. It is projected that in 2015 the Chinese e-commerce market will have grown to about $541Billion. Mckinsey forecasts that the Chinese market could reach $420 Billion to $650 Billion in total online sales by 2020. According to IResarch Consultants, B2C had 36.6% of the market, while C2C controlled the remaining market share.

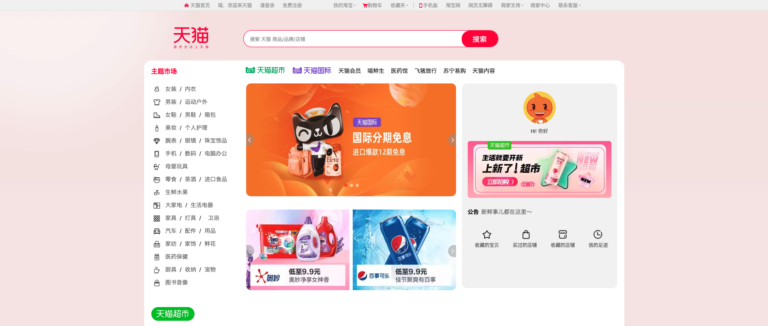

Tmall and Taobao dominate the market

The E-commerce market in China is dominated by Alibaba Group which owns both TMall and Taobao (along with Alibaba.com). However there are significant other players in the market including JD.com (previously 360buy.com), Tencent (owns Paidai and Wechat), Baidu, Ctrip.com (online travel bookings), 51buy.com.

Drivers of Growth

Growth in online sales comes from several avenues. The growth of new E-Consumers will continue with the continued expansion of China’s economy and further economic development of the interior of the country which today has less access to Internet. As internet penetration increases, the number of new first time users, especially those in the smaller cities with less diversity of products will begin to purchase online. Part of the reason for continued growth is that Internet penetration also has significant growth potential. According to the FT, only 31% of households have broadband Internet access. Furthermore, only 21% of households have mobile broadband access. With the proliferation of affordable smartphones from companies such as Huawei and Lenovo, this number is sure to increase. Mobile online purchases have become a significant part of the E-commerce mix. BusinessWeek notes that 8.6% of online transactions occur via smartphone. Thus the continued penetration and expansion of smartphones will be a continuing factor in driving online purchases, especially in less developed areas where there would ordinarily be less internet penetration.

Other drivers of growth are conglomerates such as Tencent (which owns WeChat and Paipai) and Alibaba (Taobao, Tmall, Alibaba.com) which use their established user bases, which number in the hundreds of millions, to funnel traffic to their B2C websites. Alibaba for example has 370 million users largely from its Taobao user base, and Tencent has over 200 million users from its WeChat mobile application.

How to sell on Taobao? How to sell on Tmall?

What characteristics drive consumers online on website such as Taobao or Tmall? Though overwhelmingly price is the main driver, other factors are also at play. These include quality, convenience, diversity, and, more surprisingly, foreign products. The latter two are especially important for smaller cities where products, especially foreign products may not be as widely available. According to several Bain and Company surveys, 70% of respondents compare online and offline prices. Moreover, while price is the most important factor, consumers pay attention to other factors including convenience, and diversity of items. Also Chinese consumers purchase foreign products online. For example, Chinese consumers buy 10% of all infant formula as well as 7% of all cosmetics products through online stores, which sell foreign products. As Bain notes, consumers are trending from only “price sensitive” to “consumer experience” sensitive.

Most often online purchased Categories

What are onlineconsumers looking for? Many consumers, especially first time e-commerce users purchase cheap apparel items and increasingly also electronics and cosmetics. According to Bain & Co. the most often purchased items especially for first time online buyers are apparel, electronics, and groceries. However there are several categories with incredible growth over the last several years. When looking at online penetration rates from 2010-2012, Apparel has risen from 1.6% to 13%, cosmetics have risen from 2.5% to 11%, consumer electronics from 4% to 17%, and digital books from 4.5% 30%.

To learn more about online environment in China : https://daxueconsulting.com/digital-strategy/online-market-research-in-china/

https://www.internetretailer.com/2013/10/30/60-us-retail-sales-will-involve-web-2017

https://www.reuters.com/article/2014/02/28/research-and-markets-idUSnBw285696a+100+BSW20140228