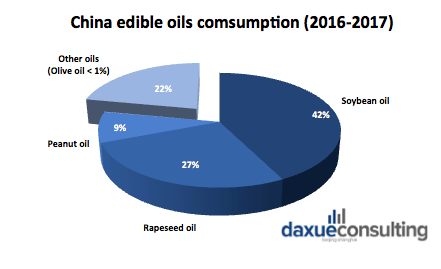

While extra virgin olive oil (EVOO) may be a staple in many countries’ cuisine, especially in southern Europe, it only has a very marginal use in China. Usually associated with foreign brands and healthy cooking, EVOO is rarely used in Chinese kitchens where soybean and rapeseed oils are more prevalent.

Healthier cooking habits drive Chinese extra virgin olive oil consumption

However, “eating better” has become a recent trend among Chinese married couples and people over 30, boosting the sales of olive oil in China. It still is very much a “lifestyle” premium product, which often offered as a gift, and not a general consumer product despite its growing popularity.

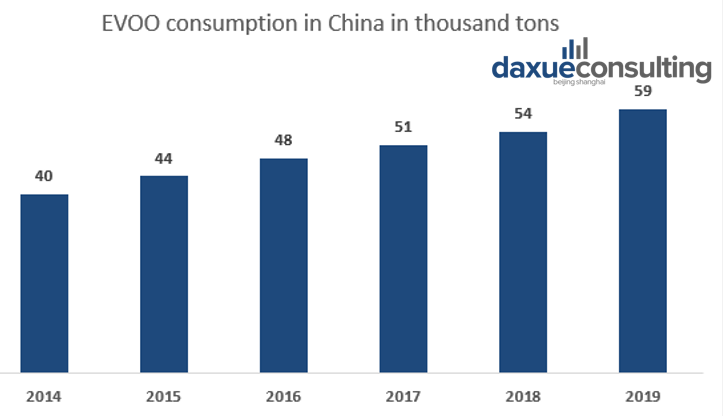

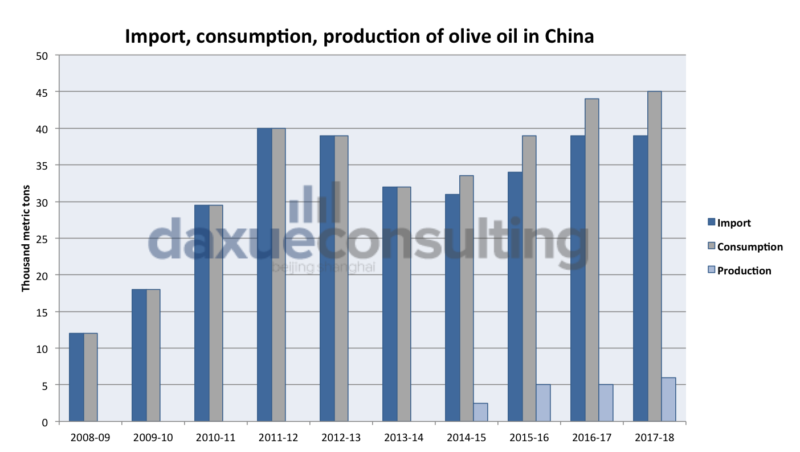

Regardless of the premium status of olive oil in China, extra virgin olive oil consumption in China has steadily increased from 40,00 to 60,000 tons according to Chinabaogao.

Data source: Chinabaogao. Consumption of EVOO in China has steadily increased over the last 5 years

China is ramping up both EVOO imports and production

Even though EVOO consumption in China is still proportionally marginal compared to other types of oil, its increasing popularity has left the Chinese demand in need of new suppliers. Out of all world class olive oil producers, it is Italy that is best positioned to meet that demand, with Tunisia being a potential contender. This increase in European olive oil exports toward China is measured in an annual 4.1% increase from 2018 to 2019.

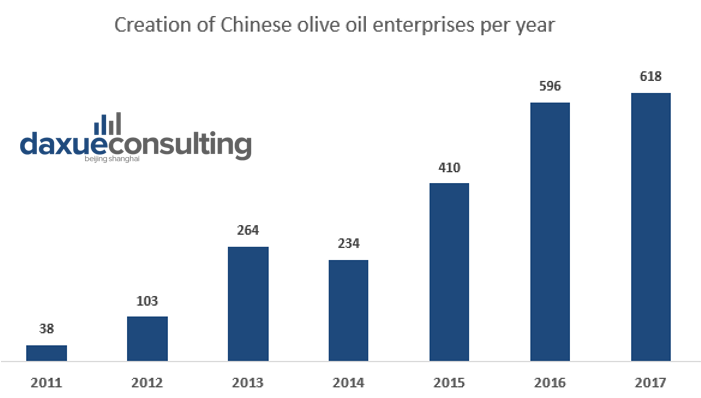

Domestic production has also significantly increased over the last decade, going from about one hundred enterprises in 2000 to almost 2500 in 2018, most of them located in the Gansu province. The quality of domestic EVOO in China has also gotten better recently, a Chinese olive oil even winning an international competition. Quality is essential for domestic production as EVOO is regarded as a premium product in China and that European brands are often branded as being more “prestigious”.

Data source: Research gate. Domestic olive oil enterprises in China have flourished at an increasing rate

Can Chinese Brand Olivoilà Take the Lead of the Olive Oil Industry in China?

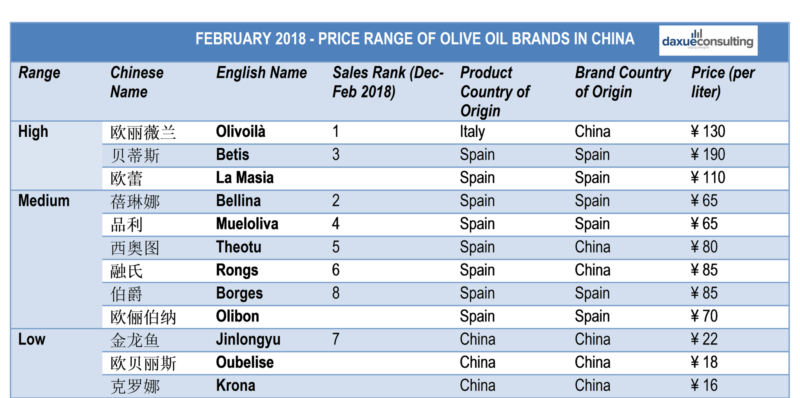

Leader of the local brand on the olive oil industry in China since October 2017, Olivoilà maintained its leadership on this highly competitive market. According to a Daxue Consulting research from Chinese online sales analytics tool Maijia (卖家) and sales data from Taobao, Olivoilà earned a total 31 million yuan online between December 2017 and February 2018. This is over twice as much as Bellina, which earned 15 million yuan in the same period. The research also shows that even though half of the eight leading companies in the domestic olive oil market were Chinese, a total of seven of those eight companies sold either Italian or Spanish (extra)-virgin olive oil, showing a clear dominance of imported olive oil products in the Chinese market. This is in part due to the perception of foreign olive oils as high-quality goods as well as the limitation of domestic olive oil supply due to unsuitable climates.

The domination of olive oil imports is in line with the latest economic trends, which show that China is becoming one of the main importers of olive oil globally. Today, more than 300 international companies are currently selling olive oil in China, demonstrating the rising interest of olive oil producers in exporting to China. According to a November 2017 report from the , an intergovernmental organization specializing in the olive and olive oil industries, olive oil imports rose by 12,8% during the 2016-2017 crop year (October 1, 2016 to September 30, 2017), despite a worldwide reduction in olive oil consumption. This upward trend primarily applies to the virgin and extra-virgin varieties, which characterize 78% of domestic olive oil imports. The quality of these types of olive oil is often higher than that of olive pomace oil (14%) or refined olive oil (8%) which encouraged its relative dominance in the olive oil market in China (International Olive Council – Market Newsletter No. 107 (July-August 2016).

The olive oil industry in China is not booming yet, but this situation may change in the future. The westernization of food habits and increasing interest in healthy food products in China could catalyze the growth of this promising market. However, the growth of olive oil demand in China is rather nuanced: olive oil is still a considered to be a luxury product in China, and its consumption is very low compared to that of other cooking oils such as soy bean oil and rapeseed oil.

Olive oil marked at 10 times the price of other cooking oils

Olive oil accounting for less than 1% of total cooking oil consumption in China

Olive oil is still very expensive for the average Chinese consumer. While the price of cooking oils such as peanut, soybean, or rapeseed oil varies between ¥10 to ¥20 (or $1,5 to $3) per liter, olive oil pricing is about 10 times higher, reaching ¥100 to ¥200 (or $16 to $32) per liter (Taobao data). One may note that cheaper olive oils with similar prices to other cooking oils also exist in the Chinese market, but these products are usually blended with other oils, and/or genetically modified. Despite the relative expensive price of olive oil, steady economic growth over the past few decades has made the product more accessible to Chinese consumers.

However, despite a growing portion of middle-class families using olive oil in first-tier cities, its consumption still represents less than 1% of the total cooking oil consumption in China. China is a major consumer of cooking oils, but its olive oil consumption is derisory in comparison: only 45,000 tons of olive oils were consumed in China during the 2016-2017 crop year, an amount which is 360 times lower than that of the national favorite, Chinese soybean oil. It is quite evident that olive is not fully integrated into the food culture in China yet. Olive oil is also barely used in the restaurant industry in China when cooking Chinese food.

Infographic created by Daxue Consulting with data gathered from the US Department of Agriculture May 2017 Oilseeds Report, China National Grain & Oils information center(国家粮油中心), and China Industry Information Network (中国产业信息)

As stated in our previous market study on consumer habits, “eating better” is now the largest category for Chinese consumer expenditures, representing about 25% of total individual spending[1]. Food scandals in China as well as cross-cultural influences on food choice have created a growing interest in healthy Western food as well as organic food. Even if there still is a lack of knowledge about olive oil in China, this situation is changing rapidly. According to a customer survey, about 70% of Chinese people are aware that olive oil can be consumed in salads and this percentage is only getting bigger. As the food culture in China changes to adapt to more Western styles, we can expect an increase in the popularity of olive oil as will as higher olive oil distribution in China.

A gift perceived as a healthy product

It is not rare to see the olive oil products presented in a package and stored in the gift section of Chinese supermarkets. Although not currently part of daily consumption habits or commonly used in Chinese food, olive oil is often a popular gift choice. More than 60% of the total olive oil sales in China are intended for gift purposes. Traditionally, imported food products are regarded as great gifts in China, especially when those products are considered to be healthy, like olive oil.

Spanish and Italian products as current market leaders of the olive oil industry in China

Nicholas Tse (谢霆锋), a famous Hong Kong actor, singer, entrepreneur, TV chef and food critic – took part in this advertisement for the olive oil leader Olivoilà. Nicholas Tse animated popular Chinese food shows such as Chef Nic (12道锋味) from 2014- 2015. He currently hosts the show “Celebrity Chef: East VS West” (名廚爭鋒).

Spanish Brands Continue to Dominate the Olive Oil Industry in China Despite Recent Production Slowdown

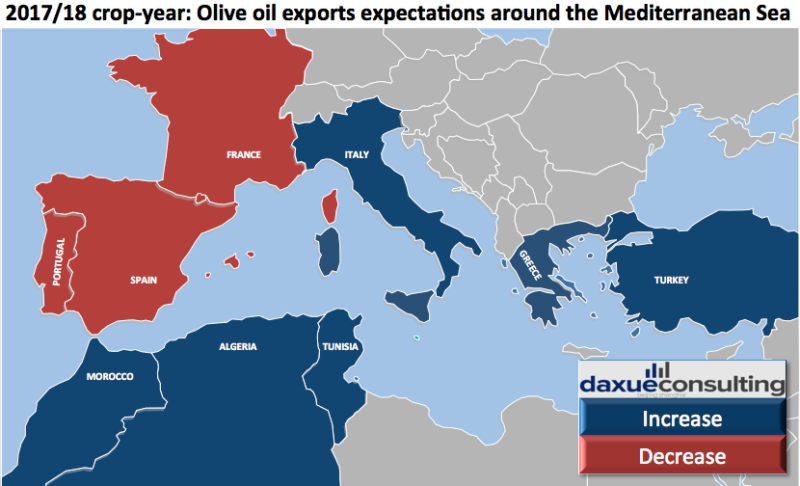

Mediterranean products are becoming more and more popular in China as the Belt and Road initiative continues to go underway. The import and export trade volume between the Mediterranean and China exceeded nearly 150 billion U.S dollars in 2016 alone. Currently, Spanish olive oil producers are still dominating olive oil industry in China. In the beginning of 2017, Spain accounted for 81% of total olive oil imports to China, leading far ahead of Italy (13%), Greece (2%), and a combination of the rest of the exporting countries together including Australia, Tunisia, Morocco, Turkey, or Portugal (4%) (International Olive Council – Market Newsletter No. 113). With an estimated 340 million olive trees, Spain is the world leader in this sector. However, production during the 2017-2018 crop-year will almost certainly decrease due to the attack of a deadly which struck a large portion of the harvest this year. On the other hand, Italian olive oil is becoming more and more prominent in the Chinese market.

Italian olive oil predicted to increase in popularity

Recent years have seen a growing number of Italian restaurants appearing in top-tiers cities. It is no surprise that Italian olive oil producers are looking for new opportunities in the restaurant industry in China, as the number of sales of Italian products to China increased by 18% in 2017, indicating the rising interest of Chinese consumers in Italian food. Olive oil exports have the biggest growth among Italian products in China, with a growth of 41% according to the European Food Agency. In writing his article for Olive oil time, Daniel Dawson interviewed both Daxue Consulting and David Granieri, president of Unaprol, the largest association of olive oil producers in Italy. Granieri noted: “it is essential to promote the culture of conscious consumption of high-quality extra virgin olive oil and develop appropriate marketing strategies to enhance the symbolic product of the Mediterranean diet.”

Moreover, Italy is also the only country in the European Union besides Greece that is predicted to have a rise in olive oil exportations during the 2017-2018 crop year (International Olive Council Production/Consumption/Imports Reports). Aside from the fact that consumers perceive Italian products in China as high-quality, this growth may be in part explained by the increase in favorability of Italian food caused by the “EU-China Tourism year” and from the promotion of the “year of Italian Food in the world”. Apart from olive oil market leader Olivoilà, some other brands already sell Italian olive oil in China such as Colavita(乐家), Farchioni (福奇), and FilippoBerio (翡丽百瑞). Certain Chinese brands even imitate Olivoilà packing on their products, a move that demonstrates the relative success of Italian products in the olive oil industry in China.

European products thus continue to control the market while the Chinese olive oil brands still struggle with establishing themselves and carrying out successful market entry into China. The reason mainly lies in the lack of development of the local industry.

Low domestic production

Chinese domestic production of olive oil remains extremely low; the country accounts for only 0,2% of the world production. China produced only 5.000 tons of olive oil in 2016-2017, compared to the 2.539.000 tons produced globally (International Olive Council Production/Consumption/Imports Reports). In the reports previously cited in this article from the International Olive Council, it was specified that the estimated domestic production of olive oil in China was almost 9 times smaller than its total olive oil consumption in 2016-2017.

Mass production of olives unfeasible in China

One of the main reasons why mass production of olive oil in China is impossible to achieve in China lies in the fact that China does not have the ideal Mediterranean climate for olive oil trees to thrive. Chinese plantations are mostly located in the provinces with arid or subtropical climates such as Gansu (甘肃) or Sichuan (四川). Olive oil producers have discovered some regions that can be adapted for growing olives, but none that are suitable for mass production. The country also lacks arable lands, and 20% of them are considered as polluted. Furthermore, the industry is still very young and lacks industry professionals. Despite having seeded the first olive tree (oleaeuropaea) in 1964, olive oil production in China only started to expand in the 2000s. Today, the industry only counts 15.000 employees in the entire country. Food scandals in China over the past few years, such as the recycled gutter oil scandal, also raised skepticism about Chinese olive oil and contributed to the growth of olive oil imports to China. However, domestic olive oil production does have potential, as some local investments are being made in the main producing areas.

Concentrated Plantations: Gansu province accounts for 80% of the total national production of olive oil

Olive oil plantations in Longnan (陇南市), a prefecture-level city in the southeast of Gansu province (甘肃), account for 80% of the total national production of olive oil. The remaining plantations are located in Sichuan (四川), Shanxi (山西), Jiangxi (江西) and Yunnan (云南) provinces. In order to encourage the local production of olive oil, the Longnan government implemented several supporting policies to provide the infrastructure necessary to develop the local olive oil industry. As such, Longnan pushed the olive oil industry in China forward, improving the local rural economy and increasing average pay for farmers. In total, 10 million yuan was mobilized in 2016 [6] to help the development of the olive industry in Gansu. Funds allocated to the in the Wudu district (武都区) Longnan Olive Research Institute(甘肃省陇南市经济林研究院油橄榄研究所) of Longnan, led to the introduction of 114 new varieties of olives in the region. In addition, the government is facilitating an on-going project to build a 100km olive tree forest along the Bailong River (白龙江) in Gansu province.

Daxue provides expert market analysis, food sensory research, and packaging research for you to gain key insights into the olive oil industry in China

Exporting to China is not as easy as exporting to other countries. In fact, a large number of global companies ultimately failed at realizing a successful market entry into China, mostly due to a lack of understanding about the country. Since the creation of Daxue Consulting in 2009, our specialization on the Chinese market and our deep understanding of China has enabled us to satisfy our previous clients.

Aside from conducting market analysis in China, we also create digital marketing strategies and conduct competitive analysis on existing online competition. Effective digital marketing and branding is imperative to communicating the relative advantage of your olive oil product. Online marketing is usually conducted in two ways: SNS (Social Networking Service) promotion and specially designed website. The majority of successful olive oil brands already sell their products on Chinese e-commerce sites such as Taobao and WeChat. In fact, SNS has become a significant source for people to find information, as the number of active WeChat (微信) accounts exceeds 1 billion, and the number of active Sina-Weibo accounts reached 340 million in 2017.

With regards to the olive oil industry, we also adopt some specific methodologies such as food sensory research in China to evaluate consumer perception of a product. We also conduct in-depth packaging research in China in order to understand how to create the most suitable packaging and designs for distribution in China.

If you are an olive oil producer seeking to invest in the olive oil market in China, Daxue Consulting can provide you with an effective and personalized solution to enter the fiercely the competitive market today. If you have any questions or inquiries, please contact us by sending an email at dx@daxueconsulting.com.

China is considered to be the greatest importer of olive oil in 2013, and this market is now of 100% growth. The International Olive Oil Council reported that China is the one of the biggest markets to grow in the olive oil industry. Indeed, China is a huge market for olive oil, because it has over 9.6 million square kilometers of land and over 1.3 billion people in China who pays more and more attention to their food consumption, raising the number of imported food for Chinese daily’s life.

Since 2006 to 2012 the average proportion of imported olive oil has been keeping the increases nearly 30% per year. Today, the Chinese market is in its adjustment stage along with the Chinese economy and politics, but something is certain is that during the following 3-5 years, the Olive industry will still continue to grow.

Considered as a great nutrition value, olive oil is more and more welcome in China. At present more than 250 brands olive oil are present in Chinese olive oil market, nearly 100% of the import comes import from Greece, Spain, Turkey, Italy, Portugal, Australia and Argentina. The main consumption cities of olive oil are the big cities such as Beijing, Shanghai, Guangzhou, Shenzhen, Tianjin and other second-tier cities.

CHINA OLIVE OIL MARKET: 2016 ANALYSIS

China’s olive industry

China belongs to the semi-tropical climate, and it has found itself some adaptable regions for growing olives, but china’s geographical environment is unsuitable for mass production and a serious lack of olive planting technology and professional and fund are restricting the development of mass olive planting in china.

China belongs to the semi-tropical climate, and it has found itself some adaptable regions for growing olives, but china’s geographical environment is unsuitable for mass production and a serious lack of olive planting technology and professional and fund are restricting the development of mass olive planting in china.

Thanks to the change of Chinese people health consciousness and the improvement of Chinese people standard of living, more and more Chinese people start to appreciate the olive oil and start to buy it. Indeed, advertising may have a huge responsibility for driving the demand of olive oil, bringing up public awareness for the health benefits of this oil, compared to the other types of traditional oil used by the Chinese. Since 2001, the average proportion of import olive oil has been increasing over 70% per year. In 2008, with the Olympics Games in Beijing, the amount of import olive oil will reach 20 000 tons and till 2011 it has reached over 100,000 tons. China is still a booming market for olive oil with a great scale.

With the average of China Customs, China has imported approximately 12.25 million tons of olive oil last year in 2014, and the value of importation of olive oil reached 4.1 million USD. The quantity and the value of olive oil imported from only Spain and Italy reached 60%.

In 2014, 80.9 million of Euros was obtained by Spain from olive oil exportation to China. Thus, China is one of the largest importers of Spanish olive oil, and Spain is the major exporter to China, sharing 57.5% of the market.

Communication in China

Online marketing and branding are an appropriate strategy for the communication of the product. There are principally two ways to develop oil in China online: SNS promotion and specially designed website.

The olive oil brand has to sell their product in Chinese e-commerce with a website in Chinese; currently, the most famous olive oil brand in China are created by retailers.

Social Networking Service or Sites (SNS) has become a significant source for people to find information. At present, many Chinese internet users have Weibo accounts. As established in “2013 Corporate Weibo White Paper“ by Sina and CIC, there are many food product enterprise, that are creating accounts on Sina Weibo. Some of them have opened very professional Weibo accounts.

The Use of Olive oil in China

Olive oil is a healthy oil, this statement is the real significant reason of this product’s reputation. In China, olive oil it is already truly considered as a healthy oil that can help to reduce cholesterol; to prevent cardiovascular disease; delay senility and prevent cancer.

Usually, in China Imported food product is used as a gift, this is the case for olive oil. In China, a good gift must show the respect you have for the gift receiver. A fake or cheap gift is looking, sometimes like a provocation. Imported oil as olive oil is generally a beautiful present with a relatively high price. During special events such as the Chinese New Year, olive oil sales increased and 60% of the sales are for gift purpose.

During the past, when the olive oil just came into the Chinese market, the price was really and it was considered as a luxury item. Today, Chinese people would rather pay more for a healthy and safer food product. Moreover, the price for other oils like peanut oil, one of the favorite oil of the Chinese cuisine, has increased a lot as well, making a smaller price gap.

A good branding is essential to dominate China olive oil market. The rapid growing market has attracted foreign and domestic olive oil producers. Within this fierce competition, the olive oil maker is numerous such as those international brands: Sol Dela Mancha, Colavita, Oro Tikalo, Hojiblanca, that have already taken a large market share and with different strategies. Oils and Foodstuffs Corporation has started its olive oil brand named Soliva which enter the market in both first tier cities and second tier cities.

China olive oil market is undertaking a fast-growing period. In China, it is truly considered as a healthy oil. And with the rise of Chinese income, they are gradually adding this ingredient to their daily cooking.

Contact us at the following mail, dx@daxueconsulting.com or follow us on our social media to get the latest trends of China market!

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about China’s digital ecosystem, see our report on WeChat mini-programs

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast