China’s remote conference tools market analysis

The unexpected coronavirus epidemic has subverted the way many Chinese people work. On the first day of resumption of work on February 3rd, 200 million people used DingTalk (钉钉) to work remotely from home. Due to the excessive number of instantaneous visits, remote conference tools in China such as DingTalk, Tencent Meeting (腾讯会议) and Feishu (飞书) had a surge in growth. The video conferencing market in China was put on the map due to the Coronavirus outbreak when white collar workers had no choice but to work remote for two month’s time

Remote conference tools in China were not always popular. Chinese people prefer to discuss business face to face, as it is important in developing business relationships. However, the epidemic has become a catalyst of the boom of telecommuting market. In the past month, hundreds of millions of workers passively participated in a large-scale social experiment of remote conferencing in China. This experiment had not been strictly planned, but rather hastily entered the battlefield on an unprecedented scale. The participants of the experiment included company managers, white-collar employees and a large number of online office product providers. Now that China’s economy is recovering after COVID-19, the phenomenon also raises a question: how the video conferencing market in China will develop after business returns to normal

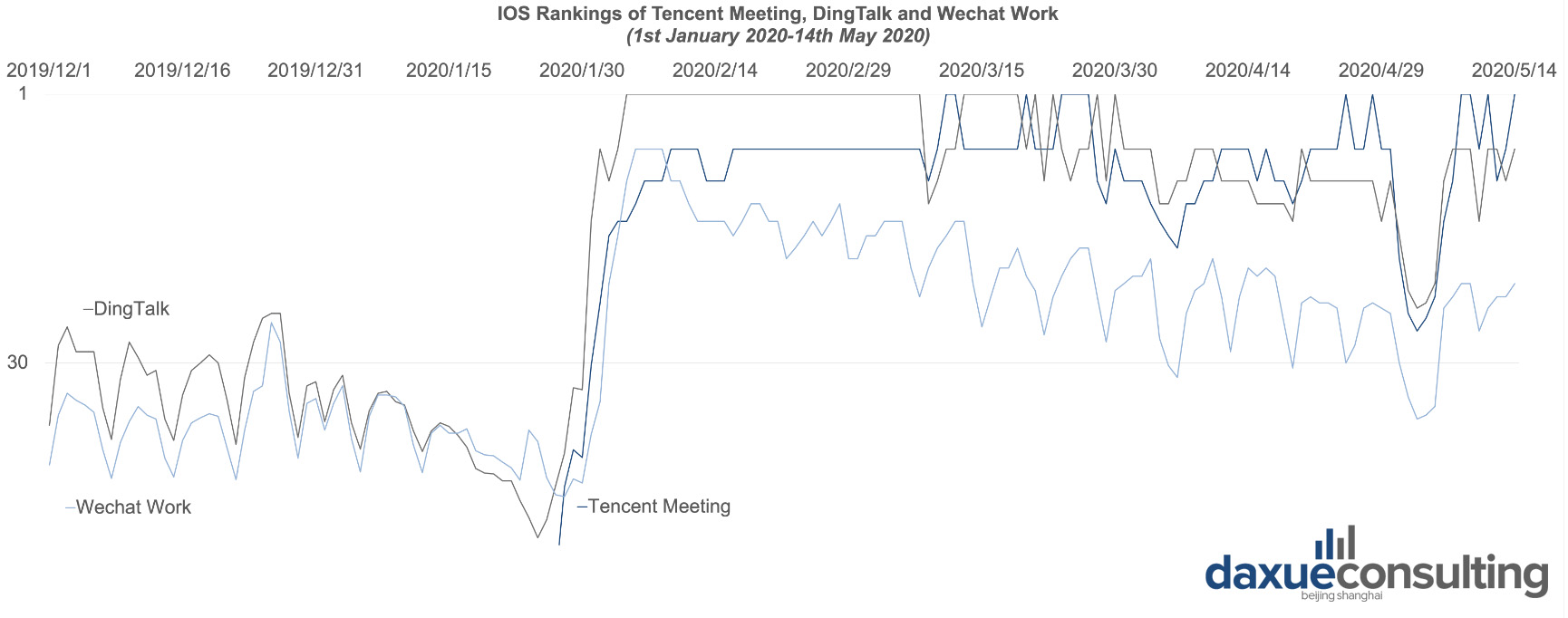

Source: qimai, Chinese Apple Store Rankings for Chinese remote work tools

The concerns of remote conferencing in China

The greatest convenience of remote conference tools is to save time and expenses of commuting and travel. In the past, the average commute time for people work in Beijing and Shanghai was almost one hour. In addition to getting up early to get prepared, they had to get up two hours in advance. After working from home for an extended period of time, most people found that they woke up later, and their working hours were longer.

As business owners or managers are most concerned about efficiency issues, they may wonder if employees still work hard from home. They may ask themselves, do employees oversleep or get easily distracted, and can the progress keep up with the company needs? Therefore, it is important to improve online office efficiency and deliver remote office iteration rules once a week. On the first day of “Cloud Office”, most people felt that work efficiency was low because they all measured the efficiency of remote office based on the thinking of on-site office.

In the traditional Chinese office environment, employees are on-site, punching in at 9 a.m. and leaving at 6 p.m. More so than in western offices, it is important to the manager that employees show their dedication by clocking in long hours. The manager was more able to verify whether the employee has worked at least 8 hours by their naked eyes. Now, the manager has no way to verify that they actually worked for 8 hours since employees are ‘hidden’ through their computers. Therefore, many managers simply believed that employee definitely would not work for 8 hours.

Trust becomes a crucial factor for China’s remote work tools market to develop

Business owners and managers can see that everyone is working hard for 8 hours on-site. Even though, in fact, 8 hours on-site does not mean 8 hours of real work. Although there is no way to monitor at home, it does not mean that the work efficiency is lower than on-site work.

A week after the resumption of work, companies adopted the new project management manner said that remote conference did not affect the efficiency of work. Contrarily, it somehow showed higher efficiency than working on site.

‘Trust’ is the most important thing for Chinese managers. Managers should be able to believe that employees can do the same or better jobs at home than they do in the office. In order to support this kind of trust, the corresponding performance measure methods should also be adjusted. They should shift from time contribution to results oriented. Whether business owners could change their methods about performance measure and develop trust in their employees becomes a crucial factor for the remote conference tools market in China to develop.

Competition among Chinese remote conference tools

In February, when the epidemic prevention and control situation was most tense, the average daily downloads of DingTalk, WeChat Work and Tencent Meeting reached 229,400, 205,600 and 217,800 respectively.

These three Apps have been in the top 10 of the Apple App Store free application rankings since February 4th, corresponding to the high download volume and frequency of use. The video conferencing market in China have been greatly boosted during the epidemic. According to Apple App Store data, the current version update frequency for DingTalk is 2 times per week, WeChat Work 1.5 times per week. Tencent meeting is slightly lower, but it has reached 1.3 times per week as well.

Main functions and features of 3 mainstream remote conference tools in China:

WeChat Work: For office scenarios, WeChat Work currently provides free basic applications, including announcements, punching cards, approvals, reports, schedules, and collaboration tools. The basic operations are the same as WeChat and can exchange information with WeChat.

Source: Zhike, WeChat Work video discussion among employees working remotely during COVID-19

Huawei Cloud WeLink: WeLink is an intelligent work platform that Huawei Cloud launched at the end of 2019. It provides functions such as health check-in, information notification, 1,000-person online collaboration, thousand-person video conferencing, audio knowledge audio, cloud documents, online training, and work reports. It also can connect to large screen, smart camera, cloud printer, NFC and other external hardware devices.

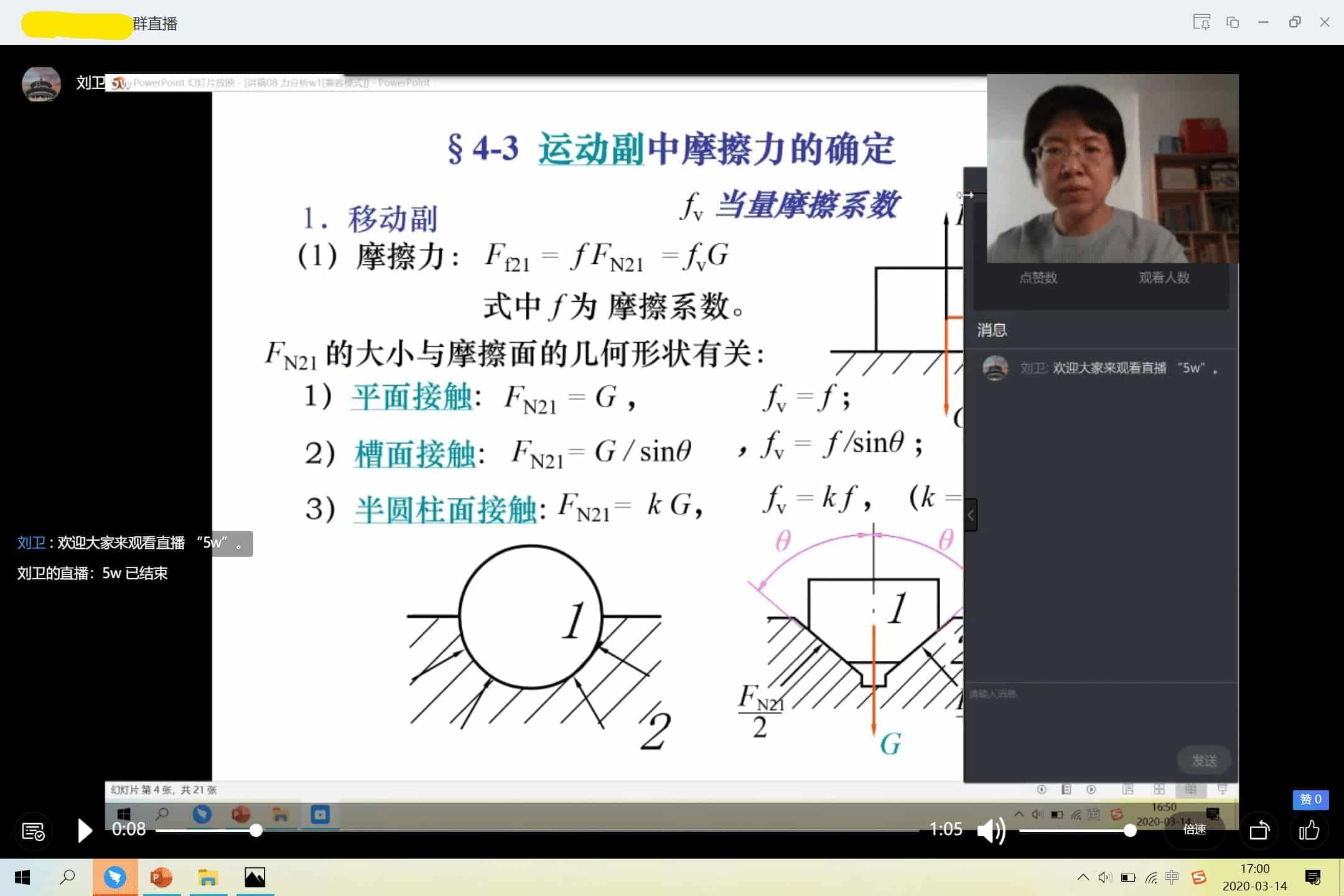

DingTalk: The well-established remote conference tool, which has the functions of employees’ groups, group live broadcast, punching cards, online collaborative documents, nailing approval, and logs. It allows external intelligent hardware, audio and video calls. It provides adaptation solutions for industries such as medical, education, and government.

Source: News.nciae, DingTalk online class

Challenges of Chinese remote conference tools

As the epidemic prevention and control situation has gradually slowed down, more and more enterprises have returned to work on site. Daily activity has become the core KPI of remote conference tools in China. The only way to survive in the remote conference tools market in China is to ensure the amount of daily activity. This is not an easy task. There are three problems to be solved behind the video conferencing market in China.

Challenge #1: Building a tight connection between the office and online

A good remote conference tool requires a tight connection between office scenes and various functions. Therefore, users will not experience the split feeling of switching between different software. This requires remote conference tool innovators in China not only have a product thinking skill but also a platform thinking skill.

WeChat Work is an example of one of the successful remote conference tools in China. The version of WeChat Work 3.0, released on the “2020 WeChat Open Course PRO” in January, not only launches an efficiency package, but also a one-stop video function supporting video and audio calls and micro-documents supporting office collaboration. Wechat Work 3.0 also supports the “session mark” function of information processing, opens 13 types of 390 interfaces covering basic capabilities such as communication, storage, and security.

Source: Zhike, Wechat Work 3.0 switches between different software

Challenge #2: Connecting with external customers

The core essence of remote conference tools is to connect customers externally and continue the business. As WeChat Work can connect with WeChat, WeChat Work users can add WeChat personal users, the two Apps are on different platforms, but they can communicate and connect directly. WeChat Work is the only remote conference tool in China that can achieve the insensible connection of C-end touch.

Source: Zhike, Wechat Work user adds Wechat personal user

Challenge #3: Making remote work tools double as marketing tools

As mentioned above, Chinese remote conferencing tools need to connect customers externally and establish their own private database. This is only the first step for remote conference tools in China to survive and establish barriers to new entrants. In other words, they should establish their own ecological network to achieve a closed marketing loop, which is both remote conference tools and marketing tools.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast