XPENG, or Xiaopeng Motors, is one of the hottest Chinese electric vehicle manufacturers, which gains its popularity from its technological innovations. After surges of Tesla and NIO stocks, two of the most discussed EV brands globally, XPENG’s stock’s exponential growth in November also caught investors and the general public’s attention. Compared to Tesla and NIO, XPENG targets a slightly lower-end market in China, offering 2 EV models ranging from 149,800 to 349,900 RMB.

China’s strict environmental regulations have contributed partially to the popularity of XPENG and Chinese EV industry in general. This rising company was founded in 2014 by former senior executives at the Chinese automobile company GAC Group, Xia Heng and He Tao. As a relatively young company that introduced its first model only in 2018, XPENG’s innovation ability makes it one of the fastest-growing homegrown EV carmakers. The models’ high price-performance ratio and tech-emphasis helps the company build brand loyalty among millennials, especially tech-savvy consumers.

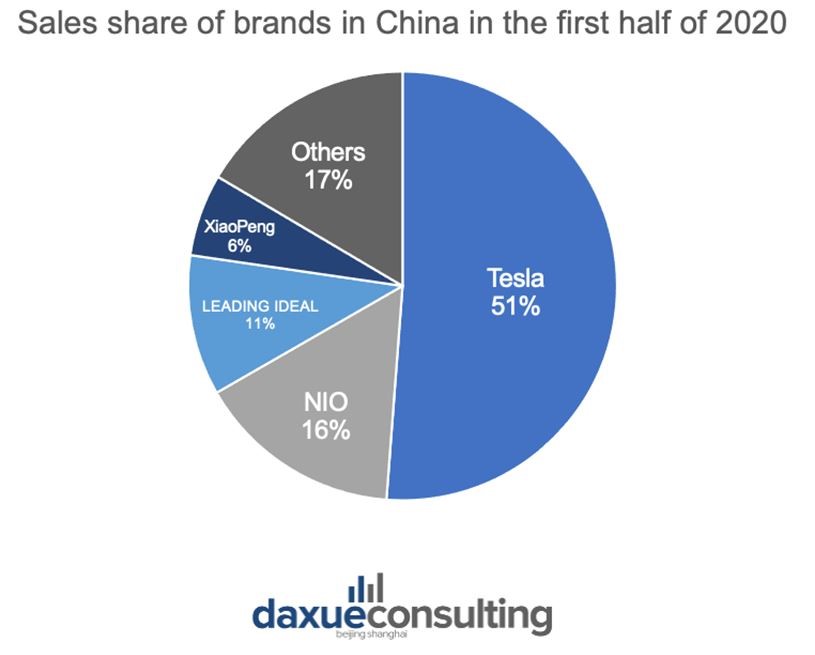

According to GF Securities’ report, in the first half of 2020, XPENG was the fifth biggest EV manufacturer, excluding traditional carmakers like BYD, contributing to 6.2% of the market share. In the fast-growing mid-range EV segment, it was able to gain the third biggest market share. Even though the brand hasn’t created the reputation as NIO has, it’s likely to grow more due to the positive feedback and its successful marketing strategies.

Source: GF Securities, Sales share of Chinese EV new forces in the first half of 2020

An automaker or an internet company?

XPENG’s EVs are marketed as “Intelligent electric cars with Internet DNA,” according to its website. Similar to NIO, XPENG, from the beginning, has been appealing to customers with its “Internet DNA” and R&D emphasis. The company directs a large portion of the resources to R&D. According to the company’s data, “43% of their 3,676 employees work in R&D related areas”, including “leading experts from the Internet, automobile and technology industries.”

In an interview, XPENG CMO Xiong Qingyun summed up that the company’s competitiveness stemmed from “intelligence,” “price-performance ratio,” and “attractive design.” XPENG repeatedly emphasizes that the company does not merely use technology but uses technology intelligently to achieve A human-centered design.

XPILOT

One of the main selling points of XPENG’s models is their advanced driving assistance capabilities. Most of its models are capable of driving assistance functionalities like Automatic Speed Limiting (ASL), Assisted Lane Change (ALC), Adaptive Cruise Control (ACC). The company also has developed an advanced automatic parking system. The official website claims that their Advanced Auto Parking Assistance “covers 70% of parking scenarios” with a success rate of “up to 80%”.

Source: XPENG, XPILOT PARKING

Xmart OS

According to the company’s promotional materials, the models are equipped with Xmart OS, an “In-car Intelligent System.” The system offers features like the AI-powered voice assistant and remote app control.

Voice assistance has gained popularity in the Chinese market, and carmakers have picked up the path to designing more user-friendly and intelligent voice assistance systems. XPENG’s voice assistant, “Xiao P,” is a huge selling point, in fact, the company claimed a “98.6%” voice recognition accuracy. The AI technology allows “Xiao P” to become more familiar with the user over time to provide more accurate and personalized services. Besides, many users find its ability to distinguish the driver’s voice from other passenger’s practical. Overall, owners of the cars have given overwhelmingly positive feedback.

Source: XPENG, Intelligent Cockpit

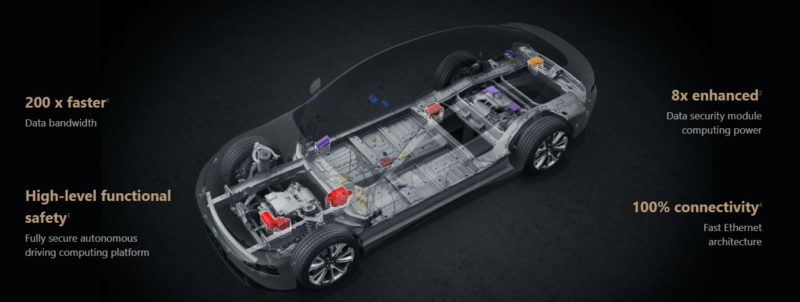

Integration

As Xiong claimed in the interview, XPENG’s in-house designs of most parts of the system, such as driving assistance and voice assistance, allow the automaker to achieve better integration. The approach provides several advantages. The users can navigate with different parts of the system more at ease. For example, the driver can initiate automatic parking through voice command. Furthermore, because of the high degree of integration, the OTA solution will offer users more thorough updates; many owners said that the future improvement of the vehicle through continuous OTA updates is one of the main reasons they chose XPENG.

Source: XPENG, SEPA system (integrated platform)

A peak into the attractiveness of XPENG’s “Internet DNA” from an owner’s feedback

In a post on Zhihu about the comparison between XPENG P7, BYD Han and Model 3, an owner of P7, who is a software engineer in Beijing, shared his experience with P7. One of the main incentives of buying P7 is the company’s continuous and human-centered technological innovation.

Because many Chinese customers prefer foreign brands, homegrown Chinese companies have to change their thinking. They have to show their products’ competitiveness against foreign brands like Tesla, especially for products in the mid-to-high end market. An anecdote from the user’s experience shows XPENG’s ability to do so. He says that “before buying [P7] my parents were surprised that I spent nearly 300,000 RMB on a little-known Chinese-made car, but now they think it’s worth it. My mom even chats with Xiao P from time to time.

He gives positive feedback on P7’s driving assistance features; like many other owners, he is also drawn to XPENG’s “Internet DNA.” He stated, “in terms of smart solutions, P7 has a lot of advantages over the other two, especially in the development of [Its] autopilot system. Nowadays, all the automakers are directing their resources to smart solutions. Still, I think [XPENG] with an Internet background will be more reliable because [XPENG] has expertise in continuous software updates. The traditional automakers don’t have experience in software, and outsourcing is not that reliable.”

Two models: price-performance ratio and futuristic design

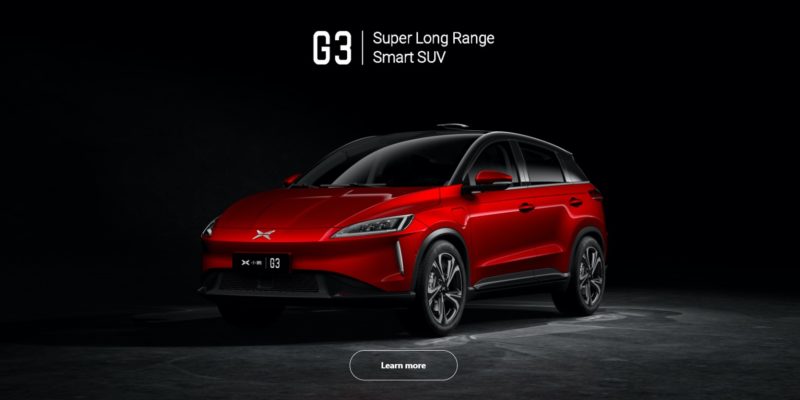

XPENG launched its first vehicle, the G3 SUV, at the end of 2018. The cheapest version of the compact SUV with a 460km NEDC driving range has a price tag of 149,800 RMB, while the most expensive version with a 520 NEDC driving range is 199,800 RMB.

Its direct competitor is BYD’s compact SUV Song Pro EV with a similar price range and driving range. Even though BYD has the advantage of being a more mature automaker, many consumers still chose G3 over Song Pro EV, due to XPENG’s nature as a new-generation EV company. G3’s driving assistant features and the in-car entertainment system of XPENG are considered superior. Additionally, G3 offers a more modern, or “futuristic” interior design according to some.

Source: XPENG, G3 Model

The second vehicle, the P7 sedan, was introduced in mid-2019. The RMD versions have a price range between 229,000 to 276,900 RMB, with NEDC driving ranges from 586km to 706km. The 4MD version has the NEDC driving range of 562km and goes up to 349,900 RMB.

It’s usually compared with BYD’s Han EV and Tesla’s Model 3 as the sub-300,000 RMB sedan choices. Like its Song Pro EV, BYD’s Han EV’s interior is also more old-fashion, although some consider it luxurious. As the most iconic EV manufacturer, Tesla has a significant advantage in its brand value, compared to XPENG. However, the specs of Model 3 versions below 300,000 RMB is much less impressive than versions of P7 with the same price, in the driving range, technology and safety features.

Source: XPENG, P7 Model

XPENG vs. NIO more collaboration than competition

The two models cover the most popular types and segments in the Chinese market, compact SUV and mid-size sedan. The choice of segments allows XPENG to avoid the direct competition against NIO, the more established new generation homegrown EV maker. NIO’s first sedan model, the latest ET7, is unlikely to compete against P7, as with its starting price of 448,000 RMB. Without direct competition, those two, among the new-generation EV makers, can also grow together and even collaborate.

The current collaboration exists in the area of the charging facilities. An extensive charging facility network is essential for the growth of an EV company, enabling its user to have an experience similar to a traditional gasoline-powered vehicle in terms of the ease of refuel. Even though many owners mostly use cars within the city, a car’s ability to complete long journeys is still a significant consideration when purchasing EVs. Many car buyers’ main objection to EVs is their disadvantage when driving long-distance. NIO’s campaign of equipping the Sichuan-Tibet Highway with rapid charging facilities reflects the importance of the size of the charging network in China.

The collaboration between XPENG and NIO Power allows their customers to use the other’s rapid charging facilities in some locations since 2019. Both the companies and users benefit from the collaboration, with a more extensive charging facility network. By allowing the owners to use a vast network, XPENG gains an edge in the competition’s current stage, in which numerous new generation homegrown EV makers compete for market share.

Sources: Geeknev, collaboration between XPENG and NIO Power

Buying cars online: a new normal?

As of November 2020, XPENG had physical locations in more than 50 cities in China. While unlike NIO, which created its physical locations as “clubhouses” to develop a sense of community, XPENG chose to have more Tesla-like physical locations. XPENG adopted innovative approaches to reach more customers, mainly online. XPENG envisions the model of designating the online channels for “Sales + Spare parts” and its physical locations to “Service + Survey.”

The company successfully established e-commerce platforms as its significant sales channel. Its approach to digital marketing and online sales strategies resembles those in entirely unrelated markets. Surprisingly, those digital marketing techniques we see in the cosmetic market also work for an EV manufacturer.

Source: Shou Xi Ying Xiao Guan, XPENG 11/11 advertisement in Shanhai

Two months leading up to 11.11 2020, XPENG collaborated with Tmall to initiate activities like lucky draws to attract attention. At the same time, the company put up advertisements for its 11.11 sale on billboards in major cities. On the day of 11.11, the company even invited celebrities like Hu Ke, and Jin Xing on Taobao live. The campaign was highly successful. XPENG achieved 10,000 orders on November 2nd, the second day of the sales. During the first half an hour on the 11th along, XPENG sold 6,500 cars.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about China’s car market

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast