Yum China holds a pivotal position in China’s F&B industry, being a key player with a diverse portfolio of well-established brands. The company, formerly known as Yum! Brands China Division, became independently listed on the New York Stock Exchange in 2016, under the ticker symbol YUMC, with its headquarters in Shanghai. As of February 8, 2023, the company reported impressive financial performance for the fourth quarter and the full year 2022, with total revenue reaching USD 2.09 billion and USD 9.57 billion, respectively.

In Q3 2023, the group’s total revenue reached USD 2.91 billion, marking a 9% increase from the previous year’s USD 2.68 billion. Despite facing challenges from COVID-19, the company not only achieved quarterly profits but also added 3,800 stores. Over the last three years, it expanded its total stores by 40%, showcasing both resilience and significant growth in the Chinese F&B industry.

Key brands and subsidiaries: the dominance of KFC and Pizza Hut

Yum China’s key brands play a pivotal role in the country’s fast-food landscape. KFC, known for its widespread presence, has firmly established itself as the preferred destination for fried chicken across diverse demographics in China. Meanwhile, Pizza Hut, celebrated for its diverse menu offerings, has carved out a niche as a popular choice for family dining. Beyond these primary brands, the group has actively pursued strategic partnerships and acquisitions, highlighting its dedication to innovation in the ever-evolving Chinese market.

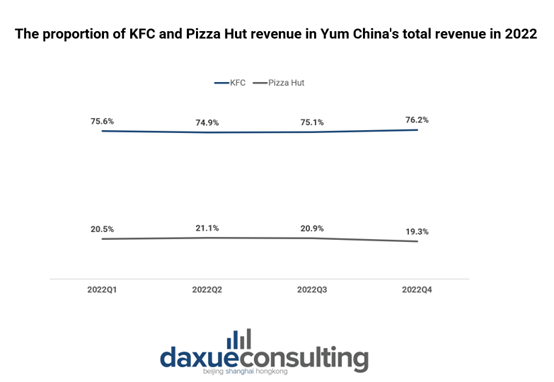

According to the group’s 2022 annual financial performance report, KFC and Pizza Hut collectively contribute over 95% of the company’s revenue. Conversely, the hotpot chain Little Sheep, the restaurant chain Huang Ji Huang, and the Italian coffee brand Lavazza currently contribute only 8.6% to the total revenue. However, their share is steadily increasing.

What are the key success factors for Yum China?

1. Leveraging localization strategy to cater to diverse regional tastes

The F&B giant distinguishes itself through a savvy marketing strategy that smartly embraces local tastes and culture, a key factor in its success. The group, exemplified by its affiliate KFC, skillfully blends Western fast-food concepts with Chinese characteristics, catering to a variety of regional preferences. Notably, KFC has introduced location-specific dishes like the “Old Beijing Chicken Roll” and regional breakfast offerings, showcasing a commitment to tailoring its menu to local tastes. This localization approach, combined with strategic initiatives such as launching exclusive products for the Chinese market, has bolstered the company’s appeal. This adaptability was particularly evident in its resilience during challenging periods like the pandemic.

The success of this strategy is apparent in KFC’s leading market share in China’s Quick Service Restaurant (QSR) market, currently standing at about 13.5%.

2. Digitalization helps deliver convenience to Chinese consumers

Yum China strategically embraces digitalization to enhance convenience for Chinese consumers, with a focus on elevating consumer services and products through WeChat Mini Programs and loyalty programs. For instance, KFC launched its loyalty program in 2016, introducing the KFC Super App, enabling customers to get rewards, make orders, and get delivery in one single platform.

According to Yum’s financial report for Q3 2023, KFC and Pizza Hut’s membership programs collectively boast more than 460 million members, with sales from these members constituting approximately 65% of the total. Accelerated by the pandemic, the company intensified its focus on online ordering and delivery services, expanding third-party delivery platforms to meet consumers’ needs. In 2022, KFC’s “non-dine-in business” accounted for 70% of sales, while Pizza Hut reached 52%.

Furthermore, the group remains at the forefront of technological innovation, as illustrated by the August 2023 launch of the VR game “Bucketverse VR.” This innovative move engages consumers in a virtual KFC world with real-world chicken rewards, effectively attracting younger consumers and tech enthusiasts.

3. Yum China’s CSR initiatives showcase a commitment to sustainability

Yum China, committed to corporate social responsibility (CSR) initiatives that enhance its reputation and align with consumer values, has undertaken significant projects over the years.

In 2008, the group launched the “Donate 1 RMB” project with the China Foundation for Rural Development, aiming to improve nutrition for children in remote areas. As of 2023, the 15-year-old initiative is widely recognized by KFC and Pizza Hut patrons, covering 14 provinces and engaging over 140 million donating consumers, raising RMB 240 million.

Since 2021, KFC has introduced “zero carbon” products with a commitment to offset the entire carbon footprint through tree planting. Recognized as the most sustainable F&B brand in China on consumers’ perceptions in our Green Guilt Report in 2022, KFC aims to offset over 2,500 tons of carbon emissions by the end of 2023 through the creation of carbon-neutral forests in Yunnan and Jiangxi provinces.

Yum China’s commitment to sustainability is further evidenced by its employees participating in over 4 million hours of socially beneficial activities. The company’s sustainability performance received notable recognition, earning the “Top 1% of S&P’s Global ESG Score” in S&P Global’s Sustainability Yearbook 2023. Remarkably, Yum China is the only company in the global restaurant and leisure industry to achieve this distinction.

4. Creating popular “meme culture” on domestic media platforms to create buzz

Yum China’s strategy, particularly in KFC’s content marketing, demonstrates a keen adaptation to Chinese cultural trends. By tapping into the popular “meme culture,” KFC sparks buzz on domestic media platforms, building a stronger connection with its audience. The standout “Crazy Thursday” campaign creatively weaves dramatic messages on social media, delving into themes like suspense, urban vibes, and youth culture. This approach resonates well with the younger crowd, actively engaging them in creating memes and posts. Through this initiative, KFC has not only garnered a significant fan base but has also seen substantial revenue growth. The Q3 2023 results for the group reveal an impressive 40% spike in sales on Thursdays compared to other weekdays, showcasing the evident success of this innovative marketing approach.

Strategic expansion in China: Lavazza’s joint venture with Yum China

In April 2020, the group and the renowned Italian coffee brand Lavazza announced the establishment of a joint venture to operate Lavazza coffee shops in China. Leveraging the group’s extensive experience and understanding of the Chinese market, the partnership aimed to tap into the vast potential of China’s coffee market.

Benefiting from the group’s well-established digital infrastructure in China, Lavazza embraced the digital trend, with approximately 70% of its sales originating from digital orders, and around 37% from delivery services. Innovative initiatives from the group, such as the flexible business district model adjusting delivery ranges based on nearby store operating hours, played a crucial role in maximizing the efficiency of Lavazza’s delivery services.

Moreover, Lavazza diversified its brand through unique collaborations, including the partnership with MiHoYo, a popular Chinese gaming company. Additionally, Lavazza’s sponsorship of the prestigious Rolex Shanghai Masters tennis tournament in 2023 extended its brand presence further, introducing creative products and themed experiences in key cities like Beijing, Shanghai, and Guangzhou. The alliance with Yum China not only provided Lavazza with a solid entry into the Chinese market but also showcased adaptability and creativity in brand promotion, setting it apart from other international coffee giants.

Yum China’s path to success via localization, digitization, and CSR initiatives

- KFC and Pizza Hut collectively contribute over 95% of Yum China’s revenue, and establish the group as a dominant force in China’s F&B industry.

- Yum China’s success lies in smartly localizing its menu, blending Western fast-food concepts with Chinese characteristics, catering to diverse regional tastes.

- The F&B giant strategically embraces digitalization to enhance convenience for Chinese consumers, emphasizing the use of WeChat Mini Programs and loyalty programs.

- The group’s commitment to CSR initiatives, like the “Donate 1 RMB” project, reflects dedication to sustainability, earning recognition as a top performer in global ESG scores.

- Through creative content marketing, particularly in campaigns like “Crazy Thursday,” Yum China’s brands build a strong connection with younger consumers, meanwhile generating substantial revenue growth.