As China’s nightlife industry keeps blooming, dropping by a bar with several friends has become a popular choice. Drinking cocktails, playing dice games while chatting with friends, and listening to live music are typical lifestyles for people in China. Since its initial establishment in the early 2000s, the bar industry in China has quickly gained momentum and prospered – especially among younger generations. During its two decades of existence, the bar industry in China has displayed a rapid increase in market size and a constant evolution of new business models. Up till today, this industry still vaunts a large growth potential and is expected to continue its non-stop transformation on its unique path.

Three most common genres of bars in China

Bars in China consist of three major genres: light bar (清吧), nightclub (夜店), and live house – each having its own characteristics and business models. According to Chen Yin, a professional market analyst in China, in 2020, light bars took up most (82%) of the market in terms of the number of units, due to their lower barriers to entry, whereas the number of nightclubs and live houses was much smaller in comparison – only accounting for 15% and 3% of the market respectively – because of the huge initial investment cost and the time-consuming event organizing routines.

1. Light bar

Light bars in China feature warm atmospheres, elegant and minimalistic interior designs, as well as light background music, with food, alcohol, and other beverages being served. It’s quieter and more suitable for friends who just want to have a conversation.

Average consumption: 50-300 RMB.

2. Nightclub

Nightclubs in China present a more bustling atmosphere, with a spacious dancefloor or stage at the center. A large variety of alcoholic drinks and snacks are served, and consumers are usually charged an entrance fee.

Average consumption: 200-1,000 RMB.

3. Live house

Live houses in China are very similar to light bars, but usually host live performances, such as gigs, poem recitation competitions, stand-up comedy shows, and broadcastings of sporting events.

Average consumption: 50-300 RMB.

Key features of the bar industry in China

Steady increase in the total number of stores, even amid the pandemic

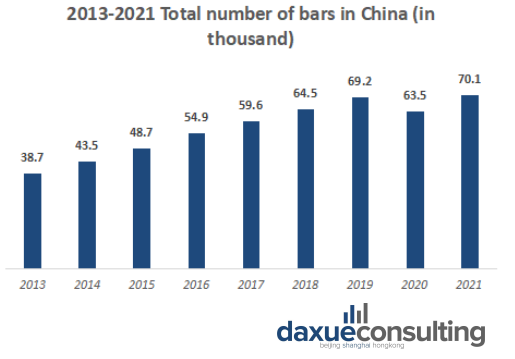

According to a market report by Zhiyan Consulting, the total number of bars in China has been going through a steady growth increase over the recent years. Despite the slight decline due to the pandemic in 2020, the bar industry in China witnessed a quick recovery and regained momentum as the situation gradually got back under control, with the total number of bars surpassing the 70,000 milestone at the end of 2021.

Young consumers are driving the bar industry in China

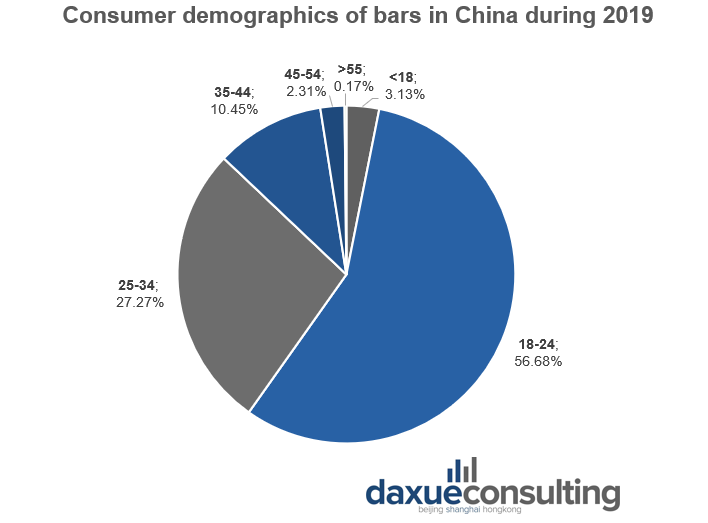

With the increasingly fast pace and heavy pressure in Chinese people’s life, bars have become very popular – especially among young people – as an efficient method to shake off the daily stress. An industry analysis posted on China’s Industry Insights Net (中国产业信息网) in 2019 revealed that bars were most popular among young adults aged between 18-24, who accounted for more than half of the market share. Consumers aged between 25-34 came next, holding 27.27% of the overall market.

Chengdu takes the lead in the number of bars, followed by Shanghai and Beijing

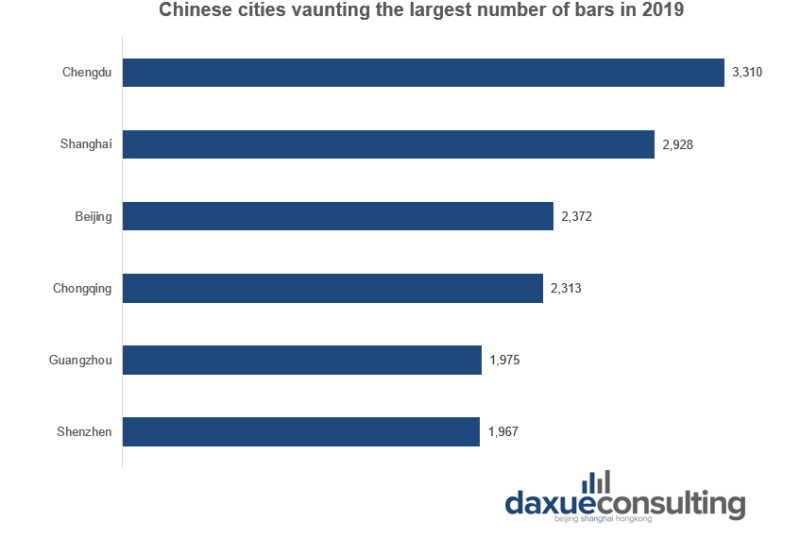

Bars are springing up all over the land of China. Each city has a unique bar culture, with bars in Beijing being wild and unrestrained, those in Shanghai being nostalgic and sentimental, and those in Guangzhou being enthusiastic and zealous. It is worth mentioning that Chengdu, the birthplace of ancient poets’ drinking culture, ranks first in terms of the number of bars (3,310 stores), followed by Shanghai and Beijing, counting about 2,928 and 2,372 stores respectively.

The bar industry in China is undergoing a non-stop transformation on a unique path

An interesting phenomenon is that the development of the bar industry in China is taking quite a unique path. According to Christopher Lowder, an experienced bartender in China, originally, Chinese bars were designed and operated in heavy reference to international flagships like PDT, Angel’s Share, or their Japanese Ginza counterparts, resulting in the initial incorporation of many western elements into their business models. However, since Facebook, Google, and most western websites are blocked in the country, China’s bar market largely lacks global interactions. Most of what happens in China stays in China, confined to China’s insulated Internet servers. Because of this partial isolation from the world, the bar industry in China can now develop its own features and march on a unique path, despite all similarities between Chinese and western bars.

Digitization and online marketing as key tools for succeeding

As a result of the ongoing pandemic and the expanding popularity of online sales channels, the bar industry in China has begun to proactively leverage online platforms and e-commerce strategies, which makes China’s bars hardly recognizable to the western public. Professionally photographed alcoholic drinks are beautifully featured on digital menus accessible via consumers’ mobile payment apps. Groups of excited young consumers can browse through vivid menus, being prompted to try new drinks based on last week’s selections, scroll until they find the right drink for them, then scan the QR code, pay immediately via Wechat, and earn points on their digital membership card. Also, bars are publishing virtual cocktail-making courses and unboxing videos of alcoholic drinks as a means to maintain engagement with consumers. Thereby, consumers will keep their brand and products in mind even though they cannot drop by the store in person.

Win a competitive advantage via collaborations

Nowadays, collaborations between bar chains and local alcohol suppliers have also been a widely adopted business model in China since it helps both sides to increase customer base and profitability. A good example of such synergy is the collaboration between “Wann” (a Shenzhen bar brand) and its local suppliers in 2020. They established a gallery – “alcohol lovers’ paradise”- featuring a deep long alley with a retro-style interior design, a collection of high-end alcohols, as well as the red and soft lighting – to create an immersive experience for alcohol consumers in line with the brand message of “enjoy the quietness of a bar”. The success of this campaign put Wann onto Weibo top search in no time, with the top trending tags being “social needs”, “quiet conversation” and “appreciate the bar environment”.

Riding the gift box frenzy in China

Another sales strategy that proved efficient is selling cocktails bundles in gift boxes with themed decorations on the outside. According to consumers’ comments on Weibo, this kind of product is especially popular on Zoom meetings, team-building activities, and non-profit fundraising events. In January 2022, the Barcelona Football Club, in collaboration with WAT (a famous cocktail brand based in Taiwan, China), launched a limited-edition cocktail gift box series that went viral and received compliments for perfectly combining cocktails with sports culture. The label of the cocktail bottles was designed after Barcelona Football Team’s red-blue sports uniforms, with a unique number on each bottle, referring to each unique football player. Moreover, cocktail bottles in the box were lined in the “4-3-3 formation”, a classic football match formation of the Catalan team.

Two trends bound to reshape the bar industry in China

Izakayas are gaining popularity

Izakaya (Japanese drinking place, 居酒屋), a type of informal Japanese bar that serves alcoholic drinks, dishes and snacks, is undeniably the new theme for this decade. It is positioned as a casual occasion for after-work drinking. Unlike most fancy and loud bars located in central business districts for people to get drunk, Izakaya bars are normally built alongside residential districts, catering to the basic night-time entertainment and social needs of the Chinese working population so that they no longer have to spend a lot of time commuting and come back home late. While it is true that the modestly designed Izakaya bars cannot catch up with the high-end ones either in transformation or innovation, they can capture their own market segment by targeting regular consumers living close by and offering a much cheaper price.

Famous beverage brands are expanding into the bar industry in China

Cross-industry alcohol sale from beverage brands is another visible future trend in the bar industry in China. In January 2019, Nayuki (奈雪), a Chinese tea brand with drinks that featured a creative mix of tea leaves, fresh milk, and fruit, established its first “Nayuki bar house” in Shenzhen, selling cocktails with beautiful colors mostly to female customers aged between 20-35. In August 2019, Starbucks also opened up its first “Mixato bar house” in Beijing, releasing a brand new series of beverage products that combined coffee with alcohol. By implementing a cross-industry alcohol sales strategy, beverage brands can effectively diversify their products, inject a sense of freshness into their brand image, as well as side-step the intense competition within the beverage industry in China.

What to bear in mind about the bar industry in China

- Bars in China are classified into three major categories – light bars, nightclubs, and live houses – each having its own characteristics.

- The bar industry in China has been growing and prospering since its initial introduction. Going to the bar is especially popular among the youngsters in China, and the bar culture is more intense in first-tier cities such as Chengdu, Beijing, and Shanghai.

- The bar industry in China is marching on a unique path. Chinese bars tend to provide different services from their western counterparts, such as providing digital services, selling creative cocktail gift boxes, and collaborating with local suppliers for marketing campaigns.

- Izakaya and cross-industry alcohol sales will be the focus of the future transformation of the bar industry in China.