Chinese consumers’ appetite for technology and customized recommendations, along with the rapid development of the lazy economy and the rise of the Gen-Z, is inducing more and more beauty brands to invest in at-home beauty devices. This has led to a rapid boom in the market for at-home beauty devices in China.

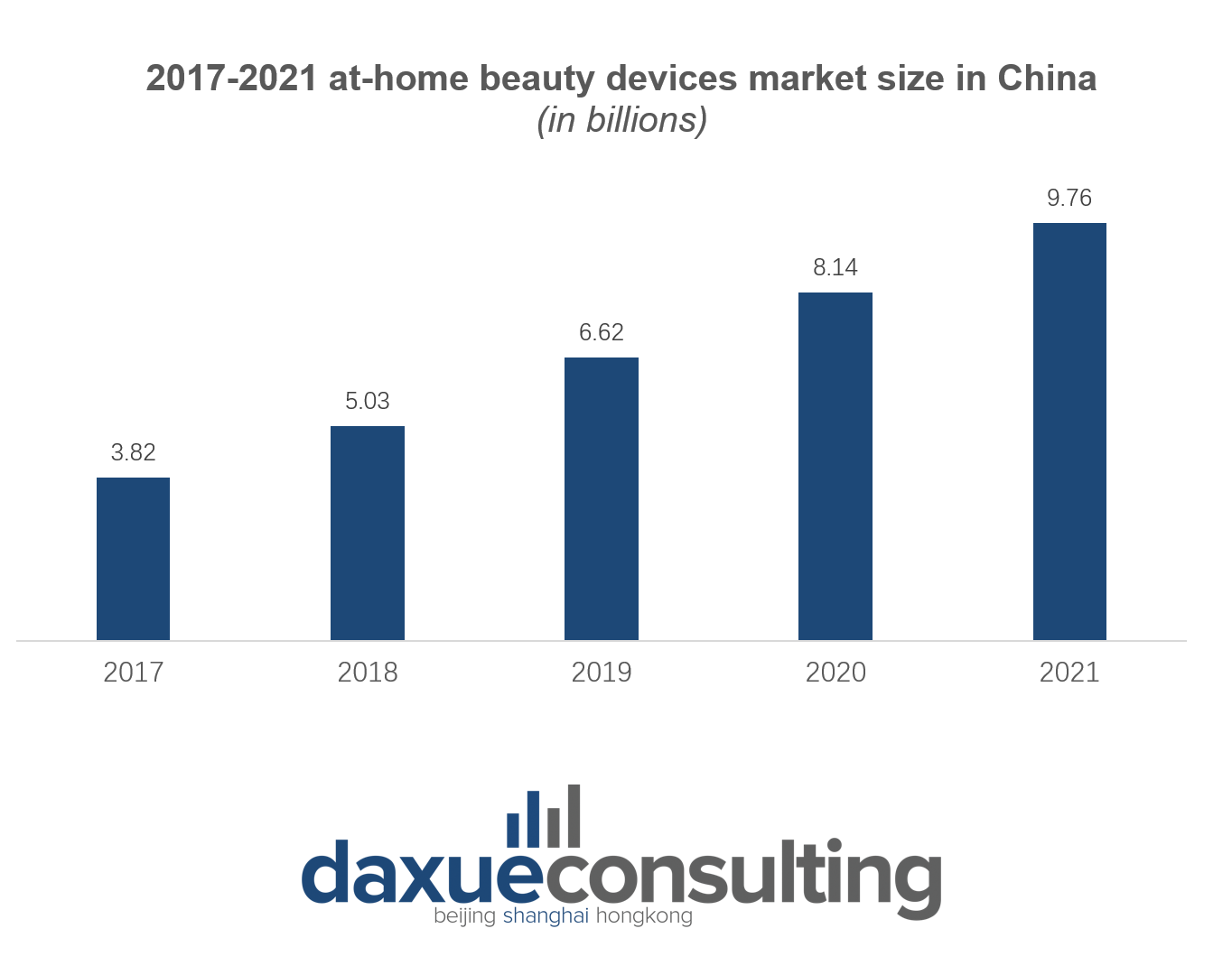

During the pandemic, Chinese consumers experimented with new ways to take care of their skin and beauty needs without needing to leave home. The at-home beauty devices market in China jumped from 2 billion RMB (290 million USD) in 2014 to 9.76 billion RMB (1.3 billion USD) in 2021, and it is expected to exceed 20 billion RMB (2.91 billion USD) by 2026. Among such tools, anti-aging devices were the most popular ones in 2020, especially those using radio frequency technology.

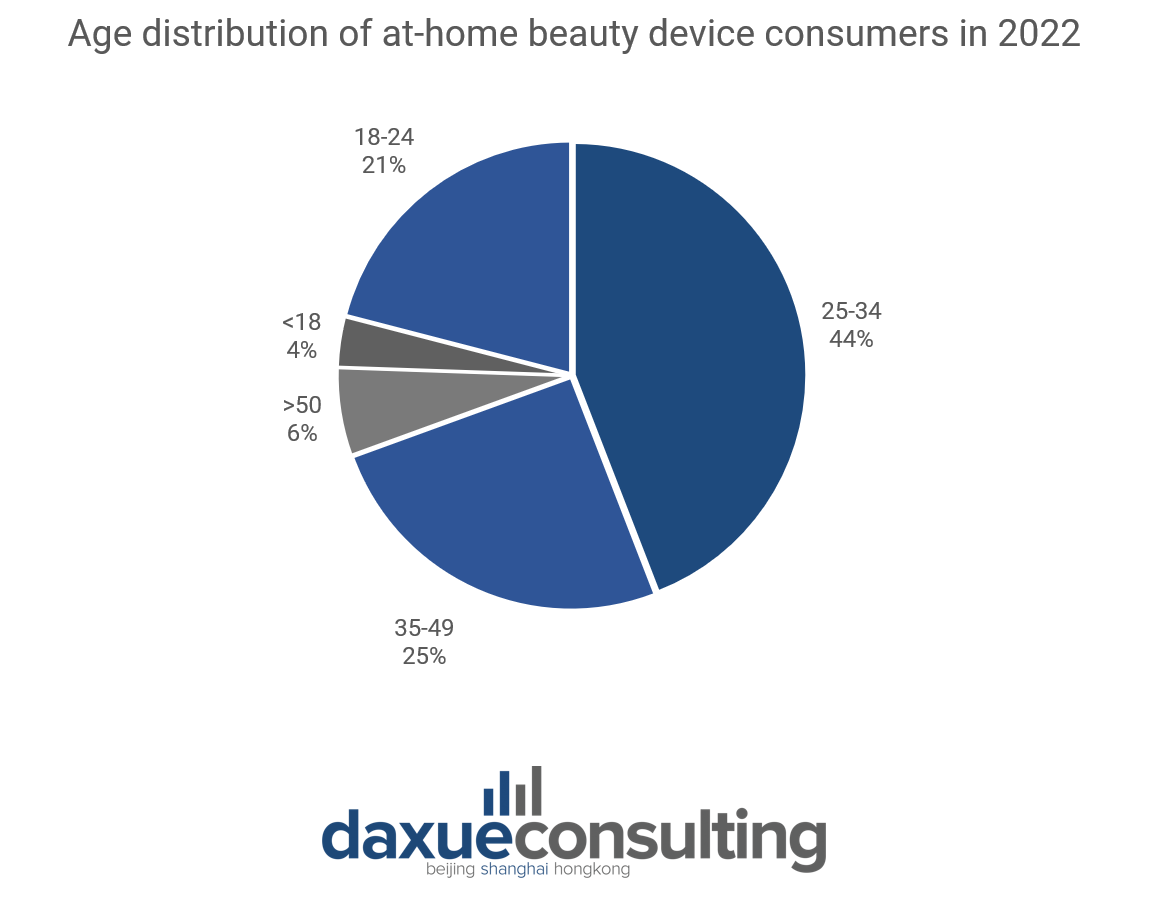

Chinese young adults are the key consumers of the beauty device market in China

In 2022, young adults (25-34) accounted for the largest segment (44%) of beauty devices consumers in China. This is because Chinese millennials and Gen Zs are placing greater emphasis on skincare and overall appearance, opting for not only traditional methods such as anti-aging creams and cosmetics, but also beauty devices. In particular, young women with a growing demand for anti-aging products are the main consumers of beauty devices in China. However, it is important not to overlook the significant growth potential among male consumers, who are also showing a rising interest in beauty devices.

Domestic beauty device brands dominate the market

Compared to Japan, the United States, and the European Union, China’s beauty device industry started relatively late. Between 2012 and 2015, the Chinese beauty device industry witnessed a significant influx of overseas brands entering the market, supported by increased attention from the capital market. This influx and investment played a crucial role in driving the growth of the industry in China.

Japanese brands Yaman and ReFa, as well as the Israeli brand TriPollar are among the most renowned beauty device brands in China. Nevertheless, many beauty giants are tapping into the at-home beauty gadgets market as well. For instance, Dior partnered with the French lighting company Lucibel to create an innovative LED beauty mask. The mask utilizes Lucibel’s LED photobiomodulation to stimulate and regenerate cells. L’Oréal affiliate Lancôme has launched its first beauty device too: an anti-aging tool leveraging LED technology to reduce the appearance of wrinkles and fine lines.

However, there are domestic beauty device brands who dominate the market nowadays. As of February 2023, based on the data from the data analytics platform Feigua, the top three beauty device brands in terms of market share were AMIRO, NOWMI, and Jmoon, all of which are domestic brands. AMIRO, the leading brand, held a substantial market share of 20.96%. Furthermore, among the top ten brands, seven were domestic. This trend of domestic brands giving tough competition to their foreign counterparts has also been observed in the broader beauty industry. Many domestic brands excel in offering cost-effective solutions and attract consumers with competitive pricing strategies.

Domestic brands succeed with the leverage of KOC marketing

Domestic top beauty device brands like AMIRO, NOWMI and Jmoon are experiencing rapid growth thanks to their effective use of KOC marketing. These brands have successfully reached a larger audience through the extensive utilization of short videos and livestreaming. For example, the sales volume of beauty devices on Douyin, a livestreaming e-commerce platform, reached 3.3 billion RMB in 2022, with a year-on-year rise of 102.22%.

The direct-to-consumer model has proved to be still effective today. Starting from 2020, AMIRO, known for its innovative products such as smart makeup mirrors, hair removers, and phototherapy mask beauty containers, heavily invested in short videos and livestreaming. This strategic move allowed the brand to stand out in the highly competitive market and achieve the top rank on Douyin’s beauty device list in 2022, with annual sales surpassing 900 million RMB.

Higher entry barriers for the beauty device market in China

In March 2022, the National Medical Products Administration released new guidelines regarding the Medical Device Classification Catalogue. These regulations impose stricter requirements on enterprises selling beauty devices. The new regulations, stipulate that such enterprises must undergo testing at approved institutions, conduct clinical trials at 2-3 registered medical device clinical trial institutions, and subsequently apply for registration with the National Medical Products Administration. However, the whole application process may take up to 3-4 years. Clinical trials alone can be as long as 1-2 years and cost several million RMB. Consequently, the entry threshold for the beauty device industry has significantly increased.

Furthermore, the new regulations not only impact on manufacturing enterprises, but also affect KOLs or KOCs engaged in live broadcast advertising. Before advertising beauty devices, Chinese influencers now need to be examined by relevant departments and hold specific beauty device business licenses.

A glimpse into the latest trends in the beauty device market in China

- The beauty device market in China is booming, due to Chinese consumers’ appetite for technology and customized recommendations, along with the rapid development of the lazy economy and the rise of the Gen-Z.

- Young female groups are the main consumers of beauty devices in China. Nevertheless, the male consumers of beauty devices have great development potential and should not be overlooked.

- Local brands like AMIRO, NOWMI, and Jmoon have emerged as dominant forces in the Chinese beauty market, surpassing the initial dominance of foreign brands.

- KOC marketing is a key factor in the success of domestic beauty device brands by generating buzz on the internet and expanding their customer reach.

- The release of new regulations in March 2022 has raised the entry barriers for China’s beauty device market, imposing stricter requirements on manufacturers and influencers.

Author: Lyu Ai

Download our white paper on China’s beauty industry