What is the consumer-to-manufacturer (C2M) model?

The founder of the Chinese e-commerce site Biyao, Bi Sheng was first to propose the C2M model in China. The C2M model is when consumers connect directly to manufacturers to purchase a product. In the C2M model, consumers place orders directly through the platform, and the factory receives consumers’ personalized orders.

The C2M model short-circuits all intermediate links, such as inventory, logistics, general sales, and distribution. It cuts off all unnecessary costs, allowing users to buy ultra-high-quality products at ultra-low prices.

A major point of the C2M model is that it produces on demand. The user places an order first, and then the factory produces it. There is no inventory-sales ratio, which eliminates chronic inventory problems. The defining feature of a C2M model is highly competitive pricing brought about by connecting factories with consumer insights, such as preferences, location, and behaviors.

Victor Tseng, vice-president of corporate development at Pinduoduo said that “C2M is essentially evolving traditional manufacturing from an R&D and marketing-driven process into a consumer-driven process”.

Biyao – first C2M platform in China

A C2M model Chinese e-commerce platform, Biyao, started in July 2015. This is the first application of the C2M model in China’s e-commerce. This platform includes a number of companies in the automobile, home furnishing, clothing, eyewear and related industries.

After the user places an order on the platform, the order will be directly sent back to the factory. Then, the factory produces and delivers the order. E-commerce platforms can use big data to get customer group portraits and analyze consumption characteristics. It helps manufacturers to select products, transform processes and reduce inventory pressure.

Source: iResearch, Biyao C2M platform

Advantages of C2M model

First of all, C2M model realizes the direct connection between the user and the factory, removes all intermediate links, which increases the price. It also connects designers and manufacturers, and provides users with “big brand quality, factory price” products.

For consumers, the C2M model emphasizes user-centricity and organizes production according to users’ individual needs.

For manufacturing companies, the C2M model improves productivity and promotes the transformation of enterprise production lines, supply chains and internal management systems.

C2M in China as a driver of e-commerce

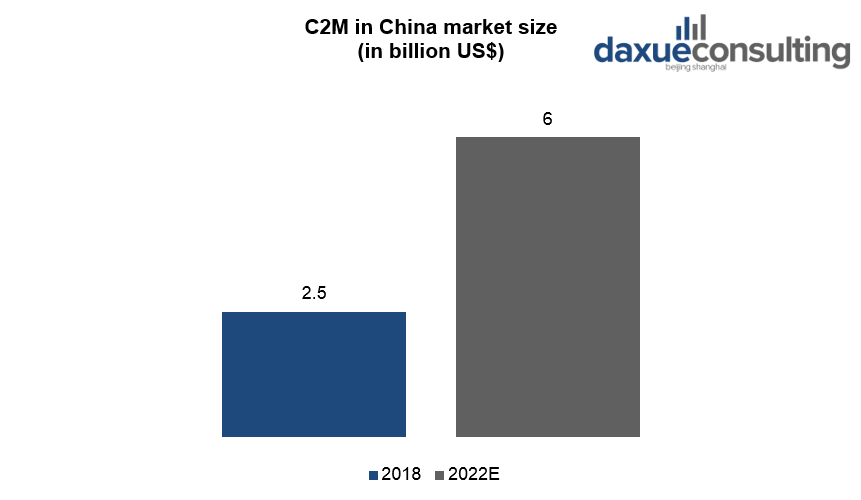

C2M in China is a new driver in the e-commerce landscape. In 2019, $420 million worth of C2M-related bookings and sales were made in a single day during China’s Double Twelve shopping day. According to data from iResearch, this figure reached $2.5 billion in 2018. Forecast shows it will reach $6 billion by 2022, which includes a compound annual growth rate of 24.4 percent. Though still a small percentage of China’s total e-commerce market, it’s a model that crucially enables brands to better address issues of inventory and supply chain efficiency. C2M is another indicator that brands which fail to listen to consumers on product preferences will miss a trick.

Data Source: iResearch, C2M in China market size

Big data and AI in China push the development of C2M in China

Companies like Alibaba and JD.com have both been utilizing C2M in China. JD.com, for example, has been testing the C2M model since 2017. The company launched its fashion technology research institute in 2018 to explore the application of AI, VR/AR in China, as well as big data.

Through the application of AI-powered data analytics, online retailers, consumer brands, and AI companies are jointly making mass-customization possible in China. The key for C2M is to connect consumers and manufacturers through data and computational infrastructure.

Young generation in China – the key users of C2M e-commerce platforms

Chinese millennials have diversified needs, while user channels have significant segmentation. They include a host of online marketplace platforms such as Taobao, Pinduoduo, and Douyin.

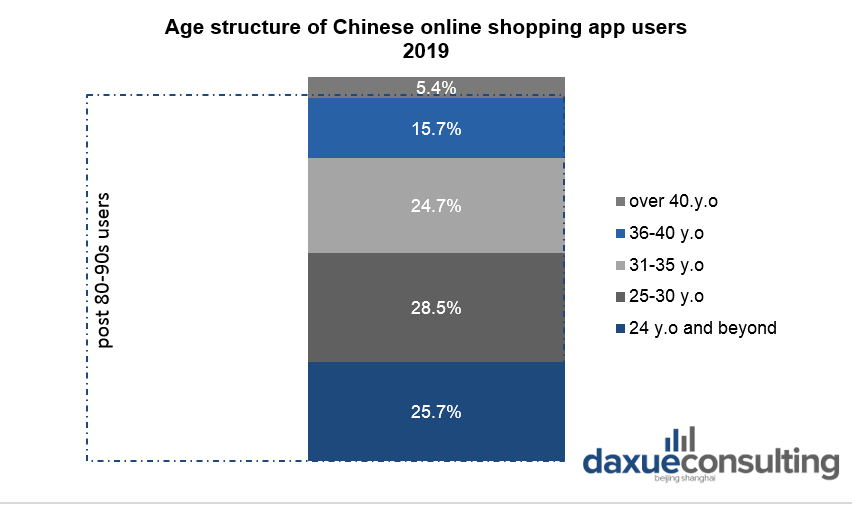

Customization options for consumers were previously costly and limited to luxury product categories. In the current e-commerce industry, the post-80s and post-90s generation is the key consumer group. The younger consumer groups have a stronger demand for product customization. C2M caters to the needs of personalized and differentiated products that young consumers pursued.

Data Source: iResearch, Age structure of Chinese online shopping app users 2019

Key e-commerce players in the Chinese market use C2M marketing

Pinduoduo is gaining popularity among Chinese consumers

Pinduoduo (拼多多) is an e-commerce platform that allows users to participate in group-buying deals. Using the app is simple, the consumer can buy a full price item or get a discount if they invite other people to participate in the purchase. After paying, there are many ways to invite friends, not only through WeChat, but also with QQ, QR code, image, or with a voice recording. In the end, they ship the discounted order when the required number of people purchase it.

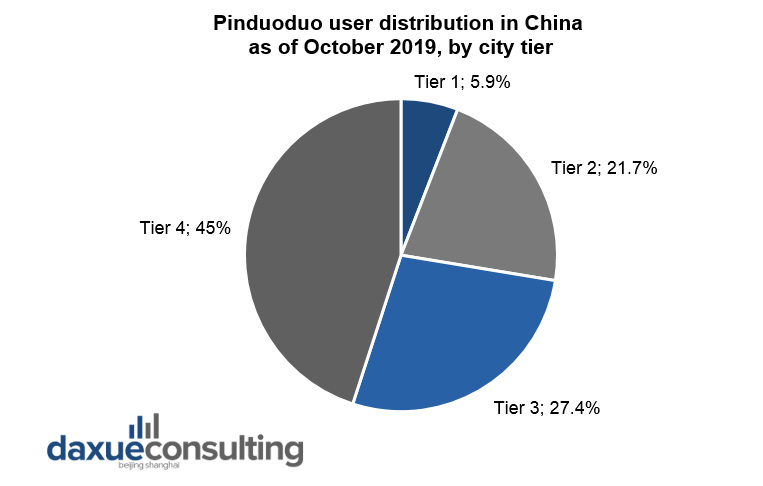

It is especially popular in third and fourth-tier cities. More than 65% of users come from third-tier cities, while only 5.9% come from first-tier cities. Unlike other e-commerce apps such as JD.com or Taobao, it has decided to focus on small towns. This policy has made it possible to attract low-income families to the App. We can make a conclusion that people in the third and fourth-tier cities are more likely to use the C2M model.

Data Source: Statista, Pinduoduo user distribution in China as of October 2019, by city tier

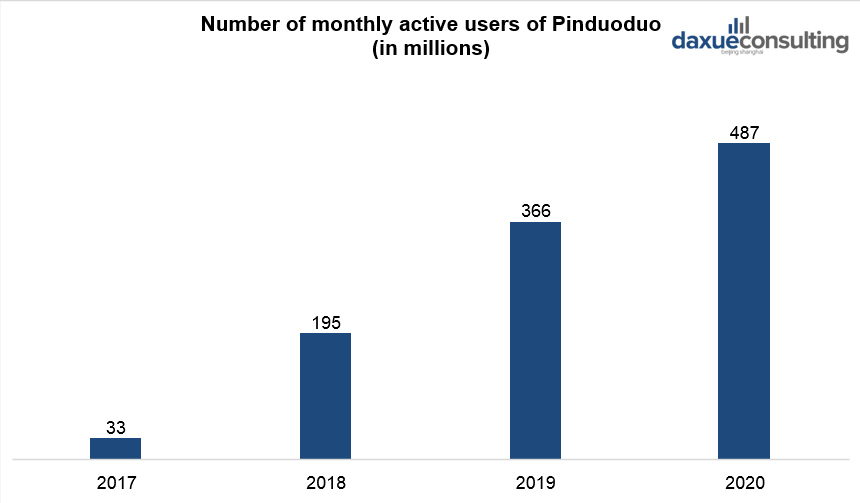

In June 2018, less than three years after the launch, Pinduoduo’s monthly active users reached 195 million people. In 2020, 487 million shoppers use Pinduoduo for their online purchases every month. In addition, many international brands such as Huawei and Apple have launched their single-brand stores on the platform, further consolidating the company’s credibility.

Data Source: Statista, Number of monthly active users of Pinduoduo

Jiaweishi case

Shenzhen’s Jiaweishi is a manufacturer of brand-name consumer goods, including Philips and Whirlpool. In 2018, they established their own brand of robot vacuum cleaners. When they started selling online through Pinduoduo’s “New Brand Initiative” program, they got direct access to huge buyer traffic.

Following the success of the initial sales of the original robot vacuum, Jiaweishi is now able to greatly improve their product and further increase sales. Based on the data collected from Pinduoduo, the robot vacuum’s randomized cleaning route to a more orderly one. Besides, Jiaweishi redesigned product’s appearance to make it more appealing to consumers.

They also addressed consumer concerns with regards to the quality of an unknown brand’s product via live streaming videos. These live streams make the manufacturing process transparent to consumers, while simultaneously spreading Jiaweishi’s brand name.

The advantages of using Pinduoduo for manufacturers

E-commerce giant Pinduoduo has been able to tell manufacturers not only how to customize in great detail, but has also been able to advise on packaging redesigning and price point setting.

Pinduoduo saw the launch of 106 manufacturer-owned brands last year and is aiming to establish 1,000 more. Even automakers are engaging with C2M firms amid a prolonged slump in sales. Pinduoduo held a team purchase promotion with car dealers during the Double Eleven shopping festival in 2019. Some 3,100 cars from five major auto brands were sold in just nine hours. Carmakers were able to gain an insight into demand and better predict consumers’ intent to purchase. This could help them optimize manufacturing and save money at multiple stages, and these savings could trickle down to consumers.

JD.com enters C2M in China

JD.com rolled out its C2M unit Jingzao in 2018. The platform now offers products including custom shirts, luggage, towels, and bedding. Moreover, JD partnered with electronic brands such as Lenovo, Konka, HP, and Dell to develop tailored products under the C2M model.

In 2020 JD.com has signed a partnership with South Korean manufacturer LG Electronics to sell RMB 5 billion ($707 million) worth of products on the e-commerce platform. Under the partnership, the two companies will cooperate in a range of areas, including product development under the C2M model. The two companies have already worked under the C2M model for small home appliances. In May 2018, they started to develop C2M air purifiers, beauty tools, hand-held vacuum cleaners, and clothing care steam “styler” systems based on JD.com data.

Besides, in 2020, the Italian designer brand Sergio Rossi co-designed a new product based on JD’s big data analysis of customer preferences. The new product is a short boot (a style quite popular with JD customers) that features the brands’ recognizable Icona logo.

Alibaba launches C2M in China through Taobao

In March, Alibaba launched a new app on Taobao called Special Offers, which works with factories to create C2M products. Its goal over the next three years is to help 1000 industries build ‘super’ factories that can directly supply customers. By 2020, more than 500,000 factories and 1.2 million production-capable suppliers in China have signed up to the platform. Chinese apparel, sportswear, and fashion companies, such as Anta and Bosideng Group, have signed up for the app and opened authorized stores online. Bosideng already collects and shares information through enterprise resource planning that helps them penetrate consumer preferences and consumption habits.

Backed by Alibaba’s AI algorithms and cloud technologies, the C2M team was able to offer real-time analytics. It helps companies to respond to changing consumption trends and identify new growth points.

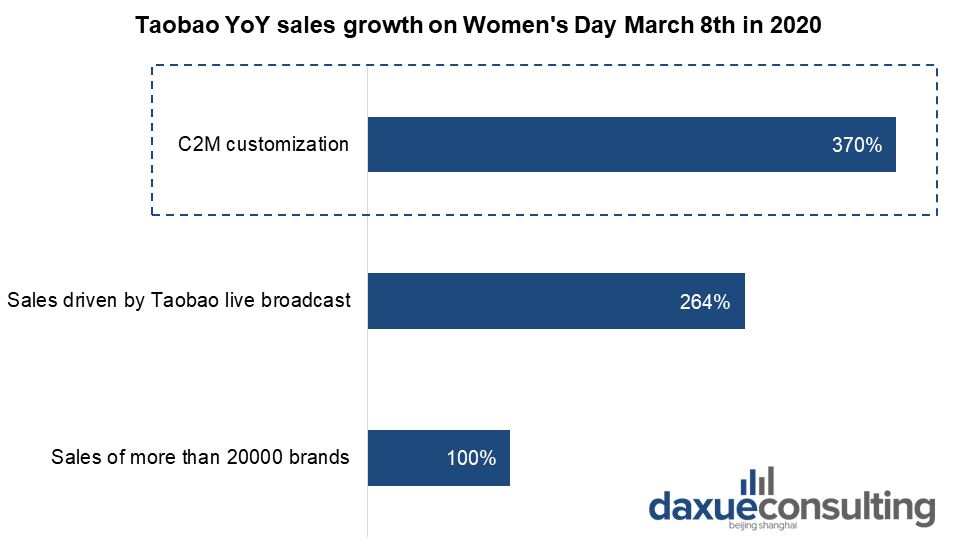

Data Source: Taobao, Taobao YoY sales growth on Women’s Day 2020

Odis case

Odis started producing car-cleaning products that consumers wanted and needed. These included portable sanitizing sprays containing at least 75% alcohol. In 2002, with the help of Alibaba, Odis was able to adjust its production lines in three days to create these items. The process would have taken Odis three months to complete on its own, said the factory. Based on analyses of consumer preferences, the factory also started making their sprays in plastic bottles instead of aluminum cans.

“Alibaba’s C2M team worked with us throughout the entire product-development process. We had a clear roadmap of exactly what consumers wanted and how many units they needed,” said Qu, Odis’s general manager.

To bring consumers closer to their products, Odis leveraged Alibaba’s digital ecosystem and organized a campaign on Tmall. It allowed consumers to pre-order the sanitizers in China before production kicked off. They sold more than 200,000 bottles of the spray within 24 hours. Alibaba also created a new section for car-sanitization solutions across its online marketplaces.

Thanks to the C2M team’s efforts, online sales accounted for more than 90% of Odis’ revenue during the pandemic. When the coronavirus spread overseas, Odis’ clients in other countries also started showing interest in the product. Since March 2020, the factory has sold close to 30 million more bottles overseas.

Prospects of C2M marketing in China

C2M model gains momentum during COVID-19 outbreak

First the US-China trade spats hit China’s huge manufacturing base with delays and uncertain revenue, which was then followed by the COVID-19 pandemic. Demand plummeted both domestically and overseas. The C2M model proved especially crucial during the COVID-19 outbreak in China. Factories across China had to halt production. Even when operations resumed, manufacturers have struggled to generate pre-pandemic levels of business.

When many of China’s brick-and-mortar factories found their production and sales channels disrupted during the Covid-19 crisis, digitization of operations became a new lifeline for survival. China’s e-commerce platforms are able to use their massive databanks of consumer behavior and algorithms to analyze and predict what China’s factories should make to respond to demand.

C2M will benefit in the long run

The move to C2M will benefit manufacturers in the long run. Firstly, it makes them more flexible in times of crises, by pivoting online and selling directly to users. Secondly, factories can also save an average of 20%-30% in production costs. The model has huge potential in China’s lower-tier cities. According to a study by Morgan Stanley, these consumers are in search of bargains but are also increasingly willing to pay more for things of higher quality. Getting factories to embrace the C2M model, however, is not without its difficulties. Manufacturers need to be open to engaging with every step of production in order to succeed.

Author: Valeriia Mikhailova

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast