The market size of the catering industry in China presents a steady growth from 2015 to 2019 but experienced a sharp decline in 2020 because of the pandemic. By the end of 2020, there were 6.53 million catering companies in China, a year-on-year decrease of 11 percent. However, the industry recovered quickly with effective prevention of the pandemic and still presents a strong growth in the following years. It is predicted that the market size of the catering industry will reach 6.03 trillion yuan in 2023, while that was approximately 3 trillion yuan in 2015. The impressive growth implies considerable potential for this industry. Consumers’ psychological changes under the impact of the pandemic could be one of the reasons contributing to the industry growth. A report from iResearch reveals that people were exhausted with anxiety and depression during the epidemic, so food became a coping mechanism for consumers to release their negative emotions. More consumers are willing to pay not only to fulfill their appetites but also to satisfy their emotional value.

Market trends and opportunities in the catering industry in China

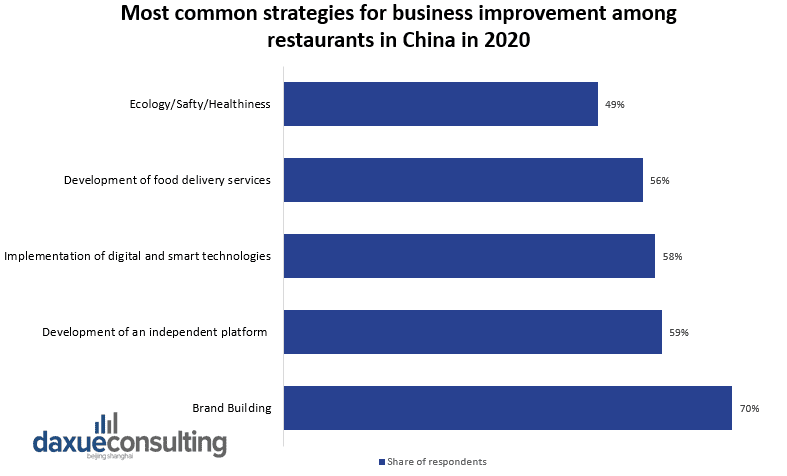

The catering industry in China is not only developing within first and second-tier cities but is also expanding in third and lower-tier cities. Restaurants in China are increasingly developing a subsidiary model by expanding their scale and branding. Brand building is critical for restaurant chains in China, as the competition within the industry is extremely fierce, so a strong brand image would be a plus while consumers make their decisions. Implementation of digital and intelligent technologies is another new trend undergoing within the industry. Technologies may include but are not limited to:

- Using a smartphone to order within the restaurant

- Paying with mobile devices

- Delivering foods by robots

All the applications of new technologies help companies reduce costs and improve service efficiency. Under the influence of the pandemic, many cities published policies requiring restaurants to offer food delivery services only, so more restaurants had to cooperate with online food delivery platforms. It is estimated that online food delivery in China will gain revenue of USD 68 billion by 2024. Though the epidemic disturbed the industry significantly, with the successful prevention and control of the pandemic, some players recovered quickly and prepared to expand their brands in the market. For example, Xiabuxiabu and Coucou Hot Pot plan to open about 700 to 800 new stores in the next three years. According to Zhihong Wen, a marketing expert in China, major players in the Chinese catering industry with a robust financial foundation can even invest and expand at a lower cost than they did in the pre-epidemic era. The supply of resources like housing and human labor increased during the pandemic while demand decreased. This phenomenon leads to a situation in which companies with stable cash flow and financial backup could recover from the impacts of the pandemic quickly and continuously expand their market.

What can we learn from the Pandemic?

The pandemic is a great lesson that teaches the catering industry the importance of keeping adjusting and innovating. One of the keywords from this lesson would be “flexibility.” To cope with unpredictable changes, players within the industry are suggested to try to establish companies with flexible assets, operation, and management methods. For example, food delivery is considered a way of flexible operation. Restaurants now could profit more by covering another consumption scenario, both in-store and off-store, as potential customers could pay for your foods and services even without visiting the store. Due to the regulations of the pandemic, people sometimes must stay at home. Some famous restaurants launched frozen prepared dishes or semi-prepared foods which are cooked on ready-to-eat plates by the restaurants or central kitchen and delivered to the customers. The dishes need to be heated in the home kitchen for a short time before tasting. Though the current market has controversial views on frozen prepared dishes, it represents massive progress for the catering industry in China.

Mobile order is another example of how restaurants save labor costs by cooperating with new technologies. No waiter is needed while customers order the food. Even waiters are replaced by robot waiters in some restaurants. By adopting new technologies, restaurant operators could focus their limited human power on the service that technologies cannot replace so that the cost of labor could be lowered and managed wisely. Catering providers should consider distributing their risks with flexible assets and operations and try to maximize profits from multiple channels. Investors are encouraged to invest with caution. Before deciding to invest in the catering industry, investors must research the industry’s overall trend and the internal operational structures of the brand.

What about the event catering market in China?

Event catering includes wedding parties, private parties, birthday parties, meeting catering, etc. Besides meeting rooms and ballrooms, finding an outdoor or open space to host a private event is not as easy in China as it is in the West. People usually live in apartments or residential communities with limited space to hold an event or party. Therefore, hotels and restaurants are the main providers of event catering services in China, as they both provide a place and food at the same time. When booking an event catering service in China, customers usually mean to book a package that includes the place of the event and the catering service. Service providers typically sell the items as a package to satisfy the market’s needs. Furthermore, the food delivery service industry has a high penetration rate in China, allowing consumers to easily get their food delivered and use their own space to hold an event.

Some companies are specialized in event catering, with a clear target group and market segment mainly focused on high-end services. However, Chinese consumers will have a tendency to favor hotels and restaurants over these kinds of services. As the event catering industry in China is quite underdeveloped compared to the market potential, related research on event catering in China is limited, so investors should enter the industry with caution.

Key takeaways of the catering industry in China

- The market size of the catering industry in China presents a steady growth from 2015 to 2019, but with a sharp decline in 2020 because of the pandemic.

- The industry recovered quickly with effective prevention of the pandemic and is predicted that the market size of the catering industry will reach 6.03 trillion yuan in 2023.

- Brand building, application of new technology, and online food delivery are trends and strategies that catering providers have been following recently.

- To cope with unpredictable changes, players within the industry are suggested to try to establish brands with flexible assets, operation, and management methods.

- The event catering industry in China is different from that in western countries, due to the differences of the local culture and consumers’ behavior.