China’s fast-food market was valued at RMB 1.28 trillion in 2023, and it expected to grow, particularly driven by the rising demand from lower-tier city consumers. With higher-cities reaching saturation, international fast-food chains are expanding to third- and fourth-tier cities. Similarly, in the local fast-food industry in China, brands like Wallace and Tastien have stronger presence in lower-tier cities. They attract young people and families with their budget-friendly menus and familiar flavors rooted in Chinese culinary traditions.

Download our China F&B White Paper

Where fast-food chains are headed

KFC is the leading fast-food chain in China, with over 11,648 locations in 2024. McDonald’s (麦当劳) follows, also having expanded significantly that year. It opened 917 new stores, bringing its total count to 6,820, or about 70% of its new international licensed market openings.

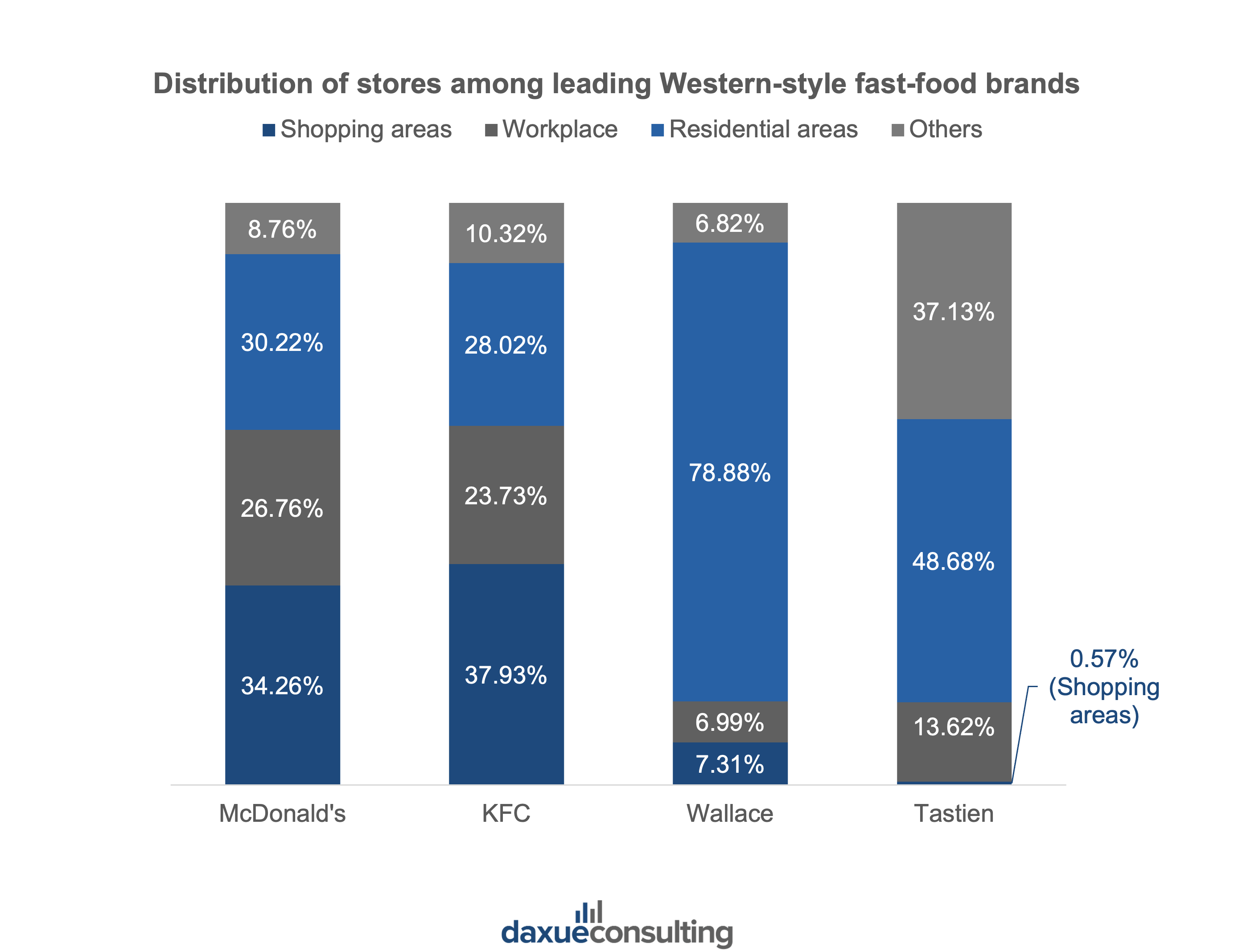

A key factor in the success of foreign brands is their ability to secure prime locations in top-tier cities. 61.0% of McDonald’s stores and 61.7% of KFC’s stores are located in shopping and workplace areas – prime locations with high foot traffic. This compares to only 14.3% of Wallace’s stores and 14.2% of Tastien’s stores. The strong presence in these areas allow foreign brands to have greater visibility and consumer reach compared to local brands.

However, as top-tier cities experience significant financial pressure and the disposable income of lower-tier cities increases, fast-food brands are expanding to the latter. Lower-tier cities present significant growth potential due to its lower rent and labor costs, rising middle class, and increasing consumer spending on dining out and entertainment.

How foreign fast-food brands like KFC achieve success in China

These global fast-food giants have achieved impressive success in the Chinese market, primarily due to their early entry, well-established brand recognition, and their willingness to adapt to Chinese tastes.

For instance, foreign brands often use emotional storytelling and cultural values in their marketing campaigns. For example, KFC emphasizes family values and traditional festivals, which resonates with Chinese consumers on a personal level and strengthens brand loyalty. They offer family-related packages such as children’s meals and family buckets to promote family dining experiences. KFC also sponsors children’s events and birthday parties, reinforcing its position as a family-friendly brand.

What makes homegrown fast-food chains in China unique

China’s local fast-food industry, including homegrown chains like Yonghe King (永和大王) and Real Kung Fu (真功夫), have established strong brand recognition since the 1990s. They offer a diverse range of menu items such as dumplings, noodles, and hearty stewed pork rice dishes that blend both Western and traditional Chinese cuisine.

What sets these Chinese local fast-food chains apart from international ones is their use of traditional cooking techniques and authentic flavors. For example, Yonghe King freshly grinds its soy milk every four hours. In contrast, KFC uses powdered soy milk rather than freshly ground soybeans. Yonghe also features hand-made youtiao (fried dough sticks) prepared freshly at six every morning. By preserving the essence of Chinese cooking while maintaining the speed and convenience of fast-food, this commitment to authenticity elevates the fast-food experience beyond mere quick meals.

How Wallace compares to KFC and McDonald’s

Wallace (华与华), previously known as CNHLS, has over 20,065 stores in China as of June 2024. This makes it one of the largest fast-food chains in the country, surpassing international brands like KFC and McDonald’s in terms of store count. More than half of Wallace’s stores are in third- and fourth-tier cities, where it targets price-conscious consumers. Wallace is known for its budget-friendly offerings, with fried chicken burgers priced as low as RMB 10. This competitive pricing strategy helps it maintain a strong market presence.

The rise of Tastien, the “Chinese burger” king

Tastien (塔斯汀), while relatively unknown in major cities, has wide presence in low-tier cities. As of May 2024, Tastien operates 7,254 stores across 342 cities in 22 provinces in China, surpassing Burger King and Pizza Hut. It is known for its commitment to “express Chinese culture with Chinese taste” (“用中国味道表达中国文化”) and introduction of Chinese burgers featuring handmade buns. Its Chinese-style burgers are made with handmade flatbreads and unique fillings like Peking duck (北京烤鸭) and Mapo tofu (麻婆豆腐).

Source: Tastien, Chinese burgers

Chinese consumers praise Tastien’s commitment to Chinese roots. On popular review platform Dianping (大众点评), a user said, “I love the burger bread. It really has a Chinese style.” Another user on RedNote (小红书) commented, “The pepper chicken leg burger is amazing. It is completely different from the Western burger method, the outside of the burger is thin, and it feels healthier than a Western burger!”

Tastien’s competitive pricing and expansion to lower-tier cities

Tastien’s competitive pricing has helped its expansion to first-tier cities, especially when compared to international chains. This affordability allows it to be favored among budget-conscious consumers and is a key factor that drove the brand’s success in the highly competitive Chinese fast-food market.

A Weibo user, for instance, pointed out the stark difference in prices between Tastien and Shake Shack. With promotions, a Tastien burger can bring the cost of a burger down to just RMB 3, while a basic Shake Shack hamburger is RMB 38.

Tastien’s new burger incorporates Chinese elements like Litsea cubeba

On June 7th, 2024, Tastien launched products inspired by ethnic minority elements, including the “Chinese Burger with Mountain Wild Fragrance” (山野寻香风味中国汉堡). The burger incorporates ingredients like Litsea cubeba, an herb used in traditional Chinese medicine, and lotus roots, which are commonly consumed in the summer. On Weibo, the hashtag #TastienNewEthnicMinoritiesBurger garnered 6.2 million views only a day after its release, highlighting people’s interests in exploring ethnic flavors.

Moreover, leveraging the Guochao (国潮) wave, the packaging incorporates ethnic features. With its Chinese lion at the center, it incorporates local elements like the caisson design – found in traditional Chinese architecture – Litsea cubeba, auspicious clouds, and flowers in the border details.

Food safety issues among Tastien and other fast-food restaurants

Food safety is a major concern for Chinese consumers. A notable case in the food and beverage industry in China is the 2008 Chinese milk scandal. Milk and infant formula were contaminated with melamine, causing about 300,000 children to fall ill and at least six infants to die.

Consumers have expressed concerns about Tastien’s food safety. On platforms like Xiaohongshu and Weibo, some users have shared concerns about undercooked chicken and inconsistent food quality across stores. For this reason, many consumers still prefer international brands like McDonald’s and KFC, who are perceived as safer and of higher quality.

China’s local fast-food industry: Winning consumers with affordable and Chinese-style meals

- Having initially focused on first-tier cities, foreign brands are expanding to lower-tier cities. Local brands have large presence in lower-tier cities, appealing to consumers through their affordability and incorporation of Chinese elements.

- KFC and McDonald’s are leading fast-food chains in China. Their success largely stems from their early entry, well-established brand recognition, and successful localization to Chinese tastes.

- Homegrown brands like Yonghe King and Real Kung Fu have established strong brand recognition since the 1990s. They particularly stand for their craftsmanship and authenticity.

- Wallace, a domestic budget-friendly chain, has surpassed McDonald’s and KFC in terms of store count. With over 20,065 stores, it focuses on third- and fourth-tier cities.

- Tastien has become a notable player, gaining recognition for its unique “Chinese burger”. The brand stands out with its strategic integration of traditional Chinese cultural elements.

- Tastien’s ethnic minority-themed menu items, such as the “Chinese Burger with Mountain Wild Fragrance,” have gained significant attention online, aligning with the Guochao trend.