China’s summer sports market is experiencing significant growth, driven by interest and sophistication in a wide range of sports, along with the government’s ambition to build a sporting powerhouse by 2035.

In this report, we analyzed 134 million posts of social media data to uncover new trends and evolving preferences in summer sports, identifying emerging opportunities and market dynamics in China. We sought to understand which sports people are doing, with whom, why they do them, and their preferred brands.

Download the report

Sports enthusiasm remains despite low consumer confidence

Despite low post-COVID-19 consumer confidence affecting some categories, Chinese consumers continue to seek experiences and products that enhance their quality of life, including travel, health goods and services, and sports apparel. This is not only limited to sporting goods and fashion but extends to travel, hospitality, and beauty.

In the first half of 2024, spending on sports and recreational articles was the second fastest growing category after telecom times, with a growth of 11.1%. With most other categories of spending experiencing flatline or minimal growth.

What drives China’s summer sports market

In summer 2024, social media posts mentioning summer sports in China reached over 15.02 billion, marking a year-on-year increase of 42%. This growth is underpinned by rising interest in recreational and leisure sports, shifting away from a purely competitive focus. Today, sports carry more of a “social attribute”, with Chinese consumers more inclined toward activities that allow them to bond with family and friends.

The key drivers of growth in China’s summer sports market include the rising awareness of healthy lifestyles, which is encouraging more individuals to participate in sports. Social media platforms like Douyin, Weibo, and Xiaohongshu are also playing a significant role by popularizing various sports, from outdoor adventures to urban-based fitness trends. Additionally, government support through initiatives like “Healthy China 2030” continues to promote physical activity and increase sports participation across all age groups.

Social listening exposes the top summer sports in China

After scrapping data from social media platforms like Xiaohongshu, Weibo and Douyin, we have uncovered the most recent consumer trends regarding mentions of summer sports, sports brands, and key phrases. China’s summer sports market is diversifying, with a mix of both traditional and emerging sports. Hiking, running, and basketball remain the most mentioned on social media, while niche activities like breakdancing and rock climbing are gaining traction.

Popular outdoor sports in China

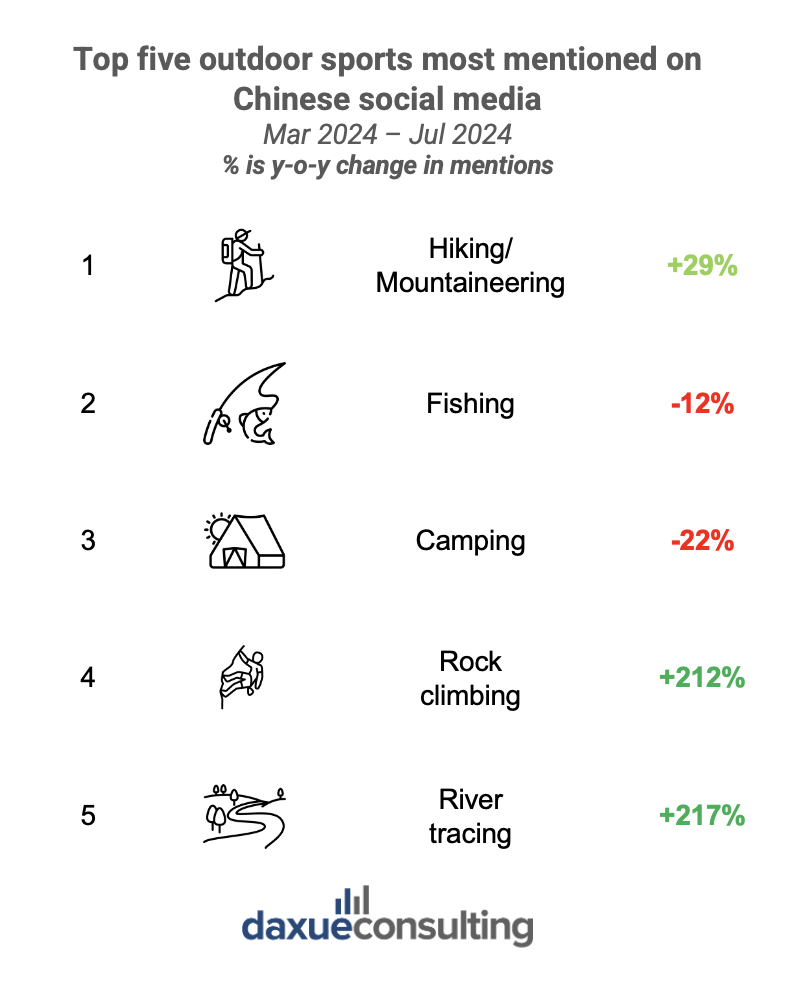

Outdoor activities saw a significant rise in 2024, with hiking and mountaineering leading the charge. This growth aligns with the broader trend of reconnecting with nature, a sentiment that has surged since the COVID-19 pandemic. According to Daxue Consulting’s social listening analysis, between March and July 2024, mentions of hiking increased by 29%.

While hiking and camping have been on the rise for years, summer 2024 say rock climbing and river tracing shoot up with 212% and 217% growth, respectively, in social media mentions.

The rise of water sports in China

This summer, water sports such as surfing and rafting have also been on the rise. Surfing mentions on social media increased by 55%, making it one of the fastest-growing water sports in 2024. More and more indoor surfing venues have emerged in first- and second-tier cities, allowing enthusiasts in non-coastal areas to practice regularly.

Overall, water sports account for 14.5% of summer sports-related online conversations. While swimming remains the most popular water sport, and serves as a base-skill for many other activities, new activities like snorkeling, indoor surfing, and river tracing are gaining attention.

Top athletes shaping China’s summer sports scene

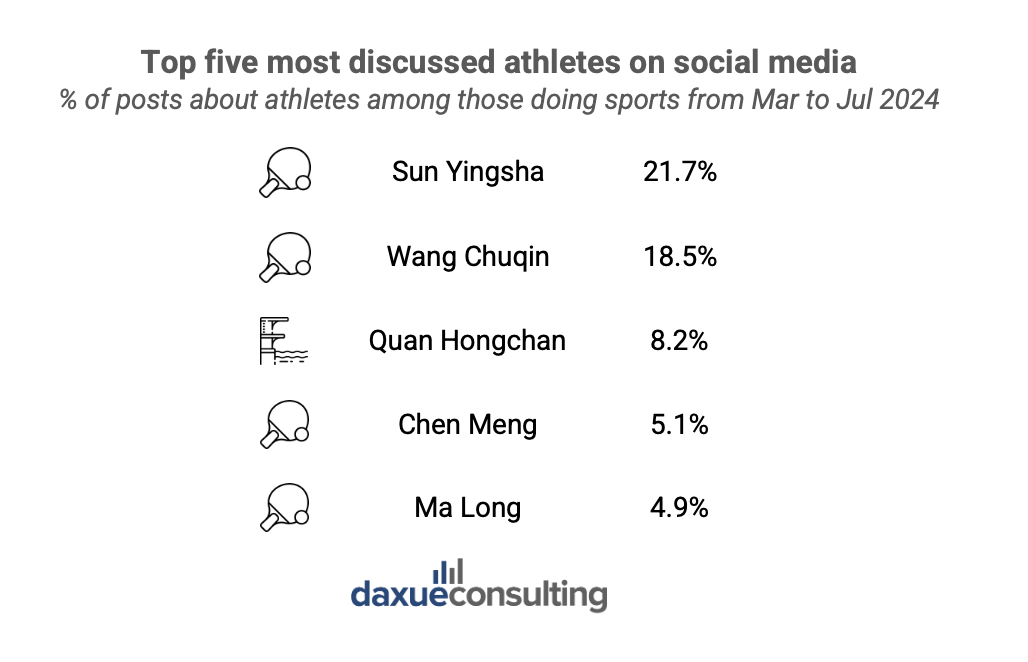

Following the the Paris Olympics, Chinese athletes attracted attention from netizens due to their individual excellence and charismatic personalities. In sports in which China is traditionally strong, such as table tennis, badminton, and diving, many familiar names continued to stir the discussions

Specifically, table tennis star Sun Yingsha (孙颖莎) was the most discussed athlete, commanding 21.7% of posts related to athletes. Her youthful energy and achievements have made her a key brand ambassador for companies like Hisense and Coca-Cola. Not far behind, Wang Chuqin (王楚钦) and Ma Long (马龙) also remained fan favorites.

Following the Olympics, interest in tennis surged, as tennis player Zheng Qinwen (郑钦文) won the country’s first-ever gold medal in women’s singles, while Zhang Zhizhen (张之臻) and Wang Xinyu (王欣瑜) claimed the first mixed doubles silver medal for Chinese tennis. There is a sharp increase in inquiries and court bookings, leading many teenagers and adults to join the sport. Fueled by the star effect, the China Open in October became the most popular edition in history. Ticket revenue exceeded 80 million yuan, setting a new record for ticket sales at the China Open, a 60% increase compared to last year. The total attendance was around 300,000, a 50% growth from the previous year.

Which sports brands are winning on Chinese social media

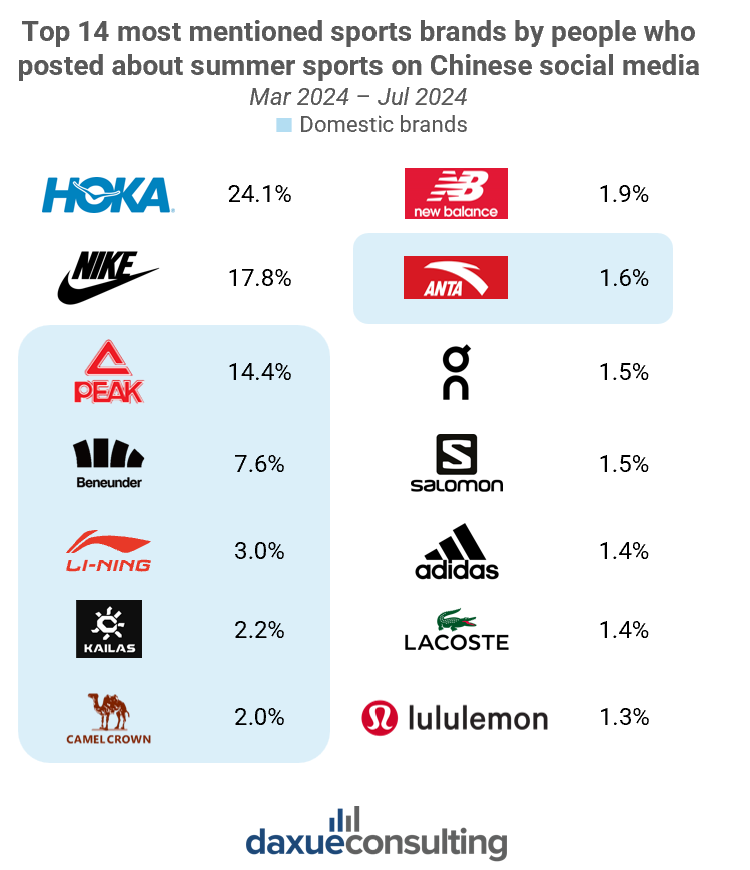

China’s sportswear market is also experiencing continuous growth and has become a battleground for both domestic giants and global brands. The top five most mentioned brands on social media during the summer of 2024 included both homegrown players like Li-Ning and Anta, as well as international brands like HOKA.

Domestic brands like Li-Ning and Anta have successfully capitalized on national pride and the rising Guochao (国潮) trend, which celebrates Chinese heritage through modern fashion. Notably, HOKA, an international outdoor and running shoe brand, saw its mentions on Weibo skyrocket during its summer 2024 campaign. The brand’s strategic focus on community engagement and collaboration with the spokesperson Li Xian (李现), such as the HOKA Fly Run Carnival, has helped it build a loyal following in China.

International brands like Nike are facing stiff competition. Nike’s revenue in China rose by 8% in fiscal 2024, but local brands have a stronghold on consumer preferences, particularly with their perceived value-for-money and cultural alignment.

The role of social media and government in the growth of China’s summer sports market

Social media’s influence

Social media platforms such as Douyin, Weibo, and Xiaohongshu have been instrumental in driving the growth of China’s summer sports market. These platforms allow brands, athletes, and consumers to connect, share experiences, and fuel trends. For instance, lululemon launched the hashtag #夏日乐挑战 (Summer Sweat Games) on Xiaohongshu to help promote events and build communities around sports.

Government initiatives

Government policies are also playing a significant role. The “Healthy China 2030” initiative encourages participation in sports and physical activities, aiming to improve public health and increase the country’s athletic competitiveness. Local governments are also investing in sports infrastructure, promoting outdoor activities, and transforming destinations like Hainan into surfing hubs.

The future of China’s summer sports market

China’s summer sports market is evolving rapidly, with growing interest in both traditional and niche activities. The rise of domestic brands, supported by cultural trends and national pride, presents a formidable challenge to global players. Meanwhile, athletes like Sun Yingsha (孙颖莎) and Wang Chuqin (王楚钦)continue to capture the hearts of millions, while emerging tennis player Zheng Qinwen (郑钦文) is also gaining recognition, representing a new era of Chinese sports stars.

As this market continues to grow, both local and international brands will need to adapt to the evolving preferences of Chinese consumers. The combination of government support, social media influence, and a shift toward recreational activities promises a bright future for summer sports in China.