In 2022, China boasted a thriving and highly developed internet ecosystem, with over 1 billion users and and impressive internet penetration rate of 76.5%. This vibrant digital landscape provides ample opportunities for improvement in various aspects of digital life. Chinese users are known to spend extended periods on internet platforms, especially via their mobile devices. According to the “50th statistical report on China’s internet development”, published in august 2022 and conducted by CNNIC (China Internet Network Information Centre), users spend over 29.5 hours a week online. Notably, smartphones are the preferred access point, with a staggering 99.6% of Chinese netizens using their mobile phones to surf the web.

This flourishing user base has fueled the rapid growth of Chinese streaming platforms. In 2021 alone, these platforms generated more than 131 billion RMB in revenue, and this upward trajectory continues. Video streaming services have gained immense popularity, with approximately 96.5% of Chinese consumers tuning in to online videos in 2022.

Download our fashion sustainability report

Although the attention is shifting to short-video apps, streaming platforms aren’t dead yet

Short-video apps have gained significant popularity in the Chinese market, attracting over 1 billion users in 2022 alone. These apps have become a dominant force, with users spending an average of 2.5 hours per day immersed in their content. The trend is particularly prominent among the younger generation, especially Gen Z, who are embracing short videos as a preferred form of entertainment and communication.

However, the life of long video platforms hasn’t ended. In fact, businesses can still benefit from promoting their products and services on Chinese traditional video platforms. First of all, longer videos allow storytelling to establish a sounder emotional relationship with customers and communicate brand values. Indeed, while short video ads enhance brand awareness, long videos improve brand perception.

Secondly, traditional platforms are perfect for high-quality informational videos where users can find out more about the products. Moreover, long videos are becoming a synonym of high-quality content and as the online video streaming universe gets more users, quality content is essential to stand out.

What are the most popular Chinese video streaming platforms?

- iQiyi

- Tencent Video

- Youku

- Bilibili

1. iQiyi

With more than 530 million MAUs in Q4 2022, iQiyi is one of the largest video streaming platforms in the world. According to their annual report, in the same year they managed to reach 103.1 million paying subscribers, an increase of 4.4% since 2021. The app is particularly known to employ a massive use of sophisticated tools, such as artificial intelligence and big data analytics.

The platform is also pushing on Research and Development, with expenses reaching 466 million RMB in 2022, a 39% increase compared to the previous year. For a couple of years now, iQiyi tried many methods to raise the interest of its users and grabbing the attention of the new ones. After having successfully launched its first interactive video advertisement in 2019, iQiyi, in collaboration with actress Xiaoqi Ai (艾晓琪), organized an exciting treasure hunt across China throughout July 2023. Participants were tasked with taking photos of as many iQiyi billboards as possible, and the winner of the competition will be gifted with autographed merchandise and discount cards for future iQiyi subscriptions. The hunt began on July 7th and will continue until July 31st, when the winner will be announced.

2. Tencent Video

Launched in 2011, Tencent Video (腾讯视频) is one of the Chinese top 3 video streaming platforms in terms of MAUs. The app managed to collect more than 120 million active paying subscribers in Q3 2022. Tencent has been created to offer a wide variety of content to its users, including videos, movies, documentaries, and sport events. Smartphones represent the main device in which users tend to watch Tencent Video: as of March 2022, the platform had over 1.2 billion mobile monthly active users.

Gen-Z and Millennial women living in low-tier cities account for more than half of Tencent Video’s users. Maybe that is the reason why Tencent decided to target low-tier cities with a brand new streaming platform called Pianduoduo (not to be confused with e-commerce platform Pinduoduo). The company announced that such video platform would provide users with movies and TV series for free without any advertising. Moreover, users will earn “gold coins” convertible into RMB for time spent watching video content on Pinduoduo.

3. Youku

Founded in March 2003 and owned by Alibaba, Youku has the label of “Chinese YouTube” and, along with Tencent Video and iQiyi, is one of the leading Chinese video streaming service providers. The app was originally independent, but went under Alibaba in 2016 when the Chinese group offered 5.1 billion USD to buy the platform. As of March 2022, the app recorded over 247 million MAUs, and accumulated 38 million visits with an average duration of more than 5 minutes in June of the same year. Despite its popularity, Youku users’ retention rate is lower than its competitors: in Q3 2022, the retention rate of iQiyi was 54.7%, whereas Youku was at 20.5%. Youku users are usually focusing on news, videogames and electronics. Even if the number of its subscribers does not rise as fast as that of Tencent Video and iQiyi, Youku remains one of the most popular and widespread video streaming platforms in China and businesses should take it into account when planning their marketing strategy.

4. Bilibili

Bilibili, founded in 2009, initially began as a platform for sharing Japanese anime content, drawing inspiration from Japan’s Niconico. Over 12 years, the company diversified, branching into advertising, mobile gaming, e-commerce, and live streaming. They also introduced a premium subscription plan offering previews and high-quality content.

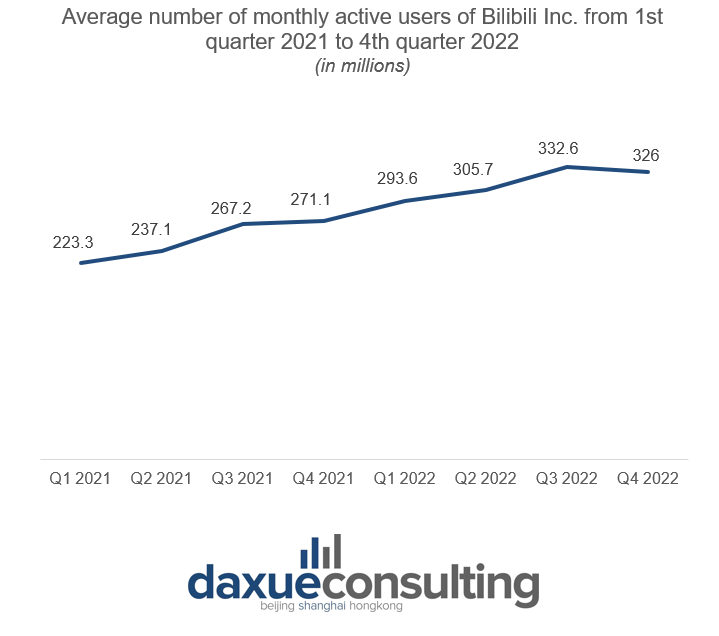

Bilibili experienced rapid growth, with a remarkable 60% ncrease in revenue from 2020 to 2021. However, this momentum slowed in 2022, with only a 4% income growth, reaching over 326 million MAUs and more than 28 million paying users.

While mobile games used to be their primary revenue source, value-added services, including premium subscriptions and live broadcasting, now make up 40% f their net turnover in 2022. Bilibili’s success is attributed to its engaged and connected community, exclusive membership for passionate users, user-generated content, and a feature allowing users to easily purchase advertised products since April 2019 through Bilibili’s mini programs.

Chinese streaming services platforms may yet bear valuable fruit

- Although nowadays live streaming and short video APPs attract the lion share of national internet users, companies can still rely on traditional video streaming platforms to establish sounder emotional relations with Chinese consumers and improve brand perception.

- iQiyi is one of the largest video streaming platforms in the world and it stands out for its technologically sophisticated tools, such as artificial intelligence (AI) and big data analytics. The big July’s treasure hunt across China is an example of the innovations which the app can bring.

- Tencent Video is one of the biggest streaming platforms in China, boasting a year-on-year increase of its MAUs and subscribers. Now, the app is focusing more on lower-tier cities, taking advantage of their ever-increasing economic and demographic growth.

- Youku is one of the pioneers and a major player in China’s online video market. Even if it does not perform as well as iQiyi and Tencent Video, the platform hangs in there and it still boasts millions of monthly visitors.

- Bilibili was one of the fastest-growing and best-performing Chinese video streaming platforms. Mobile games represented its biggest form of revenue, now overtaken by value-added services.