According to the Chinese Ministry of Commerce, during China’s golden week, which this year was a combined National Day and Mid-Autumn Festival, the retail and restaurant industry reached 1.6 trillion RMB in sales. Compared to the last year’s golden week, the average daily sales grew 4.9%, despite the global impact of COVID-19.

Since the COVID-19 pandemic, which nearly eliminated travel 9 months prior, China has loosened the strict restrictions and reopened the most entertainment facilities for golden week 2020.

The tourism industry in China is recovering

The Chinese “Golden Weeks” refer to two week-long holidays on National Day, October 1st, and the lunar spring festival in January or February. Each lasts seven or eight continuous days. Generally millions of Chinese go through long-distance travel to visit family or go on vacation, making some of the greatest migrations in human history.

In 2019, 782 million Chinese domestic tourists spent 650 billion yuan during golden week. In 2020, 637 million domestic tourists spent an estimated 466 billion yuan. Though this is a decrease from 2019, considering the circumstances, it is a pretty impressive recovery.

The tourism industry is an important mainstay of China’s golden week. However, this year is special. Due to the breakout of coronavirus in January, people canceled trips and followed strict quarantine rules at home which ask people to avoid gathering. During the five-days Labor Day holiday (May 1st) of this year, when the pandemic was not entirely controlled in China, the domestic tourism revenue sharply decreased by nearly 60% compared to that of the previous year. However, during Golden Week, this was not the case.

“Chinese consumer confidence has been significantly recovered due to the proper control of pandemic, government pro-consumption policies and stimulus and faster than the expected resumption of business activities,” said Jennifer Ye, PwC’s China consumer markets leader, in her interview with Associated Press, “The Golden Week tourism and spending figures indicate domestic consumption is recovering, partly due to so-called “revenge buying” to make up for the previous months when people were unable to travel.”

Across the country, from train station to tourist spots, the long queues show a booming economic recovery in China.

New trends in China’s golden week

The duty-free market is staying within China’s borders

Due to travel restrictions of other countries, many Chinese tourists who travel to South Korea and Japan for holiday shopping were rushing to the southern tropical island – Hainan. Around 443.8 thousand travelers arrived at Haikou Meilan International Airport (in Hainan), spending 1.04 billion yuan in duty–free shops and outlets. This number is more than double from a year earlier, as a result of the support from the local government’s offshore duty–free shopping policy. Duty free product sales reached 998.9 thousand units, the top three categories were: cosmetics (49%), watches (12%), and jewelry (12%).

China’s economic recovery after COVID-19, has continued to be striking. Unlike some predictions, the economic situation was not the same as previous recessions where people lost jobs for the long term. For most Chinese, their consumption demand had been suppressed. Middle-class consumers would like to spend their savings during this pandemic on luxury brands such as Hermes and Gucci, because of those brands’ ability to enhance or conserve the buyer’s wealth. A 30% tax on luxury products drives consumers to duty-free shops, such as those in Hainan.

Source: Xinhuanet, Gucci store at a duty-free shopping mall in Sanya City, Hainan Province, Oct. 5. 2020.

Car rental market up from 2019

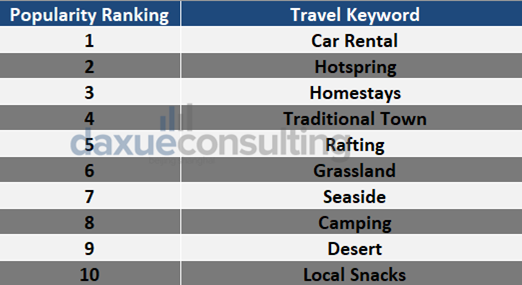

The pandemic has also changed holiday habits in the 2020 golden week in China. Most Chinese travelers still caution about the coronavirus, prefer to travel in high-cost small groups. Also, more people are willing to have a private trip and drive by themselves with family and friends along the highway to some local culture villages, like Ganzi and Lijiang.

Research from Mafengwo showed, the search frequency of “Self-Driving Trips” was 153% higher than last year. Another report by CTrip.com, an online travel agency, said reservations for cars and self-driving trips reached the highest during this holiday, with the average number of cars rented went up by 66% each day. It also pointed out that travelers spent an average of about 2,156 yuan for car rental; luxury and sports models took up 25% of orders.

Source: Mafengwo, China’s Post-COVID-19 era: Find New Mystery Spots

China’s car rental market is quickly developing in the post-COVID-19 era. A researcher of tourism big data at CTrip.com mentioned that 45% of the total car rental customers were new users, which indicates a strong potential of China’s car rental market. He also said, “Since the outbreak of the epidemic this year, more Chinese started to work from home and the demand for business travel has declined. Yet, more have recognized the advantages of car rentals, and they rent cars for work and vacation, or rent a luxury car for photography tours.”

The entertainment and retail markets stayed up all night during China’s golden week

However, with the boom of domestic tourism in China’s golden week, some people complained that hotels were all booked and tickets were all sold out, and also complained about terrible congestion on highways. Some said staying at home was the best choice, but that did not stop them from enjoying the holidays.

Golden week 2020 is one factor that boosted the economic rebound of local entertainment and restaurants, partly thanks to China’s economic recovery policies in recent months, like government vouchers and “night economy”. For example, the government of Harbin, the capital of the northeastern province of Heilongjiang, issued 200 million RMB worth of holiday vouchers for travel, movie, restaurant, and more.

During this year’s golden week, gross revenue for the box office hit 4 billion RMB. Even though this number did not exceed that of last year, it surprisingly surpassed the total revenue of 2018 despite the restriction of only filling 75% of seating capacity. Some movies, like Leap and Vanguard, were supposed to be released during the Spring Festival, but were delayed until National Day due to COVID-19. Many people were very excited to see their cinema life finally getting back to normal and regard this as a substitute experience for what they lost during the 2020 Spring Festival.

Source: Yiqikandianying WeChat Public Account, How the audience watch movies in China’s post-COVID-19 era

The most obvious sectors that contributed to the local economy of growth during China’s golden week 2020 was food (restaurants, street vendors, bars), retail/shopping (malls open until midnight), entertainment (cinema, gaming, bars). Many bookstores and e-sports gaming bars were open 24 hours while food delivery services were operational until very late.

Source: Baidu Search Big Data, Big Data of Mid-Autumn Festival and National Day Holiday

Online services spending increased

For the sake of public hygiene, many museums and tourist sites have also moved part of their activities online while controlling in-person visits to avoid gathering during the 2020 golden week in China. Many Chinese watched the raising flag ceremony in Tiananmen Square and visited the Bund in Shanghai via live-stream. According to Kuaishou, the second largest short video sharing platform, there were 213 thousand of people watching the moon via live-stream at the same time on the night of the Mid-Autumn Festival.

The stay-at-home economy in China (Zhai Economy 宅经济) continues even after the pandemic is controlled. Data from Suning.com shows, live-stream shopping, online video and novels, and Carrefour home delivery service were still growing rapidly on Suning platform during China’s golden week; sales grew by 2,383% and orders from live-streaming increased 1,854%, compared to 2019’s golden week.

Golden week highlighted the new trends in the Chinese market

Although the pandemic is still spreading, China’s economic recovery has moved forward and “revenge spending” continues. 2020’s Golden week in China has proved the huge demand of the market both online or offline. For brands, this golden week is a great opportunity to observe a new Chinese market trend under China’s post-COVID-19 era, especially on the retail market.

Here are some trends to keep in mind

- Domestic tourism was down from 2019, however more trips were individual trips to more remote places. Hence, car rentals skyrocketed, and many people sought out nature over crowded malls.

- Though domestic tourism was down, spending overall had increased. Especially spending through live-streams and e-commerce.

- In-country duty-free shopping is going to be red hot for the next few holiday periods. Since international tourism is still not available globally, many luxury shoppers are getting their tax-free fix in places like Hainan.

- On a similar note, revenge spending is still continuing, several months after the country has started recovering from COVID-19.

Author: Jiahe Cao

Duty-free shopping is a huge part of Chinese tourism. Learn all about Chinese duty free shopping in our report.

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast