The medical technology industry, commonly known as the MedTech industry, is an essential component of the healthcare industry. Such segment includes all those that create, produce, and market innovative medical equipment and health information systems that allow simpler prevention, earlier disease detection, less invasive procedures, and more potent therapies. China’s policies in the medical industry are continuously evolving. Daxue Medical‘s experts can help bring clarity to the black box of China’s healthcare industry.

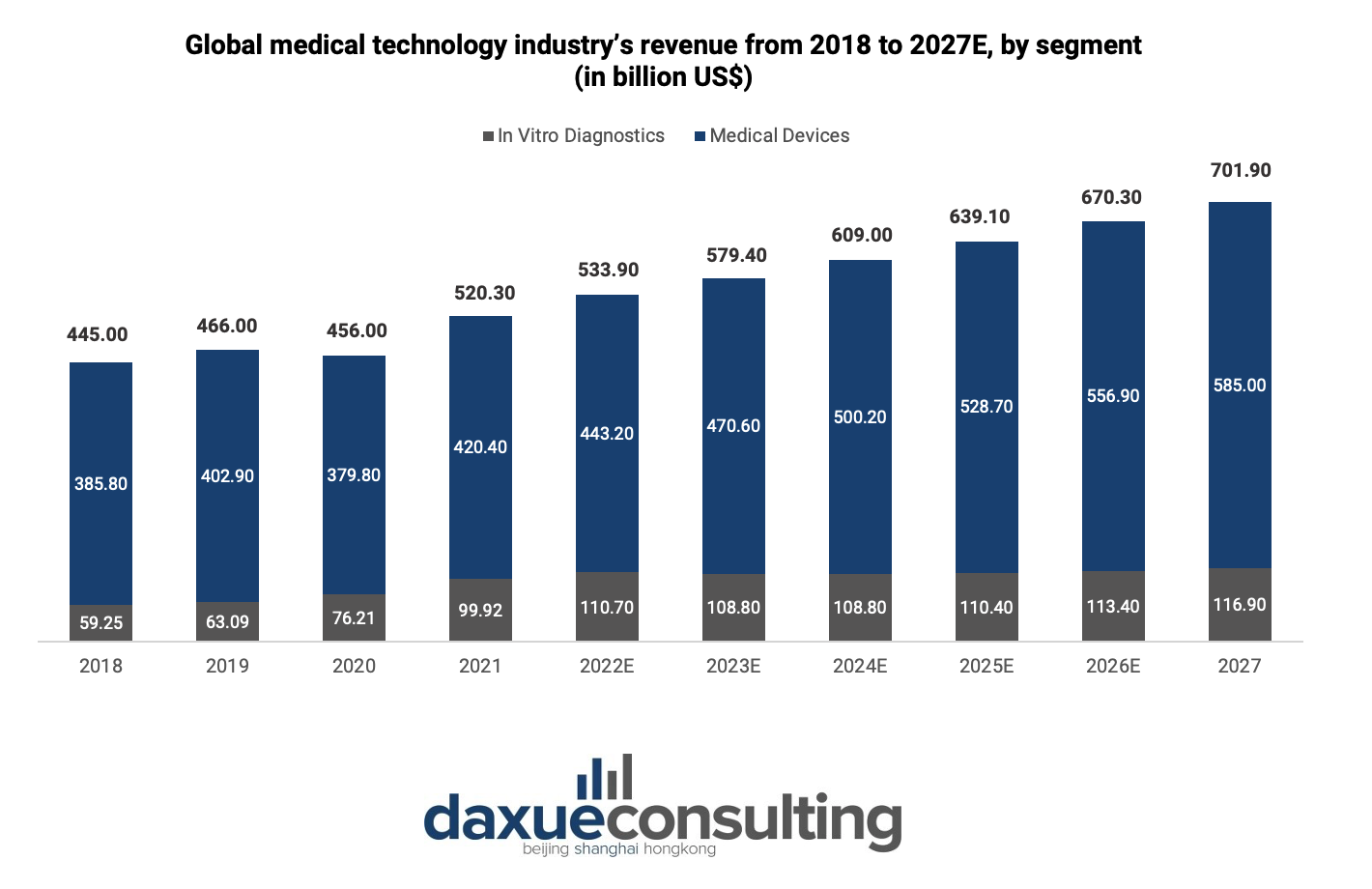

The global revenue of the medical technology industry contracted by 2.15% in 2020 but steadily increased afterwards

In 2023, the medical technology industry is expected to generate US$579.40 billion in revenue and grow to US$701.90 billion by 2027, a projected CAGR (2023-2027) of 4.91%. The United States is estimated to generate 34.48% of the market’s revenue in 2023.

Broadly speaking, the medical technology industry can be divided into two categories:

Medical devices (MDs)

Products, services, or solutions for the physical treatment, diagnosis, monitoring, and care of humans. Some examples of MDs are bandages, syringes, ultrasounds, pacemakers, stents, and so on.

In vitro diagnostics (IVDs)

Non-invasive tests that carried out on biological samples such as blood, urine, or tissues to monitor a person’s health, diagnose diseases or other disorders, and help treat, prevent, or cure illnesses. Some examples of IVDs are ABO blood-typing, blood glucose monitoring, pregnancy test, clinical chemistry analyzer, etc.

According to data from Statista, the medical devices segment takes up the majority of the global MedTech industry’s market share, accounting for about 83.01%, or US$443.2 billion (RMB2.99 trillion), of the annual revenue of the medical technology industry.

Medical technology is characterized by a steady stream of advancements that come from intensive internal industry R&D as well as tight user collaboration. In 2018, the medical technology industry has an average global R&D investment rate (R&D spending as a proportion of sales) of 8%. Additionally, the MedTech industry issued a large number of patents. According to European Patent Office, MedTech issued the most patent applications compared to other technical fields in the region in 2020.

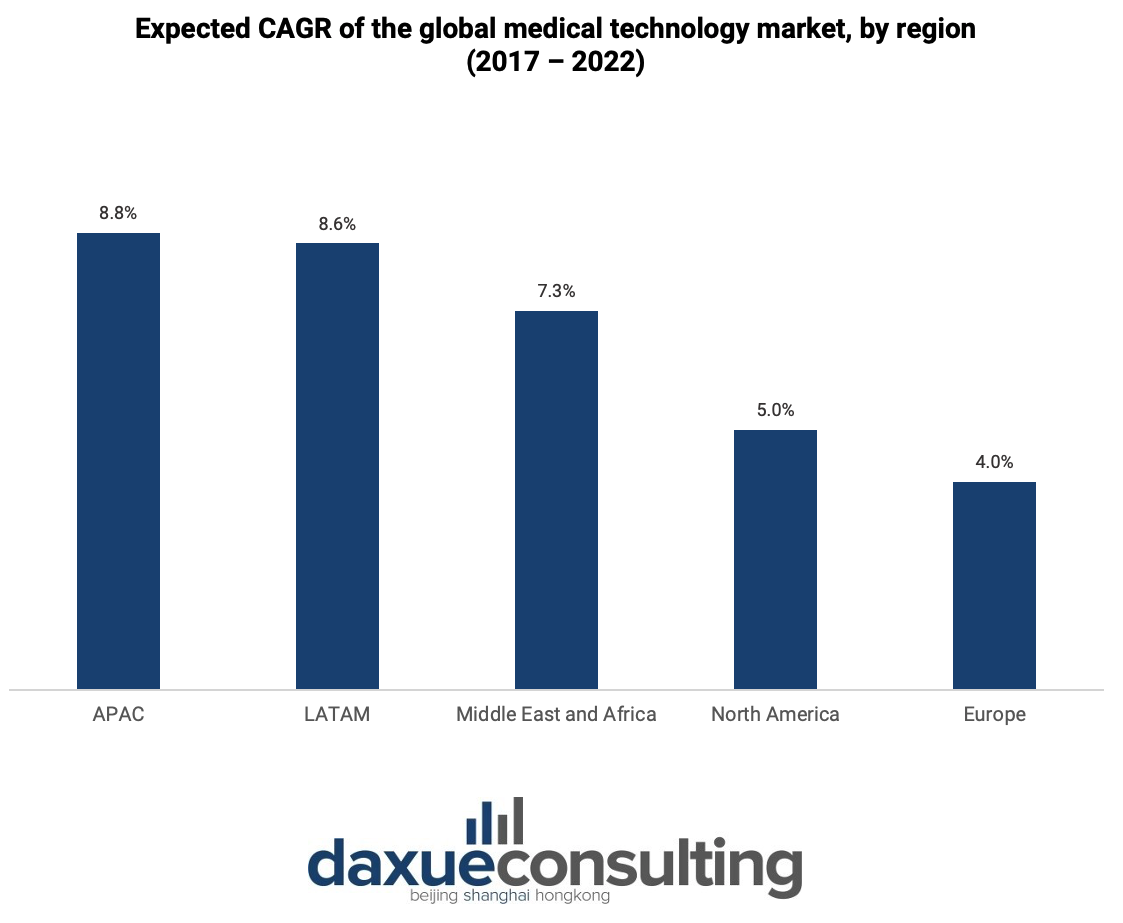

The United States and Western Europe are well-established hubs for this sector. However, industry trends indicate that Asia, particularly China, is set to become more significant in the years to come. As for the key players, most of the top ranks of the revenue boards of the medical devices segment are occupied by companies from the US.

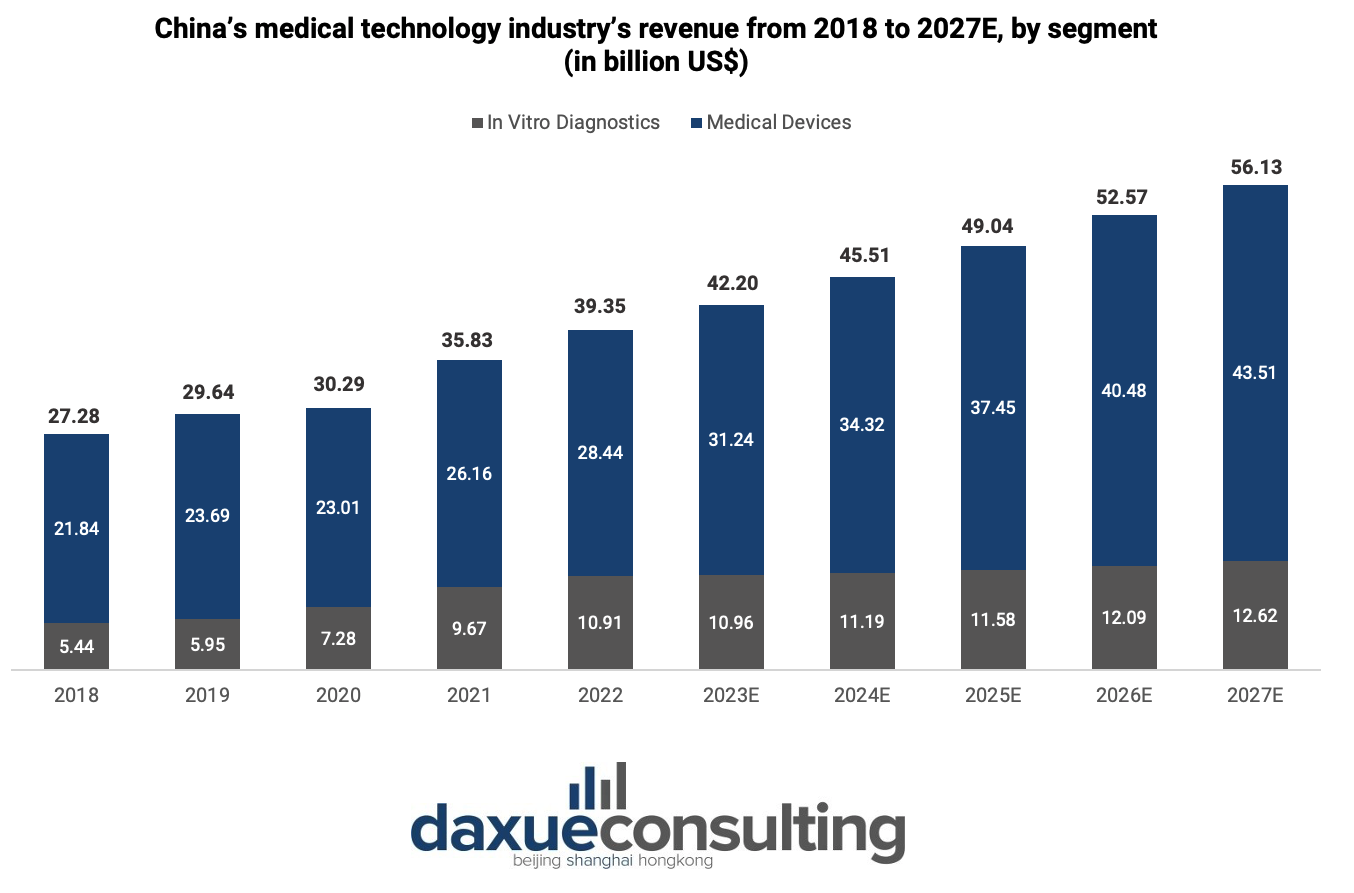

China’s GDP is growing at a slower rate, yet its national healthcare spending is increasing

China’s medical technology industry is predicted to grow with a CAGR of 7.39% from 2023 to 2027. However, the growth of China’s MedTech industry decreased in 2020 compared to 2019, from an annual growth of 8.65% (2018-2019) to 2.19% (2019-2020). Like for the global MedTech industry, medical devices hold the largest market share in China as well, accounting for around 74% of the annual revenue, or US$31.24 billion (RMB211.11 billion) in 2023.

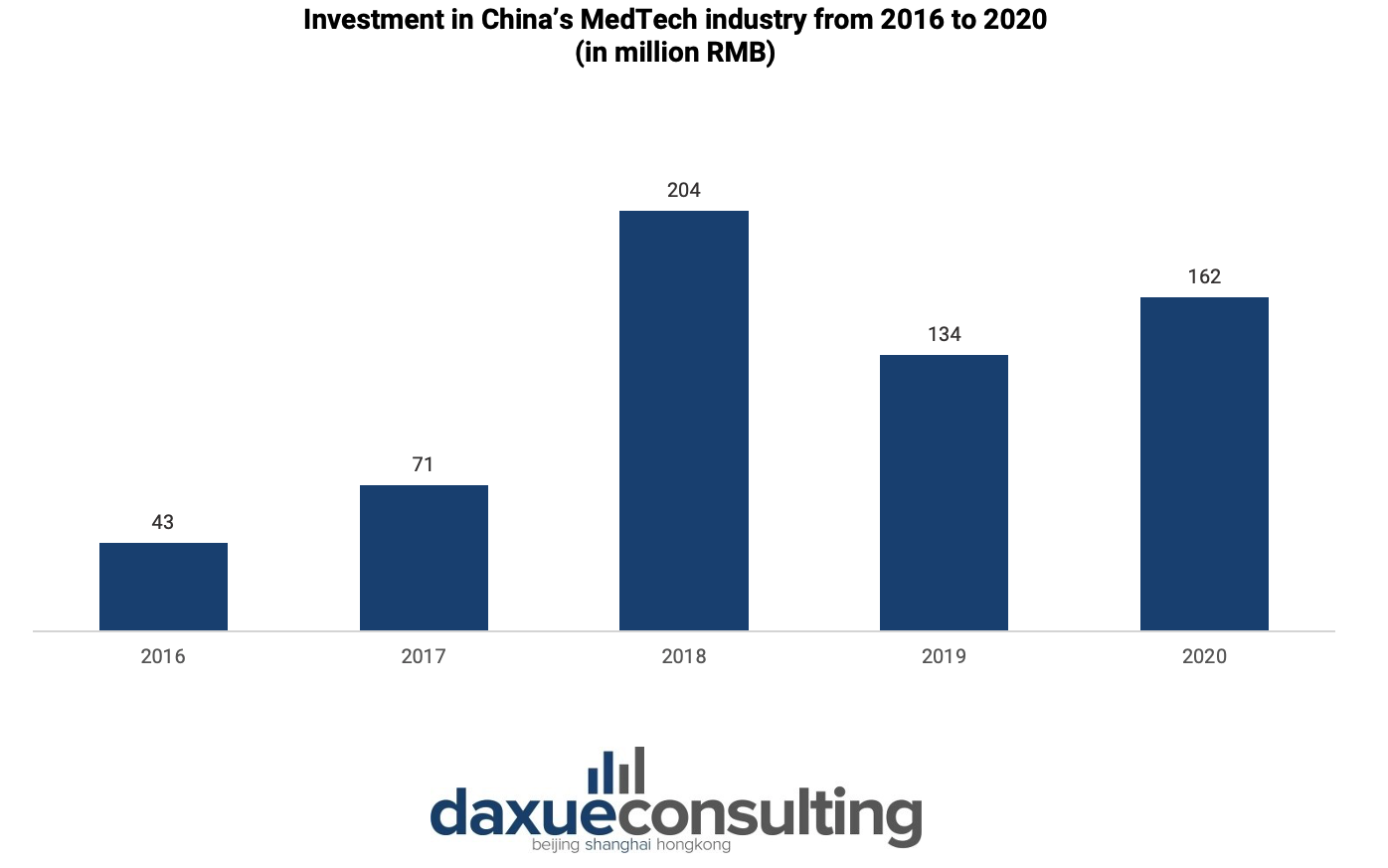

The investment in China’s MedTech industry decreased from RMB204 million in 2018 to RMB134 million in 2019. However, the amount of investment increased again in 2020 as the COVID-19 outbreak encouraged the growth of digital healthcare and the development of internet hospitals.

The pandemic also increased the role of online medical services. Given the potential benefits of digital healthcare, the Chinese government has made it clear that it will encourage the continued development of digital healthcare services.

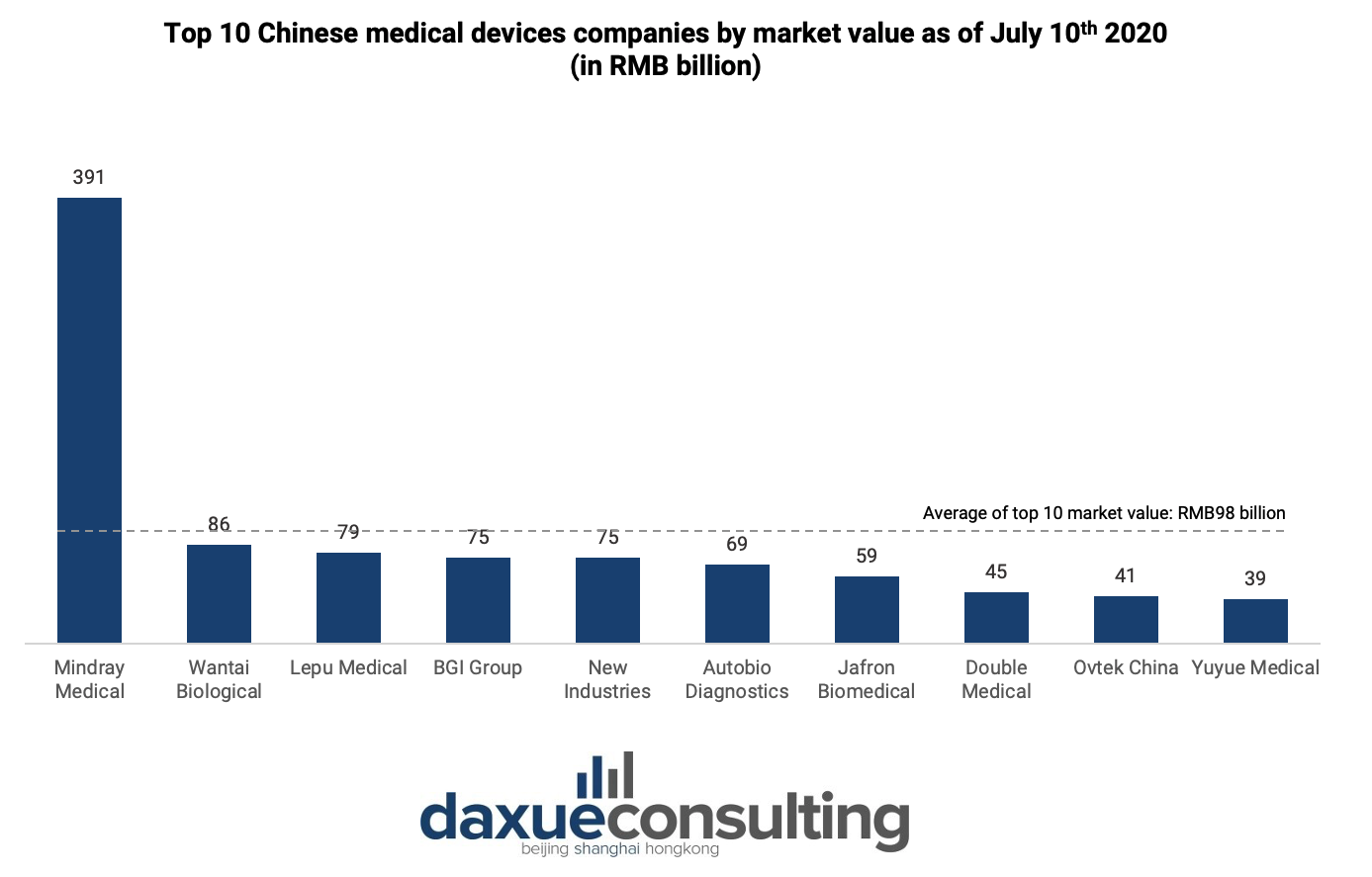

Regarding the key players, with a valuation triple that of the following competitor, Mindray was the clear market cap leader in the A-share medical device market in 2020.

COVID-19 caused a high demand for some products such as ventilators and a sharp decline in others

COVID-19 has had a detrimental impact on China’s healthcare budget, and price pressure has persisted after the outbreak. Based on McKinsey’s report, in 2020, most hospitals expected a reduction in their procurement budget while physicians believed that the usage of high-value consumables was negatively impacted.

The COVID-19 outbreak also influenced MedTech companies differently. Manufacturers of CT and ultrasound scanners, ventilators, extracorporeal membrane oxygenation (ECMO) equipment, and nucleic acid test detection kits experienced high demand and turnover. Meanwhile, due to the sharp fall in elective medical procedures, the demand for interventional devices decreased between 40% to 80% in the first quarter of 2020 according to general managers surveyed.

Four policy trends went underway before COVID-19 and are currently anticipated to pick up speed because of the epidemic.

- Volume-based procurement

- Provider reforms

- Greater localization

- Digital health

Volume-based procurement is transforming the MedTech industry in China

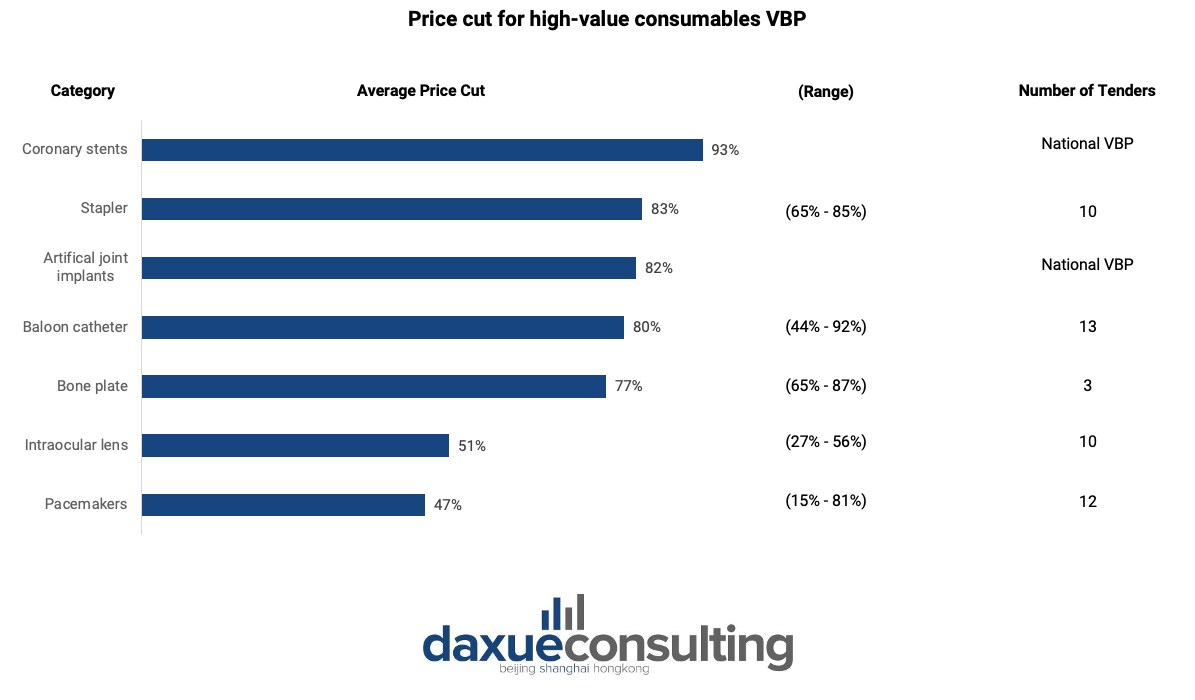

Volume-based procurement, shortened to VBP, is a set of regulations to acquire drugs in China with the intention of suppressing the inflated price of high-value medical consumables by offering manufacturers the lowest price for the market volume of cities, provinces, or the entire country. VBP was first initially piloted for pharmaceuticals and started rolling out for medical equipment in China in 2019.

VBP’s impact on the high-value consumable industry is substantial. For example, the 93% cutoff price for coronary stents rocked the industry. Moreover, provincial VBPs are being implemented concurrently, and the categories covered by them are expanding to include more segments, such as trauma, spine, and in vitro diagnostics.

The Chinese government is conducting healthcare provider reforms by encouraging more patients to visit primary hospitals

China implements a three-tiered system to classify its hospitals: primary, secondary, and tertiary hospitals. The higher the tier, the larger the capacity and capabilities. As a comparison, tertiary hospitals have more than 500-bed capacities while primary hospitals have less than 100 beds.

Chinese people are flocking to tertiary hospitals with more than half of the patients going to big class III hospitals. The data showed that primary hospitals only use less than 60% of their beds, while tertiary hospitals routinely use over 90% of their beds.

Due to the pandemic, patients had to go to local, lower-level healthcare facilities because of travel limitations and resource redistribution in the healthcare industry. Officials also realized the drawbacks of tertiary hospitals being the frontline of primary patient care: rapid capacity exhaustion and difficulties in controlling the spread of an epidemic within the facility. Therefore, government officials are now urging individuals to seek care at Community Health Centers (CHCs).

China is increasing its efforts enhance its medical product manufacturing capabilities

Concerns about medical product dependence on international supply networks have increased because of COVID-19. For instance, many analysts considered the lack of regional producers of ECMO to be a supply concern, especially due to the increased demand during the pandemic.

It is very likely that China will step up attempts to localize medical product production. Local businesses will benefit, but global corporations may also see this to easily set up production plants in China. In addition, the National Medical Products Administration (NMPA) has also issued a draft regulation that can expedite the process of registering new products after the manufacturing lines were moved to China.

Digital platforms are endorsed as healthcare moves online

One of the hallmarks of the outbreak has been the increase in the use of digital platforms. During the height of the crisis, online visits to National Health Commission hospitals increased by 17 times. The local government increased its use of digital technology as well with eight provinces having introduced online Basic Medical Insurance settlement for online medical costs.

Digital health can also be a driver of tiered treatment as patients can have tests performed at small laboratories or imaging facilities and have the results digitally sent to larger hospitals for diagnosis rather than traveling there.

Increasing policy pressure and channel shifts are key trends impacting China’s MedTech industry’s outlook

The Chinese government is implementing policies that increase pressure on prices, MNCs, and medical consumables

In addition to the VBP, the medical technology industry in China will face price pressure and growth challenges due to ongoing import substitutes and the expanding Diagnosis Related Group (DRG)/ Diagnosis-Intervention Packet (DIP) payment reforms.

Import substitutions increased in popularity in China in 2021 as a result of congested global supply chains and tense geopolitical environment. Consequently, multinational corporations (MNCs) and imports will face additional difficulties. Moreover, the transition from the fee-for-service models to the prospective payment models of DRG and DIP would radically alter how medical technology and consumables are acquired and used. Consequently, the industry will experience pressure on price and volume.

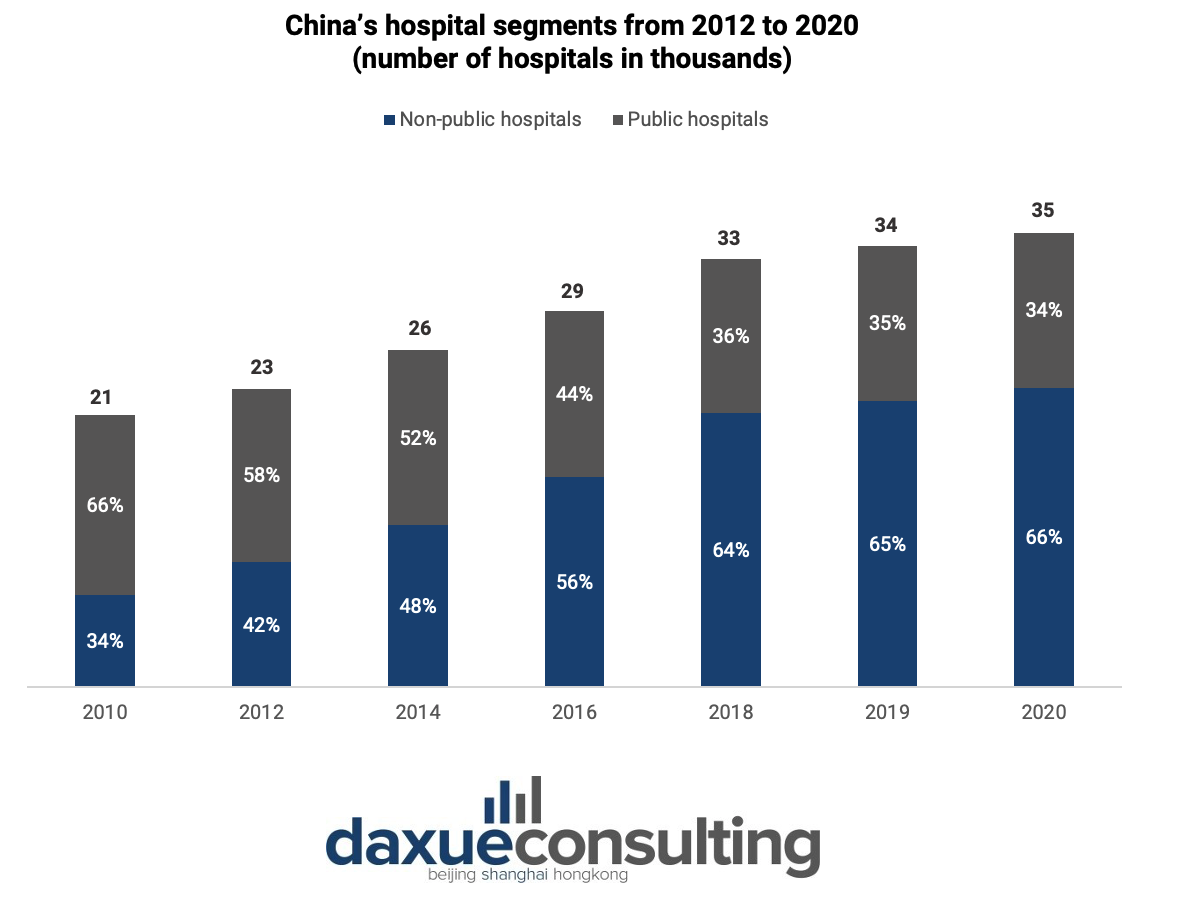

Channel shifts resulted in the increased demand for innovation

While MedTech consumables are experiencing a difficult time, new sectors such as non-public hospitals, broad markets, and digital platforms are becoming more crucial. Non-public hospitals, particularly, have grown quickly over the past 10 years and made up two-thirds of all hospitals in China in 2020.

Public hospitals offer basic and essential healthcare for the entire population. On the other hand, non-public hospitals offer additional medical services to satisfy the population’s various needs and also offer high-end services in maternity, IVF, ophthalmology, dental, and other medical specialties.

What to know about China’s medical technology industry:

- China’s MedTech industry is estimated to reach US$42.2 billion (RMB283.67 billion) in 2023 and is expected to grow with a CAGR of 7.39% from 2023 to 2027. Like for the global market, medical devices are generating the most revenue in this industry.

- In 2020, the COVID-19 pandemic sparked an increase in investments in China’s medical technology industry.

- Mindray Medical is leading the market cap in China, with a market value three times higher than Wantai, ranking as second.

- The pandemic also reshaped the medical technology industry in China. Demand for products such as ventilators and CT scans spiked while the demand for interventional devices decreased sharply.

- There are four policies implemented by the Chinese government prior to the outbreak and are expected to pick up in pace in the next few years: volume-based procurement, reformation of healthcare providers, greater localization of medical device production, and development of digital health.

- Policies implemented by the government increase pressure on the overall market and impacted MNCs and consumables. Moreover, the ongoing market and channel shifts will push the MedTech industry in China to be more innovative.