Product samples have increasingly influenced full-size purchases in recent years, reshaping the Chinese B2C market. The astonishing popularity of sample-sized products has given rise to a thriving samples economy in China which has not seen similar growth in the West. Chinese consumers are increasingly embracing sample-sized shopping, leading to a shift from samples being purely promotional to becoming a preferred purchasable packaging format. This demand has led more and more brands to sell sample-sized products directly to customers themselves, instead of leaving a void that used to be dominated by unauthorized third-party sellers.

Expansion beyond beauty

While the beauty sector has led this trend, sample-sized products in personal care, maternal and baby care, home care, food and beverages, as well as pet care are also experiencing strong sales growth. Indeed, on Chinese social media, skincare, food and beverages, and baby care are among the most discussed sample categories among Chinese netizens, illustrating broad consumer interest across a wide range of sectors.

Samples are an important marketing tool for brands

Product samples play many roles along the marketing funnel in an omnichannel market environment where customers interact with brands across multiple platforms and channels. At the awareness stage, samples allow consumers to try products advertised by KOLs and on social media, with streamers frequently introducing new products through samples. E-commerce platforms like Tmall Heybox use samples to attract customers during shopping festivals, while brick-and-mortar stores and pop-up stores leverage them to draw foot traffic. During the consideration phase, samples offer smaller-sized options that enhance the sensory experience and provide a higher value-for-money product format, allowing consumers to test new products more affordably. In the conversion stage, brands include samples in orders to enhance perceived value and drive impulse buys with appealing packaging. For retention, samples foster a sense of exclusivity and community, often integrated into loyalty programs on platforms like WeChat to maintain consumer engagement. Ultimately, samples can deepen consumer affinity with the brand, potentially turning them into brand evangelists.

Consumers born in the 90s drive sample sales

According to JD.com, shoppers born in the 90s made up 52% of total sales for sample-sized products in the first half of 2023, while those born in the 80s were responsible for 27% of the sales. Therefore, these two groups are the main consumers driving China’s samples market.

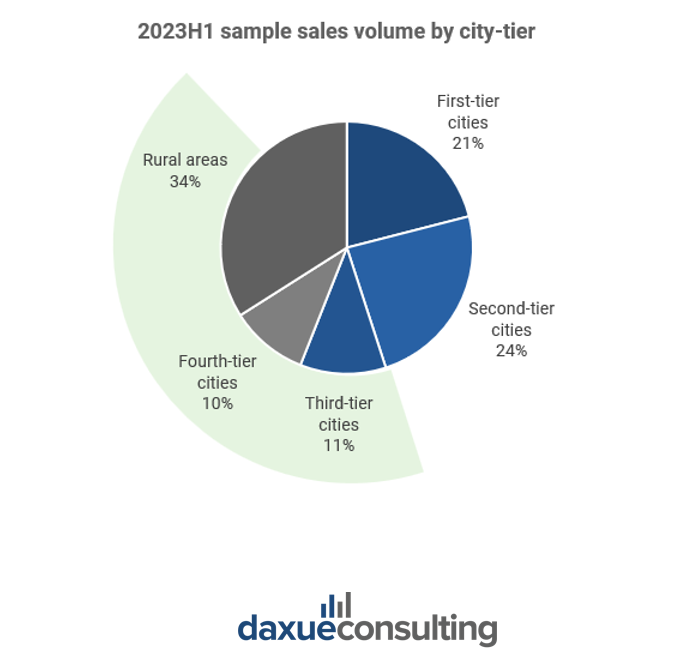

China’s sinking market contributes to the majority of sample product purchases

According to BCG’s 2023 report, it is projected that from 2022 to 2030, China will add 80 million people to its middle-class and above population, bringing the total share of this demographic to nearly 40% of the total population. Notably, over 70% of these new middle-class individuals will reside in Tier-3 and lower-tier cities. This shift underscores the importance of recognizing and capitalizing on the potential of China’s evolving “sinking markets.”

In 2023H1, sales of samples in Tier-3, Tier-4 cities, and rural areas showed remarkable growth, with increases of 42%, 45%, and 73% year-on-year, respectively. Consumers in these cities tend to prioritize convenience over brand loyalty and are more likely to seek information from friends and online reviews before making purchases. This behavior suggests a strong propensity for them to purchase sample-sized products.

Duty-free shops and vending machines are among the fastest-growing avenues for distributing product samples

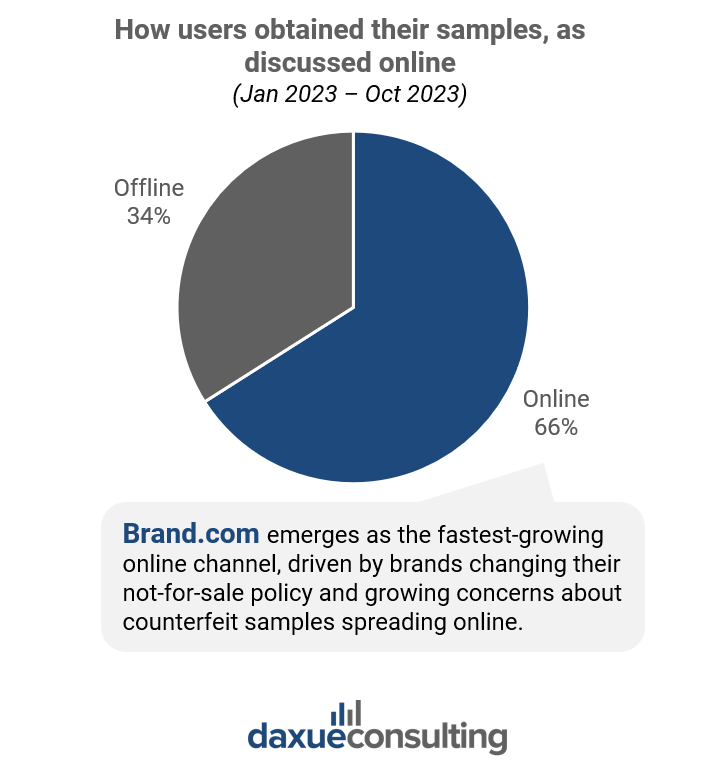

While online platforms still dominate, accounting for two-thirds of sample distribution, offline flagship stores are the single most popular offline channel, followed by social commerce and marketplaces.

Taobao’s channel “U先试用” is one of the most famous online platforms for getting product samples in China. Here, consumers can easily access a variety of product samples both purchasable and for free. A similar channel can be found on JD.com as well. In addition to these online platforms, there has been a rise in physical stores dedicated to sample products, including beauty retailers like Harmay (话梅), Haydon (黑洞), Wow Colour, and The Colorist (调色师). In 2021, Tmall further capitalized on this trend by opening a sampling pop-up store in Hangzhou. The rapid sales of samples from brands like DECORTÉ and Helena Rubinstein at this pop-up illustrated the high demand for trial-sized products and the success of this innovative approach.

Moreover, according to our social listening analysis, between January and October 2023, vending machines and duty-free shops emerged as the two fastest-growing channels for distributing product samples in China. The establishment of the Hainan Free Trade Zone in 2018 significantly boosted luxury sales, with beauty products being among the top beneficiaries. This boost has led to a notable increase in the role of duty-free stores as a channel for sample distribution, with mentions of duty-free store samples rising 3.7-fold during the analyzed period compared to the previous 10 months.

Harmay’s challenges underscore the need for reliable sourcing channels for sampled products

Initially born as an online store on Taobao, the multi-brand cosmetics retailer Harmay turned beauty samples into one of its core businesses. However, in 2022, the chain was fined by the Shanghai Municipal Administration for Market Regulation for a staggering RMB 800,000 for a lack of essential information on sample labels. This highlighted the risks associated with transactions of samples sourced from unofficial channels and grey zone commercial activities. One of the underlying problems behind this is that the demand for product samples far outweighs the available supply, leading to a heightened risk of encountering counterfeit or ambiguously sourced samples.

What to know about China’s samples economy

- China has seen a significant rise in the popularity of sample-sized products, transforming samples from purely promotional items to preferred purchasable formats.

- Beyond beauty, sample-sized products in personal care, maternal and baby care, home care, food and beverages, and pet care are experiencing robust sales growth.

- Samples play a crucial role throughout the marketing funnel. They help increase awareness through KOLs and social media, enhance consideration by offering affordable trial experiences, drive conversions with appealing packaging, and foster retention by integrating into loyalty programs, creating a sense of exclusivity and community.

- A significant portion of the new middle-class population will come from Tier-3 and lower-tier cities. Sales of samples in these areas showed remarkable growth in 2023H1, highlighting the importance of targeting these markets where consumers prioritize convenience and seek product information from friends and online reviews.

- While online platforms dominate sample distribution, offline channels such as flagship stores are also crucial. Emerging channels like vending machines and duty-free shops are growing rapidly, with duty-free stores benefiting significantly from the Hainan Free Trade Zone’s establishment, boosting luxury sample distribution.