What does China need more of?

We observed Chinese consumption during the Coronavirus and witnessed a radical shift from brick and mortar physical services towards online services in China. Given the number of people self-quarantined in their homes, those that frequented physical stores, gyms, and workplaces, are now trying out virtual offerings. Newcomers such as remote work platforms are emerging from the depths of the APP store. Understanding the changes in Chinese consumer demand during the Coronavirus allows seeing new occasions through the fog. Here is a peek at what China needs more of during the Coronavirus outbreak.

Pet owners are looking for pet sitters

While many Chinese people remain stranded in their hometowns, an invisible but significant number of furry friends are left alone at home, far away from their beloved owners. The Coronavirus outbreak boosted the pet sitting market in China, so we spoke with a pet-sitting business owner to get more insight.

Two years ago, after struggling to find someone to take care of her puppy when she was travelling abroad, Julie Chanal, a white-collar worker in China, had the idea to launch her own platform to link pet sitters and pet owners.

“At that time, I could not have imagined letting my rescued dog Polo alone or entrusting it to friends since my little one was young and a little crazy.” In December 2018, Julie decided to launch HappyNest, “A pet lover community to take care of your furry friend the time you need.” In slightly more than a year, the platform already reached around 150 pet sitters located in Shanghai.

[Photo Source: HappyNest, a pet sitting platform in China that has seized Chinese consumer demand during the Coronavirus]

Surge in pet-sitting demand during Coronavirus outbreak

During the outbreak, the platform registered a surge in demand for pet sitting. “We had a lot of booking of sitters, and some pet owners wanted to extend the duration of their pet sitting because they were extending their holidays as well.” Chanal says the outbreak also creates trouble for her business, “On the other hand, the epidemic is putting a strain on our community, with people meeting difficulties to get out of their homes to take care of other’s pets.” The time remains challenging for the young entrepreneur who is continuously seeking to extend the pet sitters community to fulfill the growing demand. Anyway, with or without the Coronavirus, HappyNest aims to double its community by the end of 2020.

Chanal is likely to achieve her goal. According to China Pet Market, it is not only a new Chinese consumer demand during the Coronavirus, since the pet population is expected to reach 755 million in 2022, with an 8.2% compound annual growth rate. The growing middle class, a massive move to cities and other demographic changes – such as having children later in life – also explain why pet owners in China would spare little expenses to make their loved ones happy. Chinese consumers are set to spend 46.3 billion yuan ($7 billion) on their pets by 2022, up from 17.5 billion yuan ($2,5 billion) in 2017.

The need to work and study online: a new model of Chinese consumption during the coronavirus

Despite offices remaining closed, Chinese companies are eager to start operations. Remote work APPs are booming on the back of the Chinese demand during the coronavirus to study and work from home.

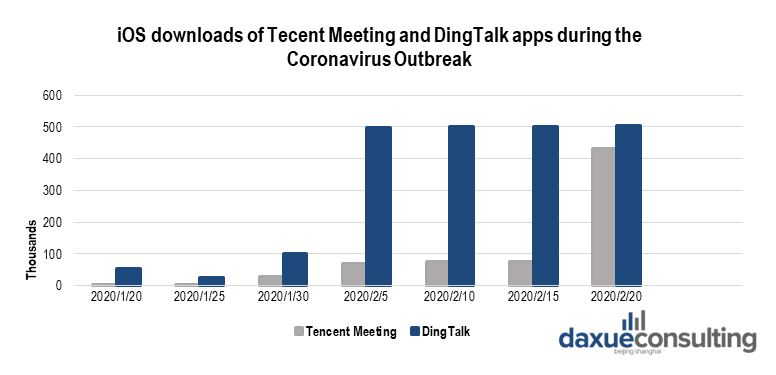

Tencent Meeting and Alibaba’s DingTalk apps are here to make you keep working at home while keeping in touch with your colleagues. From nearly zero downloads before the outbreak to more than 500,000 daily downloads as of late February, the two apps skyrocketed to the very top of the Appstore in a matter of days.

[Data Source: Qimai, iOS downloads of Tencent Meetings and DingTalk show the Chinese consumer demand for remote work APPs during the Coronavirus outbreak]

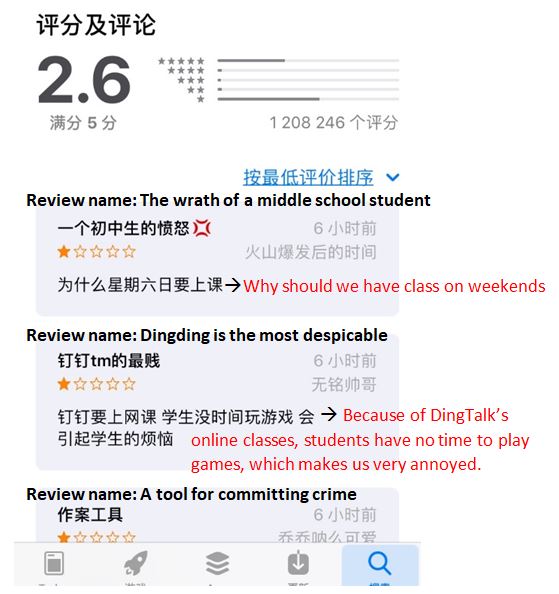

The trend also extends to students whose schools rely on such tools to deliver online lectures amid the epidemic. However, Chinese students don’t see it that way. These digital natives are massively giving one-star ratings to the most downloaded applications in hopes of making them deleted from the Appstore.

[Photo Source: Apple Store – DingTalk ratings, behind the scenes of Chinese consumption during the coronavirus]

Despite some angry reactions from the young ones, the intensive use of online office tools by companies in recent weeks is expected to continue even after offices reopen. China’s remote-working solution market could reach $477 million by 2024, up from $169 million last year.

Live-streaming platforms to relieve offline businesses

While local authorities closed gyms across the country, the Chinese are looking for ways to stay in shape. Mobile fitness apps are seizing the new Chinese consumer demand during the Coronavirus to make people do exercise at home.

That’s the perfect example of an entire industry switching from offline presence to online interactions, promptly following Chinese demand during the Coronavirus. Keep, one of the most popular fitness brands in China, smartly used the Douyin live-streaming feature to move the classes online, boosting its followers by 185% from the start of the Chinese New Year. The company releases daily fitness class schedules via Weibo and WeChat, driving traffic on Douyin, ByteDance’s Chinese version of TikTok.

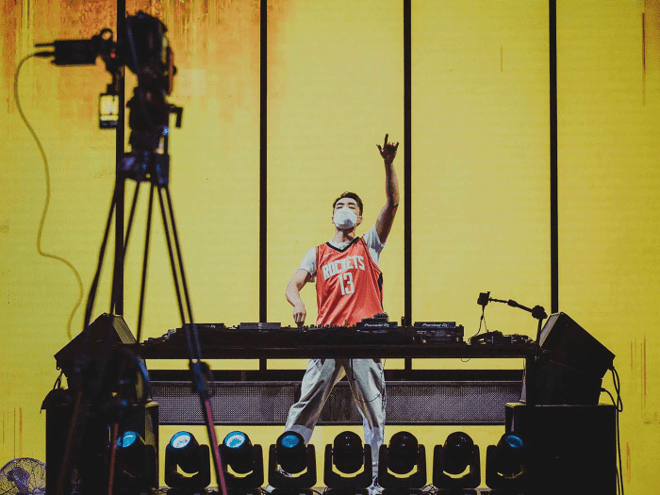

Clubbing from the safety of your livingroom

The Keep moving phenomenon doesn’t stop there, with clubs deciding to live-stream mixing performances on Douyin. A five-hour set at OneThird, a nightclub of Beijing, brought back to the club $285,000 in tips donated by the viewers on the short video platform. Banking on the trend, Douyin’s short video rival Kuaishou is now making deals with clubs across China to stream their shows.

[Photo source: Bloomberg, One Third – A DJ performs to a live stream audience at OneThird in Beijing]

Live-streaming and short videos are an answer

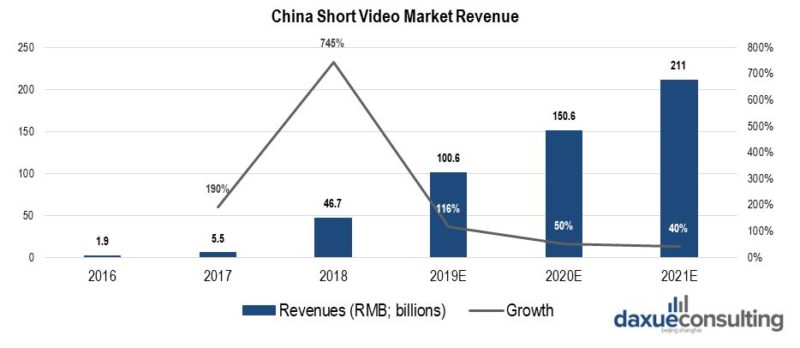

Industries are focusing their efforts to answer the Chinese demand during the coronavirus towards online services in China, sometimes accelerating existing trends. One example is this shift towards live-streaming, which already exploded in 2018, with a 745% growth year on year, thanks to improved connectivity and video maturity.

[Data source: Statista, China short video market revenue]

Outside of partying and staying fit, the Chinese are also extensively using video platforms as a way to stay informed and share their feelings during the epidemic. The Chinese demand during the Coronavirus turned to the news on the outbreak, or life hacks to fight boredom. According to Forbes, between January 20 and February 2, 574 accounts on Douyin and Kuaishou each gained between 100k-500k new followers.

Given Chinese consumption during the coronavirus of short videos and live-stream contents, there are obviously no better times to become influencers on Chinese video platforms. Sleeping in front of the camera could even make you rich!

A chance for the gaming industry

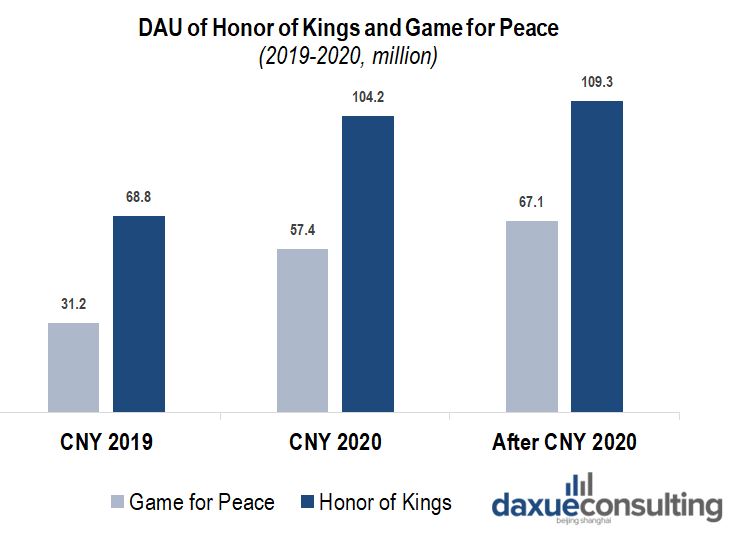

The Chinese demand during the Coronavirus for mobile games has never been so important with Tencent’s Honor of Kings, a multiplayer arena battle game, reaching up to 100 million daily active users. Plague Inc. was ranked #1 in the paid game sector of the apple store in January, before being removed by the Chinese authorities on January 28.

[Data source: Sina, Daily active users of Honor of Kings and Game for Peace]

The increase is attributed to the impact of the novel coronavirus, which led to more gamers staying at home instead of traveling or socializing outside of the home, allowing more time to play games. The craze for video games trickles on another Chinese live-streaming platform, Douyu, specialized in gaming content. On Douyu, Honor of Kings, PlayerUnknown’s Battleground and League of Legend are twice as popular than they were during Chinese New Year 2019.

On February 13, Douyin’s maker ByteDance appointed exclusive head to take care of a gaming branch, signaling its new ambitions in the mobile gaming sector. Rushing into this new consumer demand in China, the company looks to further monetize its millions of users outside of advertising, through mobile gaming.

Crisis management and market opportunity in China

In Chinese, ‘crisis’ (危机) includes the word ‘opportunity’ (机会), arguing that opportunities for growth arise during crisis. The cessation of activities caused companies to step up as leaders during Coronavirus crisis management. Chinese consumption during the coronavirus of online services in China is a game-changer for the entire Chinese economy. Anticipating the Chinese consumer demand during the Coronavirus opens new market challenges in China for those capable of thinking outside of the box. Who would have imagined virtual clubbing entertaining millions of people?

Author: Maxime Bennehard