Rising outbound tourism drives Chinese duty-free consumption

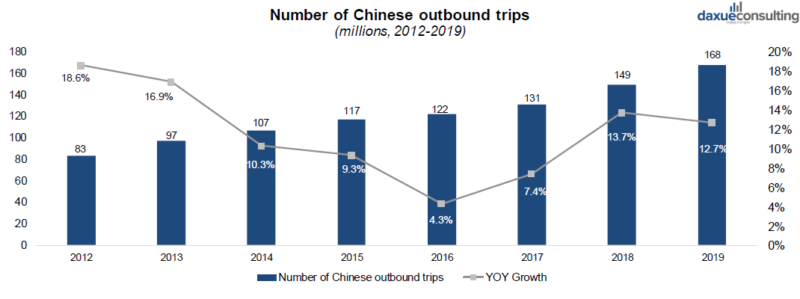

China is the world’s largest outbound travel market in both the number of tourists and spending. Drivers of China’s rising outbound travel market include rising incomes, relaxed travel visas, increased global awareness, easier access to travel information online, and more international airlines. Outbound travel is, of course, the driver of Chinese duty-free consumption. This report explains how duty-free shops, both in China and overseas, can reach Chinese travelers.

Download our full report on Chinese duty free consumption

[Data Source: chyxx.com, Chinese Duty-Free Consumption report by daxue consulting, growing number of Chinese outbound trips]

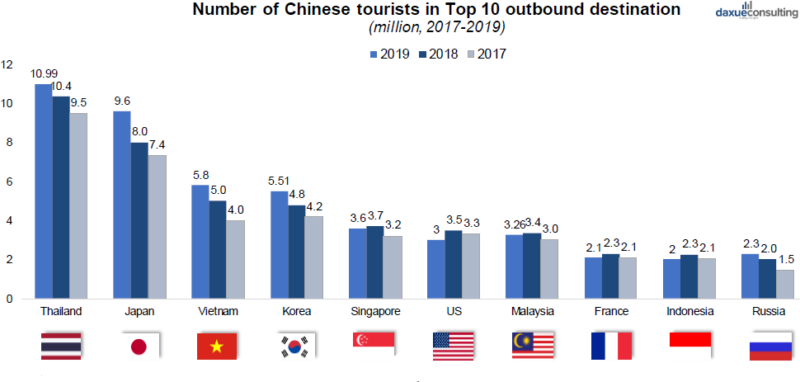

Popular destinations of Chinese outbound tourism

South-East Asian and East Asian countries are the first choice for Chinese outbound tourists. Top destinations are Thailand, Japan and Vietnam. The choice of these destinations is due to the geographical proximity to China and the ease of obtaining a visa.

[Data Source: Analysys& National Tourism Administration in different countries, Chinese Duty-Free Consumption report by daxue consulting, top outbound destinations for Chinese tourists]

Key trends of Chinese outbound tourism

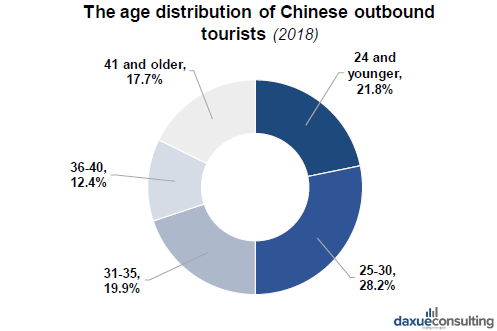

The rapid growth of outbound tourists continues to drive Chinese duty-free consumption, but the per capita single-consumption amount has not changed significantly. Besides, due to the opening of new airline routes and the general increase in consumption capacity, non-first-tier cities have become major growth engines. In terms of age distribution of tourists, the growth is concentrated on those born between 1950 -1970, and 1990 -2010. More and more Chinese travelers are interested in both shopping and new experiences. Restaurants, museums and special performances are key projects for outbound travel.

Outbound tourism expenses

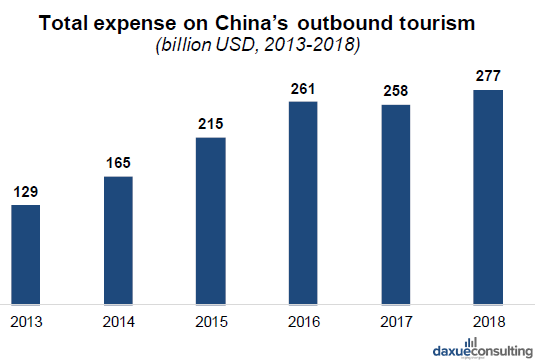

Due to the rising purchasing power of the middle classes, Chinese consumers’ spending on outbound tourism has been the world’s No.1 for 7 years and the number is still increasing. Regardless of tourism destinations, Chinese often spend a large part of total travel expense on cultural activities, accommodation, and shopping.

[Data Source: UNWTO, Chinese Duty-Free Consumption report by daxue consulting, China’s growing expenses on outbound tourism]

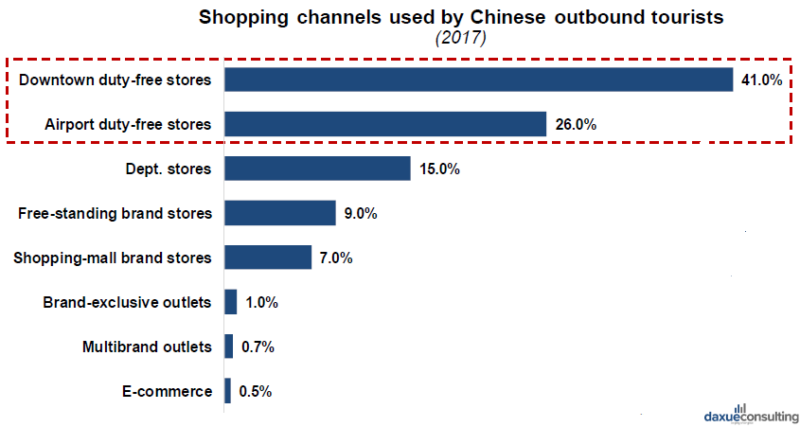

When asked about favorite shopping destinations during travel, more than 60% of Chinese outbound tourists prefer duty-free shops, as have assured quality at a cheaper price. Retailers around the world focus on Chinese customers because of their strong purchasing power. For example, in South Korea, Chinese duty-free consumption accounted for 83.4 billion RMB on duty free goods in 2018. This accounts for 73.4% of the total sales of duty-free stores in the nation.

[Data Source: McKinsey & Company, Nielsen, Chinese Duty-Free Consumption report by daxue consulting, duty-free stores are the most preferable channel for Chinese tourists]

Global duty-free sales

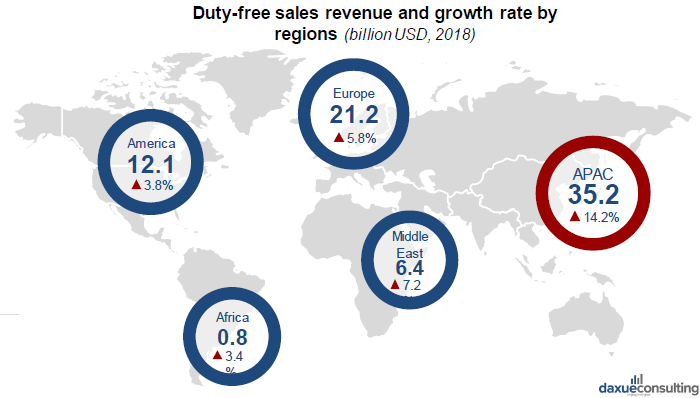

Due to an increasing number of travelers and rising spend per person, Asia Pacific region drives most the global growth of duty-free sales. In emerging countries such as India and China, Chinese middle-class consumers have the spending capacity to promote the growth of the duty-free industry in the global market.

[Data Source: Tax Free World Association, Generation research, Chinese Duty-Free Consumption report by daxue consulting, growth of duty-free sales in APAC]

Global duty-free sales in different channels

Due to the high volume of passengers, good maintenance and having a wide variety of brands and products, airport shops account for the largest amount of global sales. Downtown shops and border shops had realized significant increase in sales with the continuous expansion of shops in urban areas.

[Data Source: Statista, Chinese Duty-Free Consumption report by daxue consulting, airports take a lead as duty-free channel]

Inbound duty-free market in China

Due to policy support in recent years, China’s inbound duty-free shopping is now competing with South Korea’s dominant position. Offshore duty-free shops grew quickly during the last few years with the relaxation of restrictions and the increased number of product categories.

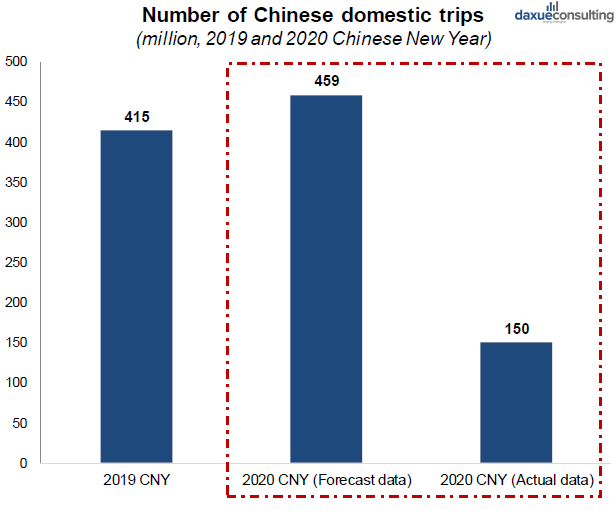

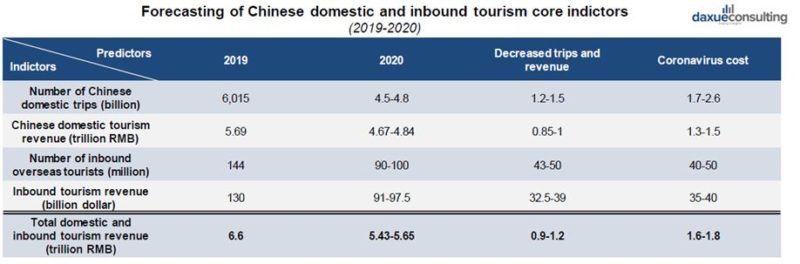

COVID-19 hits the Chinese tourism industry

The damage to the Chinese tourism industry because of outbreak is equivalent to a loss of 1 trillion RMB GDP. Many travel enterprises estimated the ongoing shutdown costs the industry about ¥17.8 billion every day.

[Data Source: Tai Media APP, Sina Finance, Chinese Duty-Free Consumption report by daxue consulting, decreasing domestic trips due to COVID-19]

Only 2% Chinese tourism related companies felt that they had not been significantly affected after the COVID-19 outbreak. Coronavirus impact on tourism in China especially visible among travel agents, hotels, and retailers (related to tourism).

[Data Source: Sohu Finance, Chinese Duty-Free Consumption report by daxue consulting]

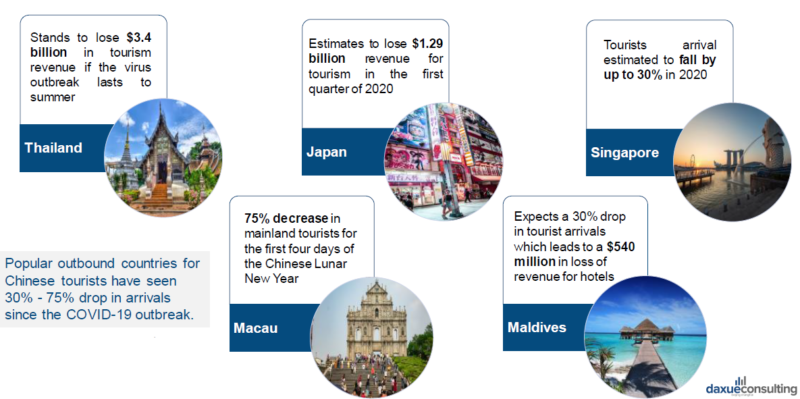

Chinese tourists contribute to the tourism industry in many countries. For instance, in 2018, Chinese tourists represent more than 70% total tourism in Hong Kong and Macao, similarly, more than 25% total tourism in Thailand, Japan, Vietnam and Korea. The impact on the economies of these countries will likely rebound in the second half of 2020.

[Data Source: Press reports; McKinsey Global Institute; Pengpai News, Chinese Duty-Free Consumption report by daxue consulting]

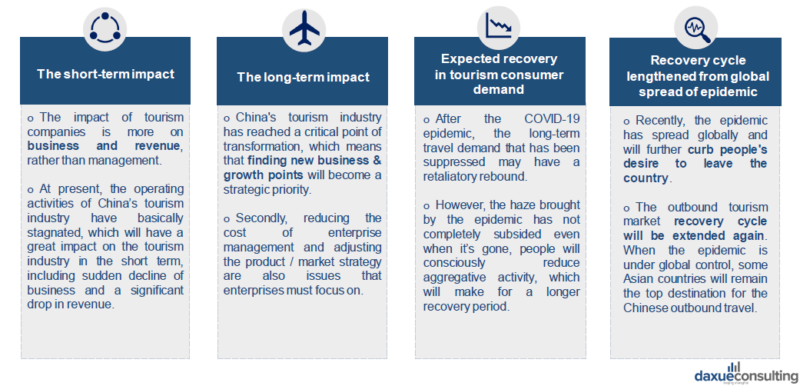

Coronavirus impact on tourism in China opened the opportunities for new online approach in this sphere. During the COVID-19 outbreak, many scenic areas and museums used live-stream to increase exposure and attract tourists, which attracted a lot of traffic. Even after the outbreak, the live-stream still can be watched by elderly and people with disabilities, and can be used as a preview before travel.

Short-term and long-term coronavirus impact on tourism in China

[Data Source: TravelDaily, Chinese Duty-Free Consumption report by daxue consulting]

Key Characteristics of Chinese Outbound Tourists

Chinese outbound tourists demographics

Those born in the 90s and 80s make the majority of overseas tourists. They are, on average, highly influenced by social media and they usually plan carefully to find value-for-money trip sand shopping. These Chinese tourists pay attention to both quality and price, they like customized activities and products offered by local stores.

[Data Source: Analysys & National Tourism Administration in different countries. China Tourism Academy, Chinese Duty-Free Consumption report by daxue consulting, majority of Chinese outbound tourists are young people]

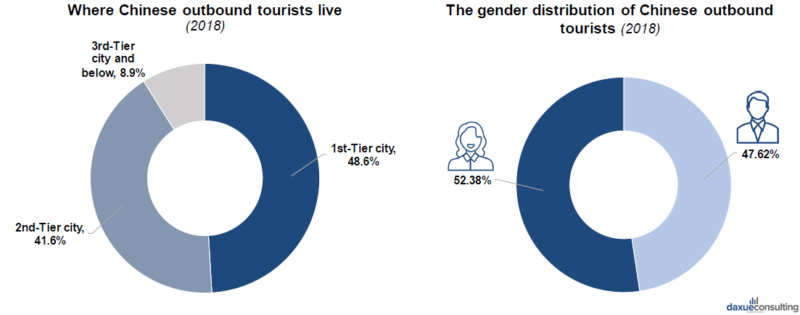

Most Chinese outbound tourists come from tier-1 and tier-2 cities (provincial capital cities), over half are female. Most are also upper middle-income citizens who are willing to spend money while traveling to seek high-quality experiences.

[Data Source: Analysys & National Tourism Administration in different countries. China Tourism Academy, Chinese Duty-Free Consumption report by daxue consulting]

Chinese Duty-free consumption: The most popular duty-free goods

Skin care and beauty products are the most popular goods in duty-free shops. Women are the most important consumers, since the top selling products are women’s products. In addition, Chinese tourists tend to buy famous wine and wrist watches. Many Chinese tourists research duty-free products before purchase by reviewing online recommendations. Even after they arrive at their destinations, Chinese travelers will continue to research about duty-free goods. Brands can reach Chinese tourists by launching their own Chinese websites and apps. This allows consumers to shop anytime, anywhere, at their convenience.

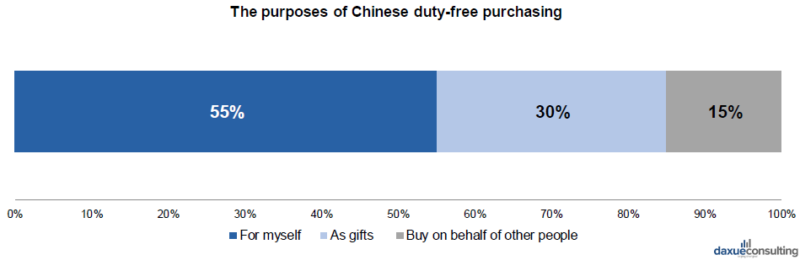

Buying purpose of Chinese Duty-free consumption

When visiting duty-free stores, Chinese tourists of ten purchase duty-free goods for themselves or as gifts. A small percentage of Chinese duty-free consumption accounts for buying duty-free goods on behalf of others, such as Daigou, which is someone who buys goods from foreign markets and sells them back to consumers in mainland China. Many duty-free consumption behaviors among Chinese tourists are planned spending rather than impulse spending, they make plans based on the info from guides and comments on Chinese social media and travel websites.

[Data Source: PTRA, m1nd-set, Chinese Duty-Free Consumption report by daxue consulting]

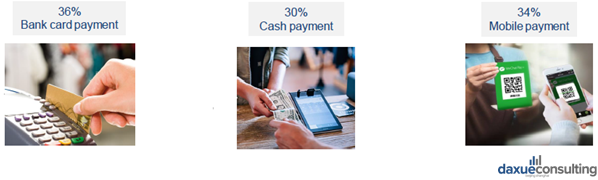

Payment methods of Chinese overseas tourists

The payment methods of Chinese tourists vary by age and travel destinations. The post-70s and 80s Chinese tourists tend to use bank card payment during trips. For post-90s Chinese tourists, mobile payments make up a big proportion of their payment methods. Cash payment is used by all the generations of Chinese overseas travelers. They use bank cards more frequently in developed regions where credit cards are used more commonly, such as the USA. At destinations where tourists can easily connect to mainland China’s banking system, such as Hong Kong, Chinese tourists prefer mobile payment since it is convenient and a better way to keep track of spending.

[Data Source: Nielsen, Chinese Duty-Free Consumption report by daxue consulting]

How Can Brands Reach Chinese Outbound Tourists

Offer content that adapts to Chinese consumers

China outbound tourists generally choose to read travel recommendations before trips, and the most convenient way is to use popular media platforms that specialize in tourism and shopping, such as Weibo, WeChat public accounts, Mafengwo, etc. Those platforms normally provide accurate content by precisely targeting groups to permeate. Naturally, major brands choose to cooperate with these platforms to get them mention their products in articles in order to gain a high degree of attention.

Interact with consumers by delivering targeting brand campaigns

As competition intensifies among brands, companies nowadays innovate and differentiate themselves by delivering customer-centric campaigns in China, and experiences that give their target audience a compelling reason to become customers. As for duty-free brands, participating in similar duty-free shopping festivals can better interact with consumers and increase brand recognition in this field. For Chinese consumers, this kind of offline events make them have easy access to some foreign luxury brands that are not easily available in mainland China.

Provide more duty-free exclusives

Since Chinese outbound travelers purchase ahead of the Chinese New Year period and other holidays, travel retail exclusives are key purchase drivers at those time period. Also, “uniqueness of products or services” is one of the most impactful factors among duty-free shoppers. Duty-free stores offer some famous Chinese brands with lower price, compare with domestic stores, like Moutai. Because of the export tax rebate policy (exported goods pay less tax), Moutai in duty-free shops is much cheaper than the same product in domestic shops, which attracted many Chinese overseas tourists who like Baijiu (白酒).

[Data Source: daxue consulting, Special selection Moutai in duty-free market]

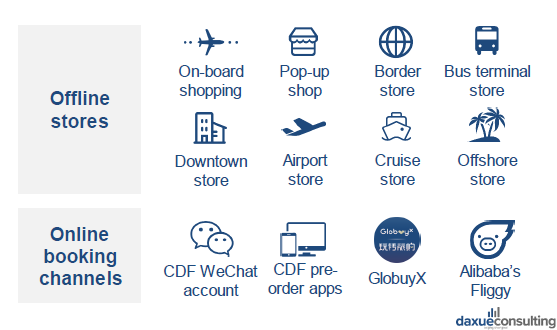

Cooperate with mobile e-commerce to reach traveling consumers

By cooperating with a mobile e-commerce platform like GlobuyX, duty-free brands can settle in mobile e-commerce to expand their promotion channels and connect with Chinese consumers. Globuy launched a WeChat mini-program that allows duty-free brands to exposure advertisements, duty-free goods discovery and pre-orders, WeChat menu links and exclusive benefits. Through this kind of cooperation, brands can reinforce their awareness and branding, achieve the purpose of communicating brand events and products with consumers and increase footprint and exposure online and offline in China.

[Data Source: GlobuyX mini-program, Chinese Duty-Free Consumption report by daxue consulting]

KOL Marketing to reach Chinese duty-free consumers

With the strong development of KOLs in China, consumers will now hold a wait-and-see attitude and buy products after KOLs. Therefore, some high-end duty-free brands choose to cooperate with KOL to increase their sales. According to Weibo data, the number of discussions on the Sanya Duty-Free’s Night in reached 30,000 times, and the number of likes exceeded 5,000. During Sanya’s Duty-Free Night, they successfully attracted a large number of fans by holding meet-and-greets with fans for major KOLs, including cosmetics, fashion, etc. When KOLs interacted with fans (take pictures, signature, etc.), they also recommended products to them.

How Duty-Free Shops Can Attract More Chinese Outbound Tourists

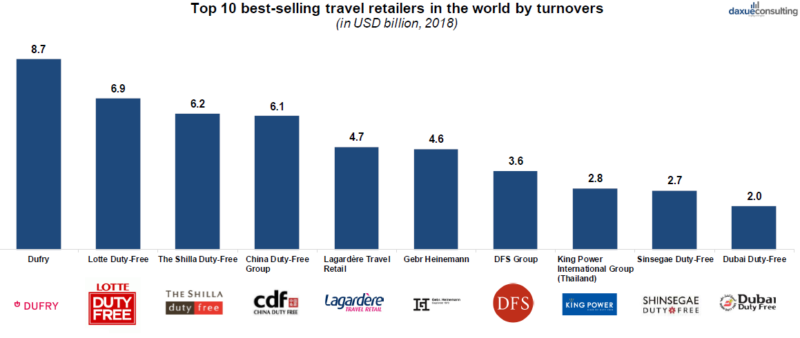

Global competitive landscape of travel retailers

The global duty-free and travel retail market is highly fragmented, and the market is dominated by non-Chinese brands.

[Data Source: Moodie Davitt report, Chinese Duty-Free Consumption report by daxue consulting, best-selling travel retailers are non-Chinese]

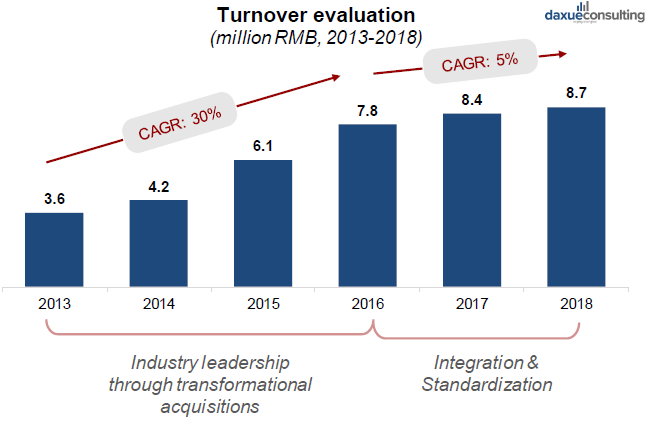

Chinese Duty-free consumption: Business overview of Dufry

DufryAG, from Switzerland, is the world’s largest duty-free retailer with over 2,300 shops in 65 countries. The combination of organic growth and M&A enabled continuous high growth of Dufry.

[Data Source: The Global Travel Retailer 2019, Chinese Duty-Free Consumption report by daxue consulting]

Dufry’s digitalization strategy

Dufry aims to be present at every stage of the whole Chinese customer journey. By using digital and technology innovation, it is enabled to improve consumers’ shopping experience and provide personal tailored services. Travel loyalty program combining shopping and travel benefits.

After one year of membership, average purchase frequency increased 80% and the average spending increased 131%, comparing to the data collected one year before the membership. Dufry has virtual lipstick testing technology in the store, customers can change the color with a tap of the screen. The strategy engages customers during in-store shopping experiences.

Dufry’s pre-order service for Chinese consumers

Dufry’s “reserve & collect” website allows consumers to pre-order duty-free goods online, then pick up and pay for Hong Kong’s offline stores. The website had 5,570 visits in November 2019. The service adopted Chinese consumers’ demands for convenience and preferential price.

[Data Source: SimilarWeb, Chinese Duty-Free Consumption report by daxue consulting]

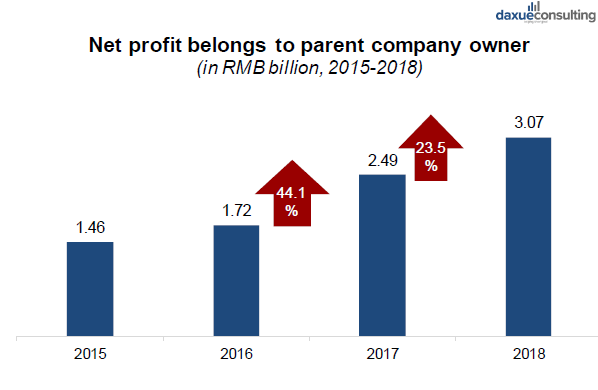

Chinese Duty-free consumption: Overview of the China duty-free Group (CDFG)(中国免税集团)

As a state-owned duty-free company, China duty-free Group (CDFG) has realized high-speed development in recent years with powerful support from the Chinese government. The company has started to step into the global market, although it focuses on China’s domestic market.

[Data Source: chyxx.com, Chinese Duty-Free Consumption report by daxue consulting]

CDFG’s new travel retail strategy

Utilize digital technology to enhance connection with consumers. For example, in 2018, CDFG built a membership big data platform that helped the company have better understanding on their customers. Then, personalized service can be offered to ensure better shopping experience.

[Data Source: tfwa.com, Chinese Duty-Free Consumption report by daxue consulting]

CDFG’s strategic cooperation with Alibaba

In November 2018, CDFG officially built strategic partnership with Alibaba Group to expand the retail market in China. The cooperation focuses on areas including e-commerce, big data and logistics, aiming at establishing a new tourism ecosystem. The partnership allowed CDFG to use Alibaba’s digital tools and e-commerce platforms to optimize offline duty-free shopping and improve its logistic efficiency. According to the agreement, consumers can use Alipay in CDFG’s offline duty-free stores. As one of the merchants on ‘Fliggy buy’ (the global shopping channel on Fliggy, platform owned by Alibaba), CDFG can provide its products and content to attract Chinese consumers.

Powerful support from Alibaba group ensure CDFG better performance on digitalization and have access to more consumers’ information.

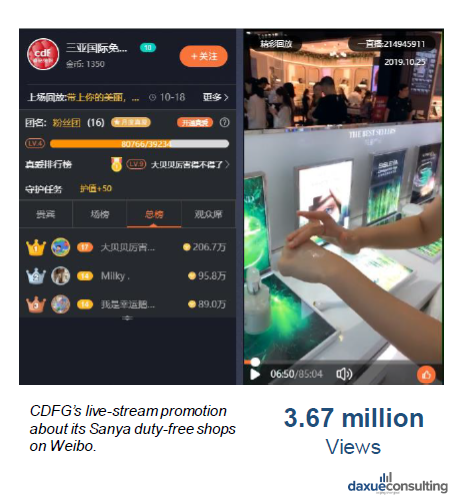

CDFG’s social media strategy

In addition to KOL collaborations, CDFG also leveraged live-stream promotions. The live-stream focused on skincare and cosmetics demonstrations. Also, it picked some popular brands to introduce price, size, discount, etc. by interviewing salespeople. Many Chinese consumers favor this kind of videos that share in-store experience. Audience members who share the video can have a chance by lucky draw to receive Guerlain’s perfume for free. This attracted much attention from Chinese customers and received 3.67 million views on social media.

The upgraded strategies of duty-free retailers

As in the case with many offer industries, digitalization offers great opportunity to the duty-free and travel retail industry. For duty-free retailers, digital technologies are tools that can build a travel retail ecosystem. By working closely with brands, airports, airlines, etc., data can be integrated to obtain a complete view of the customer journey and buying behaviors. Therefore, duty-free shops and travel retailers are enabled to provide superior customer experience and establish loyalty programs. By integrating online and offline channels, travel retailers are able to further increase personalized communication with customers at home, during their whole journey, and when they are at the airport.

Chinese traveling shoppers usually learn about duty-free products from shopping related content and other people’s comments on Chinese social media platforms. Understanding and adapting to the needs of Chinese tourists is critical. Chinese consumers have different shopping habits from other countries’ tourists. Duty-free retailers should have content and promotion activities that precisely target different types of Chinese consumers.

Key Takeaways

China’s travelers are increasingly sophisticated. The Chinese millennials (born in the 80s and 90s) are sophisticated, price sensitive, and usually search on social media and travel websites before tourism and purchase. They seek high value, unique and exclusive products during their trips.

Experience is as important as price. Chinese overseas travelers value unique experiences. Innovative store design, engaging customer service, targeting emotional connections and flexible payment methods can bring better shopping experience to Chinese duty-free consumers.

Reach consumers ahead of time and optimize convenience. Most Chinese tourists plan their duty-free purchases ahead of time. Brands and duty-free shops promote products by allowing pre-orders, remote fulfillment and mobile payments. This helps Chinese consumers move purchases from being impulse to planned, and reduce ‘inconvenience’ as a barrier of shopping.

Attracting Chinese consumers by exclusive deals. Many Chinese tourists want to buy products they cannot find in China. Duty-free stores can drive demand by having a greater array of limited-edition products, value packs, and duty-free exclusives.

See our Chinese duty free consumption report

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes