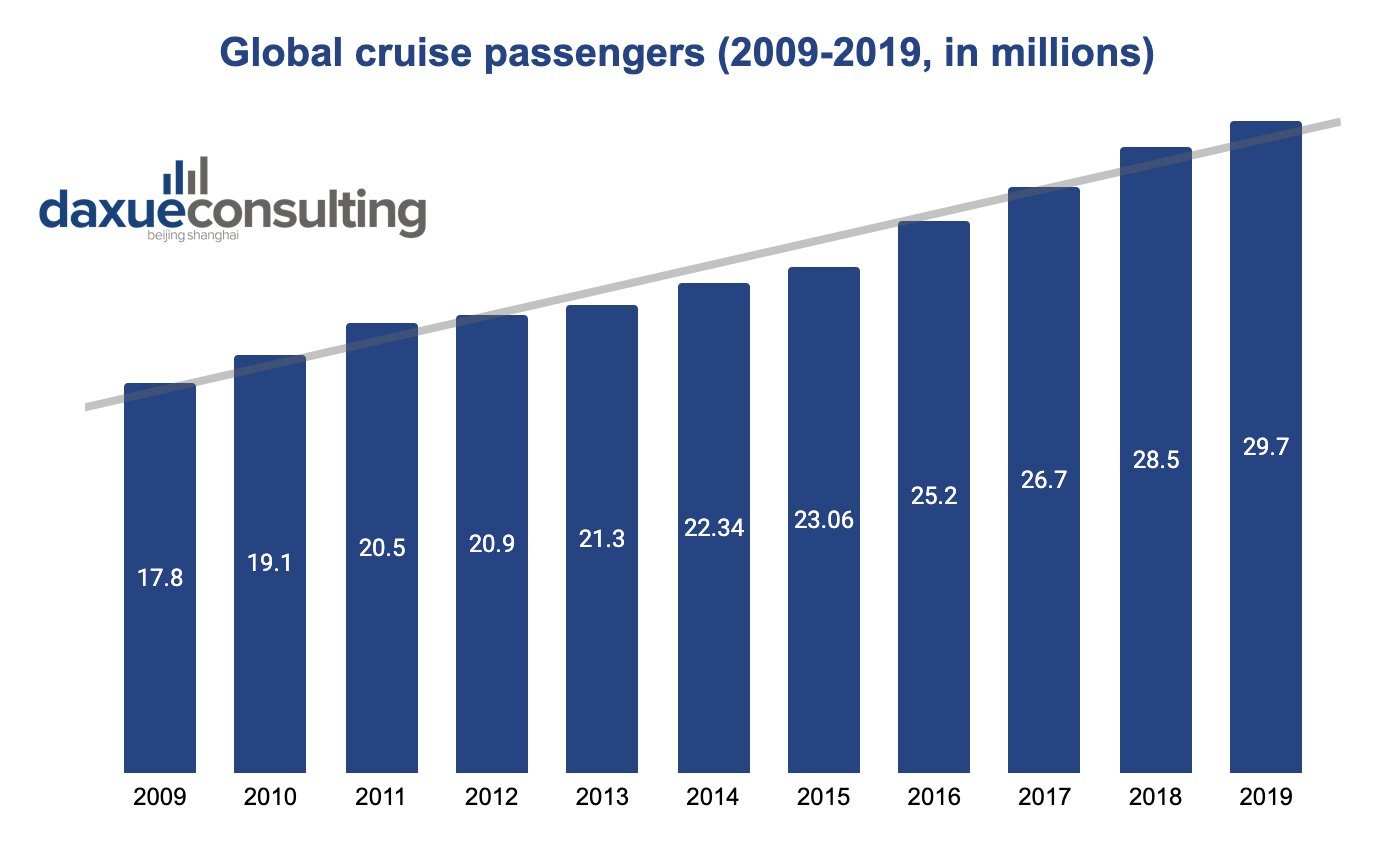

The global cruise industry is a growing market. Between 2009 and 2019, the global industry grew on average 5.28% per year. It hence increased its total passengers from 17.8 million in 2009 to 29.7 million in 2019. The Chinese cruise industry plays an important role on an international level, with Chinese consumers being the second largest nationality of cruise vacationers, only after Americans. In 2019 Chinese passengers accounted for 2.4 million or 8% of the total passengers.

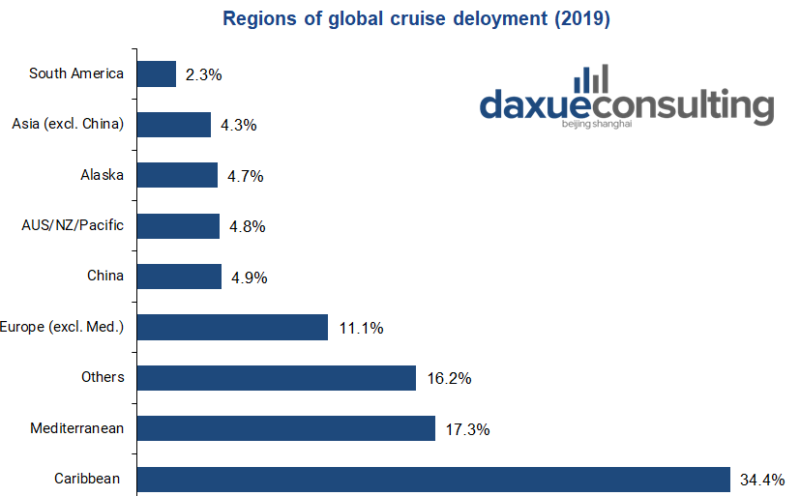

However, Chinese passengers do not exclusively take cruises in China or even Asia. In 2019, cruises in Asia, as well as in China had fallen behind destinations such as the Caribbean and Europe. The Caribbean is the global leading destination, representing 34.4% of cruises deployments. Europe accounts for the second most popular region with 28.4%, 17.3% accounting for the Mediterranean Sea. Asia still provides a large part of cruise deployment, 9.2% of the global traffic, with China accounting for 4.9%.

Data Source: Cruise Lines International Association (CLIA), shows the split by region of international cruise deployment, China makes up for only 5% of cruise deployment

What are the largest companies in the Chinese cruise market?

Carnival Corporation

In 2019 Carnival Corporation carried 12.9 million passengers on its 104 vessels, an increase of 500,000 passengers compared to 2018. This translates to a revenue of $20.8 billion in 2019. However, the American and European region contribute most to Carnival’s revenue numbers. Australia and Asia only account for $2.6 billion, roughly 12.6% of the company’s total revenue. Carnival Corporation is actively expanding its Chinese market position as the company sees an attractive opportunity of capturing Chinese travelers and predicts that China at one point will become the largest cruise market worldwide. Carnival Corporation engaged in a venture with China State Shipbuilding Corporation (CSSC) in 2015, with the first cruise ships built in China expected to be delivered in 2023.

Royal Caribbean Group

Royal Caribbean appeared in 1968 in Norway and aimed at cruises in the Caribbean. To further grow its business, Royal Caribbean acquired and merged with other cruise lines and is currently have the following sections: Royal caribbean International, Celebrity Cruises, Silversea Cruises, Tui Cruises and Hapag-Lloyd Cruises. The brands provide different targeting and regions, with Royal Caribbean International serving the Asian and Chinese market and being in the contemporary and premium segment. In 2019, Royal Caribbean recorded a revenue of roughly $10.9 billion which is considerably less than its competitor Carnival Corporation. Also, its fleet of 67 ships (2019) is much smaller than Carnival’s.

What are the largest Chinese ports and cruise routes?

The Chinese cruise industry has multiple ports along the coast of China to choose from. Here are the three largest cruise ports:

The busiest port in Mainland China is Shanghai Baoshan. It accounts for roughly 60% of China’s cruise traffic and it serves mainly Carnival’s, Royal Caribbean’s and MSC’s fleets. In 2017 Shanghai Baoshan hosted 512 port calls. The port further expanded in 2018, with a new terminal should enable the port to handle 1,000 cruise calls translating into 6 million passengers by the end of 2023. The port mainly serves routes to Japan or Korea on an international level. Domestically, Shanghai Baoshan is a popular arrival or departure port for Yangtze River cruises which usually make a stop in Wuhan or Chongqing.

Another important cruise port in Mainland China is Tianjin’s port, which is located in the north of China, close to Beijing. Major cruise lines, such as Royal Caribbean, Princess or Costa Asia operate from Tianjin. In 2017, Tianjin’s port served a total of 175 cruise calls which held a total of 940,000 passengers. Cruises mostly sail in between locations in Japan, such as Nagasaki or Fukuoka.

Also worth mentioning is Hong Kong’s port. Royal Caribbean was an early provider, offering cruises between Hong Kong and Shanghai as early as 2007. In 2017 roughly 1.7 million cruise passengers were going through Hong Kong’s port. Chinese and Taiwanese passengers accounted for 80% out of the 1.7 million. The cruise itineraries departing from Hong Kong mostly stop in Vietnam, Japan or Mainland China.

What product offering do cruises provide?

Amenities on cruise ships are essential when it comes to attracting customers. As cabins are mostly smaller than hotel rooms and passengers spend most of their time onboard the ship, cruise companies must offer a variety of services and entertainment to provide passengers with new cultural experiences. In line with most cruise companies, passengers pay a fixed fee with which they can enjoy an all-inclusive experience onboard. Special add-ons can be in the form of spa treatments, special dining experiences or to include unlimited alcoholic beverages into the package.

Cabins

Across most cruise lines, passengers can choose among four types of cabins. Firstly, the cheapest cabin is located at the inner side of the ship and does not provide a window in it. Secondly, the ocean view cabin comes with a window facing the sea. Thirdly, passengers can book a cabin with a balcony included. Lastly, the most expensive cabins are suites that not only offer more space but also include more luxury amenities and can sleep more passengers.

For example, on the Queen Elizabeth cruise ship operated by Cunard, passengers staying in the Queens Grill Suite can enjoy chocolate and champagne on arrival, daily fruit baskets and a personalized butler service. The Queen Elizabeth sails amongst others between Singapore and Shanghai with stops in Vietnam. Whereas on the cruise the inner cabin is priced at $1,929 the most expensive Queens Grill Suite lays at $8,129 for the 12 nights cruise from Singapore to Shanghai in spring 2022.

Food & Drinks

Throughout a cruise in China or Asia, the Chinese or international traveler can experience the local cuisine on board through various restaurants. Royal Caribbean’s Spectrum of the Seas ship for cruises in and around China offers local food in their Noodle bar or their Sichuan style restaurant. Also, there are Japanese dishes in the on-board Teppanyaki restaurant.

In line with most cruise lines, passengers can choose to dine in one of the many restaurants, bars and buffets that are included in the price. Additional costs are charged for special restaurants, such as private dining, cooking classes or master chef meals. Other cruise providers operate comparably. Cunard’s Queen Elizabeth ship offers a large variety of food in the main dining restaurant; however, the focus is clearly placed on Western cuisine. For an additional fee, passengers can choose to dine at specialty restaurants such as Aztec restaurant (Mexican cuisine) or Bamboo (Asian cuisine).

Entertainment

Most cruises offer a large variety of entertainment and activities to do on-board. Many of them are tailored to the Chinese cruise market to meet the consumer demands.

Firstly, passengers aged 18 years or above can enjoy gambling in the casino. There are slot machines available, as well as table games such a Roulette or even tournaments in which passengers can win money. This is particularly attractive for Chinese consumers as gambling in China is illegal.

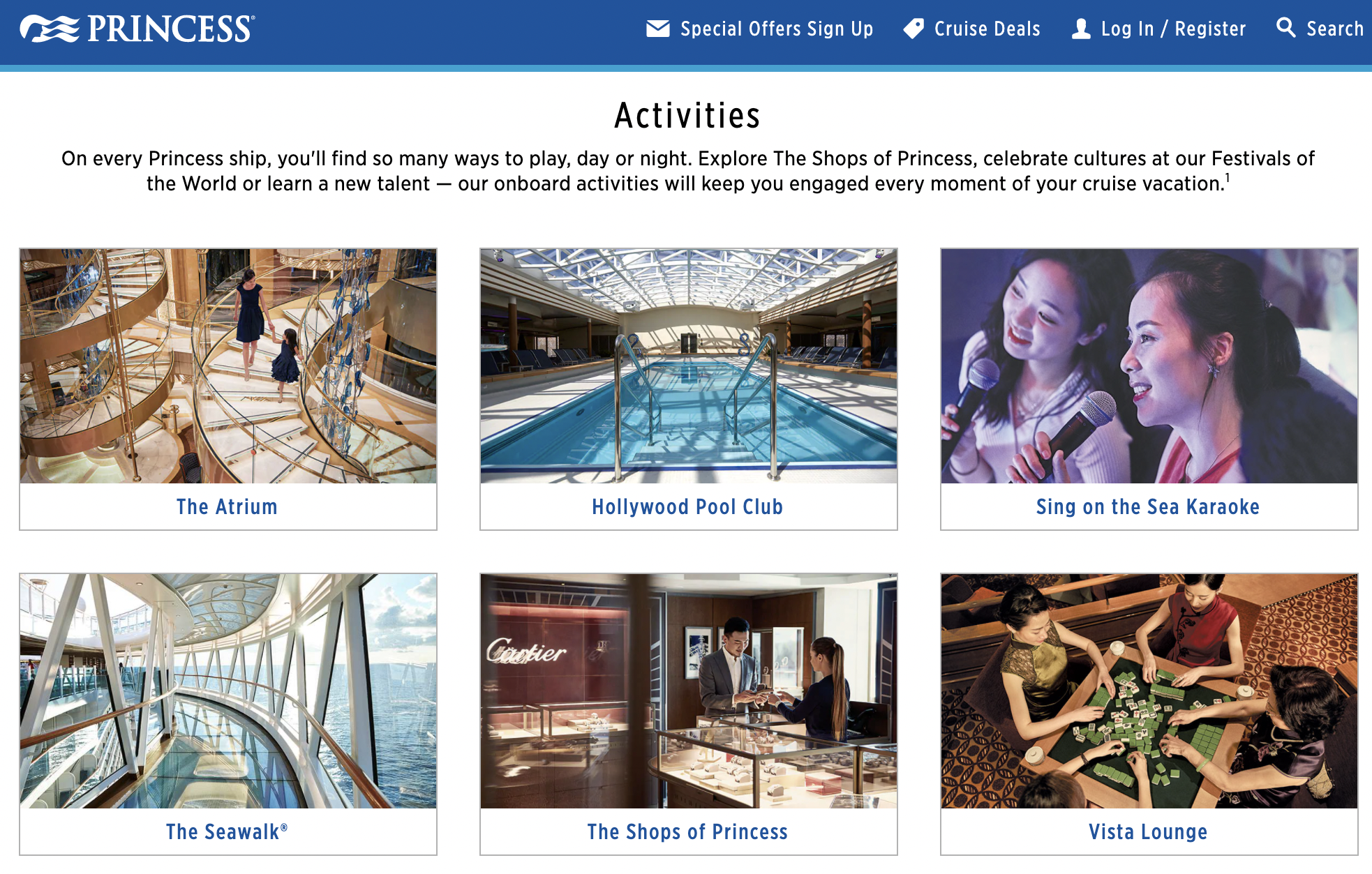

Secondly, there are various shopping stores and art auctions on-board the cruise. Passengers can enjoy going shopping for all kinds of consumer goods, such as clothes, jewelry and perfumes. The shopping on board is tax and duty free. With luxury items with much higher price in China, Chinese passengers can enjoy a large price discount on board. For example, the Majestic Princess Cruise Ship offers luxury brands such as Cartier, Chopard, Gucci and Chanel which are around 30% cheaper than the US retail price. The Chinese duty-free consumption is the world’s largest outbound travel market.

Thirdly, cruise lines provide a variety of live-shows for their passengers to enjoy. The shows are often specifically designed for the cruise and include different topics to please a large variety of people.

Unforgettable experience

Cruise passengers can enjoy a huge variety of additional activities during the cruise. Spa treatment, pools and sport courts are available on cruises. Tailored to the Chinese consumer, the Majestic Princess Cruise Ship offers private karaoke boxes in which customers can choose from American, European and Chinese song selections. The Royal Caribbean Ocean Spectrum cruise offers activities such as a skypad that simulates a skydiving experience, a climbing wall or classes in dancing and sword fencing.

How do cruise companies advertise in China?

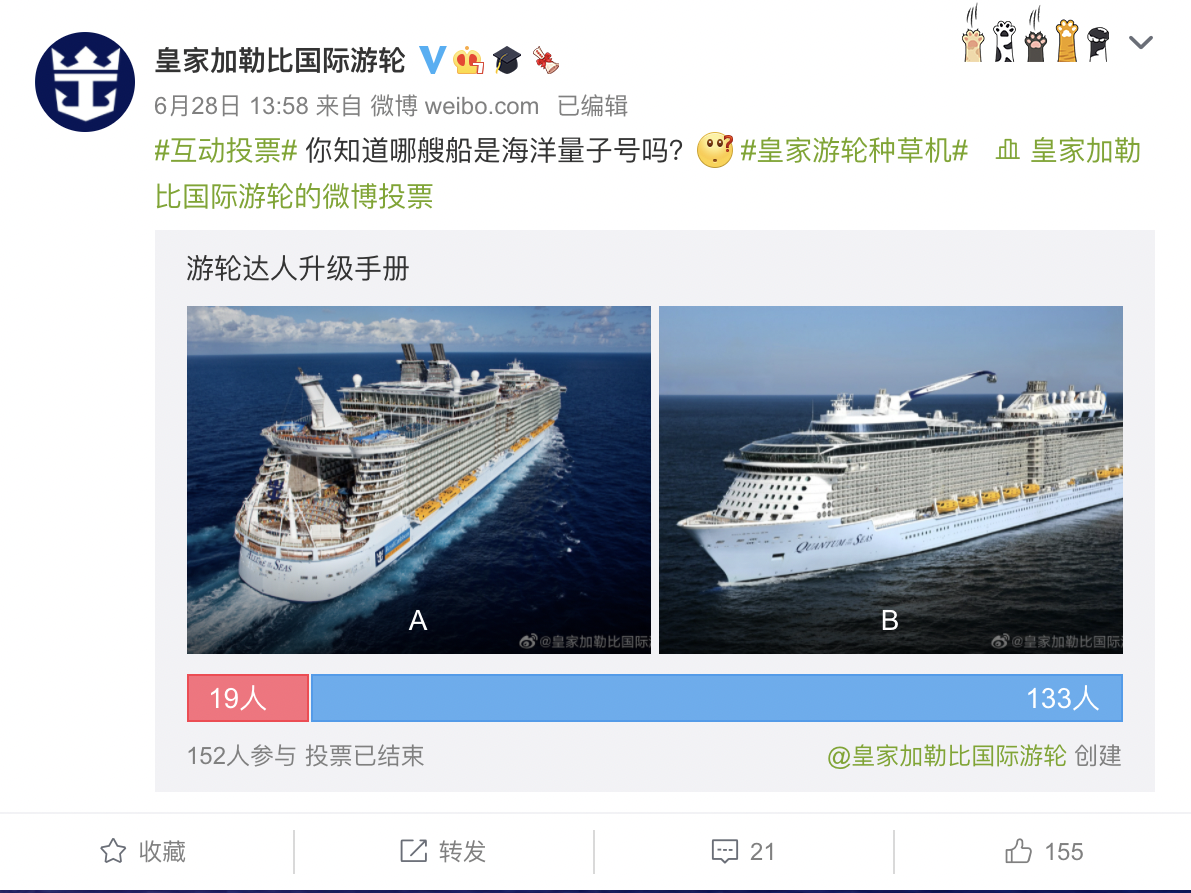

Cruise companies leverage Chinese social media channels to promote cruises and engage customers. Royal Caribbean uses daily Weibo posts to engage consumers, such as posting quiz questions. However, engagement numbers are rather low, as only 152 participants were recorded. There is still room for Royal Caribbean to improve navigating around China’s digital marketing ecosystem.

Princess Cruises has also released a video called “Princessa” that and promoted it on social media and TV. Consumers were directed to a micro blog where they could determine their travel personality and receive tailored travel suggestions and itineraries. Princess Cruises international marketing director stated that “Princessa” marks the first campaign created uniquely for its international and emerging markets, highlighting its global fly-and-cruise destinations.

Who are the main consumers in the Chinese cruise industry?

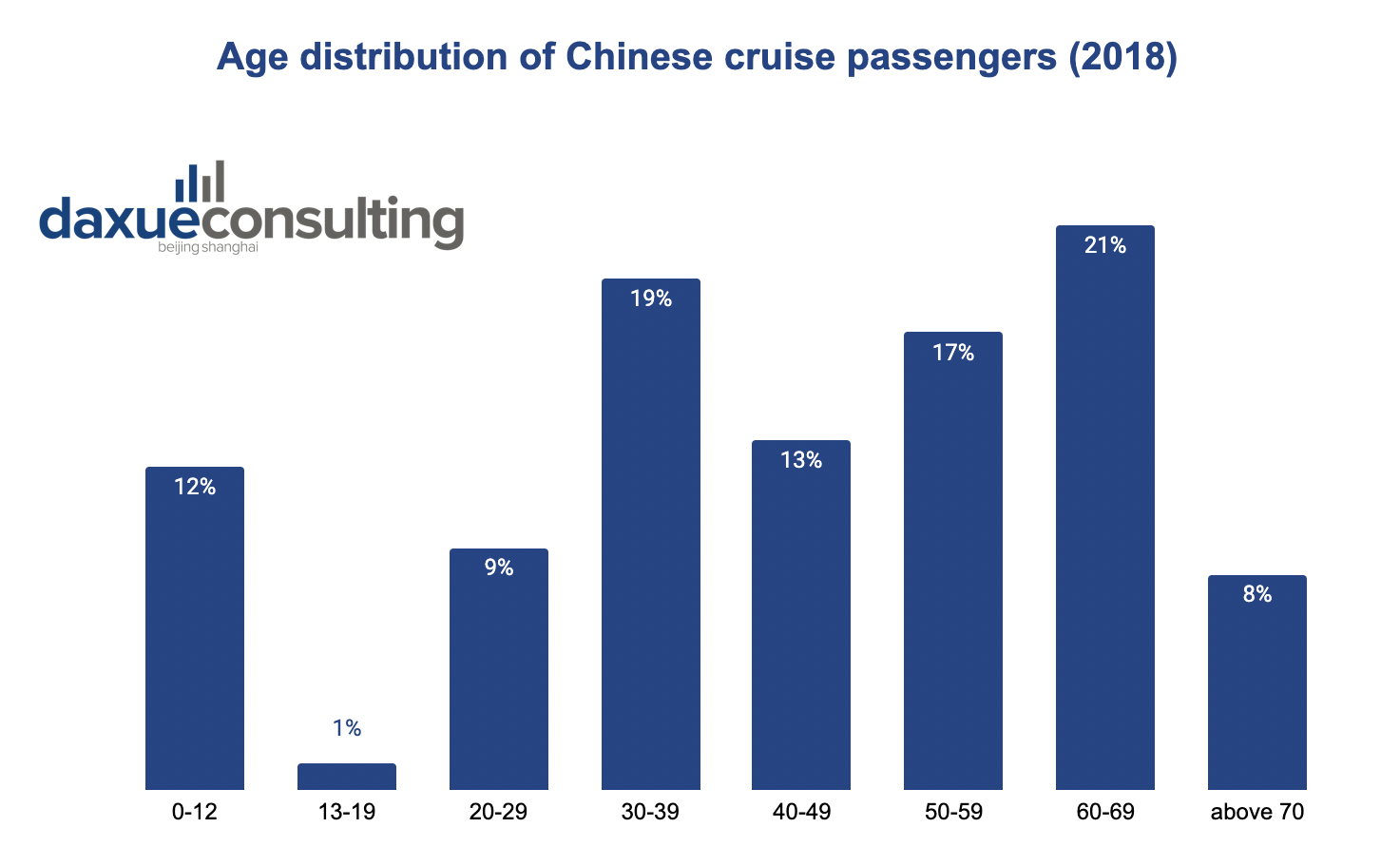

Cruise passengers in Asia are on average 45.4 years old, 2 years younger than the global average. When looking at the age distribution of Chinese cruise passengers there are several insights. Firstly, the percentage of children, especially below 12 years is considerably high, indicating that a cruise vacation is primarily popular among families. Secondly, the large percentage of 30-39 years old gives a good indication of parents travelling with their family. Lastly, the 60-69 years old consumers account for the largest percentage of Chinese consumers. This shows that a cruise vacation often includes a family with three generations on board. Chinese cruise passengers place more emphasis on family than their American counterparts. Meaning that Chinese families physically spend more time together and children spend less time in the kids’ clubs on board.

What are the current trends of the Chinese cruise industry?

The Chinese cruise market is increasingly attracting consumers and offers a large growth potential for investors. However, cruise lines face more and more pressure to provide sustainable and environmentally friendly travelling as well as providing consumers with outstanding experiences. Particularly in recent years, the global cruise industry was hit hard by the COVID-19 pandemic with China closing its borders for international travel. This also gave rise to domestic tourism trends in China.

Cruise companies are placing more importance on health and safety standards after the COVID-19 pandemic

Cruises travelling experienced a setback during the COVID-19 pandemic, being a breeding ground for large COVID-19 outbreaks. In February 2020, a Princess Cruise ship had to isolate itself off the coast of Japan with more than 700 infected passengers. In response to the recent pandemic the Cruise Lines International Association (CLIA) has released a framework all of its members have to follow. With CLIA members making up more than 95% of the international cruise capacity, it is a worldwide new set of standards to increase passenger health and safety. The document released required an increase in medical facilities, equipment, staffing and procedures, such as face masks and testing equipment. Moreover, ship sanitation and regular crew and passenger testing is necessary.

Cruise ships become more sustainable and innovative

Cruise ships may have a negative impact on the maritime environment and consumers are increasingly demanding a more sustainable cruise experience.

Ship makers are switching to vessels powered by liquified natural gas (LNG) which reduces the greenhouse gas emissions by 20% and holds no sulfur emissions. Moreover, exhaust gas cleaning systems (EGCS) cleans sulfur particles from the exhaust gas at a 98% level, contributing significantly to environmental protection. For example, Royal Caribbean’s Spectrum of the Seas cruise liner that homeports in Shanghai and Hong Kong entails an emission control system. However, there is still a lot of room for improvement. A cruise ship passenger on average is responsible for 0.82 tonnes of carbon-dioxide on their cruise, the same as flying return between London and Tokyo.

5 takeaways for the Chinese cruise industry

- Chinese nationals are the second largest group among cruise passengers, accounting for 8% of the global traffic in 2019. Cruise ship passenger demographics shows that families and the silver generation are the top consumers.

- Chinese consumers can gamble on cruise ships, while it is prohibited in China.

- A duty- and tax-free shopping offering enables Chinese consumers to save up to 30% of US retail prices and is a major selling point in the Chinese cruise industry.

- COVID-19 has accelerated higher safety and health standards on board.

- Cruise ships are becoming more environmentally friendly and sustainable.