The Chinese financial system

The growing prominence of the Chinese economy at the international level has gradually gained the attention of international media. In particular, the opening up of the Chinese stock market has attracted the interest of international investors that saw China as an untapped investment opportunity. However, for many of these international investors, the question “How to invest in Chinese stocks?” remains unanswered. For this reason, Daxue Consulting decided to shed some light on the unique history of the Chinese stock market. The last three decades have been of particular relevance for the development of the Chinese financial system, due to new and more transparent regulations, sustained economic growth and the increasing integration of China into the global economy, which created the right conditions for the internationalisation of the Chinese stock market. But how did the modern Chinese financial system became what it is now?

How to Invest in Chinese Stocks

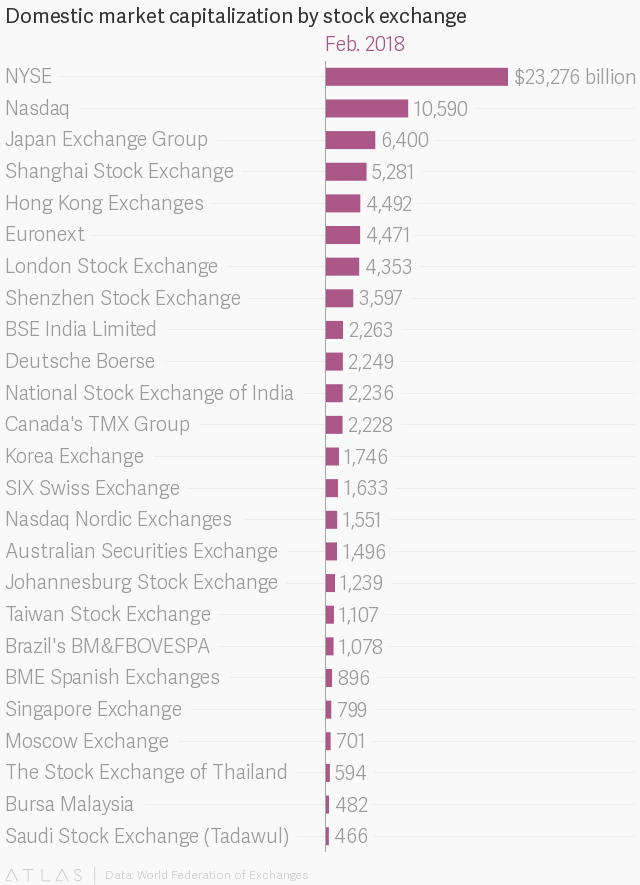

The Chinese financial system went a long way from the one-bank system under Mao to the four-bank system under Deng. Today, the banking sector in China, which is still largely controlled by the state, accounts for over $30 trillion in assets. The modern Chinese stock market was established only in 1990, primarily to privatise state-owned enterprises (SOEs). Until 2005, around 30% of equity shares were tradable, with the remaining 70% held by the state or state-backed entities. Its total market capitalisation surpassed $1 trillion in 2006. The modern Chinese stock market was established in Shanghai (Shanghai stock exchange) and Shenzhen (Shenzhen stock exchange) in 1990, during the final years of Deng Xiaoping’s leadership. One of the primary goals of this “experimental stock market” was to provide, as already mentioned, a platform that would primarily allow Chinese SOEs to receive more fundings from private actors.

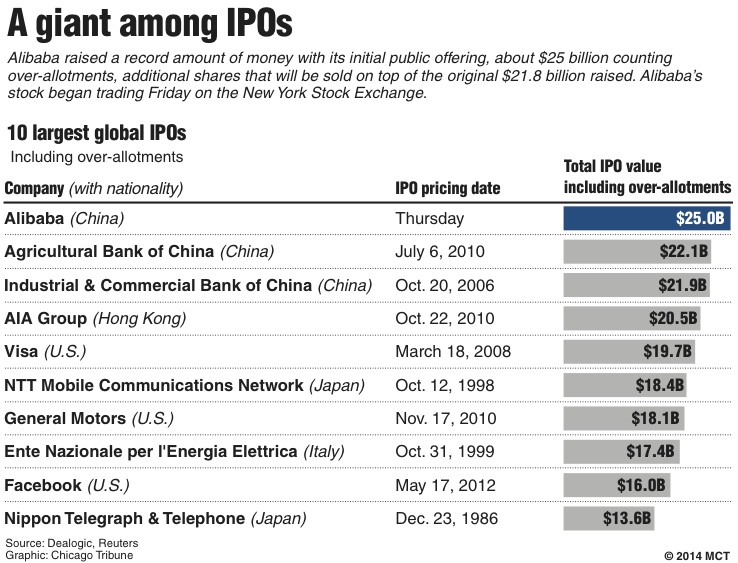

A brief history of IPOs in China: the record-breaking IPOs of Chinese companies and banks

IPOs with Chinese characteristics

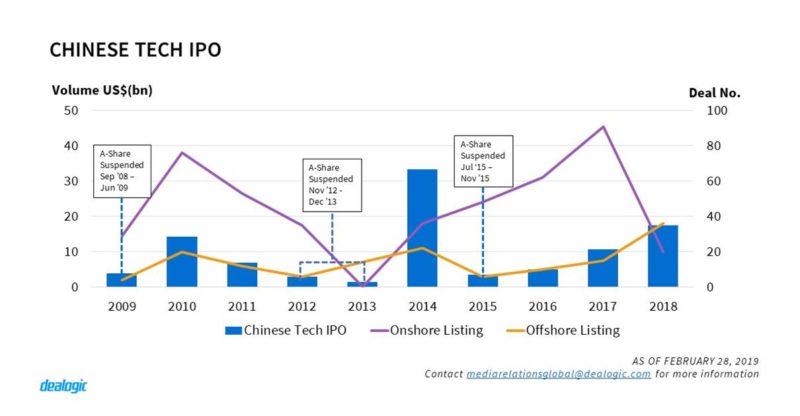

Going back to the question “how to invest in Chinese stocks?” First of all, one of the most important features of stock markets is the initial public offering (IPO). An (IPO) is the process of offering shares of a private or state-owned corporation to the public via a new stock issuance. The issuing company manages to raise capital from public investors thanks to a public share issuance. The transition from private to a public company is an important opportunity for private investors to fully realise gains from their investment, as it typically includes share premiums for current private investors. Typical of the Chinese stock market is the issuance of different types of shares: A-shares, which are issued in Chinese Yuan (RMB); B-shares, which are issued in US Dollars (USD) and H-shares, which are issued in Hong Kong Dollars (HKD). These different types of shares are regulated by the China Securities Regulatory Commission (CSRC).

How Chinese businesses are defining IPOs in China and around the world

As noted by the journal Financial Times in December of 2011, before 2009, the United States was the leading issuer of IPOs by aggregate value. Since then, however, China, with Shanghai, Shenzhen and Hong Kong, emerged as the leading issuer, raising $73 billion—almost twice the amount of capital raised on the NASDAQ and New York Stock Exchange (NYSE) combined. In 2011, the Hong Kong Stock Exchange alone raised $30.9 billion—thus becoming the leading course, while New York raised $30.7 billion.

How IPOs in China actually work and how to invest in Chinese stocks

Understanding how the rather convoluted Chinese stock market works is fundamental to avoid fatal value judgements. In fact, as noted in the paper “The Development of China’s Stock Market and Stakes for the Global Economy” published on June 1, 2017 by the academics Jennifer N. Carpenter and Robert F. Whitelaw from New York University, a key challenge for everyone that is trying to gain familiarity with China’s peculiar financial system is that of avoiding the over-application of research paradigms developed in the US. This fallacious approach projects an ill-fitting range of norms and behaviours on the Chinese financial system that do a disservice to every would-be investor approaching the Chinese stock market.

In fact, as noted earlier in this article, the existence of different types of stock shares, which are differently accessible to investors, adds a further variable to the equation of the Chinese labyrinthine stock market. On their part, Chinese firms have access to a range of choices for potential incorporations and listings, which make China a uniquely rich setting for investment and corporate listing choice. Chinese firms incorporated in mainland China can apply to list A-shares and B-shares on the Shanghai (SSE) or Shenzhen (SZSE) Exchanges, or H-shares on the stock Exchange of Hong Kong (SEHK). The SSE and SZSE each have mainboards, where larger, more mature companies list, including most SOEs. Furthermore, the SZSE has the SME and ChiNext Boards, with more relaxed listing standards, designed to accommodate smaller and more entrepreneurial firms, as Carpenter and Whitelaw pointed out in their paper.

Shanghai Stock Exchange and the Chinese financial system

The Shanghai Stock Exchange is one of the two stock exchanges operating independently in the People’s Republic of China—the other being the Shenzhen Stock Exchange. The foundation of the Shanghai stock exchange was the result of the Treaty of Nanking in 1842—which followed the First Opium War—and other agreements involving the Chinese imperial government and the colonial powers of the day. These agreements played a crucial role in the development of foreign trade in China and the influx of foreign communities in Shanghai. The securities trading market in Shanghai did not begin until the late 1860s. The first shares list was issued in June 1866, and by then the Shanghai’s International Settlement had developed the necessary sophistication—a legal framework for joint-stock companies, several banks, and an interest in diversification among the established trading houses, even though the trading houses themselves remained partnerships—for the emergence of a proper stock market.

By the early 1930s, Shanghai had emerged as the premier financial centre of East Asia, where both Chinese and foreign investors could trade government bonds, stocks, debentures and futures. However, the operation of the Shanghai Stock Exchange was abruptly interrupted by the occupation of Japanese troops on December 8, 1941. In 1946, the Shanghai Stock Exchange resumed its operations only to be closed again in 1949 by dint of the newly established Communist government. After the end of the Cultural Revolution and the ascension to power of Deng Xiaoping, in 1978, China opened up again to the outside world. During the 1980s, the securities market in China developed in lockstep with the country’s economic reform and opening up. On November 26, 1990, The Shanghai Stock Exchange was re-established, and operations began a few weeks later on 19 December. At $4.78 trillion as of March 2019, the Shanghai Stock Exchange is the world’s 4th largest stock market by market capitalisation. However, unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is not entirely open to foreign investors yet, because it is still influenced by the decisions of the central government.

Hongkong Stock Exchange and the Chinese financial system

The unique history of Hongkong played a crucial role in setting the city aside from the other financial and economic centres of mainland China. Hong Kong is a Special Administrative Region—officially known as Hong Kong Special Administrative Region of the People’s Republic of China—which has been a British protectorate from 1842 to 1997. Because of its history, Hong Kong developed more free-market-oriented financial institutions, which is why it soon became the financial bridge between mainland China and the international markets. The Stock Exchange of Hong Kong was formally set up in 1891 when the Association of Stockbrokers in Hong Kong was established, but the securities market can be traced back to 1866. In 1914, it was renamed The Hong Kong Stock Exchange. The automated exchange ordering was introduced in 1993, which was followed by stock options trading in 1995. The Hongkong Stock Exchange merged with the Hong Kong Futures Exchange and the Hong Kong Securities Clearing Company in 2000 to form the publicly-traded company Hong Kong Exchanges and Clearing Ltd. Because of the growing dominance of electronic trading, the physical trading floor of the Hongkong Kong Stock Exchange was closed down in 2017. As of March 2019, the Hong Kong Stock Exchange is valued at $4.19 Trillion, which makes it the 6th largest stock market by market capitalisation.

Shenzhen Stock Exchange and the Chinese financial system

It is one of the two stock exchanges operating independently in the People’s Republic of China, the other being the larger Shanghai Stock Exchange. It is situated in the Futian district of Shenzhen. With a market capitalization of its listed companies around US$2.285 trillion in 2015, it is the 8th largest stock exchange in the world, and 4th largest in East Asia and Asia. Most impressively, the Shenzhen Stock Exchange was established on December 1, 1990, which makes its rise among the world’s top ten stock exchanges by market capitalization even more remarkable. The SZSE has trading sessions four hours a day, five days a week from 9:30 a.m. – 11:30 a.m. and 1 p.m. – 3 p.m. Its products include A-shares, B-shares, indices, mutual funds, fixed income products and diversified derivative financial products. The SZSE supports China’s multi-tiered capital market system with three boards: the Main Board, the SME Board (launched in May 2004) and the ChiNext Market (launched in October 2009).

The evolution of the Chinese stock market and its integration with the global market

Though China’s stock market has grown to over $7 trillion, of which over 75% is tradable, its markets for equity mutual funds and derivatives are still very small and new. The equity mutual fund market began in 1998 but still has only $500 billion under management. By contrast, ICI (2016) reports that US domestic equity mutual funds have over $7 trillion under management, representing over 30% of US stockmarket capitalization. Derivatives markets are at an even earlier stage of development. The market for stock index futures opened in 2010 and index options began trading in 2015. (Carpenter Whitelaw – The Development of China’s Stock Market and Stakes for the Global Economy) Chinese businesses in the stock markets, their ever-growing relevance.

The importance of publicly listed Chinese companies: how to invest in China while respecting Chinese law

While much of the development of China’s stock markets over their almost 30 year history has been driven by domestic concerns, global investors are now becoming increasingly influential. As China has made initial steps towards relaxing capital controls and Chinese investors have viewed international investments as increasingly attractive, in part due to fear of depreciation of China’s currency, capital outflows have become an increasing concern. One fix for these outflows would be to replace them with offsetting inflows from global investors, with the stock market being a natural destination. The presence of sophisticated international institutional investors might also increase the informativeness of prices and reduce the cost of capital as argued in Carpenter et al. (2017). Klicken oder tippen Sie hier, um Text einzugeben.

What information do you need to invest wisely in Chinese companies?

The recent trends of IPOs in China

Finally, while there are a host of interesting and unanswered research questions about China’s developing stock market, from a domestic and global economic perspective the key issue is the role of this market in sustaining China’s economic growth going forward. China is at a pivotal point in its development as it attempts to transition from a state-controlled, investment-driven economy to one that is more market-oriented and consumption-driven. It is also at a critical point in its path to integration in global financial markets, as highlighted by the debate over the potential inclusion of China’s A shares in the indexes of the global financial provider MSCI.

Understanding Chinese companies and IPOs in China

The development of the Chinese financial system, in general, and the stock market in particular, will likely play an instrumental role in both of these transitions. However, there are two key questions left. First, can the stock market improve the efficiency of capital allocation and support broader financial stability? Second, can the stock market serve as a platform for greater global diversification, thus improving risk sharing and potentially lowering the cost of capital for Chinese companies? We will probably know the answers to these questions in the coming years.

Author: Abebe Gasparini

Let China Paradigm have positive economic impact on your business!

Listen to China Paradigm in iTunes