In line with the objectives of the ‘Made in China 2025’ plan, China is committed to move up the value chain, turning its products into a synonym for high-quality and innovation. According to the National Bureau of Statistics of China during 2022 H1, the per capita disposable income nationwide was US$2,537.03, recording a nominal increase of 4.7% over the same period last year, and a real increase of 3.0% after deducting price factors. The growth in the overall income has led to more people choosing to invest in luxury items.

Xi Jinping’s shared prosperity campaign has also affected the Chinese luxury industry, especially regarding the younger generation of Chinese consumers.

A closer glance at the Chinese luxury watches industry

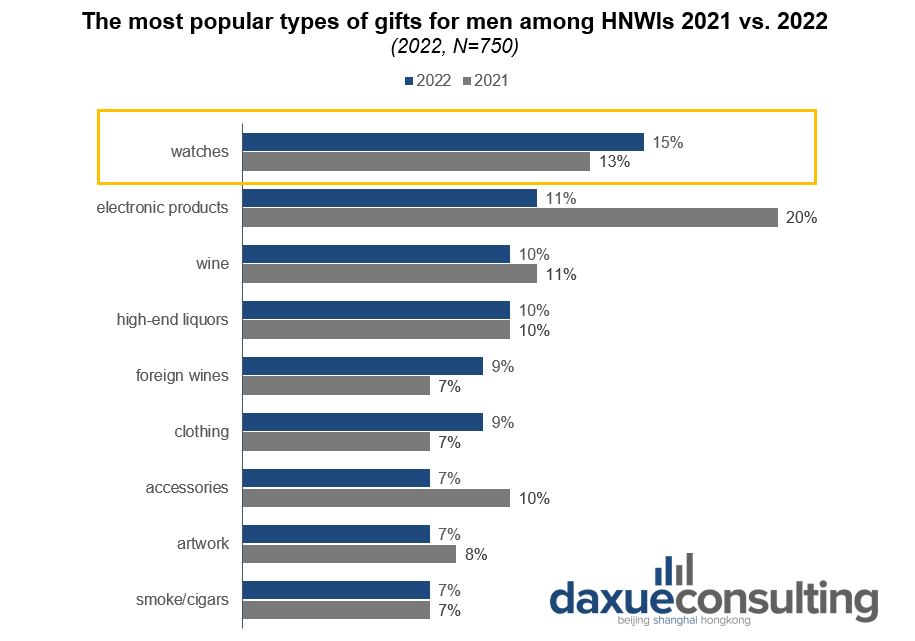

According to the Hurun Chinese Luxury Consumer Survey 2022, the most popular gifts for men were watches, while electronic devices dropped to the second place.

Moreover, 42% of respondents said they would buy second-hand luxury goods. Watches and jewellery (66%) are the most frequently purchased type of second-hand luxury goods.

Emerging Chinese watch industry has to cope with the great heritage of overseas luxury brands

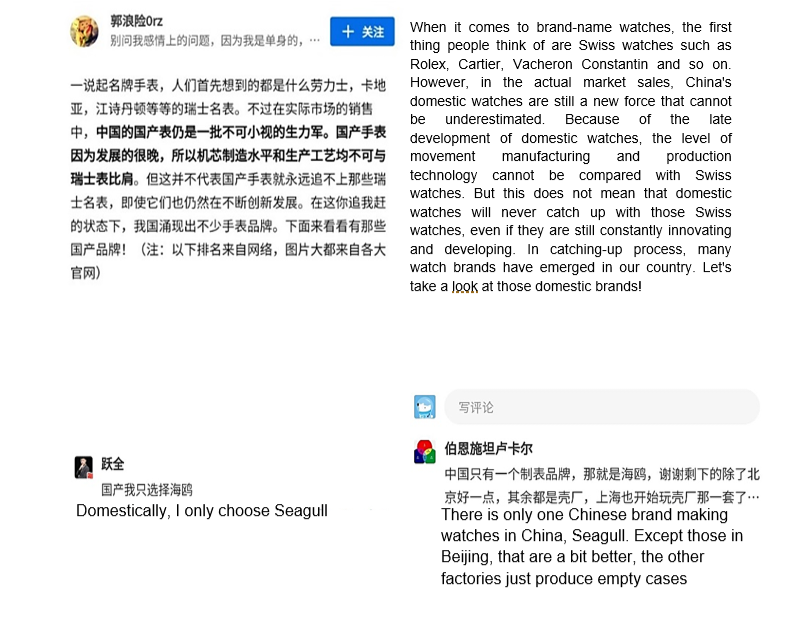

Branding is still a deciding factor for Chinese luxury first-time shoppers, who prefer purchasing well-established international luxury brands. Beyond the heritage of their name, international brands boast excellent marketing skills to increase their awareness, and vaunt much higher managerial expertise. “Swiss Made” watches dominate the luxury watch market, and the strict brand protection and certification make it even more difficult for Chinese brands to catch up with their foreign counterpart, such as Bulgari, Cartier, Rolex, Longines, and Patek Philippe.

According to the Swiss Watch Monthly Export Statistics and Analysis 2022 reported by China Horologe Association and China Customs, exports of Swiss watches were particularly strong in September, generating about US$306.7 million, one of the highest in history, recording a year-over-year increase of 19.1%. During the same period, exports almost reached US$3 billion, an increase of 12.6% compared to last year.

Luxury watches market has changed face: GEN-Z is a target but also an obstacle to overcome

46% of sales in the mainland luxury market were racked up by post‑ 80s and -90s consumers, and among which the GEN-Z accounted for 15% of the overall purchases. This group of consumers boasts enormous purchasing power and their spending is expected to generate more than US$2 trillion in 2035, according to financial advisory China Renaissance. GEN-Zs are those who lead the main trends, establishing the growth or decline of a brand, therefore it is important to understand their habits, which change day by day. Indeed, they lead the recent trend of Guochao, literally national trend, referring to the favoritism of consumers towards Chinese brands, this is considered a plus for increasing the brand awareness of Chinese luxury watches and a threat to international ones. For today’s young Chinese consumers “Made in China” does not necessarily mean “low-quality”, so the Western label is enough to compete with homegrown companies.

From digital innovation to deeper luxury experience post Covid-19

The main advantage of Chinese watch brands is being Chinese. They fully experience the rapid change in consumption trends and can understand from the inside what is happening in the country, and this is the weakness of some Western brands. Especially in the cross-border e-commerce, companies do not invest in an appropriate operating model for China. Companies’ data infrastructure has to connect all data sources so that relationships between them can be identified and understood. It must be taken into account the complexity of Chinese social media, which create an increasingly varied ecosystem thanks to consumers’ feedback. However, even multinationals still fail to fully understand Chinese culture and how it affects Chinese lifestyle (just think of the D&G case).

One strategy allowing Chinese watch brands to be perceived as high-end or remain are the VIP member rooms, a sort of special stores dedicated to premium customers, which allow consumers to enjoy services that are not available in regular store. The last generations prefer what they buy to be difficult for others to source and want to enjoy a seamless premium experience.

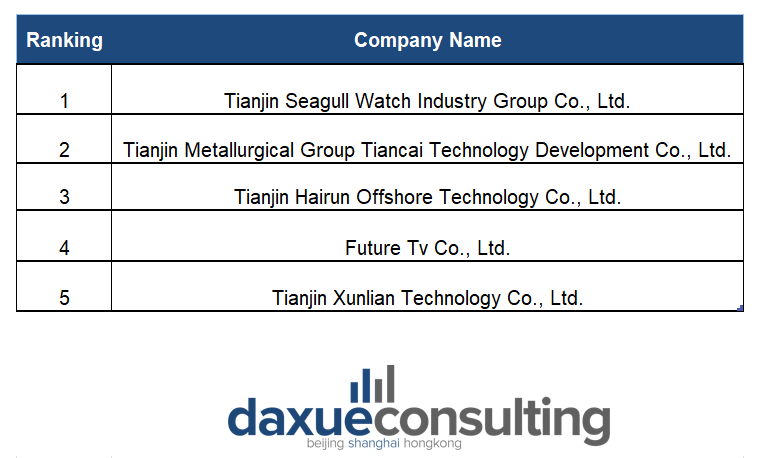

Tianjin Seagull Watch Museum

Tianjin Seagull Watch Museum offers a Chinese version of the VIP member rooms, providing a full experience by combining the world of luxury with cultural and social activities. It has been selected as the hub of the practice of industrial culture jointly established by the General Office of the Ministry of Education and the Ministry of Industry and Information Technology. It is in the Seagull Industrial Park of Tianjin Airport Economic Zone and on the Seagull Factory, hosts study and industrial tours, and allows visitors to understand the watch production process, thereby spreading the watch culture among young consumers, while increasing its brand awareness. A month ago, Seagull upgraded its R&D “hardware” and put into use a new technology center, in line with the objectives of “Made in China”.

About Chinese Luxury watch brands

Seagull Watch Company

Tianjin Seagull Watch Group 天津海鸥 is a watchmaking company located in Tianjin, China. Founded in 1955, it is the world’s largest manufacturer of mechanical watch movements, producing one quarter of total global production by volume. In 1990, the Tianjin Watch Factory became a national company, and in 1992, it founded the Tianjin Seagull Corporation, building the first Chinese watch and the first Chinese watch for export. It has recently gained substantial expertise in the manufacture of advanced tourbillons including a multi-axial orbital tourbillon movement.

Recently, in order to deeply implement General Secretary Xi Jinping’s important instructions on “cultivating a group of ‘specialized, special and new’ small and medium-sized enterprises” and implement the “Guiding Opinions on Promoting the Healthy Development of Small and Medium-sized Enterprises” issued by the Central Office and the State Office, the Ministry of Industry and Information Technology has carried out the fourth batch of specialized and new enterprises. In the list of approved reviews, Tianjin Seagull Watch Group was rated as a national-level specialized, special and new “little giant” enterprise.

CIGA Design

CIGA design is Chinese first original designer watch brand led by Mr. Zhang Jianmin, one of China Top 10 Industrial Designers since he founded the company in 2016. It has won a total of 16 international design awards by virtue of its excellent original designs. In 2020, CIGA design successfully exported to more than 100 countries, at present, it has gained over 500,000 loyal fans worldwide.

CIGA Design Blue Planet is the most innovative watch of 2021. Blue Planet, the new mechanical watch from CIGA Design, won the Challenge Watch Prize at the Grand Prix d’Horlogerie de Genève 2021 for its innovative design, despite the participation of famous brands such as Piaget, Breitling, IWC, Chanel, Chopard and Louis Vuitton.

CIGA design, together with EARTH DAY ORG, launched a limited-edition gift box for the implementation of environmental protection actions, combining the watch and pendant with environmentally friendly “decorations”, whose main theme was our planet. The goal was to inspire people to love their planet protecting the environment. The factory has used eco-friendly glue, stainless steel material, and recycled titanium to reduce carbon pollution emissions.

ASEAN as an alternative solution for Chinese luxury watches industry and China plus one strategy

Accoring to ASEANStats, ASEAN is the world’s third-most populous economy, after China and India, with a combined population of 660 million in 2020 – 8.5% of the world’s total. The median age of the population in the ASEAN region is 30.3 years, according to the World Population Prospects published by the United Nations, much lower than that of mainland China (38.4 years) and Hong Kong (44.8 years). In view of the enormous consumption power generated by this huge young population, the World Economic Forum predicted that in the next ten years, ASEAN will add 140 million consumers to the global market, its GDP per capita will grow at an average annual rate of 4%, and its position as the fifth-largest economy will climb to fourth by 2030.

Both part of RCEP, China and the ASEAN are geographically close, and in recent years, as their economies flourished, a long-term steady bilateral trade relationship has been built. Following the signing of the Framework Agreement on Comprehensive Economic Cooperation between ASEAN and the People’s Republic of China at the sixth ASEAN-CHINA Summit in 2002, the ASEAN-China Free Trade Area was rolled out in 2010.

The trade between China and ASEAN amounts to US$878 billion in 2021, which corresponds to 14.5% of the total China-World trade. According to ASEAN statistics FDI from China increased by 96% to US$13.6 billion, mostly in manufacturing, EV-related activities, the digital economy, infrastructure, and real estate. ASEAN market could be a starting point for all Chinese luxury watch brands that want to internationalize towards a specific target such as the emerging middle class of Southeast Asia.

Although Nationalism for Chinese cultural identity has had an ever-increasing impact on consumer trends in recent years and Chinese consumers are increasingly showing interest in local products, the Guochao has not yet touched the watch industry. Chinese consumers still prefer to buy and collect Swiss Made watches due to their quality assurance and status symbol, a way to identify themselves in society. The objective remains to increase technological development and the high-added value of the production chain, design, and branding which, in some sectors, is still very far from Western standards.

The emergence of Chinese luxury watch brands:

- The emerging Chinese watchmaking industry is in continuous commercial growth; however, it must face the great heritage of international brands, which continue to be a status symbol in society.

- Chinese GEN-Z’s cultural confidence, along with the rising Guochao trend, could give a boost to Chinese luxury watch brands.

- Seagull Watch Group and CIGA Design represent the perfect example of two high-end Chinese watch brands that continue to innovate and improve their capabilities.

- Despite Chinese watchmakers have improve the quality of their products in the last decades, Chinese consumers tend to prefer well-establish international brands.

- The ASEAN could become an important sales market for Chinese luxury watch brands in the expectation that Chinese consumers’ perception of local watch-makers changes.