Chinese mobile games are bringing the globe on an epic gaming adventure. It is estimated that in 2023, the global mobile game market revenue will reach $286.5 billion. Chinese companies are eyeing foreign markets to expand their reach.

Understanding the US mobile game market: key insights on US players

The penetration rate of smartphones in the US has reached 72.7% in 2021, and over 63% of online users in the US play games on their phones in 2022. As of the last quarter of 2022, the US remains the largest mobile gaming market. The US mobile game spending has remained above $5.5 billion per quarter since the start of the COVID-19 pandemic, but it has seen a 6% year-over-year decline in player spending compared to the same period in 2021.

Demographics of the mobile gaming market in the United States: age and gender trends

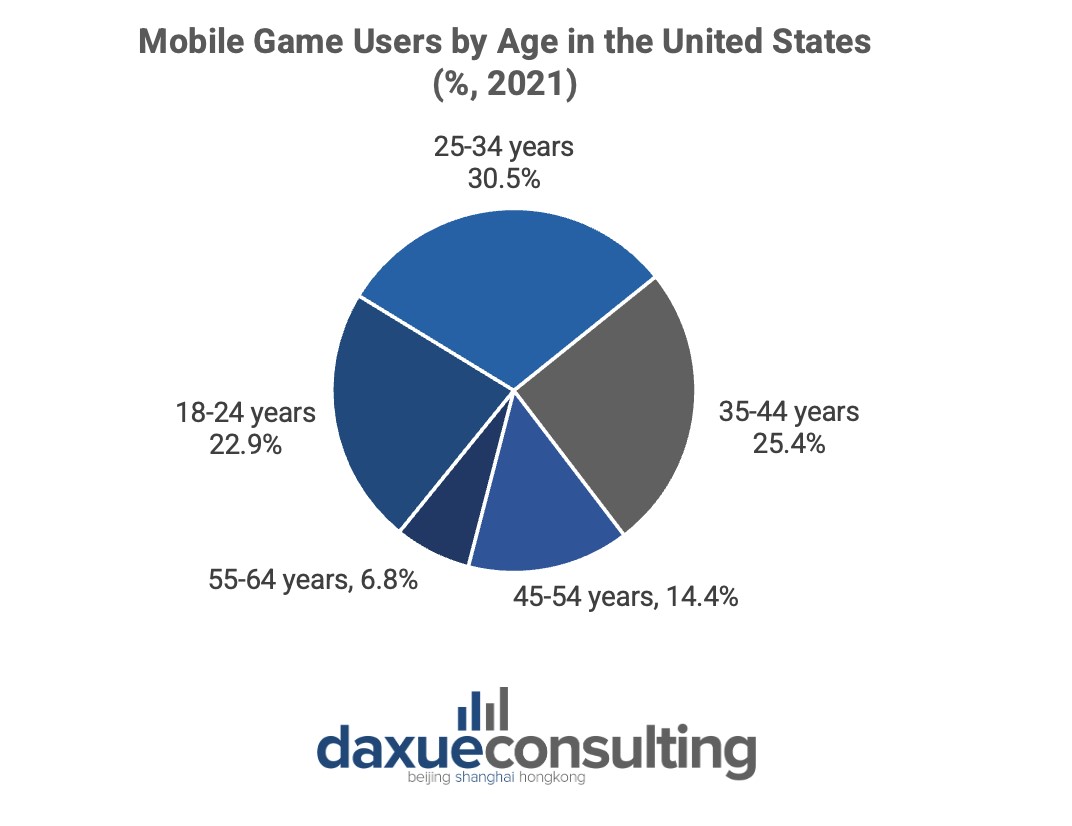

The age group of 25-34 years old represents the largest proportion (30.6%) of mobile gamers in the US, as reported by Statista. Moreover, there are 51% of mobile game users are female. Newzoo and Google Play’s study reveals that males are not the dominant group in the gaming industry, female gamers and gender minorities are also engaged in gaming than game developers previously believed. Considering that over half of the mobile gaming population is comprised of female gamers and the rapid success of female-oriented games such as Travel Frog and Kim Kardashian: Hollywood, the data implies that there is significant potential in the female-oriented gaming market.

Mobile gaming preferences in the United States: convenience and low barriers to entry

According to the annual report “Game Marketing Insights 2022” released by Facebook Gaming, most Americans play games to kill time and decompress. Unlike console games, mobile games offer a great level of convenience as they can be played anywhere with a mobile phone. Due to this preference, medium-to-light mobile games with low barriers to entry, appealing graphics, and simple operations are more attractive to American players than heavy-duty mobile games that are more immersive, difficult to learn, and require longer playtime.

US mobile gaming market: player preferences and marketing strategies

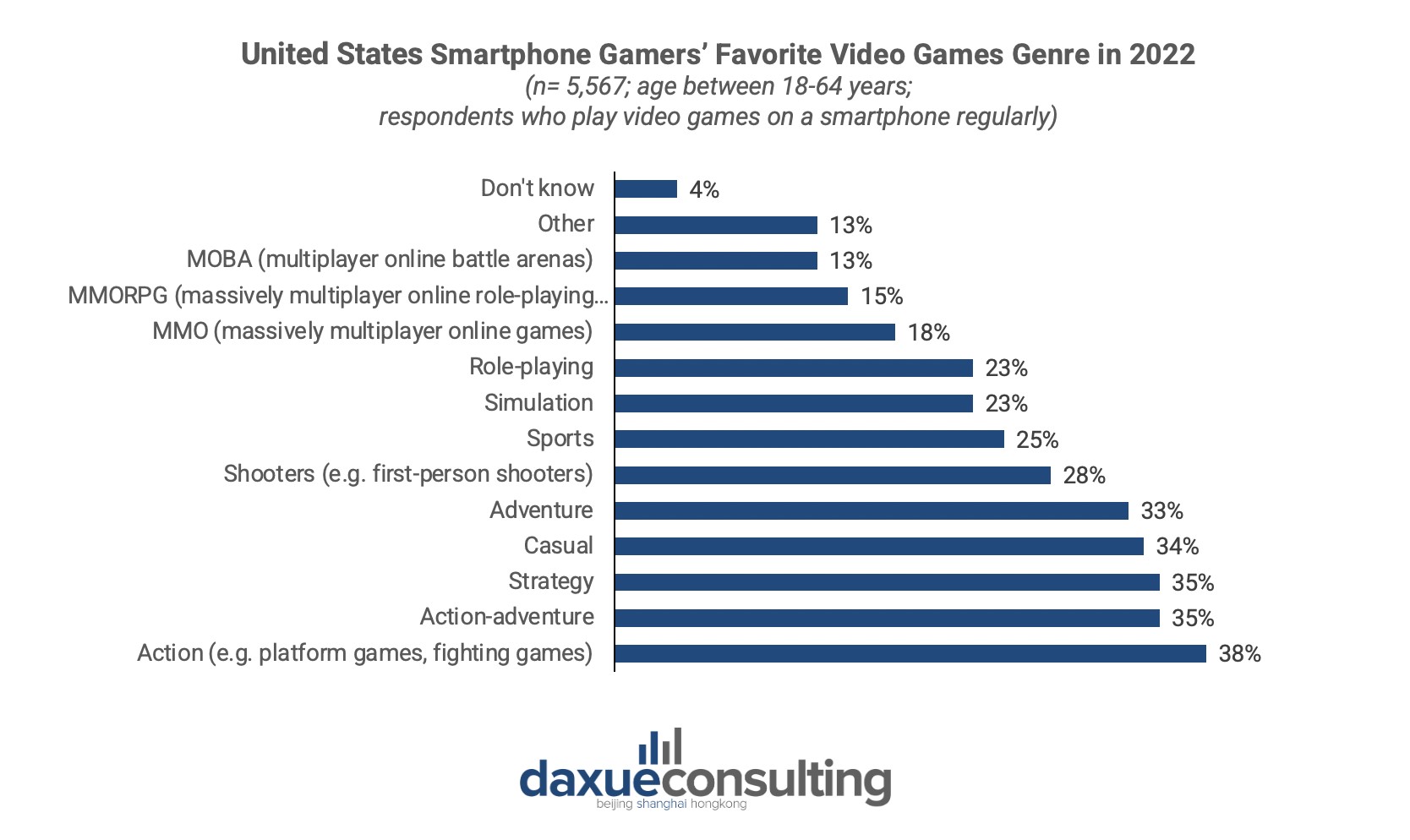

The most popular genres among US smartphone gamers in 2022 are Action (38%), Strategy (35%), Casual (34%) and Adventure (33%).

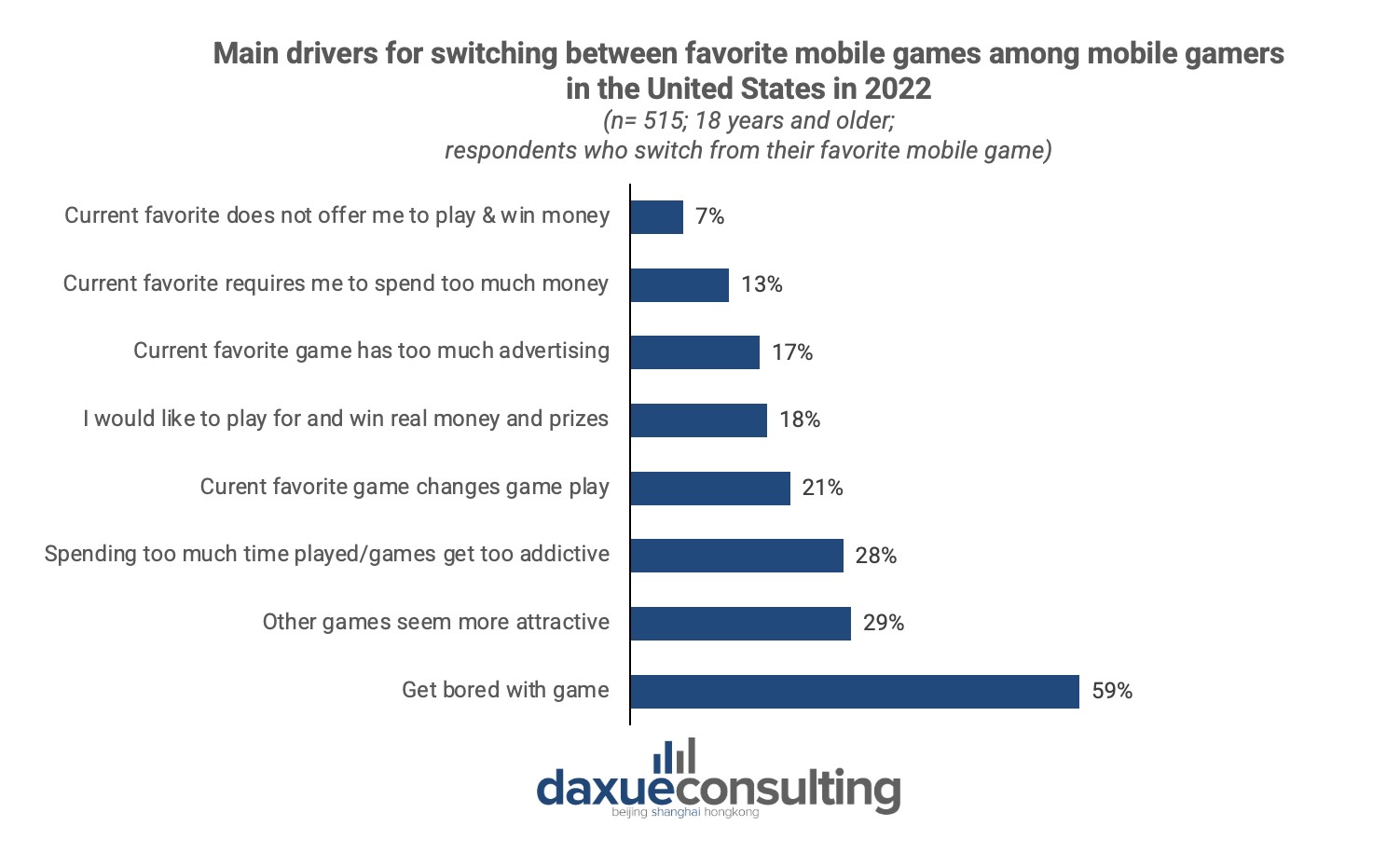

Moreover, to keep players engaged, game companies must continually update and improve their offerings, as US mobile gamers switch games primarily due to boredom, rather than price sensitivity. Although 13% of players do cite high costs as a reason for switching, it’s important to note that they are not necessarily unwilling to pay, but simply want to avoid overspending on mobile games.

Top games among American gamers in 2022

According to the data, Candy Crush Saga, Roblox, and Coin Master are currently at the top of the list. While Genshin Impact and PUBG, created by Chinese game companies, were among the top games in 2021, they did not make the list for 2022. This can be attributed to the intensifying competition within the gaming industry and the evolving preferences of players.

The greatest change to the game industry has been the Metaverse, crypto and the onset of Web3. This new phase of the internet has brought on a new set of opportunities, curiosities, and challenges across industries and communities. Within the Metaverse, Roblox is driving gaming platform growth among Gen Z and leading the pack when it comes to branded content, which is a popular application that allows users to play games, create games, and socialize online. It combines gaming, social media, and social commerce into one platform.

The performance of Chinese mobile games in foreign market

According to Sensor Tower’s Store Intelligence platform, a total of 40 Chinese game developers made it to the top 100 global mobile game publishers in terms of revenue in April 2023, earning nearly $2 billion US collectively. Among them, Tencent, HoYoverse, and NetEase remain the top 3.

How Genshin Impact went global

Genshin Impact, a Chinese mobile game released in September 2020, has achieved remarkable success. In December 2022, the Genshin Impact app generated 4.67 million downloads worldwide and generated $164 million in monthly in-app purchase revenue. Developed by miHoYo, the game stands out for its effective pre-launch strategies and promotions. The game’s marketing campaign extended to online and offline channels, including Google Ads, social media platforms, like YouTube videos, and billboards in major cities. With a production budget of $100 million US, Genshin Impact offers players an expansive open world, an engaging story, seamless combat, stunning visuals, and a captivating soundtrack. It also strikes a balance between free and paid aspects, allowing players to enjoy the game and access all content without spending money while offering optional purchases that enhance progression and convenience. Genshin Impact’s success showcases the ability of Chinese game developers to create globally appealing and monetarily successful mobile games.

Navigating monetization in the US gaming industry: balancing player satisfaction, fairness, and revenue generation

There are different ways for the business to monetization in the game industry, including free-to-play (F2P), pay-to-win (P2W) and in-game advertising. Pay-to-Win is one of the most controversial method, which is used by players to describe games that allow players to purchase in-game resources with real money.

The pros and cons of pay-to-win (p2w) in the gaming industry: exploring players’ varied attitudes

Many US players are disappointed with P2W games, which often creates an unbalanced and unfair overall experience. In contrary to Chinese gamers, the P2W concept is not generally accepted by western gamers. Hence, Chinese games headed to the west often need to adapt their revenue generation model accordingly.

However, there are players who appreciate the ability to obtain immediate satisfaction through the P2W model. On Reddit, those who argue for P2W say “Life is P2W,” therefore consider it worthwhile to invest money in order to save time and attain a more expedient and enhanced gaming experience.

Finding a balance: the shift towards free-to-play (f2p) and alternative monetization strategies through fostering player engagement and voluntary spending

Despite possessing certain advantages that contribute to its continued presence in games, the pay-to-win (P2W) model is widely viewed negatively by the majority of players in the US. However some experts say the gaming industry will transition towards a F2P approach, generating revenue through in-game purchases. This shift can be observed in popular games, where US gamers are more inclined to voluntarily spend money on in-game items without compromising the fairness of the gameplay.

Take Genshin Impact as an example, which is a F2P game that incorporates microtransactions, players can purchase a monthly pass to receive extra rewards as they play. They can also purchase in-game currency to get items and characters. It strikes a balance between free and paid aspects, allowing players to enjoy the game and access all content without spending money while offering optional purchases that enhance progression and convenience. Genshin Impact’s success showcases the ability of Chinese game developers to create globally appealing and monetarily successful mobile games.

Moreover, games like PUBG and Mobile Legends use the strategy of pay to collect rather than pay to win. In these games, the focus is not on winning, but on the allure of obtaining rare and unique items. These games are designed to provide players a path to progress quickly while satisfying their desire to collect cool skins and frames to show off to friends and rivals. If players choose to spend money on looks, that’s a personal decision, but the game doesn’t force them to spend big bucks for the core experience.

Enhancing game design for the overseas markets: localization, advertising, stickiness, competitiveness, and monetization

1. Game localization

Localizing a mobile game means more than just translating the language. Since different countries and regions have different cultures and languages, Chinese mobile gaming companies need to understand the game types, themes, styles, characters, music, and art styles that appeal to Western players. Inclusive and culturally diverse content is also important in game design, including changes in skin color, and other features that reflect the target region’s culture. One negative example worth mentioning is the choice to predominantly feature light character skins in Genshin Impact, which can be seen as a failure to cater to a diverse player base effectively. Games should have realistic settings, localized elements, and intuitive gameplay with simple controls. Sustainability is also crucial, integrating straightforward gameplay with a progressive system to maintain user interest and engagement.

2. Advertising

During the early stages of release, user acquisition is critical. To reach a global audience, it is increasingly important for publishers to invest in online ads. In addition, companies should create marketing content on social media to establish a strong presence and engage with existing users. Partnering with game streamers and YouTubers is another effective marketing channel. While traditional advertising methods such as billboards can be expensive, they can be effective for mass publicity.

3. Keep innovation and add stickiness elements

To maintain user engagement, it is important to innovate and introduce features that keep players hooked. One effective way to increase user retention is through incentive systems. Such systems can include progressive rewards, daily login bonuses, seasonal events, missions, challenges, and social features such as guilds and friend lists. These sticky elements encourage players to spend more time in the game and play more frequently. However, it is important to strike a balance, as overloading players with too many of these features can lead to burnout and make the game feel like a chore instead of an enjoyable experience.

4. Competitiveness and completion

Competitiveness is a key factor in the success of many top-grossing mobile games available today. Multiplayer games allow users to compete against each other, which not only keeps them engaged for longer periods but also encourages them to purchase in-game items. Even casual and offline games can benefit from incorporating competitive elements, such as leaderboards and achievements, to keep players engaged and motivated to reach higher levels. These elements not only increase the player’s motivation but also keep them interested in playing the game for a more extended period of time.

5. Monetization

Free-to-play (F2P) or freemium has become the most common way to monetize mobile games in recent years, with many developers opting to release their games for free in order to attract a wider audience. However, it’s important to find the right balance between monetization and the overall user experience. Over-monetizing a free game can lead to frustration and resentment among players, which can ultimately result in a loss of player base and revenue.

Another popular monetization strategy for mobile games is to incorporate advertising. Games can generate revenue through reward videos, interstitial ads, and banner ads. These types of ads are designed to be unobtrusive, providing players with the option to watch an ad in exchange for extra coins or tools, displaying interstitial ads when switching game scenes, or showing non-intrusive banner ads that don’t interfere with gameplay.

What Chinese mobile game brands need to know to succeed in the US and the world

- US mobile gaming demographics show a diverse player base, with a balanced proportion of male and female gamers, demonstrating the potential in the female-oriented gaming market.

- Convenience and low barriers to entry are important preferences for US players, favoring medium-to-light mobile games with appealing graphics and simple operations. Action, Strategy, Casual, and Adventure are popular genres among US mobile gamers.

- US Players shows mixed attitudes for Pay-to-Win (P2W) models in the gaming industry, with some seeing it as unfair while others appreciate the immediate satisfaction it offers. However, the gaming industry is shifting towards a Free-to-Play (F2P) approach with alternative monetization strategies, focusing on voluntary spending and fostering player engagement.

- Enhancing game design for US markets involves localization, targeted advertising, adding sticky elements, fostering competitiveness, and finding the right balance in monetization strategies.

Read our 10 mistakes Chinese brands make when going abroad report