We have collaborated with iClick Interactive, a leading enterprise and marketing cloud platform in China in releasing a Chinese Travel Shoppers 2022 Whitepaper.

Click to download the Chinese Travel Shoppers 2022 Whitepaper

The whitepaper provides an overview of the travel retail market in China, with a spotlight on Hainan, as well as a macro-view of shoppers’ trends and behaviors. We analysed Chinese travellers using iClick’s iAudience platform to gain insights from over 1,198 million anonymous active online users on a monthly basis, focusing on demographics, interests, and internet behaviour to provide strategic recommendations to retailers on how to attract, engage, and convert Chinese travellers.

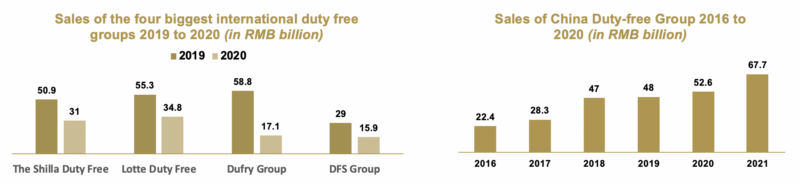

China’s travel retail market has proven more resilient than the global market

Due to the COVID-19 pandemic, the past couple of years have been unquestionably difficult for the global travel retail industry. However, China’s domestic travel retail market has proven more resilient than the global one. While the four largest international travel retailers each saw at least a 38% drop between 2019 and 2020, China’s travel retail market only saw a 4.8% drop during the same years, followed by a 66.8% growth the following year.

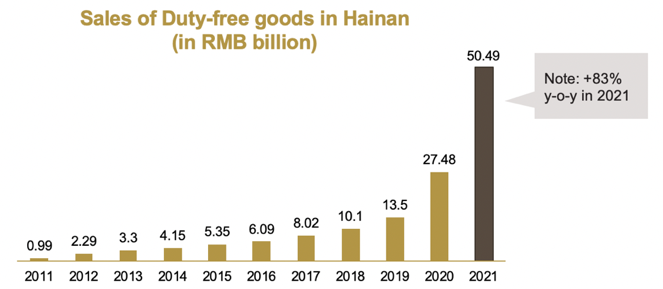

The shift from international to domestic travel amid the pandemic was one of the most outstanding characteristics of the post-COVID-19 travel market in China, which has led to the tremendous growth in duty free sales. During the first half of 2021, the number of domestic tourists in China doubled that from the first half of 2020.

This phenomenon has led to Hainan replacing international destinations like South Korea for travel shopping. As a result, the China Duty Free Group has become the largest duty free retailer in the world in 2020.

Brands must keep up with China’s quickly changing travel habits

Chinese travel habits have been shifting in many ways, one of these changes is the newfound preferences for shorter trips that are closer to home and outdoor tourism. Bookings for short trips for the October National Holiday in 2021 increased 56% y-o-y according to TongCheng’s data. To catch the demand of these tourists, China is opening up more domestic duty free shopping centers in large cities like Beijing and Shanghai, which are more accessible over shorter weekend trips.

Another trend we see is “Bleisure”, the merging of business and leisure travel. 60% of business travellers say they would arrange personal trips during their work travel in the upcoming years.

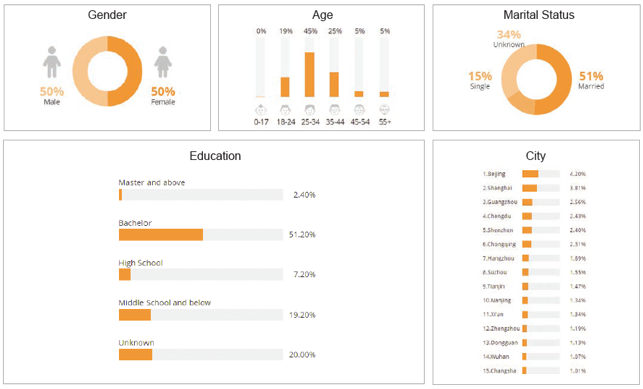

Chinese Travel retail shopper demographics from iAudience

This whitepaper leverages iClick’s iAudience to understand who today’s Chinese travel shoppers are. Here is a peek at some of the demographic insights from the Whitepaper:

- Age: 25-34

- Gender: 50/50 Male and female

- Marital status: Married

- Education: Bachelor’s degree

- Location: First-tier cities, including Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu

Brands in both travel retail and tourism should prioritize flexibility and agility to reach the evolving travellers. In more concrete terms, this means being integrated on digital platforms and continually seeking to understand the evolving Chinese travellers, without attachment to previous ideas about whom they were in the past. By reading this whitepaper, you are already a step ahead in the game.