When chocolate was introduced to the Chinese market in the 1980s, companies lacked three things: a temperature-controlled supply chain, retail stores equipped with air-conditioning, and most importantly, Chinese consumers’ trust. Chocolate was a foreign oddity, and as much as an exotic product had piqued consumers’ interest, its high price and low availability did not encourage consumption. It was not until the mid-1990s, following the Chinese economic growth, that proper distribution and retail channels emerged in the chocolate market in China, allowing chocolate consumption to rise. However, Chinese consumers’ trust and interest did not come so easily.

Download our China F&B White Paper

45 years later, chocolate still feels foreign

The Chinese chocolate market is still relatively small

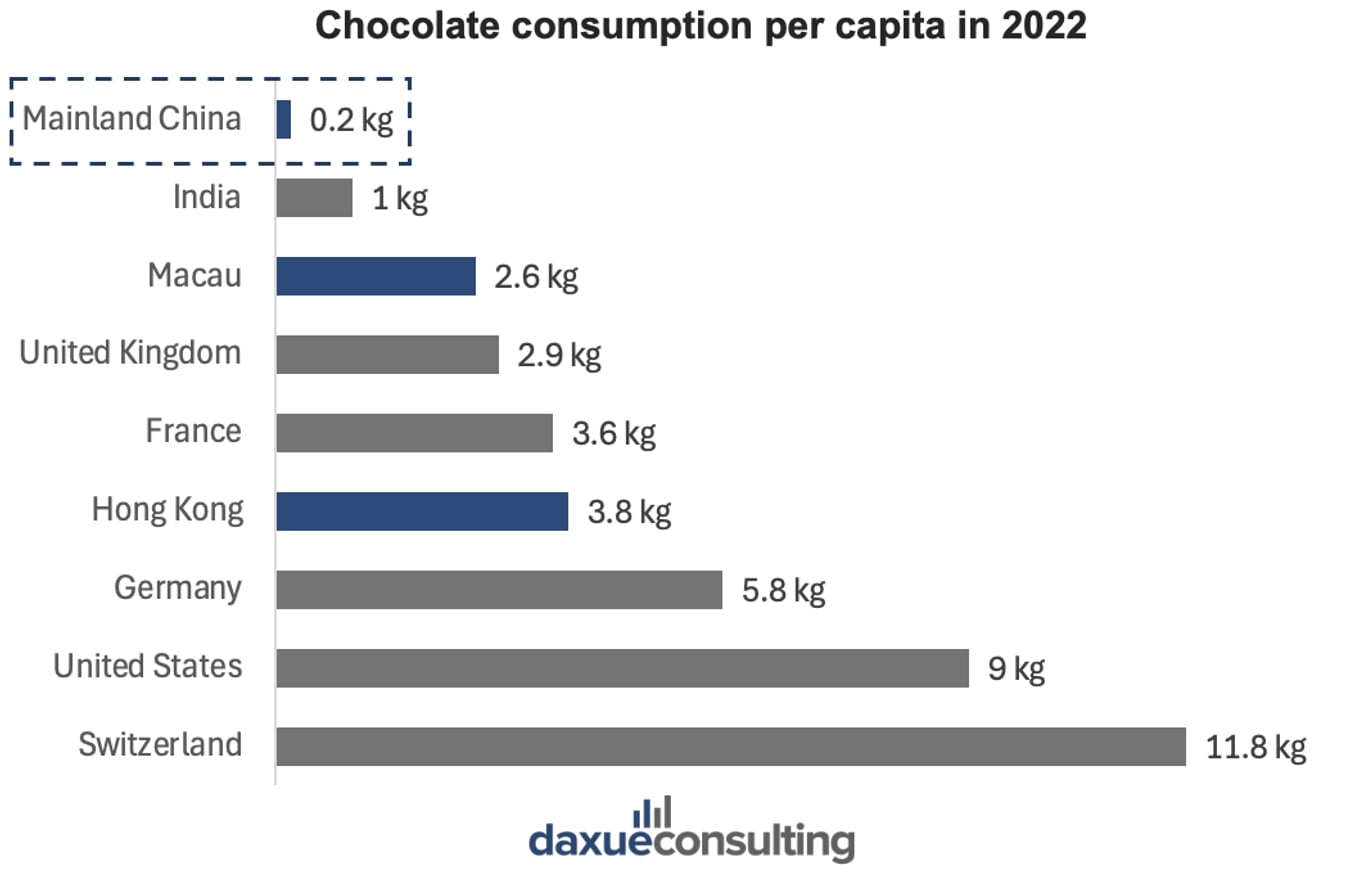

Chocolate consumption in China is quite low compared to the rest of the world. In 2022, Chinese people had a chocolate consumption per capita of 0.2 kilograms, which is not comparable to the top chocolate consuming countries such as Germany (5.8 kilograms), the United States (9 kg) and Switzerland (11.8 kg). However, Hong Kong and Macao, where chocolate was introduced earlier through European colonization, highlight China’s growth potential, with per capita consumption reaching 2.6 kg and 3.8 kg, respectively, in 2022..

The Chinese chocolate market is slowly yet steadily growing. It is projected to generate revenue of USD 3.81 billion in 2025, a remarkable achievement compared to its revenue of USD 2.1 billion in 2010. Furthermore, it is expected to grow at a CAGR of 4.57% from 2024 to 2030, reaching USD 4.76 billion by 2030.

Chinese consumers enjoy small portions

Sweetness is often necessary to introduce new flavors to a population, as it is easier to enjoy than stronger flavors. However, due to a dessert culture that is not as sweet as in other regions, Chinese consumers’ sweetness tolerance is quite low. Therefore, chocolate is typically consumed in smaller portions, with bite-sized pieces favored over large bars.

China’s taste for chocolate gets sophisticated as dark chocolate grows

In recent years, as the Chinese chocolate market matures, consumer interest in dark chocolate has surged. The segment is experiencing strong momentum, with projected annual growth nearing 5% from 2024 to 2029, slightly faster than the overall chocolate market. Dark chocolate surpassed milk chocolate, capturing over 50% of the market share in 2024. This shift reflects growing health consciousness among Chinese consumers, as well as better compatibility with their low sweetness tolerance.

Chinese parents are wary of giving chocolate to children

Overall, Chinese consumers have a disproportionate view on how chocolate’s unhealthiness compared to other treats. Therefore, many parents are reluctant to give chocolate to their children. To overcome this, companies such as Daily Heqiao are introducing chocolates with less sugar and added vitamins to change the product’s perception.

How chocolate is adapting to Chinese preferences

Gifting culture

In China, chocolate is primarily purchased as a gift for special occasions such as business and personal events or national occasions like New Year’s Eve, Valentine’s Day, and the Qixi Festival, rather than for personal consumption. This gifting culture contributes to the popularity of boxed chocolates, which are the best-selling products in the market.

Flavored chocolate and diversification

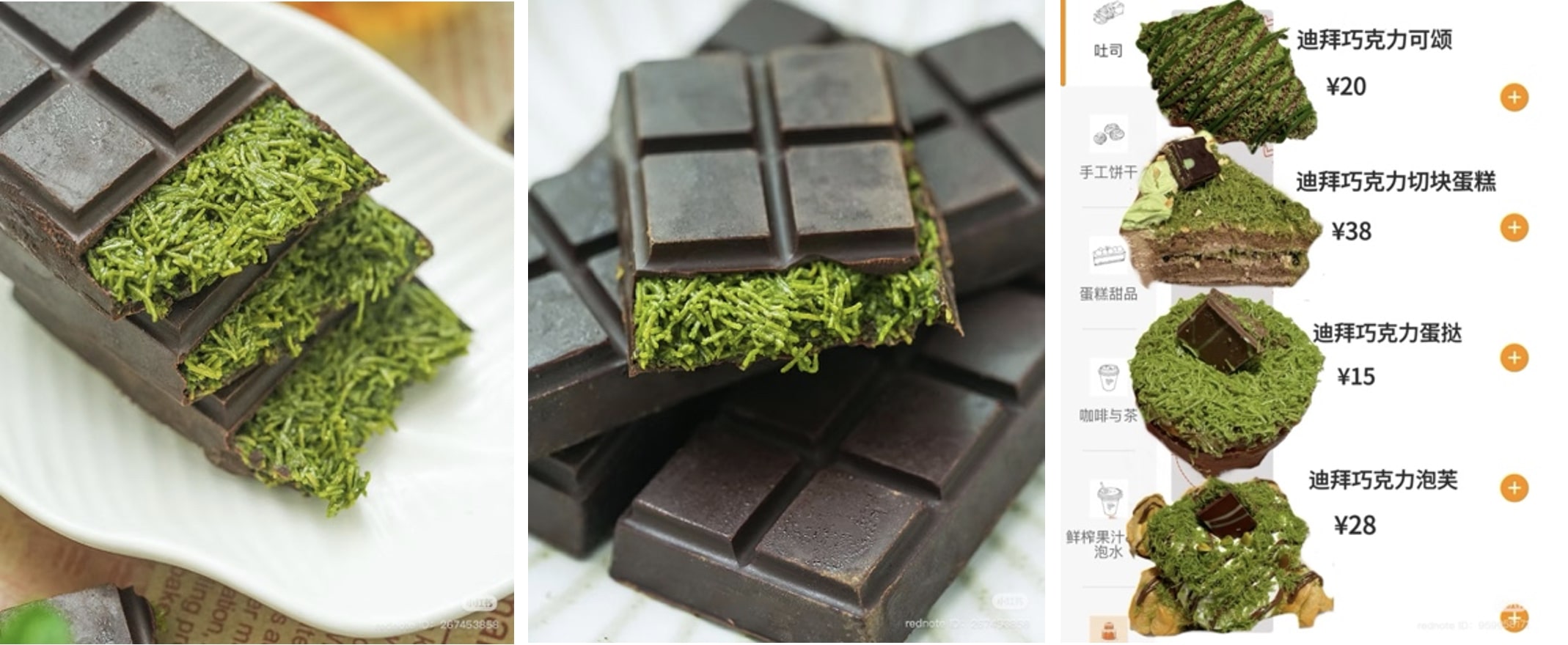

Chinese consumers enjoy a diverse palette of tastes, appreciating flavors like matcha, red bean, or strawberry in their chocolates. This interest in variety is common to different industries in China. Beverage chains usually offer more choices and customization possibilities than in the West, where, for instance, minimalism and simplicity are preferred. International brands therefore need to adapt their recipes to the continuously changing local tastes. The success of Ritter Sport in China, a German chocolate brand, can be explained by its many flavored options available in the country. Consumers enjoy sharing their opinion on each taste on social media and testing the ones that went viral.

Chinese social media also follows interntional trends such as the recent popularity of Dubai chocolate, a chocolate bar filled with kadayif and pistachio. Its success in China showcases the population’s interest in original flavors.

Chinese habits and tradition through chocolate

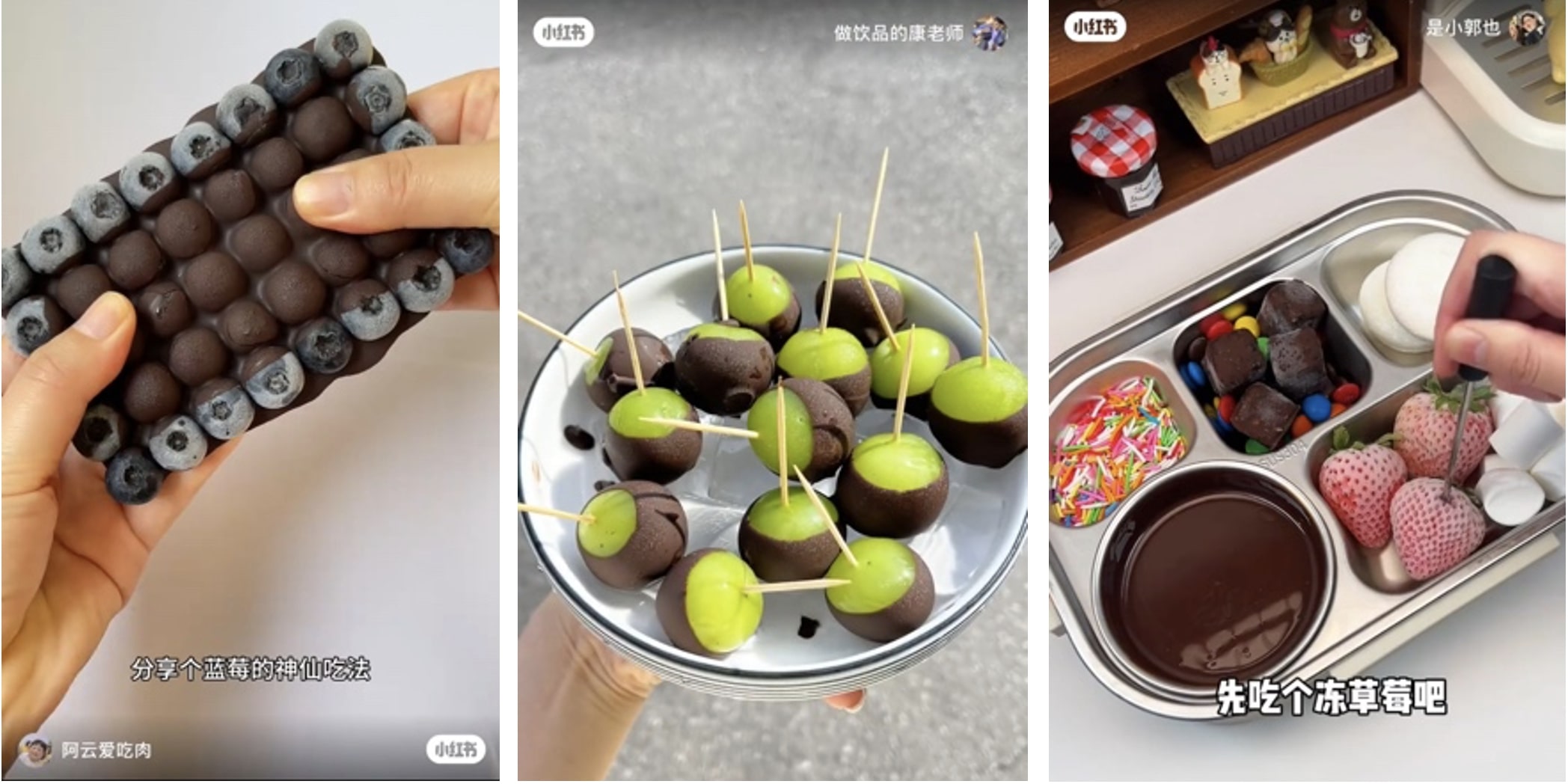

Chocolate is increasingly appearing in formats familiar to the Chinese street food culture. Skewered fruits dipped in melted chocolate, resembling the traditional tanghulu style, are gaining popularity at markets and festivals.

Artisanal chocolate slabs with embedded nuts are also trending. They are known to be incredibly expensive, sometimes reaching RMB 1,000 per kilogram. Many Chinese influencers are filming themselves trying to recreate them at home at much lower cost, increasing their visibility.

Frozen fruits are quite common in China, therefore strawberries, blueberries and grapes, paired with chocolate appeal to Chinese consumers’ preferences. Chocolate fondues, known in China as chocolate hotpots (巧克力火锅) and inspired by regular hotpot, also went viral. The trend also reflects the cultural importance of shared dining in China.

Foreign brands still dominate, but local chocolate is catching up

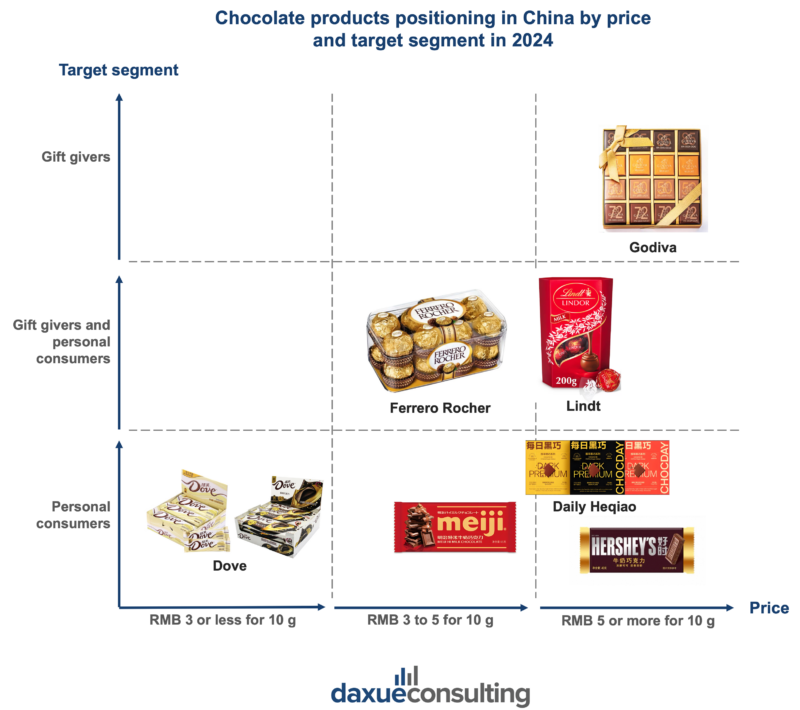

In 2024, China’s chocolate market remains heavily dominated by foreign brands, which benefit from consumer perceptions of superior quality.

The success of Dove in the personal consumption segment

Mars holds a commanding lead primarily through its Dove brand, which has successfully positioned itself as a romantic, emotionally resonant product targeting young women. As a consequence, its advertising campaign and packaging design aim to maintain a romantic image of the product. Dove also chose a local famous actor and singer called Xiao Zhan (肖战) as its ambassador. Well known for playing in dramas and singing romantic songs, he fits perfectly with the brand image.

Rising competition from domestic players

However, competition is intensifying. The local brand Daily Heiqiao is gaining popularity among consumers seeking healthy and nutritious premium products as their chocolate contains a high percentage of cocoa content. With its vision “dreamed in China, made in Switzerland”, the brand is now present in most supermarkets of the country and has become one of the most prominent players in just a few years.

Gift-targeting chocolate players

In the gifting segment, Ferrero Rocher remains a standout with its culturally resonant gold packaging symbolizing wealth and good fortune, making it a go-to for weddings and special occasions. Premium players like Godiva and Lindt also thrive in this space, leveraging elegant packaging and high product quality to appeal to high-income gift buyers, generally priced above RMB 5 for 10g.

How is the Chinese chocolate market evolving?

- Chocolate is still a relatively new product in China, introduced only in the 1980s and hindered at first by limited infrastructure, low consumer familiarity, and health concerns.

- While per capita consumption remains low (0.2 kg in 2022), the market has grown steadily, with projected revenue reaching USD 4.76 billion by 2030.

- Chinese consumers enjoy sweet, bite-sized chocolate, though interest in dark chocolate is rising due to growing health consciousness and dietary preferences.

- Chocolate in China is strongly influenced by gifting culture and social media trends, with local adaptations such as matcha or fruit flavors, chocolate-dipped snacks, and premium artisanal products gaining traction.

- Foreign brands like Dove, Ferrero, Godiva, and Lindt still dominate, but domestic challengers like Daily Heiqiao are quickly emerging with localized, health-focused offerings.