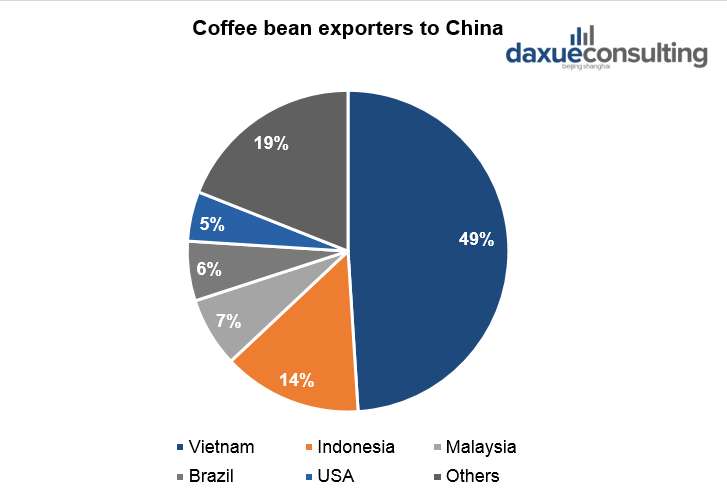

More than 50 countries produce coffee, and about one-third of the world’s people drink it. Currently coffee is becoming popular in the Chinese beverage market. With the improvement of living standards and the growing awareness of coffee culture, coffee bean market in China is on the rise. The demand for premium coffee beans has increased in China. Coffee bean exports to China from South America, Central America and Africa rising from less than 10% a decade ago to nearly 20%. Vietnam accounted for over 49% of the coffee bean exports to China. In 2019, China imported 65,100 tons of coffee. The import value was US$269 million. The import is quite stable, although there was some decline in 2019.

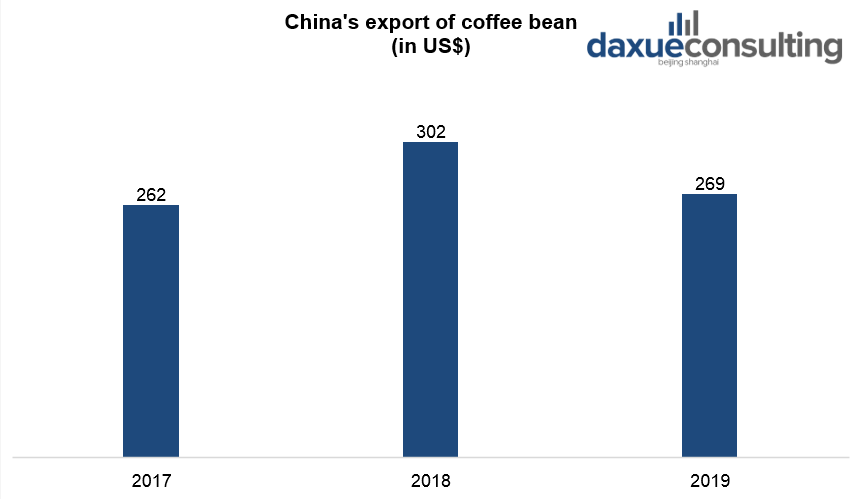

China is also an exporter of coffee. In 2017, China exported $237 million of coffee beans. As of June of 2019, China has exported around 1.4 million 60-kilogram bags of green coffee beans. Export of green coffee beans shows a stable growth, as quality is improving.

Data Source: qianzhan, China’s export of coffee beans

On-trade sales of coffee mainly go through three types of establishments: coffee shops/cafés (independent and chained), Internet cafés and fast food restaurants. Currently, both in the instant coffee market and China’s coffee shops chain market, foreign brands occupied a large amount. It happens due to lack of domestic coffee brand in the coffee bean market in China.

The coffee commodity chain in China is still developing

Dry processing is simple to operate and is the most traditional and cheapest coffee bean processing method. It is the most common method in China. The deep processing of coffee includes roast and ground coffee processing. This way is the most suitable for making espresso, which is the type of bean most used in Chinese coffee culture. With the rapid growth of coffee beverage consumption, many manufacturers across the country are currently actively working on the coffee processing industry. Such companies as Dehong Hougu Coffee Company, Hainan Lishen Company, Baoshan Orchid Company, Yunling Coffee Company are focusing on building commodity chain that will let them to be competitive in the coffee bean industry in China.

The assistance of Nestle and Starbucks

China’s primary coffee growing region is in Yunnan Province, accounting for 98% of production in the coffee bean market in China. Nestle had established agricultural assistance services across Yunnan and has since been the largest single buyer. Another international lead firm, Starbucks, followed Nestle by established its own sourcing operation in Yunnan in 2009. Nestle operated several collection stations across Yunnan, while Starbucks also established a smaller-scale farmer support center.

Source: ResearchGate, China and the changing economic geography of coffee value chains, ‘Main coffee production areas in China’

Starbucks plans on roasting facilities in China

There are few roasters in China compared to in Western coffee-consuming countries. However, their number is growing due to the increasing popularity in coffee and demand for more specialty coffee companies. There are big commercial roasters in China that focus mostly on mass production for instant coffee. Alongside this, there are also single-shop roasters that often aim for higher quality and roast on a small scale.

In 2020 Starbucks China announced that it will invest about $130 million in China to open a roasting facility in 2022. The project is set to handle Starbucks’ largest roasting capacity, including a roasting plant, warehouse, and distribution center. It will strengthen the coffee industry in China. Beyond roasting, once in operation, the park will integrate green coffee bean warehouse management and processing. With plans to co-locate a highly automated and “intelligent” distribution center that will become the heart of the Starbucks distribution network in China. The facility also will serve as a training ground for coffee roasters.

Coffee bean market in China is entering a stage of rapid development

Increased demand for coffee beans

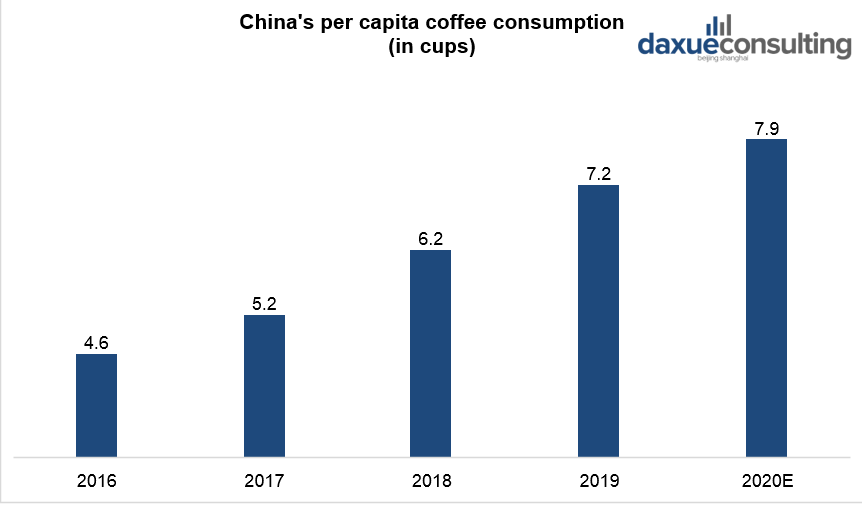

The demand for coffee in the Chinese market grew in the past five years. At present, the Chinese coffee market is entering a stage of rapid development. According to statistics, the per capita coffee consumption in China was 6.2 cups in 2018. In 2019, China’s per capita coffee consumption was about 7.2 cups. As coffee consumption is rising in China, the demand for coffee beans will also grow.

Data Source: Prospective Industry Research Institute, ‘China’s per capita coffee consumption’

In 2019 the most consumed coffee types among coffee drinkers in China were single origin, espresso (including espresso drinks like Americanos and lattes), and cold brew. That is why espresso beans in China make up a large part of coffee bean exports to China.

China’s coffee bean imports have been on an upward trend

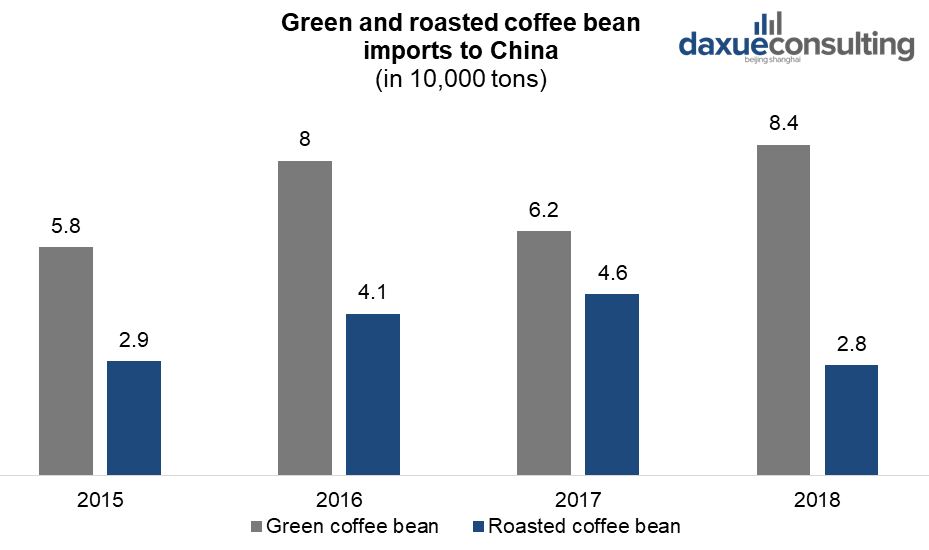

In the past four years, China’s coffee bean imports have been on an upward trend. From January to November 2017, China imported 110,000 tons of coffeebeans.

QYResearch predicted that coffee bean export to China will grow to 124,000 tons in 2020. In terms of origins, the biggest supplier of coffee to China is Vietnam. In 2018 the export volume of green coffee beans to China was 84,300 tons, and the export volume of roasted coffee beans and instant coffee powder was 28,800 tons. The slight decline happened in 2018 has rebounded in 2019.

Data Source: Zhiyan Consulting, ‘Exports of green coffee bean and roasted coffee bean to China’

Vietnam, Indonesia, Malaysia, Brazil, and the US are the key countries in coffee bean exports to China. In 2017 Vietnam accounted for almost half of all imports. Based on these origins, and information from external sources, Robusta is the most common imported coffee to China. Robusta is also known as espresso beans in China. However, imports from Colombia and Central America have been increasing significantly in recent years, growing at over 25% per annum. Now it makes up around 5% of the total.

Data Source: International Coffee Organization, ‘Coffee bean exporters to China’

Coffee bean industry in China: the quality is improving

China produces 138,000 metric tons of coffee beans annually. However, although China’s coffee production is high, it is difficult to directly associate coffee with China. This is because the coffee beans in Yunnan used to be of low quality, mostly used as raw materials for instant coffee. However, China already can produce good quality coffee beans.

Yunnan coffee plants is the key producer of coffee bean in China

A French missionary brought coffee to Yunnan province in the late 19th century, marking the crop’s introduction to China. Nestlé also arrived early in Yunnan to encourage the cultivation of coffee. Hogood Coffee, the largest domestic instant coffee maker, appeared in 2007. It has been responsible for cultivating much of the coffee in the Dehong region. In 2013, Yunnan Coffee Traders became the region’s first dedicated specialty coffee exporter. In 2018 they were the largest exporter of Yunnan specialty coffee in China. Much of the Yunnan coffee is exported to Germany and Japan.

Other centers of coffee bean market in China are Fujian and Hainan. Fujian and Hainan mainly grow Robusta. However, the domestic production is too small and these espresso beans in China are usually coming from Vietnam.

Coffee bean brands in China

Illy: A market leader in China

Italian roaster illycaffé has been in China for 15 years, in that time establishing itself as a clear market leader in the coffee bean market in China. It accounts for 30 percent of the imported roast and ground coffee segment in China. With a long and celebrated history as an innovator in the coffee industry, illycaffé is perhaps most famous for its signature blend of nine varieties of Arabica coffee selected from the best harvests in the world. Along with the introduction of new products, illycaffé is taking its products to the market through several channels. The company works with more than 1,000 clients in China in the hotel, café, and restaurant segments. In addition to this, the company’s Italian-style café franchise Illy Caffe has three outlets across the country, and there are another nine illycaffé retail outlets providing full range of Illy products – beans, ground coffee, and capsule machines.

Lavazza: Premium coffee grounds in China

Yum China Holdings has entered a joint venture to develop the Lavazza coffee shop concept in China. As the first step, a Lavazza flagship store in Shanghai, has opened its doors to customers in Asia. Recently, the Lavazza Group has embarked upon a process of international development aimed at tapping into new markets. Meanwhile, Yum China has made encouraging advances into China’s coffee market. In 2019, this brand sold 130 million cups of coffee to Chinese consumers. More than just the classic Italian espresso, Lavazza employs a variety of roasting and extraction techniques, introducing unique coffee creations to China for the first time. Bel Paese Coffee is an exclusive line-up created for the Chinese market, offering a “unique journey of tastes from across the different regions of Italy.”

Rwandan coffee enters China’s market

Rwanda was the first African nation to join the Alibaba-led Electronic World Trade Platform. Organized by the Alibaba group, the online event aimed at promoting Rwandan coffee which is available on the Chinese e-commerce market. Event featured coffee from Gorilla Coffee – a brand from Rwanda Coffee Company, promoted to about 20 million fans that were following online. By the time of buying, up to 3000 pieces (about 1.5 tonnes) of the coffee were bought online in a space of about 1 minute. Besides, as a result of the agreement, Rwandan coffee is available on Alibaba’s platforms. Coffee lovers in China also can access the product through Tmall.

Prospects of the coffee bean market in China

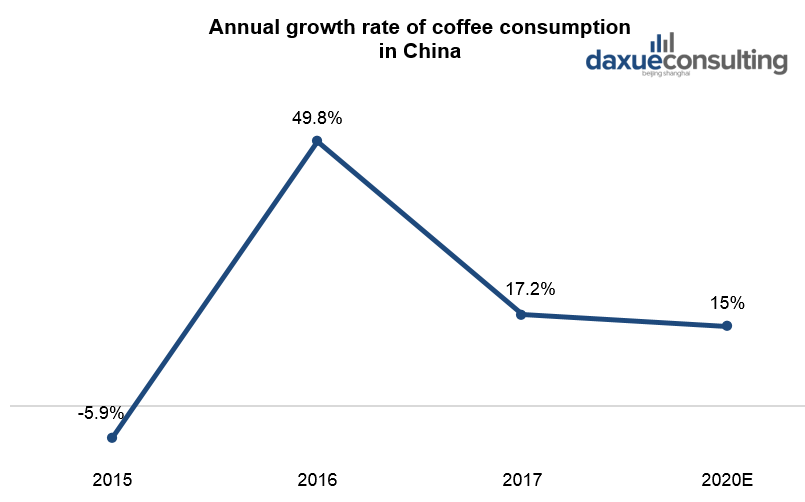

Due to growing middle class in China and the popularity of coffee among younger generation, coffee bean industry in China has a great potential. Forecast predicts that the average annual growth rate of coffee consumption in China will reach 15% in 2020.

Data Source: QYResearch, ‘Annual growth rate of coffee consumption in China’

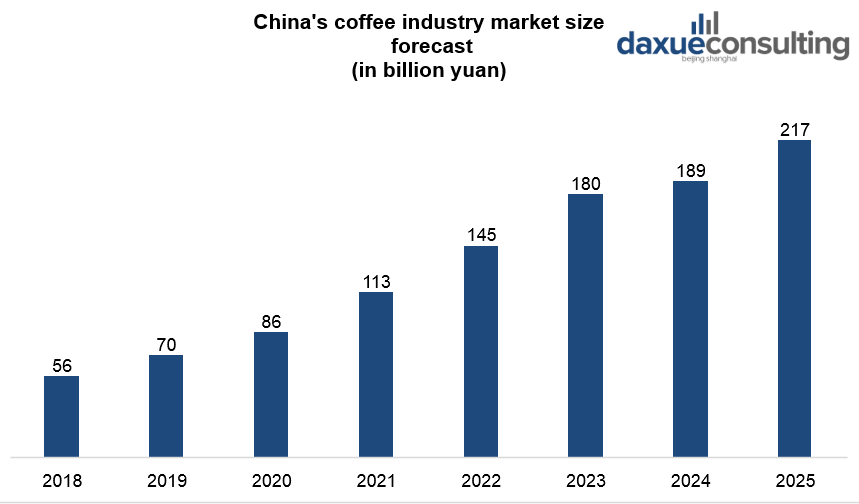

With the improvement of the living standards in China and the recognition of coffee culture, it may stimulate domestic coffee consumption. Forecast shows that the size of China’s coffee market will reach 217.1 billion yuan in 2025.

Data Source: qianzhan, “China’s coffee industry market size forecast’

As the size of coffee market in China is growing, it offers boundless potential for coffee bean industry. In the future China can become a major coffee-consuming country. Due to the growing gap between supply-demand in domestic coffee market, foreign producers increase a variety of exported coffee beans to China. Furthermore, with the constant improvement of domestic living standard, the consumption and demand of coffee will expand rapidly.