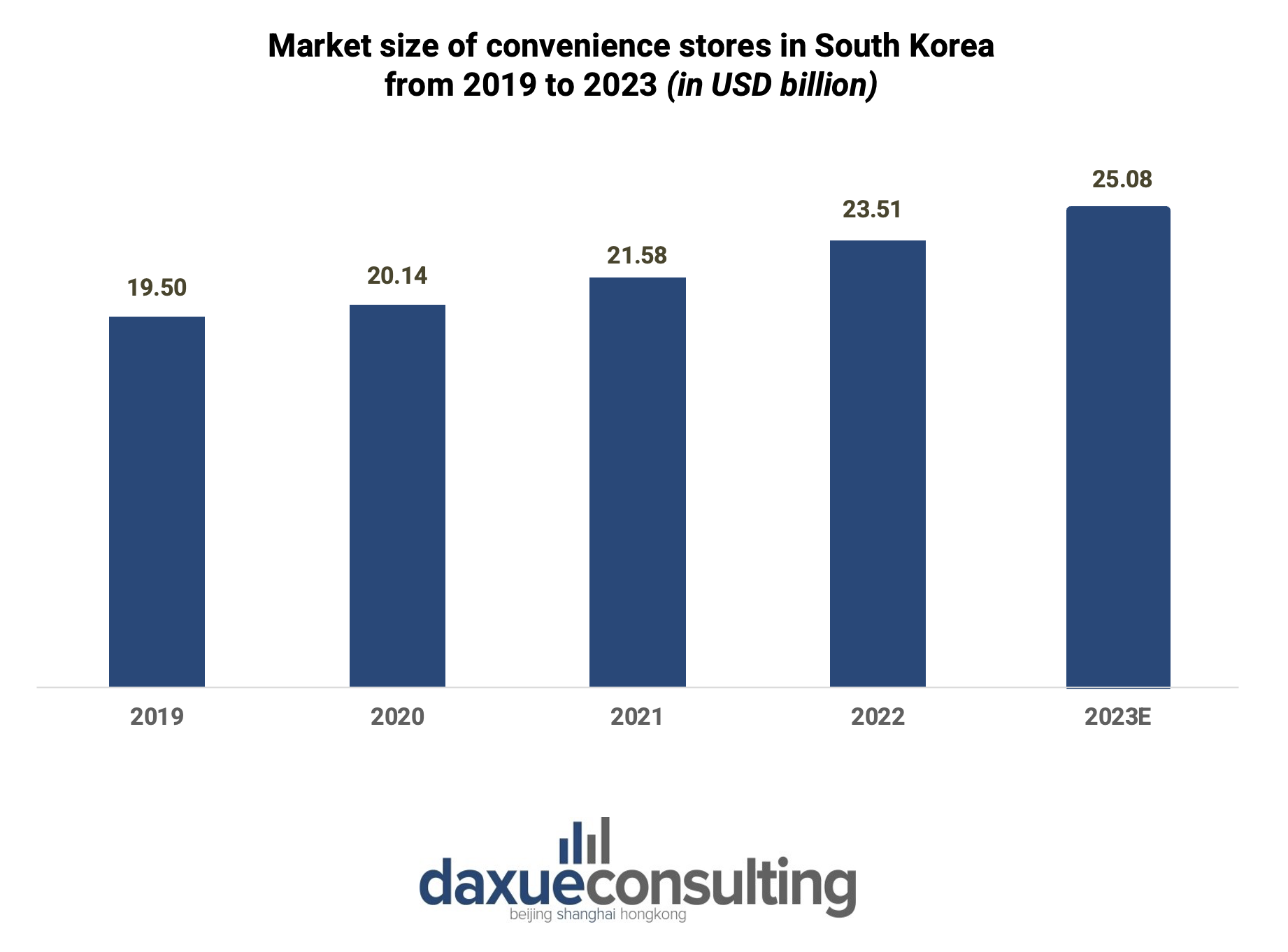

Convenience stores in South Korea are continuing to grow, surpassing 50,000 stores in 2022. CU, GS25, and 7-Eleven are three of the biggest convenience store chains in the country. With these three leaders, the market size for convenience stores in South Korea is expected to be USD 25.08 billion in 2023, marking an estimated growth of 6.3% compared to 2022. Moreover, with convenience stores diversifying their services and exploring more creative endeavors, they are expected to contribute to their sustained growth in the future.

Read our South Korea F&B market report

Fierce competition between CU and GS25

CU and GS25 are the leading convenience stores in Korea. While there is no clear winner between the two, they clearly surpass other convenience stores in terms of brand awareness and the number of stores. This heightened competition propels them to deliver differentiated products and services that cater to the diverse needs of their consumers.

Enhancing product differentiation with collaborations

In 2010, GS25 co-launched Korean actress Kim Hye Ja (김혜자)’s lunch box, which came to popularity for its rich and diverse ingredients. Because of the collaboration’s increasing popularity and positive responses from the consumers, the actress’s name “haeja (혜자)” became a newly coined word for plentiful and abundant. Co-branding in South Korea like this has been ongoing for an extended period.

However, collaborations have become more creative, new, and fun to capture the MZ Generation’s attention. The primary objective behind these collaborative products is not solely revenue-driven; instead, it aims to increase awareness and interest of the product and the brand. Given that convenience stores have a widespread presence across South Korea, partnering with them ensures that brands receive ample attention. Gompyo, a flour brand, was well-known among older generations. However, after launching Gompyo White Beer in collaboration with CU, it adopted a more youthful image and became more recognized among the younger generation. Similarly, the Korean canned whelk brand Yudong Whlek collaborated with 7-Eleven, and the Korean shoe polish Malpyo partnered with CU, to launch beers. These were unexpected collaborations, yet they proved to be interesting and engaging for young consumers.

Convenience stores are diversifying their services

CU and GS25 are strategically expanding their platforms beyond traditional convenience stores. CU and GS25 are expanding their platforms so that they can transform into comprehensive lifestyle management entities, providing various daily needs and enhancing their roles in consumers’ everyday lives.

Convenience stories are offering more products and experiences that were not traditionally offered by the convenience stores in the past. In addition to providing delivery and pickup services, they cater to various lifestyle needs to enhance customer convenience. CU, for instance, worked with laundry startup company “Oh!Laundry (오드리세탁소)” and began providing laundry collection and delivery services in 2019.

GS25 provides pet sitting and training services to single-person and two-person households. Consumers can call pet trainees to their homes by visiting GS25 stores. Additionally, GS25 has expanded its product range by selling home training products from the Korean sports product brand “Xexymix (젝시믹스)” and has released its self-produced breathalyzer, thereby enhancing the diversity of offerings in their stores.

7-Eleven’s evolution: unveiling the future of convenience stores with Food Dream ECO

While 7-Eleven may not boast as extensive a store network as CU and GS25, it is focusing on setting itself apart by enhancing the uniqueness of its offline stores. In 2019, 7-Eleven introduced its first “Food Dream (푸드들림)” stores, designed to offer customers more extensive space to enjoy their convenience foods.

Then in 2023, 7-Eleven opened an upgraded version of the stores, known as “Food Dream ECO”. The upgraded version is bigger and provides a more health-focused selection of products compared to its ordinary stores. It offers a range of vegan products and protein-high food for the consumers. Moreover, it incorporates an eco-friendly theme. In response to consumer interest in ESG (Environmental, Social, and Governance), Food Dream ECO uses eco-friendly resources to design its interiors and sets up a special space for zero-waste household goods.

Food Dream ECO is a strategic initiative by 7-Eleven, designed to align with the future values of health-conscious and environmentally aware consumers.

MZ Gen are the main consumers of convenience stores

While convenience stores are popular among all generations, they particularly appeal to the MZ Generation. According to Shinhan card, 62% of consumers who use Shinhan card in convenience stores from that generation. While other generations visit convenience stores about three times a month, the MZ Generation use convenience stores five times a month. However, while the MZ Generation visits convenience stores more frequently, they tend to spend smaller amounts. They spend an average of USD 4.57 per visit, whereas other generations spend around USD 6.1.

Beyond convenience: Understanding the factors driving consumers to South Korea’s convenience Stores

Young consumers are drawn to convenience stores for several reasons. The 24/7 accessibility and ubiquitous presence of these stores make them a convenient choice. Although the price may be slightly higher than local supermarkets, many MZ from the MZ Generation are willing to spend a bit more, acknowledging the added convenience and benefits offered by convenience stores. For more price-conscious consumers, convenience stores provide enticing sales events, particularly offers like 1+1 or 2+1.

Convenience stores are leveraging digital marketing by creating fun and relatable content to engage consumers and encourage continued store visits. For instance, CU, released web dramas like “Convenience Store Newbie (편의점 뚝딱이)” and “Convenience Store Junkies (편의점 고인물)”. These web dramas became hugely popular, having over 300 million views on YouTube. Convenience store brands are also integrating the metaverse into their strategies to capture the attention of Gen Z consumers. In 2021, CU opened a virtual store with a view of the Han River. Users can enter the realistic-looking store and even participate in activities with real-life benefits.

These marketing strategies, combined with the geographical advantages of conveniences stores, are drawing young consumers into South Korea’s convenience stores.

South Korea’s retail revolution: Key insights into domestic convenience stores

- With South Korea’s top three convenience store brands – CU, GS25, and 7-Eleven leading – the market size for South Korea’s convenience stores is expected to be USD 25.08 billion in 2023.

- CU and GS25 are evolving into lifestyle platforms, focusing on products and services differentiation. Co-branding has emerged as a popular marketing strategy in South Korea, allowing brands to promote themselves collaboratively and reshape their brand image.

- Despite having fewer stores than CU and GS25, 7-Eleven is focusing on differentiating itself through its offline stores. Its Food Dream ECO stands out for its eco-friendliness and healthcare products and services.

- MZ generations are the main consumers of convenience stores. Although they spend less money per visit than other generations, they go to convenience stores much more often for reasons beyond accessibility.