How will the Chinese cross-border e-commerce market change? New CBE regulations

On January 1st, 2019, China implemented new cross-border e-commerce regulations to improve the supervision of CBE retail imports. The two Circulars were issued by the Ministry of Commerce, the National Development and Reform Commission, the Ministry of Finance, the General Administration of Customs (GAC), the State Administration of Taxation and the State Administration for Market Supervision.

The new CBE regulations reflect a longstanding objective to divert cross-border e-commerce sales from unregulated channels like the “Daigou” to a more closely supervised channel. The law provides incentives for business to transact through the CBE channel and an enforcement mechanism against illicit operations. By coming down heavily on Daigou merchants and increasing incentives to import legally, the Chinese government aims to collect more taxes from cross-border e-commerce imports.

The cross-border e-commerce industry in China

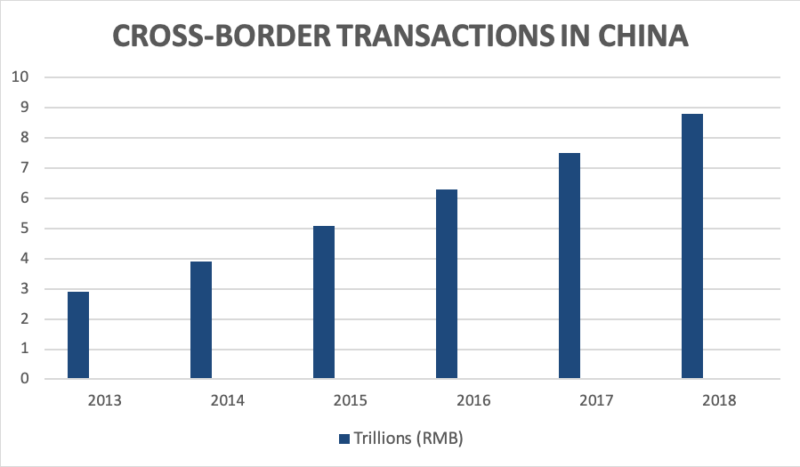

E-commerce sales in China currently account for 24% of all retail sales domestically, and the channel is expected to grow by another 10% in 2019. All cross-border e-commerce in China cumulatively generates USD 1.1 trillion annually, and that number is growing 21% year over year.

With e-commerce growing in importance, meaningful oversight and regulation of the industry is an essential goal for lawmakers.

Previous norms for cross-border e-commerce retail imports to China: Daigou

A significant amount of cross-border e-commerce in China was previously done through the grey channel known as ‘Daigou.’ Daigou ( 代购), literally ‘Surrogate Shopping’ or ‘buy on behalf’ is a form of cross-border importing in which a group or individual outside of China buys goods and then illegally circumvents Chinese import tariffs on their purchases. A Daigou product is any product that was brought into China without having to pay import taxes and with the intention to re-sell.

Daigou shoppers buy the desired goods outside of China, and then mail the goods back or re-enter China posing as tourists, concealing their purchases or carrying in quantities as ‘personal items’ under the threshold for customs declaration. Once safely back in China with the goods from overseas, the Daigou shoppers sell the items to domestic buyers at an upcharge.

Depending on the goods brought into the country and the way in which they are brought in, Daigou activities can be charged as criminal offenses like smuggling, tax evasion, fraud, and legal exploitation.

Daigou sales across all sectors in China total USD 15 billion annually, meaning that Chinese authorities lose tremendous tax revenues on these illegal transactions. A 2015 survey of Chinese online luxury shoppers found that 35% have used the Daigou to purchase luxury goods online, while only 7% used the website of the brand they are buying, or think they are buying.

Daigou purchases are often luxury goods from major cities like Paris, London, New York City, Hong Kong, Tokyo, and Seoul. Daigou agents abroad will buy massive quantities of designer merchandise and then smuggle them home to China to sell. Luxury goods in China can sometimes cost as much as 4 times what they do in their country of origin, due to high import taxes. Thus, the Daigou channel in China emerged in response to high import taxes on luxury goods.

China’s new CBE regulations tighten up loopholes that Daigou shoppers had used to avoid import tariffs and make the entire process entirely illegal. All importers will be required to register as e-commerce operators and acquire licenses in both China and the country where they shop, making their business subject to taxation in both China and the region where they purchased goods. A Daigou merchant is defined as an importer because they buy products abroad and then sell them at home.

Many Daigou merchants have adopted a wait-and-see attitude towards China’s new cross-border e-commerce regulations. Many merchants who advertised their products or services on social media have ceased from posting, fearing that their posts will incite government action. Other online sellers have turned to creative new social-media advertisements, promoting Daigou products in foreign languages, through hand-drawn photos, with fake names, or communicating to clients only through voice messages. Many other Daigou merchants have decided to quit the game entirely instead of turning their business legal or struggling to keep selling illegally.

As China cracks down on Daigou merchants, the merchants are forced to obtain licenses, register as businesses, and pay import taxes, albeit at a reduced rate. This increases the business costs, so in order to keep revenues, stable Daigou merchants are forced to raise prices. Even the merchants who slip through are selling their smuggled goods at higher prices to make the risk of getting caught worth it. With the increased prices after new CBE regulations, it is in many cases no longer cheaper for Chinese consumers to buy Daigou products over legally imported ones.

What do new CBE regulations change in the Chinese cross-border e-commerce market?

A new regulatory system will be implemented to handle taxation, inspection and quarantine, customs clearance and payment methods to regulate cross-border e-commerce in China.

- The limits for tax-free cross-border purchases by Chinese consumers has been increased. Consumers can now purchase higher-value products from abroad without paying import tariffs, and with import VAT and consumer taxes collected at a fraction of the usual rate.

- Reselling imported products in China through the Daigou is now explicitly illegal.

- Chinese websites will be required to offer greater protection of consumer rights.

- E-commerce platforms will be required to more rigorously protect intellectual property rights and respond to reports of violations in a timely manner.

- The list of types of businesses required to comply with CBE laws has been expanded to include online sellers, platform operators, operators on platforms, and microbusinesses.

- Businesses selling through non-traditional shopping channels like social media and WeChat are now expressly subject to CBE regulation.

Cross-border e-commerce in China now only through legitimate channels: Daigou stay behind

China’s new CBE regulations create incentives for businesses to import goods legally through the CBE channel, instead of through the Daigou. Incentives include new benefits such as:

Value limit relaxation in China

Previously, the value limit for tax-free goods imported through the CBE channel was RMB 2000 per shipment and RMB 20,000 per year. That limit has now been raised 150% to RMB 5000 per shipment and RMB 26,000 per year. The relaxation of the value limit permits Chinese merchants to import higher-cost goods under the CBE program.

Expanded positive lists in China

“Positive lists” are lists of product categories that can be imported duty-free. The lists have now been expanded to include 63 new product categories that are exempt from paying import taxes. These products include consumer goods like food, electronics, and healthcare items. The lists of duty-free CBE goods now cover 1321 products.

CBE pilot zones in China

In certain zones in China, CBE importers enjoy easier customs procedures and supportive policies. The list of cross-border e-commerce pilot zones in China has now been expanded to 22 more cities, including Beijing, Nanjing, and Shenyang.

The regulations also guarantee continuance of the previous incentives for businesses to import through the CBE program. These previous benefits that still hold true include:

Pre-import registration waiver China

Previously, the government had been discussing requiring businesses to apply for a registration document before they could import certain categories of products such as cosmetics, and medical devices. China’s new CBE laws continue to allow products in these categories to be imported through the CBE channel in China.

Tariff exemption and tax reduction in China Free trade zones in China

Products imported through the CBE channel are exempt from customs duties, and import VAT and consumption taxes are collected at a 30% discount. This benefit is a continuation of the previous policy.

Free trade zones in China

Foreign sellers can stockpile their goods in China’s designated free trade zones (FTZ), from where they can fulfill customer orders and deliver products directly to purchasers. This practice is more efficient for overseas sellers who would alternatively have to deliver purchases through constant international parcels. Foreign sellers not enrolled in the CBE program cannot sell their products from an FTZ to Chinese consumers. This benefit is a continuation of the previous policy.

Strengthening enforcement against illicit cross-border e-commerce operations in China

The new cross-border e-commerce laws warn parties against exploiting the tax reduction benefit of the new CBE program, and explicitly holds the overseas sellers and their designated Chinese partners jointly and severally liable.

E-commerce platforms and sellers found guilty of smuggling, tax evasion, and willful violation of the new laws can be fined RMB 2 million and RMB 500,000 respectively, and possibly face criminal charges. Since the new laws rolled out in January, Chinese customs have reportedly increased inspections and imprisonments of Daigou merchants at airports.

Chinese cross-border e-commerce market: Impacts of China’s new CBE rules

China’s crackdown on the Daigou is unlikely to significantly impact the total consumption of cross-border e-commerce goods.

The new policies force taxes on Daigou merchants, making price differences between imported Daigou products and products from legal CBE platforms insignificant.

Consumers will benefit from purchasing goods from credible and legally liable retailers, instead of worrying about dodgy daigou sellers potentially selling them counterfeit goods or unsafe products.

The main beneficiaries of the new cross-border e-commerce regulations are the Chinese government and legitimate e-commerce platforms. The government gets to collect hefty taxes from a new source and has the validity of their laws strengthened. E-commerce platforms like TMall and JD will benefit from the regulations because a crackdown on Daigou merchants will divert consumer demand for imported goods to legitimate channels.

Overseas retailers who previously had their products resold in China through the Daigou channel welcome the new CBE regulations. Overseas products imported through the Daigou had a competitive advantage over products legally imported and sold in China. Now that Daigou products and legally imported products cost around the same, unfair competition is regulated, and overseas retailers will see a boost in sales.

“Small sized foreign companies will find it challenging to comply with all new enforced CBE regulations and limited with a few options to sustain their business in the Chinese cross-border e-commerce market,” Min Chun, Daxue’s research project leader.

Author: Alison Bogy

Daxue Consulting helps you get the best of the Chinese market

You have a question on how to benefit from new regulations, do not hesitate to get in touch with our experts at dx@daxue-consulting.com who already has ideas of the solutions for you.